Achieving genuine financial clarity often feels like navigating a dense fog. Many people create budgets, only to find them quickly abandoned or ineffective. The common pitfall? Focusing solely on what they *intend* to spend without routinely comparing it to what they *actually* spend. This disconnect is precisely why a robust Actual And Projected Personal Budget Template Blank becomes an indispensable tool for anyone serious about mastering their money. It’s more than just a list of numbers; it’s a dynamic feedback system designed to illuminate your spending habits, forecast your financial future, and empower you to make informed decisions.

This sophisticated yet accessible financial instrument is invaluable for a wide range of individuals. Whether you’re a recent graduate looking to establish strong financial habits, a seasoned professional aiming to optimize savings, a family planning for major expenses, or simply someone who feels their money disappears too quickly, understanding and utilizing a template that blends both planned and actual figures is a game-changer. It provides the insight needed to stop merely reacting to your finances and instead, proactively shape your financial destiny.

The Power of Dual Perspective: Why Actual Meets Projected Matters

Many traditional budgeting approaches fall short because they offer only a partial view of your financial landscape. A “projected” budget outlines your intentions, forecasting what you *plan* to earn and spend. While this is a critical first step, it remains hypothetical until confronted with reality. This is where the “actual” component of your budget template comes into play. It meticulously tracks what you *actually* earn and spend, providing a concrete record of your financial transactions.

The true genius lies in the side-by-side comparison. By placing your projected figures alongside your actual expenditures and income, you create a powerful feedback loop. This comparison isn’t about judgment; it’s about learning. It reveals where your estimates were accurate, where you might be overspending or underspending, and where your financial habits deviate from your intentions. This ongoing dialogue between expectation and reality is essential for identifying patterns, correcting course, and making meaningful adjustments to your financial strategy. Without this dual perspective, a budget remains a static plan, rather than a living, breathing financial guide.

Unpacking Your Personal Budget Template: Key Elements to Look For

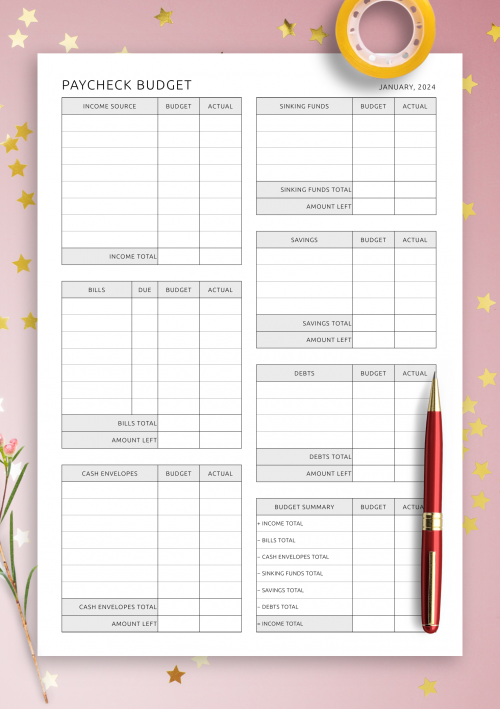

A well-designed personal budget template is a comprehensive financial dashboard, not just a simple ledger. It should intuitively guide you through categorizing your income and expenses, ensuring no financial stone is left unturned. When seeking or creating your own financial planning template, look for several critical components that allow for both projection and tracking.

Here are the fundamental sections every effective income and expense tracker should include:

- **Income Sources:** Detail all expected (projected) and received (actual) income. This could include your primary **salary**, side hustle earnings, rental income, or any other money flowing into your accounts.

- **Fixed Expenses:** These are costs that typically remain **consistent** month-to-month. Examples include rent/mortgage payments, loan repayments (car, student), insurance premiums, and subscription services. Both projected and actual figures should be recorded.

- **Variable Expenses:** This category accounts for costs that fluctuate. Think **groceries**, dining out, entertainment, utilities, transportation (gas, public transit), and clothing. These often require the most attention as they are areas where overspending frequently occurs.

