In the bustling world of culinary arts and event planning, a catering business thrives on passion, creativity, and impeccable execution. However, even the most delicious menu and flawless service can’t sustain a venture without a solid financial foundation. Many entrepreneurs, swept up in the excitement of serving delightful experiences, often overlook the critical importance of meticulous financial planning. This oversight can quickly turn a dream into a daunting challenge, highlighting why a structured approach to managing your money is not just advisable, but essential for survival and growth.

Imagine having a clear roadmap that not only tracks every dollar in and out but also forecasts future financial health, helping you make informed decisions and seize opportunities. That’s precisely the power of a well-crafted budget. It transforms vague financial hopes into concrete plans, providing clarity and control over your catering operations. Whether you’re a seasoned caterer looking to optimize profits or a newcomer eager to set your business on the right track, understanding and implementing an effective Catering Business Budget Template is your first step towards sustainable success.

The Indispensable Role of Financial Planning in Catering

Running a catering business is a complex dance between culinary artistry and sharp business acumen. Every event, from intimate dinner parties to grand corporate galas, involves numerous variables: ingredient costs, labor expenses, equipment rentals, transportation, and marketing. Without a robust financial framework, these variables can quickly lead to unforeseen expenditures and eroded profit margins. A comprehensive budget acts as your financial GPS, guiding you through the unpredictable landscape of the food service industry.

It’s more than just tracking past expenses; it’s about strategic foresight. A well-developed financial plan allows you to anticipate seasonal fluctuations, plan for major capital expenditures, and allocate resources effectively. It helps you understand the true cost of each dish, the profitability of different event types, and where you might be overspending. This proactive approach ensures that your catering venture isn’t just surviving but actively thriving and growing.

Key Benefits of a Robust Catering Budget

Implementing an effective financial plan offers a multitude of advantages that extend far beyond simply keeping tabs on your money. It empowers business owners with insights, control, and the confidence to make critical decisions. A detailed financial blueprint can truly be a game-changer for your catering operations, providing clarity and direction.

One of the primary benefits is enhanced profitability. By meticulously tracking income and expenses, you can identify areas of waste, negotiate better deals with suppliers, and optimize your pricing strategies. This direct impact on your bottom line ensures that your hard work translates into sustainable revenue. Moreover, a clear expenditure tracking system enables better cash flow management, preventing those stressful moments where you might have funds tied up or insufficient liquidity for immediate needs.

Furthermore, a comprehensive financial framework provides the data necessary for strategic growth. Want to expand your services, invest in new equipment, or hire more staff? Your budget will tell you if and when these moves are financially viable. It also serves as a crucial document when seeking financing or investments, demonstrating your business’s stability and potential to lenders and investors. Ultimately, it fosters accountability across your team, as everyone understands the financial goals and their role in achieving them.

Deconstructing Your Catering Budget: Essential Components

To build an effective financial plan for your catering business, you need to understand its core elements. It’s not just a single spreadsheet but a dynamic tool composed of several critical categories that reflect the unique operations of a food service company. Each component plays a vital role in providing a holistic view of your financial health.

