In the intricate world of corporate finance and equity management, the decision for a company to repurchase its own shares is a significant strategic move. Whether it’s to boost shareholder value, consolidate ownership, facilitate an employee exit, or prevent hostile takeovers, a share buyback can serve multiple critical objectives. However, the success and legal integrity of such an operation hinge entirely on the clarity and comprehensiveness of the underlying documentation. Without a meticulously drafted agreement, what begins as a strategic maneuver can quickly devolve into costly disputes, legal challenges, and unintended financial repercussions.

This is precisely where a robust share buy back agreement template proves invaluable. It serves as the foundational blueprint, offering a structured, legally sound framework for the transaction. For business owners, legal counsel, corporate secretaries, and investors alike, having access to a reliable, customizable template streamlines the process, ensures compliance, and protects the interests of all parties involved. It transforms a complex legal undertaking into a manageable, transparent, and predictable event, laying the groundwork for a smooth and effective share repurchase.

The Imperative for Formal Documentation in Modern Business

In today’s fast-paced corporate environment, the need for clear, written agreements transcends mere formality; it is a fundamental requirement for risk mitigation and operational efficiency. Verbal agreements, even between trusted parties, are inherently susceptible to misinterpretation, memory lapses, and shifts in intention, paving the way for ambiguity and potential conflict. When it comes to something as pivotal as share ownership and corporate capital structure, such uncertainties are simply unacceptable.

A well-drafted legal document acts as the definitive record of understanding. It captures the precise terms, conditions, and obligations agreed upon by all stakeholders at a specific point in time. This clarity is not just about avoiding arguments; it’s about establishing legal enforceability. In the event of a disagreement or a breach, a comprehensive written agreement provides the undeniable proof necessary for effective dispute resolution, whether through negotiation, mediation, or litigation. For businesses operating in a highly regulated landscape like the US, adherence to documented processes is also a cornerstone of good governance and regulatory compliance.

Safeguarding Interests: Core Advantages of a Structured Repurchase Plan

Employing a high-quality share buy back agreement template offers a multitude of benefits that extend far beyond simple record-keeping. Firstly, it provides unparalleled clarity regarding the transaction’s specifics. Details such as the number of shares being repurchased, the agreed-upon price per share, the payment schedule, and any conditions precedent are explicitly laid out, leaving no room for guesswork. This transparency fosters trust and ensures all parties are on the same page.

Secondly, a robust agreement offers crucial legal protection. It defines the rights and responsibilities of both the company (the repurchaser) and the shareholder (the seller), safeguarding them from potential liabilities and unexpected outcomes. Provisions for representations and warranties, for instance, ensure that certain facts about the shares and the parties are true and accurate. Moreover, by clearly outlining the process and obligations, the template helps ensure compliance with relevant corporate laws, securities regulations, and the company’s own bylaws or articles of incorporation. This proactive approach significantly reduces the risk of legal challenges and costly corrective actions down the line, solidifying the strategic value of the share buy back agreement template.

Adapting Your Framework: Customization Across Industries and Scenarios

While a template provides a strong foundation, its true utility lies in its adaptability. No two share buybacks are identical, and the specific needs of a transaction can vary significantly based on the industry, the company’s stage of development, and the underlying purpose of the repurchase. A well-designed share buy back agreement template is built with this flexibility in mind, allowing for precise customization.

For instance, a tech startup repurchasing shares from an exiting co-founder might require specific clauses related to intellectual property assignment and non-compete agreements. In contrast, a mature manufacturing firm executing a large-scale public market buyback might focus more on regulatory compliance, exchange rules, and detailed payment mechanics. Similarly, a buyback initiated to resolve a shareholder dispute will necessitate strong dispute resolution clauses and perhaps specific confidentiality undertakings. The template can be adjusted to include provisions for earn-outs, deferred payments, escrows, or specific performance metrics, ensuring the agreement precisely reflects the commercial and legal nuances of each unique situation.

