Running a small nonprofit organization is a true labor of love, often fueled by passion and an unwavering commitment to a cause. Whether you’re addressing critical community needs, advocating for change, or preserving vital resources, your dedication makes a profound impact. However, even the most passionate mission requires a sturdy financial foundation to thrive and grow sustainably. Without a clear financial roadmap, even the most well-intentioned efforts can falter.

This is where a robust budgeting tool for small nonprofits becomes indispensable. Far more than just a collection of numbers, a carefully crafted financial planning document for non-profits acts as your organization’s financial compass, guiding decisions, ensuring accountability, and paving the way for future success. It transforms abstract goals into actionable plans, allowing you to allocate precious resources effectively and demonstrate fiscal responsibility to your stakeholders.

The Unsung Hero: Why a Budget Matters for Small Nonprofits

For small nonprofits, every dollar counts, and every decision has tangible consequences. A well-structured budget is not merely a bureaucratic requirement; it’s a strategic asset that empowers your organization to achieve its mission more effectively. It provides clarity amidst financial complexities, turning potential chaos into a coherent system.

Firstly, an organizational budget framework promotes transparency and accountability. Donors, grant-makers, board members, and even volunteers want to see that their contributions and efforts are being managed responsibly. A clear budget demonstrates how funds are acquired and expended, building trust and strengthening relationships with all stakeholders. It answers the fundamental question: "Where does the money go?"

Secondly, a detailed fiscal management tool enables strategic decision-making. When you know your financial capacity, you can make informed choices about program expansion, staffing, fundraising initiatives, and operational improvements. It helps leadership prioritize expenses, identify potential shortfalls before they become crises, and ensure that resources are aligned with your organization’s strategic goals, rather than reacting to every immediate financial pressure.

Finally, an effective financial roadmap for charities acts as a critical risk management tool. It allows your organization to anticipate challenges, such as unexpected funding cuts or increases in operational costs, and develop contingency plans. By understanding your financial position, you can proactively address vulnerabilities and build a more resilient organization, safeguarding your impact even during uncertain times.

Beyond the Basics: What a Robust Budget Template Offers

While the core purpose of any budget is to track income and expenses, a specialized Small Nonprofit Budget Template offers enhanced benefits tailored to the unique environment of non-profit entities. It goes beyond simple arithmetic, providing a framework for dynamic financial management. This specific structure helps to demystify financial planning, making it accessible even for those without a deep accounting background.

Such a budgeting guide for smaller organizations provides a structured way to forecast revenue and expenditures over a specific period, typically a fiscal year. This forward-looking approach allows your team to set realistic financial goals and plan activities accordingly, rather than simply reacting to past performance. It supports a proactive stance on financial health.

Furthermore, a comprehensive resource allocation plan helps in tracking actual performance against budgeted figures. Regular comparisons are vital for identifying variances, understanding their causes, and making timely adjustments. This ongoing monitoring process ensures your organization stays on course and can adapt quickly to changing circumstances, fostering a culture of continuous financial improvement.

Crucially, a well-prepared financial blueprint for community groups can significantly bolster grant applications and fundraising appeals. Grantors often require detailed budgets demonstrating how their funds will be utilized and the overall financial health of the organization. A professional and clear budget enhances your credibility and increases your chances of securing essential funding, showing that you are a responsible steward of resources.

Key Elements of an Effective Nonprofit Budget

A high-quality budget template for small nonprofits isn’t just a grid of numbers; it’s a living document that captures the essence of your organization’s financial story. To be truly effective, it must encompass several core components that provide a holistic view of your financial landscape. These elements ensure accuracy, transparency, and strategic utility.

