Navigating the complexities of financial separation, whether in a business partnership, a joint venture, or a personal relationship, can be one of the most challenging periods for any individual or entity. The emotional and logistical strains are often compounded by a lack of clarity regarding shared assets, debts, and future obligations. Without a clear roadmap, what should be a structured process can quickly devolve into protracted disputes, significant legal costs, and irreparable damage to professional or personal reputations.

This is precisely where a robust framework for financial disentanglement becomes not just beneficial, but absolutely essential. For legal professionals, business owners, human resource departments, and individuals seeking to resolve financial ties amicably and efficiently, a well-structured separation financial agreement template offers a powerful solution. It provides the necessary foundation to delineate terms, establish boundaries, and ensure that all parties understand their rights and responsibilities, paving the way for a smoother, more predictable transition.

The Imperative of Documenting Financial Transitions

In today’s intricate legal and economic landscape, the need for written, formalized agreements has never been greater. Verbal understandings, while sometimes convenient, are notoriously fragile and prone to misinterpretation, especially when significant financial interests are at stake. As relationships evolve or conclude, having a clear record becomes the ultimate arbiter, reducing ambiguity and preventing potential litigation.

A meticulously drafted document serves as a protective shield for all parties involved. It minimizes the risk of future disagreements by explicitly outlining the terms of financial separation, including asset distribution, debt allocation, and ongoing financial support, if applicable. This proactive approach ensures that everyone operates from the same understanding, fostering transparency and accountability.

Moreover, the regulatory environment demands precision. From tax implications to corporate governance, proper documentation ensures compliance with relevant laws and regulations, safeguarding against legal repercussions down the line. A written agreement is a testament to due diligence and professional conduct.

Unlocking the Advantages of a Structured Framework

Leveraging a high-quality separation financial agreement template provides a myriad of advantages that streamline an otherwise arduous process. Perhaps most significantly, it offers consistency and comprehensiveness, ensuring that no critical aspect of the financial separation is overlooked. This structured approach helps prevent the common pitfalls associated with ad-hoc arrangements.

Templates act as a significant time-saving tool. Instead of drafting a complex legal document from scratch, which can be both costly and time-consuming, parties can begin with a pre-formatted structure. This allows them to focus their energy on negotiating the specific terms relevant to their unique situation, rather than on the foundational legal language.

Beyond efficiency, a well-designed template lends an air of professionalism and legal soundness to the proceedings. It ensures that standard legal clauses and best practices are incorporated, providing a solid, defensible framework should any terms ever be challenged. This peace of mind is invaluable for all stakeholders.

Tailoring Your Financial Separation Document

One of the greatest strengths of a comprehensive separation financial agreement template lies in its adaptability. While providing a standardized framework, it is inherently designed to be customized to suit a diverse range of industries and specific scenarios. This flexibility ensures its utility across various contexts, from corporate dissolutions to personal financial exits.

For instance, a business partnership dissolving might require intricate clauses concerning intellectual property rights, client transition plans, and the valuation and transfer of business assets. Conversely, a marital separation agreement would focus more on spousal support, child custody and support arrangements, and the division of marital property and retirement accounts. Each scenario demands specific provisions.

The template can be modified to reflect the nuances of different state laws in the US, industry-specific regulations, or unique asset structures. Whether it’s the separation of finances within a professional services firm, the conclusion of a joint venture in tech, or the disentanglement of personal finances, the core structure provides a versatile foundation upon which to build a highly individualized and legally sound agreement.

Core Elements of a Definitive Accord

Every effective financial separation document must contain certain essential clauses to be legally sound and functionally comprehensive. These components ensure clarity, enforceability, and thoroughness, covering all critical aspects of the financial disentanglement. Here are the indispensable sections that should be present in any robust agreement:

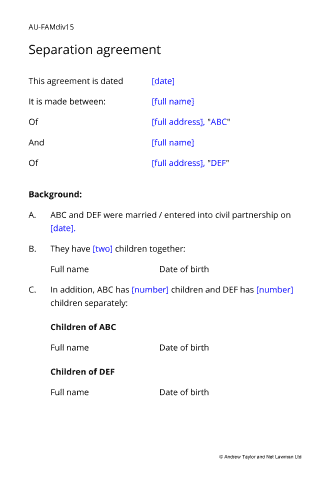

- Identification of Parties: Clearly states the full legal names and contact information of all individuals or entities involved in the agreement. This establishes who is bound by the terms.