- **Savings & Debt Payments:** Beyond minimum debt payments, allocate sections for your projected and actual contributions to savings goals (emergency fund, down payment, retirement) and any extra debt repayments you make. This highlights your progress towards **financial growth**.

- **Category Totals & Variance:** Crucially, the template should automatically calculate totals for each category and, most importantly, show the **variance** (difference) between your projected and actual figures. This is where insights truly emerge.

This structured approach to your personal finance template ensures you capture all relevant data, making it easier to analyze your spending habits and adjust your financial roadmap.

Setting Up Your Budget: A Step-by-Step Guide

Embarking on your budgeting journey with a personal financial template might seem daunting, but it’s a straightforward process that yields immense returns. The key is to approach it systematically, starting with your knowns and then diligently tracking your unknowns. This method transforms a blank document into a powerful financial strategy document.

- Gather Your Financial Data: Before you even touch your budget worksheet, collect all necessary financial information. This includes recent pay stubs, bank statements, credit card statements, and any records of recurring bills. Having these documents handy will ensure accuracy when you begin populating the template.

- Input Projected Income: Start by filling in your estimated income for the upcoming month. Be realistic and, if your income fluctuates, use a conservative estimate or an average from the past few months. This sets your baseline.

- Outline Projected Fixed Expenses: Next, list all your fixed expenses with their estimated amounts. Since these are usually consistent, this section should be relatively easy to fill out accurately. Don’t forget any annual expenses that you might want to prorate monthly.

- Estimate Projected Variable Expenses: This is often the trickiest part. Think about your typical spending in categories like groceries, dining, transportation, and entertainment. Use past spending as a guide, but also consider any upcoming events or changes that might affect these figures. Be honest with yourself.

- Set Projected Savings & Debt Payments: Allocate funds towards your savings goals and any extra debt payments you plan to make. Treat these as non-negotiable expenses, paying yourself first before discretionary spending.

- Track Actual Income and Expenses: As the month progresses, meticulously record every dollar you earn and spend in the "actual" columns of your budget. This is the most vital step for gaining insight. Use a dedicated app, spreadsheet, or even manual entry, whatever method works best for you to ensure consistency.

- Review and Adjust: At the end of the month (or weekly, if preferred), compare your actual spending against your projected spending. Note the variances. If you overspent in one area, where can you cut back next month? If you underspent, can those funds be redirected to savings or debt? This iterative process is what makes an actual and projected budget so effective.

Beyond the Basics: Customizing Your Financial Blueprint

While a general budget template provides a solid foundation, its true effectiveness is unlocked through customization. Your financial life is unique, and your financial management spreadsheet should reflect that. Generic categories might not fully capture your spending habits or financial goals, which can lead to frustration and abandonment of the budget.

Consider these ways to tailor your personal finance template:

- Detailed Categories: Rather than a broad "Entertainment," perhaps you need "Streaming Subscriptions," "Concerts," and "Dining Out." Similarly, "Transportation" might become "Gas," "Car Maintenance," and "Public Transit Fares." The more granular you get, the clearer your spending patterns become.

- Specific Savings Goals: Instead of a generic "Savings," create distinct lines for "Emergency Fund," "Vacation Fund," "New Car Down Payment," or "Kid’s College Fund." This helps visualize progress towards each specific objective.

- Irregular Income/Expenses: If you have irregular income (e.g., freelance work, commissions) or infrequent but large expenses (e.g., car registration, holiday gifts), build in sections or separate tabs to plan for these. You might project an average for income or set aside a monthly amount for large, infrequent expenses.

- Visual Cues: Utilize color-coding for different expense types (e.g., green for needs, yellow for wants, red for overbudget categories). This provides quick visual insights into your spending at a glance.

- Integration with Other Tools: Think about how your budget template can integrate with other financial apps or bank features. Some templates offer direct import features, while others complement manual tracking in a money management spreadsheet by providing the analytical framework.

- Goals Section: Include a dedicated area for your financial goals, both short-term and long-term. This acts as a constant reminder of why you’re budgeting and helps you align your projected spending with your aspirations.