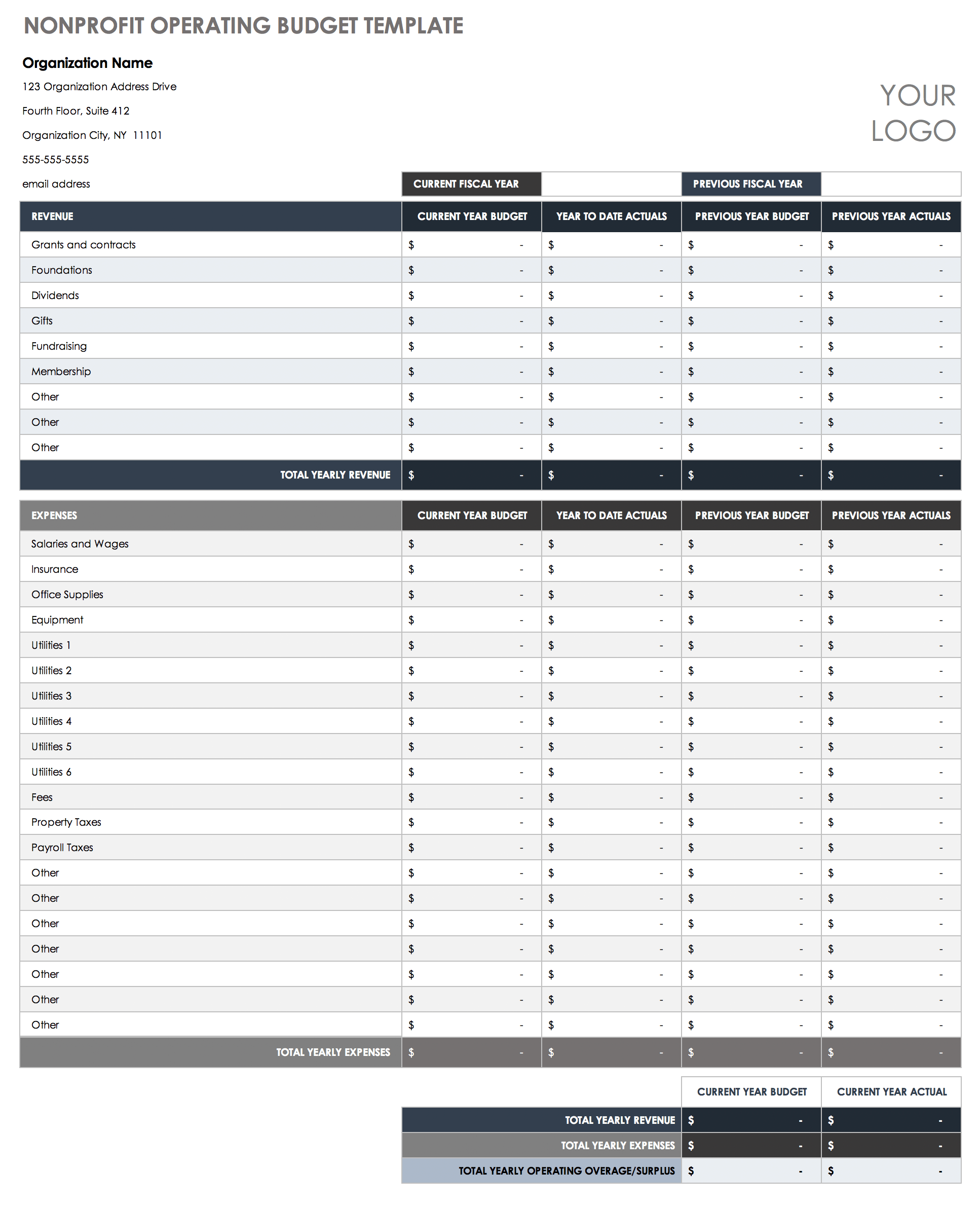

Here are the essential components typically found in a robust Small Nonprofit Budget Template:

- Revenue Streams: This section details all anticipated sources of income. It should be broken down into specific categories such as:

- **Grants:** Government, foundation, or corporate grants.

