In an ideal world, managing your finances would be intuitive, stress-free, and perfectly aligned with your long-term goals. For many of us, however, the reality is often a whirlwind of incoming bills, fluctuating expenses, and the perennial question of where all our hard-earned money actually goes. It’s easy to feel overwhelmed, to simply hope for the best, or to avoid looking at the numbers altogether. Yet, taking control of your financial destiny doesn’t require a degree in economics or a personal financial advisor; it simply requires a clear roadmap and the right tools.

That’s where a well-structured approach to managing your household finances comes into play. It transforms abstract anxieties into concrete data, empowering you to make informed decisions and steer your financial ship with confidence. Far from being restrictive, a robust financial management system offers clarity, reduces stress, and unlocks the potential for savings and goal achievement you might not have thought possible. It’s the essential first step towards building a secure financial future for yourself and your family.

Why a Budgeting Tool is Your Financial North Star

Understanding where your money comes from and where it goes is the bedrock of financial stability. A comprehensive household spending plan acts as your personal financial compass, guiding every spending decision and investment choice. It illuminates hidden spending patterns, highlights areas for potential savings, and provides the necessary insights to reduce debt and grow your wealth. This isn’t just about cutting costs; it’s about intentional living and aligning your spending with your values and aspirations.

The benefits extend far beyond mere number-crunching. With a clear overview of your income and expenditures, you gain a sense of control that can dramatically reduce financial stress. You’ll be better equipped to handle unexpected expenses, plan for major life events like buying a home or sending a child to college, and ultimately, achieve financial freedom. Whether you’re a recent graduate, a growing family, or nearing retirement, a meticulously crafted financial blueprint empowers you to make proactive choices instead of reactive ones.

Key Elements of an Effective Financial Plan

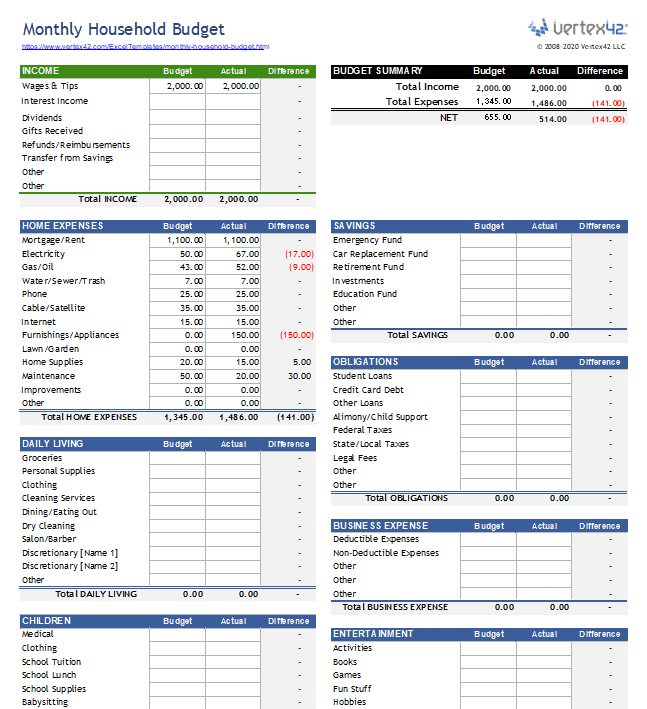

While the specifics might vary, every successful personal financial tracker shares several core components. These elements work in concert to give you a complete picture of your financial health. Understanding and diligently populating each section is crucial for the effectiveness of your overall money management system.

Firstly, accurately recording all your income sources is paramount. This includes salaries, freelance earnings, passive income, and any other money flowing into your accounts. Knowing your total net income sets the baseline for all subsequent calculations.

Next, you’ll categorize your expenses. These typically fall into two main types:

- Fixed Expenses: These are costs that generally remain the same each month, such as rent or mortgage payments, loan installments (car, student), insurance premiums, and subscription services. They are predictable and easier to budget for.