- Effective Date: Specifies the exact date from which the terms of the agreement become legally binding. This is crucial for establishing timelines and the applicability of clauses.

- Purpose and Scope: Articulates the intent of the agreement and precisely what financial aspects it covers, whether it’s the division of assets, allocation of debts, or termination of a business relationship.

- Asset Division: Details how all shared assets—including real estate, bank accounts, investments, retirement funds, vehicles, and personal property—will be identified, valued, and distributed among the parties. Specificity here is paramount.

- Debt Allocation: Outlines the responsibility for all shared liabilities, such as mortgages, loans, credit card debts, and business debts. It should specify who is responsible for which debt and how joint obligations will be handled.

- Spousal or Partner Support (Alimony): If applicable, this section defines the terms of financial support, including the amount, duration, payment schedule, and any conditions for modification or termination.

- Child Custody and Support (if applicable): In personal separation contexts, this section meticulously details parenting schedules, decision-making authority, child support obligations, and provisions for health insurance and educational expenses.

- Confidentiality Clauses: Protects sensitive financial information, business strategies, or personal details shared during the separation process from unauthorized disclosure.

- Representations and Warranties: Statements by each party confirming the accuracy of financial disclosures and their legal capacity to enter into the agreement.

- Indemnification: Specifies that one party will compensate the other for certain losses or damages, particularly concerning undisclosed liabilities or breaches of the agreement.

- Dispute Resolution Mechanisms: Establishes the process for resolving disagreements that may arise from the agreement, such as mediation, arbitration, or litigation, often aiming for less adversarial methods first.

- Governing Law: Identifies the specific state or jurisdiction whose laws will govern the interpretation and enforcement of the agreement.

- Waivers and Releases: Clauses where parties relinquish certain rights or claims against each other, often to prevent future litigation based on past issues.

- Modification and Amendment: Outlines the formal process required to make changes to the agreement after it has been signed, typically requiring mutual written consent.

- Integration Clause (Entire Agreement): States that the written document constitutes the complete and final agreement between the parties, superseding any prior verbal or written understandings.

- Signatures and Witnesses/Notarization: Requires the signatures of all parties, dated, and often witnessed or notarized to ensure authenticity and legal enforceability.

Optimizing Your Agreement for Clarity and Reach

Beyond the legal substance, the practical presentation of a separation financial agreement template significantly impacts its usability and overall effectiveness. Thoughtful formatting, clear language, and considerations for both print and digital use are crucial for ensuring the document is easily understood, accessible, and actionable for all parties involved.

For optimal readability, keep paragraphs concise, typically two to four sentences. Use clear, descriptive headings and subheadings to break up long sections of text, making it easier for readers to navigate the document and locate specific information. Bullet points, as used above, are excellent for listing key provisions, responsibilities, or assets, improving comprehension at a glance.

Font choice and size also play a vital role; opt for professional, legible fonts (e.g., Arial, Times New Roman, Calibri) at a comfortable size (10-12pt). Ensure sufficient line spacing and margins to prevent a cluttered appearance. For digital use, consider creating a navigable PDF with bookmarks or an interactive document, enhancing user experience. Implementing clear version control is also paramount when multiple revisions are made, ensuring everyone refers to the most current iteration.

In conclusion, the journey of financial separation, whether personal or professional, is inherently complex and laden with potential pitfalls. However, by strategically employing a well-constructed separation financial agreement template, parties can transform a daunting prospect into a manageable, structured process. This foundational tool streamlines negotiations, clarifies obligations, and fortifies the legal standing of the arrangements made.

The value proposition of using such a template extends far beyond mere convenience; it is a critical investment in clarity, protection, and peace of mind. For legal practitioners, business stakeholders, and individuals alike, leveraging a professional separation financial agreement template ensures that transitions are handled with the utmost professionalism, efficiency, and legal diligence, minimizing disputes and facilitating a smoother path forward for everyone involved.