In communities across the United States, food pantries stand as vital lifelines, offering sustenance and hope to countless individuals and families facing food insecurity. These invaluable organizations operate on the goodwill of donors, the dedication of volunteers, and often, extremely tight resources. While the passion for helping is abundant, effective financial management is the bedrock upon which long-term sustainability and maximized impact are built. Without a clear financial roadmap, even the most well-intentioned pantry can struggle with resource allocation, operational efficiency, and demonstrating accountability to its supporters.

This is where a structured financial planning tool becomes indispensable. It’s more than just a spreadsheet; it’s a strategic asset that transforms good intentions into measurable outcomes. By providing a clear snapshot of income and expenses, it empowers pantry leadership to make informed decisions, optimize operations, and ensure that every dollar and every donated can of food reaches those who need it most. Let’s explore how a dedicated financial planning tool can elevate your food assistance program, ensuring its continued ability to serve the community effectively and responsibly.

Why a Structured Financial Plan is Essential for Food Pantries

The landscape for non-profit organizations, especially those providing direct aid like food pantries, is increasingly complex. They face fluctuating donation levels, rising food costs, and the ongoing challenge of meeting growing community needs. In this dynamic environment, operating without a clear financial strategy is akin to navigating a ship without a compass. A well-defined food pantry budget provides that essential guidance, ensuring resources are used wisely and strategically.

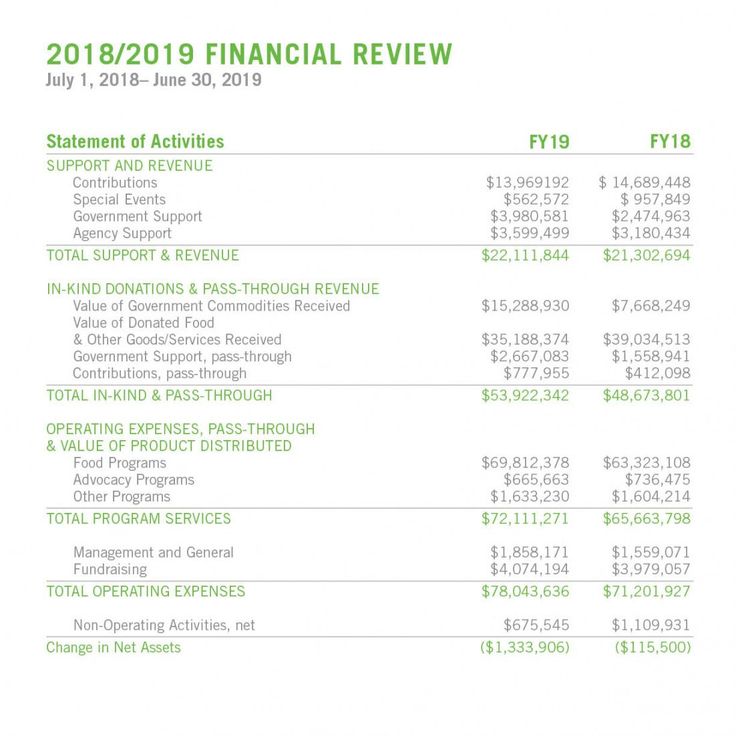

Accountability is paramount in the charitable sector. Donors, grant providers, and the community at large expect transparency and responsible stewardship of funds. A comprehensive financial plan helps demonstrate this commitment, providing clear documentation of how financial resources are acquired and expended. This level of transparency not only builds trust but also strengthens the organization’s reputation, making it more attractive to future supporters.

Furthermore, a robust financial plan enables proactive problem-solving rather than reactive crisis management. It allows pantry leaders to anticipate financial shortfalls, identify areas for cost savings, and plan for future initiatives, such as expanding services or upgrading facilities. This foresight is crucial for the long-term viability and growth of any food assistance program, ensuring it can adapt and continue to meet the evolving needs of its beneficiaries.