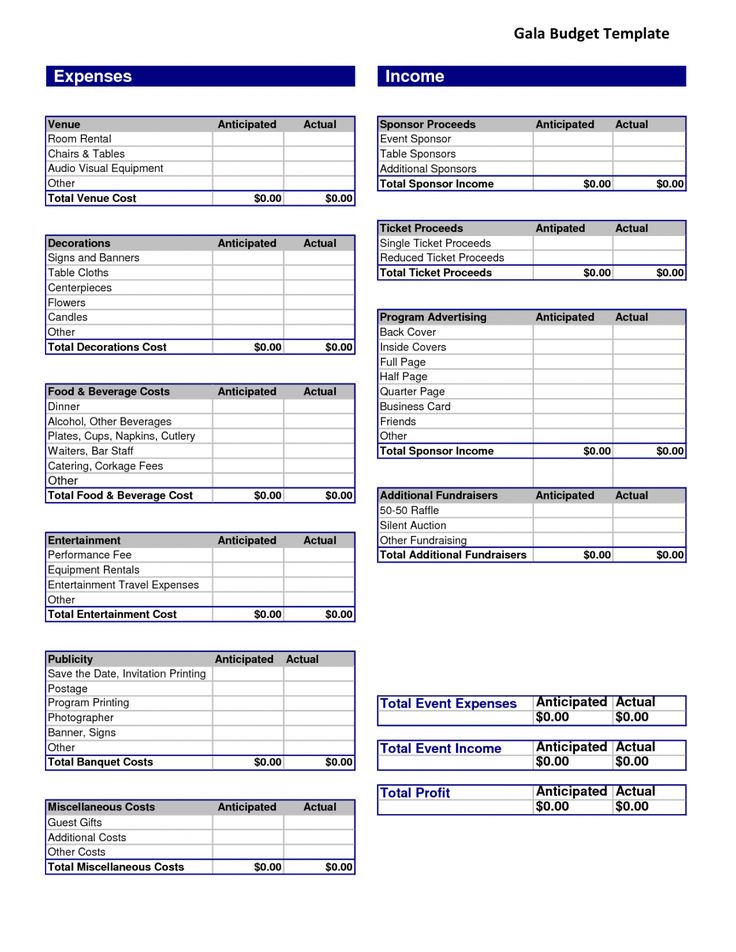

At its heart, any financial blueprint for a catering operation must meticulously detail both your revenue streams and your expenditure categories. On the revenue side, this includes income from various event types, menu upgrades, beverage packages, and any additional services like staffing or equipment rental. Understanding where your money comes from is as important as knowing where it goes.

The expenditure side, however, is often where the real magic of cost control happens. This is where you itemize every single outgoing cost, enabling you to pinpoint areas for optimization. A comprehensive list of typical costs includes:

- Food and Beverage Costs: Raw ingredients, prepared items, alcohol, non-alcoholic beverages. This is often your largest variable cost and needs careful management.

- Labor Costs: Wages for chefs, servers, bartenders, event managers, dishwashers, and administrative staff. Include hourly rates, overtime, benefits, and payroll taxes.

- Operating Expenses:

- Kitchen & Equipment: Rent, utilities (gas, electric, water), equipment maintenance, smallwares, cleaning supplies.

- Venue & Rental Fees: Costs associated with event spaces, tables, chairs, linens, dishware, and specialty décor.

- Transportation: Fuel, vehicle maintenance, delivery fees, and insurance for your catering vehicles.

- Marketing & Sales: Advertising, website maintenance, social media management, promotional materials, and client acquisition costs.

- Administrative Costs: Office supplies, software subscriptions, phone, internet, and professional services like accounting or legal advice.

- Insurance & Licenses: General liability insurance, liquor liability, health permits, business licenses, and food safety certifications.

- Fixed vs. Variable Costs: Differentiating between costs that remain constant (rent, salaries) and those that fluctuate with sales volume (ingredients, hourly labor) is crucial for accurate forecasting.

- Contingency Fund: Always allocate a percentage of your budget (typically 5-10%) for unexpected expenses or emergencies.

By breaking down your finances into these granular categories, you gain unparalleled visibility into your catering business’s financial performance. This detailed cost analysis allows you to set more accurate pricing, identify inefficiencies, and make data-driven decisions that propel your business forward.

Crafting Your Own Catering Financial Blueprint

While the idea of building a comprehensive financial plan might seem daunting, it’s a systematic process that becomes easier with practice. You don’t need to be a financial wizard; you just need a clear strategy and a commitment to detail. The aim is to create a living document that evolves with your business, not a static report that gets filed away.

Start by gathering all your historical financial data. This includes past invoices, bank statements, sales records, and any existing expense logs. This information forms the baseline for your projections. If you’re a new business, you’ll need to research industry averages and make educated estimates. The next step is to project your revenue. Consider your target number of events, average client spend, and any seasonal trends. Be realistic but also aspirational, balancing your goals with market realities.

