In an economy that often feels unpredictable, managing your money can sometimes feel like navigating a dense fog without a compass. The daily demands of bills, the allure of spending, and the distant dream of future financial security can create a confusing landscape, leaving many feeling overwhelmed and uncertain about their financial footing. It’s easy to drift through payday to payday, hoping for the best, but true financial peace of mind rarely comes from hope alone.

What if you could turn that fog into a clear path, transforming uncertainty into confidence and distant dreams into achievable goals? The good news is that such clarity is not just possible, but accessible through a fundamental yet powerful tool: a well-structured financial plan. This plan doesn’t have to be complicated; in fact, its effectiveness often lies in its simplicity and your commitment to using it. For millions of Americans, the first and most crucial step towards this clarity begins with a clear understanding of their income and outgo, all organized within an actionable framework.

Why a Budget is Your Financial North Star

At its core, a budget is not about restriction; it’s about liberation. It’s the ultimate tool for understanding where your money comes from and, more importantly, where every dollar goes. Think of it as your personal financial North Star, guiding your spending and saving decisions towards your ultimate financial destination, whether that’s debt freedom, a down payment on a home, or a comfortable retirement. Without this guide, it’s all too easy for hard-earned money to disappear without a trace, leaving you wondering where it all went.

A robust financial budget template provides a clear snapshot of your financial health, identifying areas of strength and opportunities for improvement. It empowers you to make conscious choices about your spending, rather than letting your money dictate your life. This level of insight translates directly into less financial stress, greater control over your assets, and the ability to proactively plan for both expected and unexpected life events. It transforms abstract financial goals into concrete steps, making the journey to financial well-being tangible and attainable.

Decoding the Anatomy of an Effective Budget Template

While there are countless types of budgeting tools available, from simple pen-and-paper ledgers to sophisticated software, the most effective ones share common fundamental components. A well-designed personal finance template simplifies the often-daunting task of categorizing your money, ensuring no essential area is overlooked. Understanding these core elements is the key to choosing or creating a budgeting tool that truly works for you and your household.

The beauty of a comprehensive expenditure tracker lies in its ability to break down complex financial data into manageable, understandable segments. It provides a visual representation of your money’s flow, highlighting where adjustments can be made to better align with your financial objectives. This systematic approach ensures that you’re not just guessing about your finances, but operating with informed precision.