Key Benefits of Utilizing a Dedicated Financial Planning Tool

Adopting a formal budgeting system offers a multitude of advantages that extend beyond mere number crunching. It enhances nearly every aspect of a pantry’s operations and strategic planning. One primary benefit is improved decision-making. With a clear overview of financial health, leaders can make evidence-based choices about purchasing, staffing, and program expansion, rather than relying on guesswork.

Another significant advantage is enhanced fundraising capabilities. Grant applications and donor appeals are often strengthened by a detailed financial plan that outlines specific needs and demonstrates fiscal responsibility. Potential funders are more likely to invest in organizations that can clearly articulate their financial requirements and show how their contributions will be used effectively to achieve specific impacts. A precise budget framework instills confidence in those considering support.

Operational efficiency also sees a marked improvement. By meticulously tracking income and expenditures, a pantry financial planning tool helps identify areas of waste or inefficiency. This could mean finding more economical suppliers, optimizing transportation routes, or streamlining administrative processes. Every dollar saved through efficiency can then be redirected to directly support the mission of providing food.

Finally, a consistent financial management approach fosters greater internal communication and alignment among staff and volunteers. When everyone understands the organization’s financial constraints and goals, it promotes a unified effort towards common objectives. This shared understanding reduces misunderstandings and ensures that all activities align with the overall financial strategy of the food distribution service.

Core Components of an Effective Pantry Financial Plan

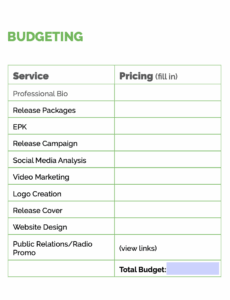

An effective Food Pantry Budget Template is designed to capture all relevant financial data, offering a holistic view of the organization’s economic health. It typically breaks down into two main categories: income and expenses, each with several crucial sub-sections. Understanding and meticulously tracking these components is fundamental to sound fiscal management.

Here are the key elements you’ll typically find within a comprehensive financial planning sheet:

- Revenue Streams:

- **Cash Donations:** Direct financial gifts from individuals, corporations, and community groups.

- **Grants:** Funding received from foundations, government agencies, or other charitable organizations.

- **Fundraising Events:** Income generated from special events, such as galas, bake sales, or charity runs.

- **In-Kind Donations:** The estimated monetary value of donated goods (e.g., food, cleaning supplies, office equipment) and services (e.g., pro-bono accounting, marketing).

- **Other Income:** Miscellaneous revenue from sources like bank interest or small sales.

- Operational Expenses:

- **Food Procurement:** Costs associated with purchasing food items directly from suppliers, including fresh produce, proteins, and non-perishables.

- **Transportation:** Expenses related to picking up donations, delivering food, and vehicle maintenance (fuel, repairs, insurance).

- **Storage and Facilities:** Rent or mortgage payments, utilities (electricity, water, gas), and maintenance for the pantry space.

- **Staffing and Personnel:** Salaries, wages, benefits, and payroll taxes for any paid staff members.

- **Volunteer Support:** Costs associated with volunteer appreciation, training, background checks, or specific supplies they use.

- **Administrative Costs:** Office supplies, insurance (general liability, D&O), accounting services, legal fees, and postage.

- **Outreach and Marketing:** Expenses for promoting services, recruiting volunteers, and engaging with the community.

- **Technology:** Costs for software subscriptions, website maintenance, and hardware necessary for operations.

- **Miscellaneous:** Any other recurring or one-time expenses that don’t fit into the above categories.

Getting Started: Customizing Your Financial Planning Sheet

While a generic Food Pantry Budget Template provides an excellent starting point, its true value comes from its customization to your specific organization. Every food assistance program has unique operational nuances, funding sources, and expenditure patterns. The first step in adaptation involves reviewing historical financial data, typically from the past one to three years, to understand average income and expense levels.

Analyze your pantry’s specific operations. Do you rely heavily on bulk food purchases, or are in-kind donations your primary source of food? Do you have paid staff, or is your operation entirely volunteer-driven? These distinctions will dictate which categories are most important to track and where you might need to add or remove line items in your financial management tool. For instance, a pantry with its own delivery vehicle will need detailed transportation cost tracking, while one that relies on donor drop-offs might have minimal transport expenses.