Once you have your revenue projections, meticulously itemize all your expenses using the categories outlined earlier. Break down food costs per portion, estimate labor hours per event, and factor in all fixed overheads. It’s often helpful to categorize expenses as either fixed (e.g., kitchen rent) or variable (e.g., ingredients per plate) to better understand how costs scale with activity. Remember to include your contingency fund for unforeseen circumstances. This systematic approach to creating your catering expenditure spreadsheet ensures no stone is left unturned.

Leveraging Your Budget for Growth and Profitability

Creating a financial plan is only the first step; its true value lies in its continuous use and adaptation. Your budget should be a dynamic tool that you revisit regularly, not just once a year. Regular review and adjustment are crucial for maintaining its relevance and effectiveness in guiding your catering business towards sustained success.

Use your financial framework to compare actual performance against your projections. Are your food costs higher than anticipated? Is your labor more efficient? These variances provide invaluable insights, helping you identify areas that need attention. Perhaps you need to renegotiate with suppliers, optimize your menu for ingredient costs, or refine your staffing schedule. This ongoing analysis transforms your budget from a static document into an active management tool, a true profitability roadmap for caterers.

Furthermore, integrate your financial planning with your pricing strategy. Knowing your precise costs allows you to set prices that are not only competitive but also profitable. It helps you understand the margin on each dish and event, informing decisions about minimum order sizes, package deals, and premium offerings. Regularly evaluate different event types or client segments based on their profitability, allowing you to focus your marketing efforts where they yield the best returns. Your catering business budget template isn’t just about control; it’s about strategic empowerment.

Frequently Asked Questions

How often should I review and update my catering budget?

Ideally, you should review your catering budget at least monthly, comparing actuals to projections. Major updates, such as annual planning or significant changes to your business model, should occur quarterly or annually. Regular review helps you catch discrepancies early and adjust your financial plan proactively.

What’s the difference between a fixed and variable cost in catering?

Fixed costs are expenses that do not change regardless of your sales volume, such as monthly kitchen rent, insurance premiums, or administrative salaries. Variable costs, conversely, fluctuate directly with the number of events or portions served, like ingredient costs, hourly wages for event staff, and transportation per event. Understanding this distinction is vital for accurate pricing and forecasting.

Can a financial blueprint help with pricing my catering services?

Absolutely. A detailed financial blueprint is indispensable for accurate pricing. By knowing your precise food, labor, and overhead costs per event or per plate, you can set prices that cover all your expenses and ensure a healthy profit margin. It allows you to offer competitive rates without undercutting your profitability.

What if my actual expenses consistently exceed my budget?

If actual expenses frequently exceed your financial plan, it’s a clear signal to investigate. Start by analyzing specific categories to identify the culprits. Are ingredient costs rising? Is labor inefficient? Are there hidden fees? Once identified, take corrective action, such as negotiating with suppliers, optimizing recipes, improving staff scheduling, or re-evaluating your overall operational costs. It’s an opportunity to tighten your cost management system for catering operations.

Is it necessary to include a contingency fund in my catering budget?

Yes, including a contingency fund is highly recommended for any catering operation. Unexpected events, such as equipment breakdowns, last-minute ingredient price hikes, or sudden staff illnesses, can quickly derail your finances. Allocating 5-10% of your total budget to a contingency fund provides a crucial buffer, ensuring you can handle surprises without impacting your profitability or operational stability.

Steering a catering business to sustained success requires more than just culinary talent; it demands astute financial management. A robust financial plan is not a burdensome task but an empowering tool that provides clarity, control, and the confidence to navigate the competitive food service landscape. It allows you to track every penny, optimize your operations, and make strategic decisions that drive growth.

By embracing a comprehensive approach to your financial planning, you’re not just budgeting; you’re actively shaping the future of your catering venture. It’s an investment in your peace of mind and your company’s prosperity, ensuring that your passion for food translates into a thriving and profitable enterprise. Start building your financial roadmap today, and watch your catering dreams take flight with solid financial backing.