In today’s competitive talent landscape, fostering a vibrant and supportive workplace culture is no longer a luxury but a strategic imperative. Organizations are increasingly recognizing that engaged employees are more productive, innovative, and loyal, directly impacting the bottom line. However, the commitment to enhancing the employee experience often comes with a significant question: how do we effectively allocate resources to these vital initiatives? This is where a well-structured approach to funding your people-centric programs becomes indispensable, providing clarity and strategic direction.

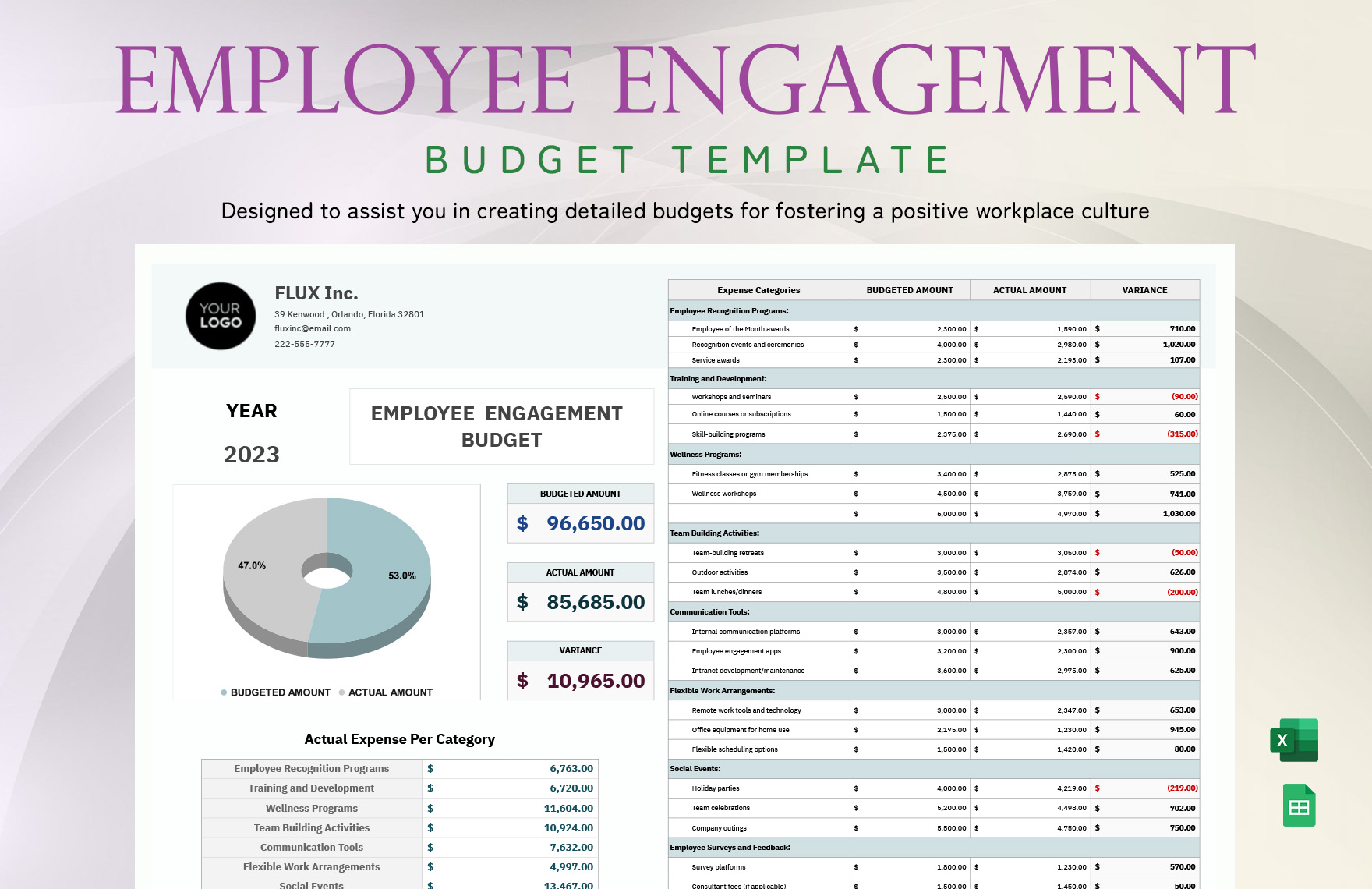

Developing a robust financial framework for your engagement efforts is crucial for any organization looking to make a meaningful impact. It ensures that investments are aligned with strategic goals, prevents reactive spending, and provides a clear pathway for measuring return on investment. This article will guide you through understanding, creating, and leveraging an Employee Engagement Budget Template to transform your employee experience and drive sustained organizational success.

