In the vibrant world of choral music, where harmonies intertwine and voices unite, the focus is often, and rightly so, on the artistic expression. Directors and members pour their hearts into rehearsals, perfecting intonation, dynamics, and interpretation. Yet, behind every successful performance, every impactful tour, and every inspiring community outreach program, lies a crucial, often overlooked, foundation: sound financial management. Without a clear understanding of income and expenditures, even the most talented choirs can face unexpected challenges that distract from their musical mission.

Imagine the peace of mind that comes from knowing exactly where your choir’s money is going, anticipating future needs, and planning for growth with confidence. This is where a well-structured financial tool becomes indispensable. It’s not just about tracking expenses; it’s about empowering your ensemble to achieve its artistic dreams without financial hurdles. A robust Choir Budget Template transforms abstract financial concepts into actionable insights, providing a roadmap for fiscal responsibility and artistic flourishing.

The Unsung Hero: Why Every Choir Needs a Financial Plan

For many choirs, especially volunteer-led or community-based groups, financial planning can seem daunting, a task better suited for professional accountants than passionate musicians. However, a choir budget is far more than a simple ledger; it’s a strategic document that ensures the longevity and vitality of your vocal ensemble. It allows leadership to make informed decisions, allocate resources effectively, and communicate financial health transparently to members, stakeholders, and potential donors.

Having a dedicated financial plan fosters an environment of trust and accountability. When everyone understands the financial landscape, from membership dues to performance costs, it cultivates a shared sense of responsibility. This transparency is key to preventing misunderstandings and building a strong, unified team, all working towards common musical goals. It shifts the focus from guessing to knowing, transforming financial management from a chore into a powerful tool for artistic advancement.

Ultimately, a detailed financial framework safeguards your choir’s future. It helps anticipate potential shortfalls, identify opportunities for savings, and plan for significant investments like new sheet music, guest artists, or a recording project. By proactively managing finances, choirs can avoid crisis situations and instead focus their energy on what they do best: creating beautiful music together.

Demystifying the Dollar: What Goes Into a Choir’s Financial Blueprint?

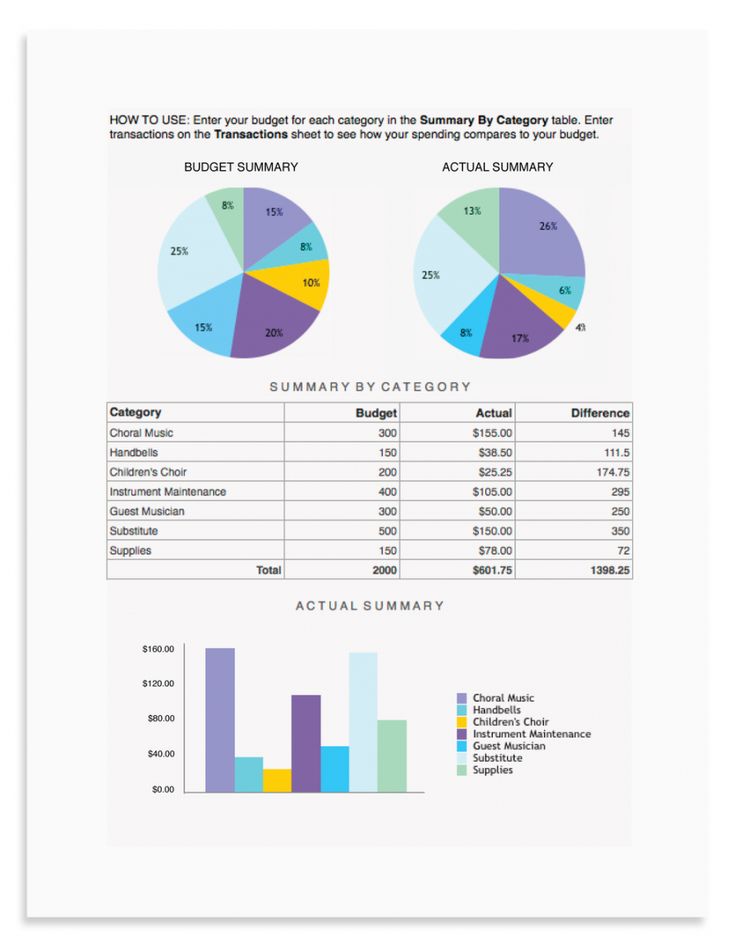

Understanding the components of a comprehensive financial plan is the first step toward effective management. A well-designed Choir Budget Template will typically categorize both income and expenses, offering a clear snapshot of your financial flow. On the income side, sources can be diverse, ranging from member dues and ticket sales for performances to fundraising events, grants, and individual donations. Each revenue stream needs to be accurately estimated and tracked.

Expenditures, on the other hand, are often more numerous and varied. These can include the costs associated with rehearsal space rental, purchasing or licensing new music, director and accompanist fees, and instrument maintenance. Uniforms or performance attire, marketing materials, website hosting, and administrative supplies also represent regular outflows that must be accounted for.

Beyond the essentials, choirs often incur expenses related to special events, such as concert hall rentals, sound engineers, guest soloists, or travel for competitions and tours. Building a buffer for unexpected costs, known as a contingency fund, is also a critical component. A detailed and organized financial framework ensures that all these elements are captured, allowing for thorough planning and preventing surprises.