- **Individual Donations:** Contributions from private donors, often including recurring gifts and one-time donations.

- **Corporate Sponsorships:** Funds or in-kind support from businesses.

- **Program Service Fees:** Income generated from services provided (e.g., workshop fees, ticket sales).

- **Fundraising Events:** Net income projected from galas, runs, online campaigns.

- **Investment Income:** Interest or dividends from endowment funds or reserves.

- **In-Kind Contributions:** Estimated value of donated goods or services, which are crucial for small nonprofits.

- Operating Expenses: These are the costs associated with running your organization and delivering your mission. Categorization is key for analysis and reporting:

- **Program Expenses:** Costs directly related to delivering your mission, such as supplies for activities, participant support, and direct program staff salaries.

- **Administrative Expenses:** Overhead costs necessary to keep the organization running, including office rent, utilities, insurance, administrative staff salaries, legal fees, and accounting services.

- **Fundraising Expenses:** Costs incurred to solicit donations, such as marketing materials, event costs, and fundraising staff salaries.

- **Marketing & Communications:** Expenses for outreach, website maintenance, social media management, and public relations.

- **Technology & Software:** Costs for necessary software licenses, hardware, and IT support.

- **Professional Development:** Training, conferences, and membership fees for staff and board.

- Restricted vs. Unrestricted Funds: A crucial distinction for nonprofits. **Unrestricted funds** can be used for any organizational purpose, while **restricted funds** are designated by the donor for specific programs or projects and must be tracked separately. Your budget needs clear columns or sections to differentiate these.

- Cash Flow Projections: Beyond annual totals, understanding when money comes in and goes out throughout the year is vital. Monthly or quarterly cash flow projections help prevent liquidity issues and ensure funds are available when needed.

- Variance Analysis Column: A space to compare budgeted amounts with actual results, allowing for easy identification of discrepancies and their analysis. This fosters continuous learning and adjustment.

Bringing Your Budget to Life: Practical Tips for Implementation

Having a great Small Nonprofit Budget Template is one thing; bringing it to life and making it a functional, dynamic tool is another. Effective implementation transforms a static document into an actionable plan that truly serves your organization’s mission. It requires commitment, collaboration, and a willingness to adapt.

Start by engaging your team in the budgeting process. While final approval rests with leadership and the board, involving program managers, fundraising staff, and even key volunteers can yield valuable insights and foster a sense of ownership. They often have the most direct understanding of specific program costs and potential revenue streams. Their input ensures the financial planning document for non-profits is realistic and comprehensive.

Next, prioritize regular review and adjustments. A budget is not set in stone; it’s a living document. Schedule monthly or quarterly meetings to compare actual income and expenses against your budget. Discuss variances, understand the reasons behind them, and make necessary revisions. This iterative process allows your organizational budget framework to remain relevant and responsive to changing realities.

Don’t shy away from leveraging basic technology. Even a well-structured spreadsheet program (like Excel or Google Sheets) can serve as a powerful budgeting tool for small nonprofits. There are also affordable, user-friendly accounting software options designed for non-profits that can integrate budgeting features, streamlining your financial management. These tools help automate calculations and improve accuracy.

Finally, remember to include in-kind contributions in your financial roadmap for charities, even if they don’t directly impact cash flow. Donated goods, pro-bono services, and volunteer hours have real economic value. Quantifying these contributions in your budgeting guide for smaller organizations provides a more complete picture of your organization’s resources and impact, which is valuable for grant reporting and demonstrating community support.

Navigating Common Budgeting Challenges

Even with the best Small Nonprofit Budget Template, small organizations often encounter unique financial hurdles. Understanding these common challenges and developing strategies to overcome them is crucial for maintaining fiscal health and ensuring long-term sustainability. Proactive problem-solving can turn potential crises into manageable situations.