Why Investing in Employee Engagement Matters

The benefits of a highly engaged workforce resonate throughout an entire organization. Companies with high engagement levels typically report lower absenteeism, reduced turnover, and higher customer satisfaction. These aren’t just feel-good metrics; they translate directly into substantial financial gains and a stronger market position. Ignoring employee engagement often leads to disengaged staff, which can be a silent killer for productivity and morale.

A dedicated spending plan for staff engagement demonstrates to your employees that their well-being and professional growth are valued. This commitment builds trust, fosters a sense of belonging, and ultimately empowers individuals to contribute their best work. Without a clear financial commitment, engagement initiatives often become sporadic, lacking the consistency and impact needed to drive real change.

Understanding the Core Components of an Engagement Budget

An effective workplace engagement financial framework isn’t just a list of expenses; it’s a strategic allocation of resources designed to nurture and motivate your workforce. It encompasses various categories, each contributing to a holistic employee experience. Understanding these core components is the first step in building a comprehensive and impactful budget for staff engagement.

This financial model should reflect your company’s unique culture and strategic objectives. It’s about more than just throwing money at problems; it’s about investing wisely in programs that genuinely resonate with your team and yield tangible results. Consider what truly impacts your employees’ daily lives and long-term career paths within your organization.

Key Categories for Your Engagement Spending Plan:

- **Recognition & Rewards Programs:** This includes budgets for peer recognition platforms, service awards, performance bonuses, and spot awards. Effective recognition is often the most cost-effective way to boost morale.

- **Professional Development & Training:** Allocations for external courses, certifications, internal training workshops, leadership development programs, and tuition reimbursement. Investing in growth shows employees you value their future.

- **Well-being & Mental Health Initiatives:** Funding for employee assistance programs (EAPs), wellness challenges, gym memberships or subsidies, mindfulness apps, and mental health support services. A healthy employee is a happy, productive employee.

- **Team Building & Social Events:** Resources for team lunches, holiday parties, company outings, virtual social events, and department-specific team builders. These foster camaraderie and a sense of community.

- **Communication & Feedback Tools:** Subscriptions for employee survey platforms, internal communication tools (e.g., Slack, Teams), and anonymous feedback systems. Open dialogue is crucial for engagement.

- **Work-Life Balance Support:** Budgets for flexible work arrangements (e.g., remote work stipends, co-working space subsidies), parental leave support, and dependent care resources.

- **Physical Environment & Amenities:** Investments in ergonomic equipment, comfortable break areas, healthy snacks, or on-site facilities that enhance the daily work experience.

Crafting Your Engagement Spending Plan: A Step-by-Step Approach

Developing a comprehensive employee engagement budget template requires a structured approach. It’s not a one-size-fits-all solution but a customizable framework that aligns with your organization’s specific needs, size, and culture. Here’s how to build your own effective financial planning for employee programs.

First, assess your current state. What engagement initiatives are already in place? What are their costs and perceived effectiveness? Gather feedback from employees through surveys, focus groups, or one-on-one discussions to understand their needs and pain points. This diagnostic phase is crucial for identifying gaps and opportunities.

Next, define your engagement goals. Are you aiming to reduce turnover by a certain percentage? Improve employee satisfaction scores? Increase participation in wellness programs? Clear, measurable goals will inform your spending priorities and help justify your investment. Your budget should be a direct reflection of these objectives.

Then, research and benchmark. Look at what similar companies in your industry are spending on staff experience. While you don’t need to mimic them exactly, benchmarking provides valuable context and helps set realistic expectations. Explore various vendors and solutions for different initiatives, comparing costs and features to find the best fit for your budget.

Finally, draft, review, and refine. Create a preliminary draft of your engagement initiative funding guide, allocating funds to each identified category based on your goals and research. Present this draft to key stakeholders, including HR, finance, and leadership, for feedback. Be prepared to justify your proposed expenditures with anticipated benefits and potential ROI. This iterative process ensures buy-in and a well-supported plan.