Maximizing Your Budget’s Impact: Tips for Lasting Success

Having a robust actual and projected budget is one thing; consistently using it to achieve your financial goals is another. The real magic happens when you commit to making budgeting an ongoing practice rather than a one-time setup. To truly harness the power of your financial management tool, integrate these habits into your routine.

- Be Realistic from the Start: When setting your projected figures, aim for honesty, not perfection. Overly strict budgets are often unsustainable. It’s better to slightly overestimate variable expenses initially than to constantly feel deprived. You can always adjust downwards as you gain more clarity.

- Track Consistently and Accurately: This is the most critical step. Make it a habit to log your transactions daily or every few days. Delayed tracking leads to forgotten expenses and inaccurate data, undermining the entire exercise. Many find linking their bank accounts to a digital budgeting tool helpful for automation.

- Review Your Budget Regularly: Don’t just set it and forget it. Schedule a weekly or bi-weekly check-in to compare your projected vs. actual spending. This allows you to catch overspending early and make course corrections before it’s too late in the month. A monthly comprehensive review is essential for strategic adjustments.

- Automate Where Possible: Automate savings transfers, bill payments, and even debt repayments. This ensures that you’re consistently working towards your goals and reduces the mental load of remembering every transaction.

- Don’t Fear Adjustments: Your financial life isn’t static, and neither should your budget be. Life happens – unexpected expenses arise, income changes, or goals shift. Be prepared to adapt your projected budget as needed. Flexibility is a sign of a healthy budget, not a failed one.

- Celebrate Small Wins: Acknowledging your progress keeps you motivated. Did you stick to your grocery budget? Did you contribute an extra amount to savings? Recognize these achievements. Financial wellness is a marathon, not a sprint.

Frequently Asked Questions

How often should I update my budget using an actual and projected personal budget template?

While you should ideally log transactions (actual spending) daily or every few days, a comprehensive review of your projected versus actual figures should happen at least once a month. This monthly review allows you to analyze trends, adjust your projections for the upcoming period, and ensure your budget aligns with your current financial situation and goals.

What if my actual spending is consistently way off my projections?

This is a common experience and precisely why an actual and projected budget template is so valuable. If your actuals consistently deviate, it’s a sign that your projections might be unrealistic or that your spending habits need closer attention. Don’t get discouraged! Revisit your projected figures, break down your variable expenses into more granular categories, and identify where the discrepancies lie. Use this information to create more accurate projections next month, or consciously work on reducing spending in problem areas.

Is using a projected vs. actual budget template similar to zero-based budgeting?

They are complementary but distinct. Zero-based budgeting (ZBB) is a method where every dollar of income is assigned a job, meaning your income minus your expenses (including savings and debt payments) equals zero. An actual and projected budget template provides the framework for tracking and comparing, which can be *used* with ZBB. You can apply the principles of ZBB within your template by ensuring all projected income is allocated, and then track the actuals against those “jobs.”

What tools can help me manage an actual and projected budget template?

Many tools can assist. Simple solutions include a **spreadsheet** (Excel, Google Sheets), which allows for full customization. More robust options include dedicated budgeting apps like You Need A Budget (YNAB), Mint, or Personal Capital, which often automate transaction imports and provide visual summaries. The best tool is the one you will consistently use.

How can I get started with finding an actual and projected personal budget template blank?

Many online resources offer free downloadable templates. You can search for “free personal budget template,” “monthly budget worksheet,” or “spreadsheet budget for actual vs. projected” to find options. Most financial blogs, banks, and personal finance websites provide these. Alternatively, you can create your own in a spreadsheet program, customizing it to your specific needs right from the start.

Embracing an Actual And Projected Personal Budget Template Blank is more than just a financial exercise; it’s a journey towards self-awareness and empowerment. It transforms abstract financial goals into achievable milestones by providing the clarity and control you need. By consistently comparing your intentions with your reality, you gain invaluable insights that allow you to make smarter choices with your hard-earned money.

Take the first step today. Download or create your personal budget template, fill in your projections, and commit to tracking your actual spending. The path to financial freedom is paved with consistent effort and informed decisions, and this dynamic budgeting tool is your most reliable guide. Start shaping your financial future, one projected and actual dollar at a time.