In an increasingly complex financial world, clarity and control over our money are not luxuries, but necessities. Many of us navigate our daily lives with a vague understanding of where our hard-earned dollars go, leading to stress, missed financial goals, and a persistent feeling of being just one step behind. Imagine a tool that transforms this ambiguity into a clear, actionable roadmap for your money, empowering you to make informed decisions and build the future you envision.

That’s precisely the power of a well-crafted Personal Expenses Budget Template. It’s more than just a list of numbers; it’s a living document that brings transparency to your spending habits, helps you identify opportunities for saving, and serves as the bedrock for achieving everything from a down payment on a home to a comfortable retirement. Whether you’re a recent graduate starting your financial journey, a seasoned professional aiming for smarter investments, or a family simply trying to keep up with rising costs, understanding and utilizing a robust expense tracking system is the single most effective step you can take towards financial well-being.

Why a Personal Budget Matters

At its core, a budget is a spending plan. It allocates your income to different areas, from essential living expenses to savings and discretionary spending, before you even spend it. This proactive approach is a game-changer, shifting your financial mindset from reactive to strategic. By consciously deciding where your money goes, you regain control and reduce the anxiety often associated with personal finance.

A powerful personal financial blueprint allows you to clearly see your financial reality. It highlights areas where you might be overspending, identifies opportunities for cutting back without sacrificing quality of life, and ensures you’re allocating enough towards your most important goals. This insight is invaluable for breaking cycles of debt, building an emergency fund, and saving for significant life events. Ultimately, it’s about aligning your spending with your values and aspirations, making every dollar work smarter for you.

What Makes an Effective Expense Tracking Template

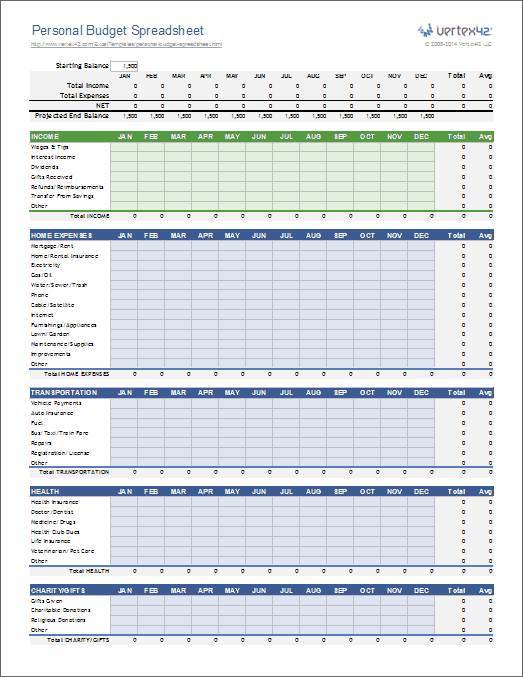

A robust expense tracking template isn’t just about listing transactions; it’s about providing a comprehensive, adaptable framework for managing your entire financial picture. While the specific layout might vary, certain core components are non-negotiable for a truly effective tool. These elements ensure you capture all necessary data and gain meaningful insights into your spending and saving habits.

An ideal template should be intuitive, allowing you to easily input and categorize your income and expenditures. It needs to be flexible enough to accommodate fluctuations in your financial life, such as raises, unexpected expenses, or changes in living situations. The best financial management template simplifies the often daunting task of money management, making it accessible and even enjoyable.

Here are the key elements to look for in a comprehensive budget spreadsheet:

- Income Section: A clear area to list all sources of income, including your net pay, side hustle earnings, and any other money flowing into your accounts.

- Fixed Expenses: Categories for expenses that typically remain the same each month, such as rent/mortgage, loan payments, insurance premiums, and subscriptions. These are predictable and foundational.

- Variable Expenses: Sections dedicated to costs that fluctuate, like groceries, dining out, transportation, utilities (which can vary), and entertainment. This is where most overspending often occurs.

- Savings & Debt Repayment Goals: Designated categories for contributions to your emergency fund, retirement accounts, investment portfolios, and specific debt repayment strategies. This ensures you’re actively building wealth and reducing liabilities.

- Actual vs. Budgeted Comparison: A crucial feature that allows you to compare what you *planned* to spend versus what you *actually* spent in each category. This feedback loop is essential for refining your budget.

- Transaction Log: A detailed area to record every transaction, including date, amount, and category, enabling granular tracking and easy reconciliation.

Getting Started: Customizing Your Financial Blueprint

Implementing a Personal Expenses Budget Template might seem daunting at first, but with a structured approach, you can create a customized financial blueprint that genuinely serves your needs. The goal is to build a spending plan that reflects your unique circumstances, not a rigid set of rules that leaves you feeling deprived. The beauty of a template lies in its adaptability.

Begin by gathering all your financial information. This includes bank statements, credit card statements, pay stubs, and any other records of income and expenses for the past few months. Having this data readily available will make the initial setup much smoother. Don’t skip this step; it provides the real-world foundation for your budget.