Anatomy of a Robust Repurchase Agreement: Essential Clauses

The effectiveness of any legal document stems from the thoroughness of its core provisions. A comprehensive share buy back agreement template should systematically address all critical aspects of the transaction to prevent future ambiguities. Here are the essential clauses every agreement should contain:

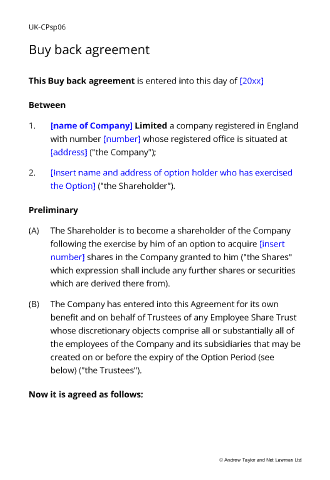

- Identification of Parties: Clearly names the company (the buyer) and the specific shareholder(s) (the seller) involved in the transaction, including their legal addresses and other relevant identification.

- Shares Subject to Repurchase: Specifies the exact number and class of shares being bought back, and confirms the seller’s clear title to these shares.

- Repurchase Price and Consideration: Details the agreed-upon price per share, the total consideration, and the currency. It should also outline how the valuation was determined, if relevant.

- Payment Terms: Defines the method of payment (e.g., wire transfer, check), the payment schedule (e.g., lump sum, installments), and any conditions tied to payments.

- Closing Date and Mechanics: Establishes the date and location for the closing of the transaction, outlining the procedures for share transfer, delivery of documents, and receipt of payment.

- Representations and Warranties: Mutual assurances from both parties regarding their authority to enter the agreement, the validity of the shares, the absence of undisclosed liabilities, and other material facts. These clauses are critical for protecting against misrepresentation.

- Covenants: Obligations that each party agrees to perform or refrain from performing before or after the closing (e.g., company’s obligation to maintain certain records, shareholder’s obligation to assist with filings).

- Conditions Precedent: Specific events or actions that must occur before the parties are obligated to close the transaction (e.g., obtaining regulatory approvals, shareholder votes, third-party consents).

- Indemnification: Provisions outlining how one party will compensate the other for losses arising from breaches of the agreement or specific liabilities.

- Confidentiality: Clauses protecting sensitive information disclosed during the transaction process.

- Governing Law and Jurisdiction: Specifies the state laws that will govern the interpretation and enforcement of the agreement, typically a US state, and the courts where disputes will be resolved.

- Dispute Resolution: Outlines the process for resolving disagreements, which might include negotiation, mediation, or arbitration before resorting to litigation.

- Notices: Defines how official communications between the parties should be sent and received.

- Entire Agreement: States that the written document constitutes the entire agreement between the parties, superseding all prior oral or written understandings.

- Amendments: Specifies that any changes to the agreement must be in writing and signed by both parties.

- Assignment: Dictates whether the rights or obligations under the agreement can be transferred to a third party.

Ensuring Clarity and Accessibility: Formatting and Usability Tips

Beyond the legal substance, the practical presentation of a share repurchase agreement significantly impacts its usability and overall effectiveness. An agreement that is difficult to read or navigate can lead to misunderstandings, even if its legal content is sound. Thoughtful formatting and design are therefore crucial.

Firstly, use clear and concise language. Avoid overly complex legal jargon where simpler terms suffice, ensuring that even non-legal professionals can grasp the core intent. Break down long sentences and paragraphs into shorter, more manageable chunks. Employ consistent heading and sub-heading structures (like H2s and H3s in this article) to logically organize content, making it easy for readers to quickly find specific sections. Utilizing bullet points and numbered lists, especially for detailed conditions or itemized requirements, greatly enhances readability. For print, ensure adequate margins, a readable font size, and sufficient line spacing. For digital use, consider features like internal hyperlinks for cross-referencing within the document. A well-formatted agreement should be intuitive to review, allowing parties to quickly identify their obligations and rights, and minimizing the time spent deciphering the document’s structure.

Utilizing a professional, meticulously crafted share buy back agreement template is more than just a convenience; it’s a strategic business imperative. It provides the legal backbone necessary to execute complex equity transactions with confidence, minimizing risks and fostering clear communication among all stakeholders. By standardizing the framework while allowing for critical customization, businesses can navigate the intricacies of share repurchases efficiently and effectively.

In an era where precision and legal compliance are paramount, relying on a trusted share buy back agreement template empowers companies to protect their interests, adhere to regulatory standards, and achieve their strategic financial objectives without unnecessary friction or costly legal missteps. It represents an investment in clarity, protection, and operational excellence, ensuring that every share buyback contributes positively to the company’s long-term success.