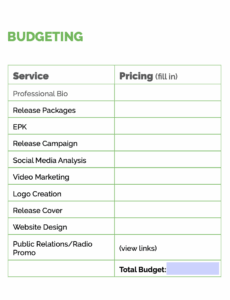

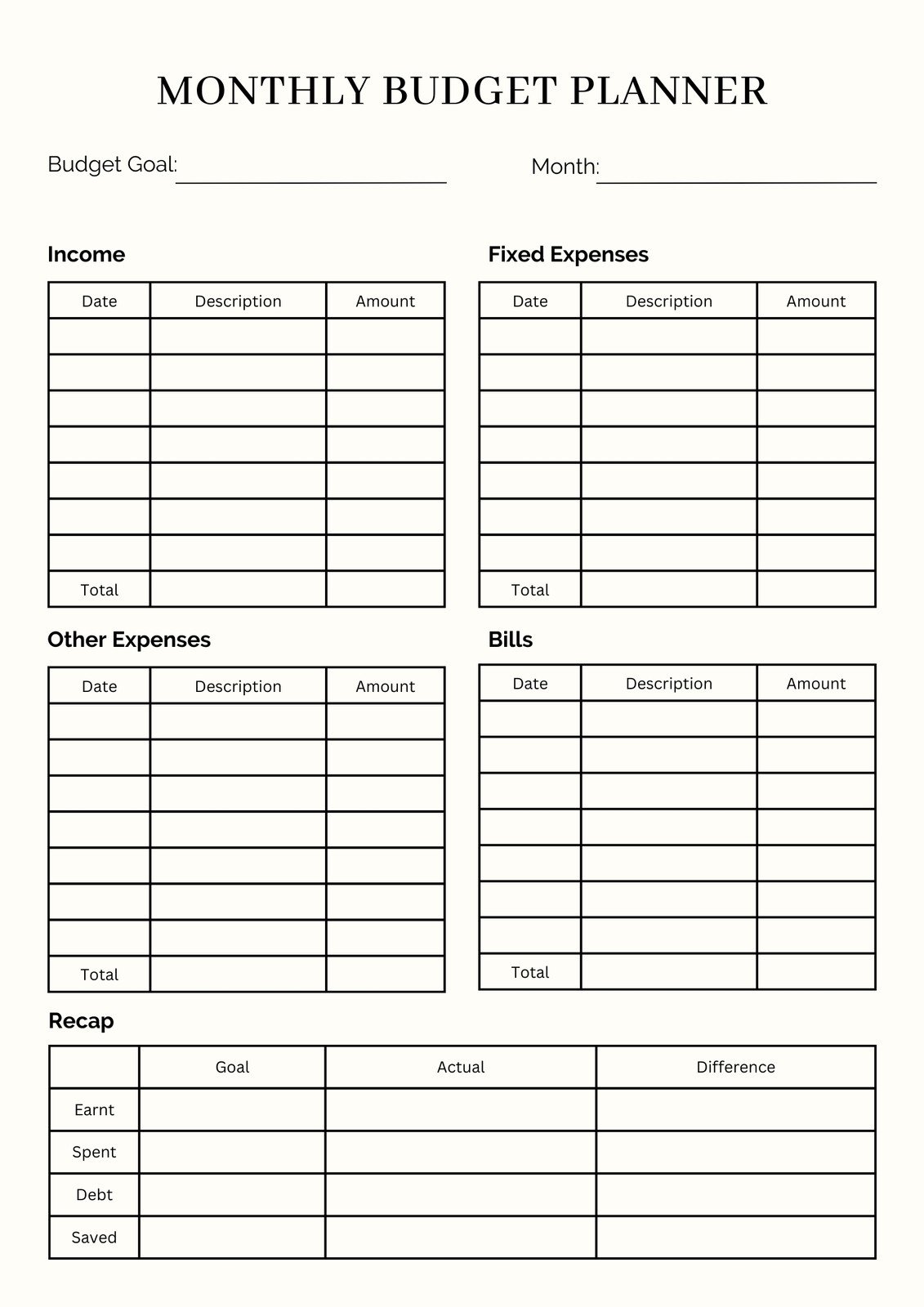

Here are the essential components you should expect to find in any good spending plan template:

- **Income Sources:** A clear listing of all money coming in, whether it’s your primary salary, freelance work, investment dividends, or other revenue streams. This provides the baseline for your budget.

- **Fixed Expenses:** These are costs that typically remain the same month after month. Examples include **rent or mortgage payments**, loan installments (car, student), insurance premiums, and subscriptions.

- **Variable Expenses:** Unlike fixed expenses, these costs fluctuate. Categories like **groceries, dining out**, utilities (which can vary seasonally), transportation, and entertainment fall into this group.

- **Savings & Investments:** This crucial section tracks money allocated for future goals. This includes contributions to your **emergency fund**, retirement accounts (401k, IRA), college savings, or a down payment fund.

- **Debt Repayment:** Beyond minimum payments for loans and credit cards, this section helps you track additional payments made to accelerate debt freedom, especially for high-interest debts.

- **Miscellaneous/Buffer:** A small allocation for unexpected small expenses or as a buffer against slight overspending in other categories. This prevents minor deviations from derailing your entire money management worksheet.

- **Tracking & Review:** A section or method to regularly compare your budgeted amounts against your actual spending. This is where you identify discrepancies and make adjustments.

Customizing Your Template for Life’s Many Phases

A generic budget spreadsheet is a good starting point, but true financial mastery comes from personalization. Life is dynamic, and your money management worksheet should reflect that. What works for a single individual straight out of college won’t necessarily suffice for a growing family or someone nearing retirement. The power of a versatile financial planning budget template lies in its adaptability to your unique circumstances and evolving financial goals.

For instance, a young professional might focus heavily on student loan repayment and building an emergency fund, with a smaller allocation for retirement. A couple planning a wedding will need specific categories for venue deposits, catering, and attire. Families with children will prioritize childcare, education savings, and increased grocery budgets. As you approach retirement, your emphasis might shift to maximizing retirement contributions, planning for healthcare costs, and managing investment drawdowns.

The key is to view your personal budget planner not as a rigid set of rules, but as a living document. It should be flexible enough to accommodate significant life changes, such as a new job, a new family member, a move to a new city, or an unexpected medical expense. Regularly review and adjust your categories and allocations to ensure your fiscal planning template remains relevant and effective. This continuous customization ensures that your budgeting efforts are always aligned with your most current priorities and aspirations, keeping your financial roadmap clear and actionable.

Putting Your Budget into Action: Tips for Success

Having the perfect income and expense tracker is only half the battle; the other half is consistently putting it into action. Many people start with enthusiasm but quickly lose steam. The journey to financial stability through budgeting requires discipline, patience, and a few strategic habits. It’s about building a routine that makes money management a natural part of your life, not a dreaded chore.