Next, categorize your past spending using the framework provided by your chosen budget spreadsheet. This step is critical for understanding your current habits. You might be surprised at how much you’re spending on certain discretionary items, or conversely, how little you’re allocating to savings. Use this information to inform your initial budget allocations. Be honest with yourself about where your money has been going.

Once you have a clear picture of your income and typical expenses, set realistic spending limits for each category. This isn’t about immediate drastic cuts; it’s about making conscious choices. Start with amounts that feel achievable, and gradually adjust as you become more comfortable and knowledgeable about your spending patterns. Remember, the goal is progress, not perfection. Regularly reviewing and adjusting your expense tracker will be key to its long-term success.

Beyond the Numbers: Maximizing Your Budget’s Impact

While the quantitative aspects of a Personal Expenses Budget Template are undeniably important, its true power extends beyond mere arithmetic. A successful spending plan integrates into your daily life and empowers positive financial behaviors. To truly maximize the impact of your financial planning tool, consider incorporating strategies that address the psychological and behavioral aspects of money management.

One highly effective technique is to automate your savings and bill payments. By setting up automatic transfers to your savings accounts, investment portfolios, and for recurring bills, you ensure that your financial goals are prioritized, and you minimize the risk of forgetting payments. This "pay yourself first" approach guarantees that you’re consistently working towards building wealth before other expenses compete for your funds.

Another valuable strategy for managing variable spending is to utilize the "envelope method," even in a digital age. Allocate specific amounts for categories like groceries, entertainment, or dining out. Once that virtual "envelope" is empty, you stop spending in that category until your next budget cycle. This tangible limit can be incredibly effective in curbing overspending.

Finally, regularly schedule "money dates" with yourself or your partner. These aren’t punitive sessions but dedicated times to review your budget spreadsheet, track your progress, and celebrate your wins. This consistent engagement keeps your financial goals top of mind and allows you to make timely adjustments, ensuring your budget remains a relevant and effective tool for your ongoing financial journey.

Common Pitfalls and How to Avoid Them

Even with the best Personal Expenses Budget Template, achieving financial mastery isn’t without its challenges. Many people start with great enthusiasm but quickly become disheartened when they encounter obstacles. Understanding these common pitfalls beforehand can help you navigate them more effectively, ensuring your long-term success.

One of the most frequent mistakes is setting unrealistic expectations. Expecting to go from zero savings to perfectly optimized spending overnight is a recipe for frustration. Financial change is a marathon, not a sprint. Start with small, manageable adjustments and celebrate incremental progress. A budget that’s too restrictive can also lead to burnout; allow for some discretionary spending to maintain motivation.

Another pitfall is ignoring small expenses. Those daily coffees, impulse purchases, or forgotten subscriptions can add up significantly over a month, eroding your budget without you even realizing it. This is where diligent expense tracking becomes crucial. Make sure every dollar is accounted for, no matter how small.

Finally, many people give up too soon. It’s common to miss a budget target or have an unexpected expense derail your plan for a month. The key is not to view these as failures but as learning opportunities. Analyze what went wrong, adjust your financial management template, and restart with renewed determination. Consistency, not perfection, is the goal in creating a sustainable spending plan.

Frequently Asked Questions

How often should I update my expense tracker?

Ideally, you should review and update your expense tracker weekly to keep up with transactions and ensure accuracy. A more thorough review, including reconciling accounts and analyzing overall performance, should be done monthly. If your income or major expenses change significantly, adjust your budget immediately.

What if my actual spending consistently exceeds my budget?

If you’re consistently over budget, it’s a sign that your spending plan needs adjustment. First, review your variable expenses to identify areas where you can cut back. Second, consider if your budget allocations are realistic; you might need to increase certain categories and find offsets elsewhere. Lastly, explore opportunities to increase your income.

Is a digital spreadsheet better than a paper budget?

The “better” option depends entirely on your personal preference and how you best engage with your finances. Digital spreadsheets offer automation, calculation capabilities, and easy data analysis. Paper budgets can be more tactile, reduce screen time, and for some, feel more tangible. Choose the method that you’re most likely to stick with consistently.

How detailed should my spending categories be?

Start with broader categories to avoid getting overwhelmed. As you become more comfortable with your personal expense budget, you can refine and create more specific sub-categories if you find it helpful for analysis. The balance is to have enough detail to be informative, but not so much that it becomes cumbersome to track.

Can a budget really help with large financial goals like buying a house?

Absolutely. A budget is the foundational tool for achieving any significant financial goal. It allows you to identify exactly how much you can realistically save each month towards a down payment, track your progress, and make informed decisions about adjusting your spending to reach that goal faster. It transforms a dream into an actionable plan.

Embracing a robust expense tracking template is more than just a financial exercise; it’s an investment in your peace of mind and your future. It provides the clarity to understand your financial landscape, the tools to navigate it effectively, and the confidence to steer towards your most ambitious goals. The journey to financial freedom often begins with this single, powerful step: taking control of your spending.

Don’t let the idea of budgeting feel like a restriction; instead, see it as a liberation. A well-managed spending plan frees you from financial worries, empowers you to make intentional choices, and allows you to allocate your resources towards what truly matters to you. Start today, and witness the transformative impact a simple Personal Expenses Budget Template can have on your life. Your future self will thank you.