- Variable Expenses: These fluctuate from month to month and require more diligent tracking. Examples include groceries, utilities (which can vary seasonally), transportation costs, dining out, entertainment, and personal care. These are often the areas where you have the most control and can find opportunities for savings.

Beyond just spending, a robust budgeting framework also prioritizes savings and debt repayment. Dedicated categories for these are essential. Whether you’re building an emergency fund, saving for a down payment, or actively paying down high-interest debt, these financial goals should be explicitly factored into your spending plan, not just addressed with leftover funds. This proactive approach ensures your long-term financial health is always a priority. Finally, the element of tracking and review is indispensable. Simply setting up a budget isn’t enough; you must regularly log your actual spending against your planned amounts and review your progress. This dynamic process allows for adjustments and ensures your personal spending guide remains relevant and effective.

Choosing the Right Budgeting Approach for You

The beauty of managing your finances today is the abundance of methods and tools available, allowing you to find an approach that truly resonates with your lifestyle and preferences. There isn’t a one-size-fits-all solution, but rather a spectrum of effective strategies you can adapt using a custom budgeting sheet.

One popular method is the 50/30/20 rule: 50% of your income goes to needs, 30% to wants, and 20% to savings and debt repayment. This provides a simple, high-level framework that’s easy to grasp and apply, especially for beginners. For those who prefer more granular control, the zero-based budget ensures every dollar has a job. You allocate every cent of your income to expenses, savings, or debt repayment, leaving a "zero" balance at the end of the month. This method demands precision but offers unparalleled clarity on where your money is going. Another time-tested approach, now digitized, is the envelope system. Traditionally, cash was placed into physical envelopes for different spending categories. Today, many apps and digital templates replicate this by allocating funds to virtual "envelopes" or categories, preventing overspending in any one area.

When selecting your actual tool, consider these options:

- Spreadsheets (like Excel or Google Sheets): Ideal for those who enjoy customizing and have a basic understanding of formulas. A spreadsheet offers ultimate flexibility and can be tailored to an almost infinite degree. This is often where a Personal Home Budget Template shines brightest, as it offers a robust starting point.

- Budgeting Apps: Offer automation, syncing with bank accounts, and often provide visual insights. They are great for real-time tracking and on-the-go management, though they may have subscription fees.

- Notebook & Pen: The simplest and most accessible method. While lacking automation, it encourages active engagement with your finances and can be very effective for those who prefer a tactile approach.

Ultimately, the best approach for your household budget spreadsheet is one you’ll consistently use. Experiment with different methods and tools until you find the perfect fit that empowers you to take command of your finances without feeling overwhelmed.

Customizing Your Financial Planning Tool

A generic household spending plan is a good starting point, but its true power is unlocked when you tailor it to your unique financial landscape. This personalization transforms a basic structure into a dynamic, relevant financial roadmap specifically designed for your life. Customization isn’t just about making it look pretty; it’s about ensuring it accurately reflects your income, expenses, and financial goals.

Start by adjusting the income categories to precisely match all your revenue streams, whether it’s multiple jobs, side gigs, or rental income. Then, dive deep into your expense categories. While a template will offer standard classifications like groceries and utilities, think about your specific spending habits. Do you have unique hobbies that require regular investment? Are there significant recurring medical expenses? Add these as distinct categories to gain clear visibility into these specific outflows. This level of detail helps prevent money from falling into "miscellaneous" black holes.

Another critical customization involves integrating your financial goals. If you’re saving for a down payment, a child’s education, or a dream vacation, create dedicated savings categories within your template. Similarly, if you’re tackling specific debts, set up lines to track progress on each loan. This makes your financial management tool not just a record of the past, but a proactive plan for the future. Regularly review and update your Personal Home Budget Template as your life circumstances change. A new job, a significant purchase, or an unexpected expense should prompt a re-evaluation and adjustment of your categories and allocations. This iterative process ensures your budget remains a living, breathing document that continues to serve your evolving financial needs.