Firstly, be realistic with your initial allocations. Don’t cut categories so severely that your budget becomes unsustainable, leading to burnout and abandonment. Allow for some discretionary spending; deprivation is a common reason budgets fail. Secondly, track every dollar. Whether you use an app, a spreadsheet, or a notebook, knowing where your money goes is paramount. This insight helps you identify impulse spending and areas where you can trim expenses without feeling deprived.

Thirdly, automate your savings. Treat savings and debt payments as non-negotiable fixed expenses, ideally moving money to these accounts as soon as you get paid. This ensures you pay yourself and your future first. Fourthly, review your budget regularly. A weekly or bi-weekly check-in helps you stay on track, catch discrepancies early, and make minor adjustments before they become major problems. Finally, don’t be afraid to adjust. Life happens. If an expense comes up that wasn’t budgeted for, don’t throw in the towel. Adjust your plan for the current month and learn from it for the next. Consistency, not perfection, is the ultimate goal.

Beyond the Numbers: The Broader Impact of Strategic Budgeting

While a budget spreadsheet is undeniably a numerical tool, its true power extends far beyond rows and columns of figures. Embracing a disciplined approach to your finances through a well-maintained personal budget planner fundamentally transforms your relationship with money. It cultivates financial literacy, sharpens your decision-making skills, and most importantly, provides a profound sense of control and empowerment over your financial destiny. This proactive stance significantly reduces financial anxiety, a common stressor in modern life, leading to improved mental and emotional well-being.

By consistently applying your budgeting tool, you move from simply reacting to financial events to strategically planning for them. This shift enables you to pursue ambitious goals like saving for a child’s education, taking that dream vacation, or achieving early retirement. It’s about building a life where your money works for you, supporting your aspirations rather than limiting them. The habit of strategic budgeting fosters a mindset of intentionality, where every spending decision is a step towards your larger vision, creating a virtuous cycle of financial progress and personal growth. Ultimately, an effective financial budget template is not merely an accounting document; it’s a blueprint for a more secure, fulfilling, and financially free life.

Frequently Asked Questions

How often should I review my budget spreadsheet?

For most people, a weekly quick check-in to track spending and a more thorough review at the end of each month are ideal. This allows you to catch overspending early, make necessary adjustments, and reflect on your financial progress regularly. Major life changes or annual goals might warrant a quarterly or annual comprehensive review.

Is a manual spending plan template better than an app?

Neither is inherently “better”; it depends on your personal preference and learning style. A manual money management worksheet, whether on paper or a simple spreadsheet, often forces deeper engagement with your numbers, which can be highly beneficial for understanding. Apps offer automation, syncing with bank accounts, and often provide visual insights, saving time for those who prefer digital convenience. The best tool is the one you will consistently use.

What if I consistently overspend in a specific category?

If you consistently exceed a budget category, it’s a sign that your allocation might be unrealistic or that you need to re-evaluate your spending habits in that area. First, consider if you genuinely need more funds in that category and adjust your budget accordingly. If not, explore ways to reduce spending, such as finding cheaper alternatives, cutting back, or reallocating from a less critical category. Don’t view it as a failure, but as an opportunity to learn and refine your plan.

Can a financial budget template help with debt repayment?

Absolutely. A robust financial budget template is invaluable for debt repayment. By clearly outlining all your income and expenses, it helps you identify “extra” money that can be directed towards accelerating debt payments. It also makes you aware of how much interest you’re paying, providing a powerful motivator to pay off high-interest debts faster. It allows you to create a focused debt snowball or avalanche strategy and track your progress towards becoming debt-free.

How do I account for irregular income in my household budget tool?

Budgeting with irregular income requires a slightly different approach. One common strategy is to base your household budget tool on your lowest anticipated monthly income. Any income received above that minimum can then be allocated to a “buffer” fund, savings goals, or accelerated debt repayment. Another method is to save a few months’ worth of expenses in an emergency fund, creating a cushion that smooths out income fluctuations, giving you more stability.

Taking control of your finances doesn’t have to be an intimidating endeavor. It begins with a single, deliberate step: understanding where your money truly goes and consciously deciding where you want it to lead you. A thoughtfully constructed and consistently utilized budget empowers you to move beyond merely reacting to your financial situation and towards proactively shaping your financial future, building a foundation of security and opportunity.

The journey to financial well-being is a marathon, not a sprint, and your budget is the essential training plan that ensures you’re prepared for every mile. Embrace the clarity and confidence that comes with a clear financial roadmap. By committing to this powerful tool, you’re not just organizing numbers; you’re investing in your peace of mind, your future goals, and ultimately, a life lived with greater financial freedom and purpose.