Strategic Allocation: Where to Focus Your Funds

With a clear financial framework in place, the next challenge is to strategically allocate your resources to maximize impact. Prioritization is key, especially when budgets are not unlimited. Focus your investments on areas that will yield the greatest return in terms of employee satisfaction, productivity, and retention.

Consider segmenting your budget based on different employee needs or strategic pillars. For instance, younger employees might prioritize professional development and flexible work options, while long-tenured staff might value recognition and comprehensive benefits. A flexible resource allocation for employee well-being can cater to diverse demographics within your workforce.

A critical aspect of strategic allocation is to avoid spreading your resources too thinly. It’s often more effective to invest significantly in a few high-impact initiatives rather than making small, negligible contributions across many areas. Regularly review the effectiveness of your programs to ensure your funds are being utilized optimally and adjust as needed. This iterative approach to investing in workforce satisfaction helps ensure continuous improvement.

Measuring ROI and Optimizing Your Engagement Investments

A budget is more than just a spending plan; it’s a tool for accountability and improvement. To demonstrate the value of your investments, it’s essential to measure the return on investment (ROI) of your engagement programs. This involves tracking key metrics before and after implementing initiatives and correlating them with your spending.

For instance, if you invest in a new professional development platform, track completion rates, skill improvements, and how those new skills contribute to project success or promotions. For wellness programs, monitor participation, health claims, and reported stress levels. The goal is to show a tangible benefit that justifies the financial outlay for your team engagement financial model.

Regularly analyze your data to identify what’s working well and what isn’t. Are certain programs consistently under-utilized? Are others exceeding expectations and delivering clear value? Use these insights to optimize your engagement budget framework. Don’t be afraid to reallocate funds from less effective initiatives to those that are proving to be successful. Continuous optimization ensures your financial resources are always working as hard as possible to enhance the employee experience.

Frequently Asked Questions

How often should we review and update our employee engagement spending plan?

Ideally, your engagement spending plan should be reviewed quarterly to assess effectiveness and make minor adjustments. A comprehensive annual review is essential to align with overall business objectives, re-evaluate priorities, and plan for the upcoming fiscal year. This allows for flexibility and responsiveness to changing employee needs and market conditions.

What if our organization has a limited budget for engagement initiatives?

Even with a limited budget, significant impact can be achieved by focusing on low-cost or no-cost initiatives. Prioritize genuine recognition, clear communication, opportunities for professional growth (e.g., mentorship, internal learning), and fostering a positive work environment. Leveraging internal resources and employee volunteers can also stretch a tight budget further.

How can we get leadership buy-in for a dedicated employee engagement budget?

To gain leadership buy-in, present a clear business case. Connect engagement initiatives directly to tangible business outcomes such as reduced turnover, increased productivity, improved customer satisfaction, and enhanced profitability. Provide data, benchmarks, and potential ROI projections. Emphasize that investing in employees is investing in the company’s future success.

Should remote and in-office employees have separate budget allocations?

While the overall engagement budget should cover all employees, it’s wise to consider specific allocations for remote and in-office staff, as their needs for engagement may differ. Remote teams might benefit more from virtual team-building activities, home office stipends, and enhanced communication tools, whereas in-office staff might appreciate on-site amenities or local team events. Flexibility and equity are key.

What are the biggest pitfalls to avoid when creating an engagement budget?

Common pitfalls include treating engagement as a one-time expense rather than an ongoing investment, failing to align initiatives with actual employee needs, not measuring the impact of programs, and neglecting to get leadership buy-in. Also, avoid being overly prescriptive; an effective budget allows for flexibility to respond to unforeseen opportunities or challenges.

Establishing a clear and actionable employee engagement budget template is a proactive step towards building a thriving workplace culture. It transforms abstract desires into concrete plans, ensuring that your organization’s commitment to its people is backed by tangible resources. This structured approach not only optimizes spending but also strengthens the foundation of your company by cultivating a workforce that feels valued, supported, and motivated.

Embrace the power of strategic financial planning for your employee experience initiatives. By meticulously crafting your budget, measuring its impact, and continually refining your approach, you can create an environment where employees truly flourish. This dedication will undoubtedly lead to a more resilient, innovative, and successful organization for years to come.