Tips for Budgeting Success

Embarking on your budgeting journey can feel daunting, but with a few tried-and-true strategies, you can transform it into an empowering habit. Consistent effort and a realistic outlook are far more valuable than perfection from day one.

First, be realistic with your expectations. Don’t try to drastically cut every expense overnight. Start by tracking your actual spending for a month or two before setting strict limits. This baseline will provide a more accurate picture of where your money is truly going and help you create a sustainable plan. Secondly, track every dollar. This might seem tedious at first, but meticulously logging all income and expenses, even small ones, is crucial. Small, forgotten transactions can quickly add up and throw off your entire budgeting framework. Utilize apps, spreadsheets, or even a small notebook to record everything.

Third, automate your savings. Set up automatic transfers from your checking to your savings accounts, investment accounts, or debt repayment funds immediately after you get paid. Treating savings as a fixed expense ensures you prioritize your financial future before discretionary spending. Fourth, involve your household. If you share finances with a partner or family, make budgeting a collaborative effort. Open communication about financial goals and spending habits can prevent misunderstandings and foster a shared commitment to the household spending plan. Finally, review and adjust regularly. Your life circumstances will change, and so should your budget. Schedule a monthly or quarterly review to assess your progress, identify areas for improvement, and make necessary adjustments. Don’t view deviations as failures, but as opportunities to learn and refine your money management system.

Frequently Asked Questions

How often should I update my budget?

Ideally, you should review and update your budget at least once a month. This allows you to reconcile your actual spending with your planned budget, make adjustments for upcoming expenses, and ensure your financial management tool remains accurate and relevant to your current situation. A quick daily or weekly check-in can also help keep you on track.

What if I can’t stick to my budget?

It’s common to miss your budget targets occasionally, especially when starting out. Don’t get discouraged. Instead, use it as a learning opportunity. Analyze where you overspent, understand why, and adjust your budget for the next period. Perhaps some categories were underestimated, or you encountered an unexpected expense. Be flexible and forgiving, and focus on continuous improvement.

Is a spreadsheet really better than an app for budgeting?

Neither is inherently “better”; the best tool depends on your personal preferences and needs. Spreadsheets offer unparalleled customization and a deep understanding of your finances, ideal for those who like hands-on control. Apps provide automation, real-time tracking, and convenience, perfect for on-the-go management. Many people use a combination, leveraging a detailed home budget spreadsheet for planning and an app for daily tracking.

How do I handle unexpected expenses in my budget?

The best way to handle unexpected expenses is to anticipate them by building an emergency fund. Your budget should include a dedicated savings category for this. For smaller, less critical unexpected costs, try to reallocate funds from flexible spending categories (e.g., dining out, entertainment) within your current month’s budget. For larger, unforeseen expenses, tap into your emergency fund, and then prioritize rebuilding it.

Should I include sinking funds in my financial management system?

Absolutely! Sinking funds are a fantastic way to budget for future, known expenses that aren’t monthly (e.g., car maintenance, holiday gifts, annual insurance premiums). By setting aside a small amount each month into specific sinking fund categories, you avoid financial surprises and ensure you have the cash ready when those expenses inevitably arise, preventing them from derailing your main budget.

Taking control of your finances is one of the most empowering steps you can take toward securing your future. It’s a journey, not a destination, and it starts with a clear understanding of your current financial landscape. A well-crafted and diligently maintained personal finance tracker isn’t just a collection of numbers; it’s a living document that reflects your aspirations and guides your path to financial well-being. It transforms vague hopes into achievable goals, turning financial stress into newfound confidence.

Embrace the power of knowing where every dollar goes and where it can take you. By consistently engaging with your financial management system, you’re not just budgeting; you’re actively designing the life you want to live, making conscious choices that align with your deepest values. Start today, and watch as your financial clarity grows, bringing with it a profound sense of peace and the freedom to pursue your dreams.