Creating a budget proposal can seem daunting, but it doesn’t have to be! This guide will walk you through the process in a casual, easy-to-understand way. Whether you’re a freelancer, a small business owner, or just trying to manage your personal finances better, a well-crafted budget proposal can help you achieve your goals.

What is a Budget Proposal?

Simply put, a budget proposal is a document that outlines your financial plan. It details your expected income and expenses over a specific period. This could be anything from a month to a year or even longer.

Why is a Budget Proposal Important?

Helps you set financial goals: By outlining your income and expenses, you can clearly define your financial objectives.

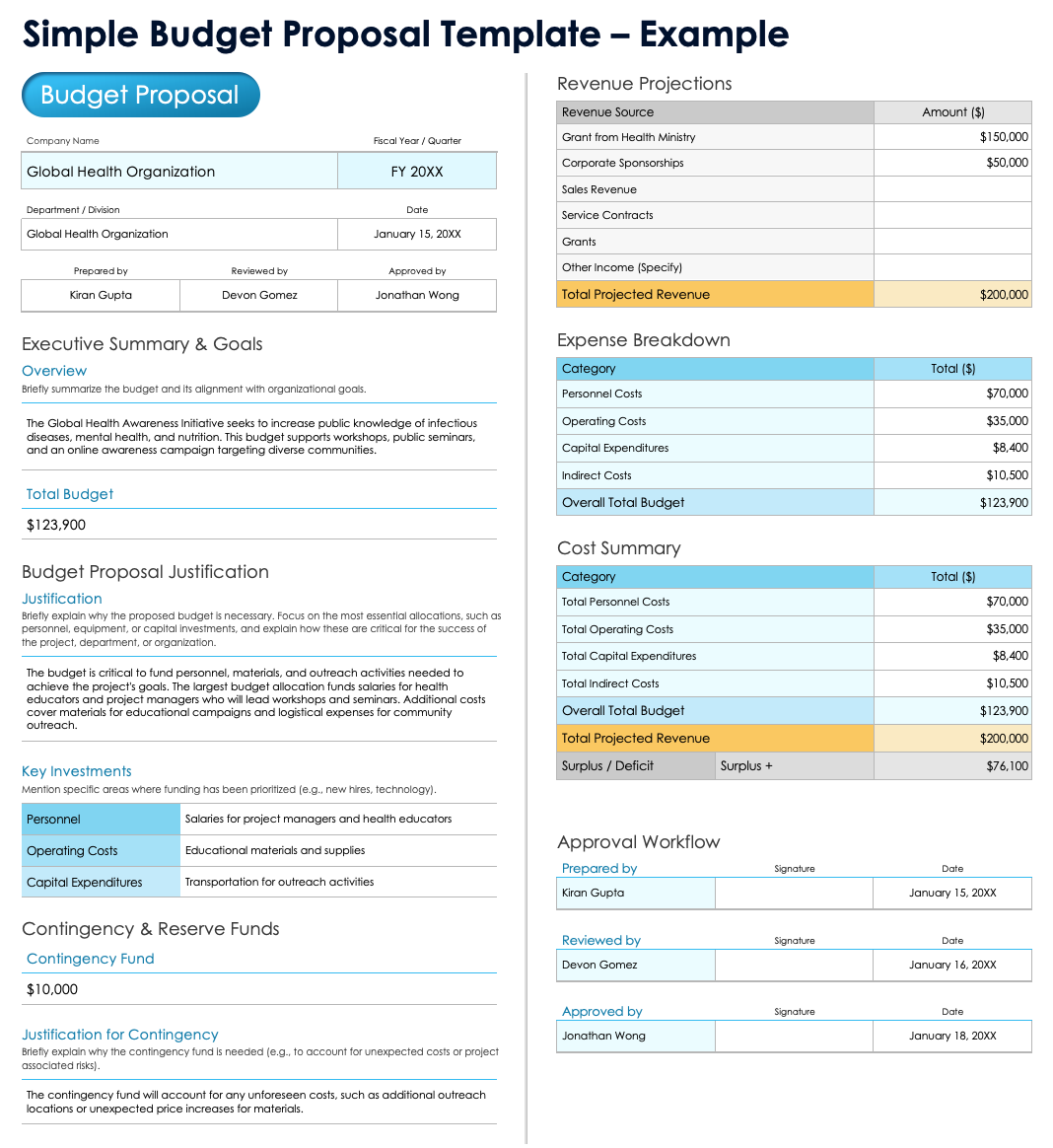

Image Source: smartsheet.com

Key Components of a Budget Proposal

Income

Identify all sources of income: List all your income streams, such as salary, freelance work, investments, and any other sources of income.

Expenses

Categorize your expenses: Divide your expenses into categories such as:

Create a Budget Worksheet

Gather all your financial information: Collect bank statements, credit card bills, and any other relevant financial documents.

Develop a Savings Plan

Set savings goals: Determine how much you want to save and for what purpose (e.g., emergency fund, down payment on a house, retirement).

Review and Adjust

Regularly review your budget: Review your budget at least once a month to track your progress and make necessary adjustments.

Tips for Creating an Effective Budget Proposal

Be realistic: Don’t set unrealistic expectations for your income or expenses.

Budgeting Resources

Personal Finance Websites: Many websites offer valuable resources and tools for budgeting, such as Mint, Personal Capital, and NerdWallet.

Conclusion

Creating a budget proposal may seem like a daunting task, but it’s a crucial step towards achieving your financial goals. By carefully tracking your income and expenses, setting realistic goals, and regularly reviewing your budget, you can gain control of your finances and build a more secure financial future.

FAQs

1. What if I don’t have any income?

If you are currently unemployed or have very low income, you can still create a budget proposal. Focus on your expected expenses and explore potential sources of income, such as government assistance programs or part-time jobs.

2. How often should I review my budget?

It’s recommended to review your budget at least once a month. However, you may need to review it more frequently if your financial situation changes significantly.

3. What if I consistently overspend?

If you consistently overspend, try to identify the root cause of the problem. Are you impulse buying? Are you entertaining too often? Once you identify the problem areas, you can take steps to address them.

4. Can I use a budget proposal for business purposes?

Yes, budget proposals are essential for businesses. They help businesses plan their finances, secure funding, and make informed decisions about their operations.

5. What are some common budgeting mistakes to avoid?

Some common budgeting mistakes include:

This article provides a basic framework for creating a budget proposal. Remember to adapt it to your specific needs and circumstances.

Budget Proposal Template