One prevalent issue is unpredictable income streams. Many small nonprofits rely heavily on individual donations, grants, or fluctuating event revenues, making accurate forecasting difficult. To mitigate this, consider diversifying your funding sources, building a cash reserve for lean periods, and developing conservative revenue projections. A cost allocation model for non-profit entities that accounts for variable income is essential.

Another common pitfall is underestimating expenses. New initiatives, unexpected operational costs, or increases in service demand can quickly strain a tight budget. Always build in a contingency fund—typically 5-10% of your total budget—to cover unforeseen costs. Regularly review vendor contracts and operational needs to ensure your financial blueprint for community groups accurately reflects current costs.

The lack of dedicated financial expertise can also be a significant challenge. Small nonprofits often have limited capacity for full-time financial staff. Consider engaging a fractional CFO, an experienced volunteer, or a board member with financial acumen to provide oversight and guidance. Investing in basic financial literacy training for key staff can also build internal capacity, making your resource allocation plan more effective.

Finally, over-reliance on a single funding source creates significant vulnerability. If that source diminishes or disappears, your organization faces existential threats. Actively pursue a mix of funding – individual donors, foundations, corporate support, and earned income – to create a more resilient financial structure. A well-diversified funding strategy, supported by your detailed financial planning document for non-profits, is key to long-term stability.

Frequently Asked Questions

How often should a small nonprofit review its budget?

While an annual budget sets the broad financial plan, small nonprofits should ideally review their budget performance monthly. This allows for timely identification of variances between budgeted and actual figures, enabling quick adjustments and informed decision-making before small issues escalate into major problems. At minimum, a quarterly review is highly recommended.

What’s the difference between an operating budget and a program budget?

An **operating budget** covers the overall income and expenses for the entire organization for a specific fiscal year, including administrative, fundraising, and program costs. A **program budget**, on the other hand, is a subset that details the specific income and expenses for a single program or project, allowing for granular tracking of that initiative’s financial performance. Both are crucial components of a comprehensive financial roadmap for charities.

Can a budget help with grant applications?

Absolutely. A detailed and well-prepared budget is a critical component of almost every grant application. It demonstrates to funders that your organization is financially responsible, has a clear plan for using their funds, and understands the true costs of its operations and programs. It builds trust and significantly strengthens your application’s credibility, making your budgeting guide for smaller organizations a powerful advocacy tool.

What if our actuals consistently differ from our budget?

Consistent variances indicate that your budgeting process or underlying assumptions may need adjustment. It’s an opportunity to learn. Analyze the reasons for the discrepancies: were revenue projections too optimistic, or were expenses underestimated? Use these insights to refine future budgets, improve forecasting accuracy, and potentially adjust operational strategies to align more closely with your financial capacity. Don’t view it as a failure, but as data for improvement.

Do we need a professional accountant for our budget?

While a professional accountant or bookkeeper can be invaluable for ensuring compliance, preparing financial statements, and offering expert advice, a small nonprofit can often initially manage its budget with well-structured templates and diligent internal tracking. As the organization grows in complexity or revenue, engaging a financial professional becomes increasingly important to maintain accuracy, ensure compliance, and provide strategic financial guidance. Many templates are designed to be user-friendly for non-accountants.

In the dynamic world of nonprofit work, where every resource is precious and every action carries significant weight, a sound financial strategy is not merely an option—it’s a necessity. The adoption of a well-crafted financial planning document for non-profits transforms uncertainty into clarity, empowering your team to focus on what truly matters: delivering impact. It’s the invisible backbone that supports visible change, ensuring your organization can continue its vital work for years to come.

Embrace the power of proactive financial management. By implementing a thoughtful and adaptable Small Nonprofit Budget Template, you’re not just managing money; you’re cultivating sustainability, building trust, and amplifying your mission. This foundational tool equips you to navigate financial complexities with confidence, securing your organization’s future and enhancing its capacity to serve the communities that depend on you. Start building your robust financial foundation today, and watch your impact grow.