Engage key stakeholders in the customization process. This includes board members, the executive director, finance committees, and even long-term volunteers who have an intimate understanding of day-to-day operations. Their input can reveal overlooked expenses or potential income streams. The goal is to create a budget framework that accurately reflects your pantry’s reality and supports its unique mission and operational model. Remember, this tool is meant to serve your pantry, not the other way around.

Maximizing Impact: Tips for Ongoing Financial Stewardship

Implementing a budget is just the beginning; consistent financial stewardship is key to its long-term effectiveness. Regular review is paramount. Schedule monthly or quarterly meetings with your finance committee or leadership team to review the budget versus actual expenditures and income. This allows for timely adjustments and keeps everyone informed about the pantry’s financial health.

Forecasting and planning for the future are also critical. Beyond tracking current numbers, a robust financial plan should enable you to project future income and expenses. This helps in strategic planning, identifying potential funding gaps, and preparing for seasonal fluctuations in donations or demand. Consider creating multiple budget scenarios—best case, worst case, and most likely—to prepare for various possibilities.

Don’t overlook the importance of contingency planning. Unexpected expenses or dips in donations can occur. Building a reserve fund, even a small one, into your budget can provide a crucial safety net during leaner times. This financial cushion can prevent disruptions to your core services and help maintain stability when unforeseen challenges arise.

Finally, effective communication of your financial status is vital. Share budget summaries with your board, major donors, and even your volunteers. Transparency fosters trust and encourages continued support. When people understand how their contributions are being managed and the impact they are making, they become more invested in the success of your food assistance efforts. This open dialogue strengthens the entire community supporting your mission.

Frequently Asked Questions

How often should our pantry review its financial plan?

Ideally, your pantry should conduct a detailed review of its financial plan monthly. This allows for prompt identification of discrepancies, quick adjustments to spending, and accurate tracking of income against projections. A quarterly review is the minimum recommended to maintain effective financial oversight.

Can a small, volunteer-run pantry truly benefit from a detailed budget?

Absolutely. Even the smallest, entirely volunteer-run pantry benefits immensely from a detailed financial plan. It provides clarity on spending, helps articulate needs for fundraising, ensures resources are maximized, and fulfills transparency expectations, regardless of the organization’s size.

What’s the best way to track in-kind donations within a budget?

For in-kind donations, it’s best to estimate their fair market value. You can create a separate line item or section within your financial management tool for these contributions, categorizing them by type (e.g., donated food, volunteer hours, donated services). While not cash, tracking their value provides a more complete picture of your pantry’s total resources and impact.

How does a well-managed financial plan help with grant applications?

A well-managed financial plan provides concrete data that demonstrates your organization’s fiscal responsibility and specific funding needs. Grantors look for detailed, clear budgets that show how their money will be used effectively and align with the pantry’s mission. It signals professionalism and trustworthiness, significantly strengthening your application.

Is there an ideal time to start implementing a new budgeting system?

The best time to start implementing a new budgeting system or a Food Pantry Budget Template is at the beginning of your organization’s fiscal year. This allows you to track a full year’s worth of financial activity consistently. However, if that’s not feasible, any time is a good time to begin improving your financial stewardship. Just ensure you account for the portion of the fiscal year already passed.

Adopting a robust financial management strategy, anchored by a customized budget, is not merely a bureaucratic task; it’s a strategic imperative for any food pantry committed to long-term community service. It transforms an intuitive, mission-driven operation into a highly efficient, transparent, and sustainable force for good. By embracing the principles of sound financial planning, your organization ensures that every resource is optimized, every donor dollar is wisely spent, and every individual seeking assistance receives the support they need.

The journey towards enhanced fiscal health for your food assistance program starts with a single step: committing to a structured approach to your finances. Utilize a comprehensive financial planning tool to gain clarity, foster accountability, and empower your team to make the most impactful decisions. In doing so, you strengthen not only your organization but also the very fabric of the community you tirelessly serve, providing enduring hope and nourishment for those who need it most.