Crafting Your Custom Choral Financial Management Tool

There’s no one-size-fits-all solution when it comes to managing a choir’s finances. The ideal financial management tool will be tailored to your specific ensemble’s size, goals, and operational model. Begin by reviewing historical financial data, if available. Look at past income and expenses to establish realistic baselines for your projections. This historical perspective is invaluable for anticipating future trends and making more accurate forecasts.

Next, consider your choir’s artistic and operational goals for the upcoming season or year. Are you planning a major tour, commissioning a new piece, or expanding your educational outreach? Each of these initiatives will have significant financial implications that must be integrated into your planning. Involve key stakeholders, such as the director, board members, and finance committee, in this collaborative process to ensure buy-in and a comprehensive perspective.

When building or adapting a budget, focus on clarity and granularity. A good spending plan breaks down broad categories into specific line items, making it easier to track and control. Here are some key components to include:

- **Income Sources:** Clearly list all expected revenue streams, such as member dues, ticket sales, donations, grants, and fundraising profits.

- **Expenditure Categories:** Detail all anticipated costs, including **Personnel (Director, Accompanist fees)**, **Rehearsal Space**, **Music Rights and Purchases**, **Performance Venue Costs**, **Marketing and Advertising**, **Travel and Accommodation**, **Equipment Maintenance**, and **Administrative Supplies**.

- **Contingency Fund:** Allocate a percentage of the total budget (e.g., 5-10%) for unexpected expenses or emergencies.

- **Reporting Structure:** Define how and when financial reports will be generated and shared with relevant parties, ensuring transparency and accountability.

Maximizing Your Funds: Smart Strategies for Choral Ensembles

Once your financial blueprint is in place, the next step is to implement strategies that maximize your resources and ensure financial stability. Creative fundraising is often a cornerstone of a successful choral group. Think beyond traditional bake sales; consider partnerships with local businesses, themed concert series, or online crowdfunding campaigns that resonate with your mission. Clearly articulating your financial needs and how funds will be used can inspire greater generosity.

Grant writing can also unlock significant funding opportunities from foundations, arts councils, and community organizations. Research grants specifically aimed at supporting musical arts, cultural education, or community engagement. Tailor your applications to highlight your choir’s unique contributions and the positive impact it has on the community. A well-managed budget provides the data and credibility needed for compelling grant proposals.

Building strong community partnerships extends beyond fundraising. Collaborating with other local arts organizations, schools, or community centers can lead to shared resources, reduced costs for venues or equipment, and expanded audience reach. Strategic planning in your fiscal guide allows for these proactive engagements, turning potential expenses into collaborative opportunities.

Common Pitfalls in Choral Spending Plans and How to Avoid Them

Even with the best intentions, choirs can fall into common financial traps. One frequent oversight is underestimating or completely overlooking certain costs. Hidden expenses like performance licensing fees, insurance, or minor administrative supplies can quickly add up if not budgeted for. A thorough review of past spending and consultation with experienced colleagues can help identify these “surprise” costs.

Another significant pitfall is failing to establish and maintain a contingency fund. Without a safety net, an unexpected expense—like a sudden increase in rehearsal space rent or a last-minute equipment repair—can derail the budget and cause considerable stress. Always aim to allocate a portion of your income to this critical reserve.

Poor communication about the choir’s financial health can also lead to issues. When members, the board, or even the director are not fully aware of the budget, it can result in unrealistic expectations, frustration, or a lack of motivation for fundraising efforts. Regular, clear financial updates are essential. Lastly, many groups create a budget at the beginning of the year but fail to track actual spending against it or revise it as circumstances change. A budget is a living document that needs regular monitoring and adjustments to remain effective.

Frequently Asked Questions

Why is a dedicated financial framework important for a small community choir?

Even small choirs benefit immensely from a clear financial framework. It ensures transparency with member dues, allows for planning small expenses like new music or an accompanist’s fee, and prevents the director from personally covering unforeseen costs. It fosters sustainability and peace of mind, regardless of the group’s size.

How often should our choir’s monetary guide be reviewed?

Ideally, your choir’s monetary guide should be reviewed at least quarterly to track actual spending against projections. A more thorough review and revision process should occur annually, usually before the start of a new performance season, to incorporate new goals and adjust for changing financial realities.

What’s the best way to get choir members involved in financial planning?

Engage choir members by forming a small finance committee, which can include members with financial expertise. Be transparent with budget summaries, hold open discussions about financial goals, and clearly communicate how member contributions and fundraising efforts directly support the choir’s artistic endeavors.

Can a budget help with fundraising efforts?

Absolutely. A well-defined budget clearly articulates your choir’s financial needs, allowing you to present specific funding requests to donors, grant-makers, and sponsors. It demonstrates fiscal responsibility and provides concrete examples of how their contributions will be utilized, increasing their confidence in supporting your organization.

Crafting and maintaining a robust financial plan might not involve soaring high notes or intricate harmonies, but it is undeniably one of the most vital components of a thriving choral program. It transforms financial ambiguity into clarity, enabling thoughtful planning and strategic growth. By embracing this crucial administrative task, choir leadership can ensure that their ensemble not only survives but truly flourishes, free to pursue artistic excellence without the burden of financial uncertainty.

The investment of time and effort into developing a clear financial roadmap pays dividends far beyond mere numbers. It cultivates an environment where creativity can truly take flight, backed by a solid and sustainable foundation. Equip your choir with the financial tools it deserves, and watch as your collective voices reach new heights, unencumbered by monetary concerns.