Navigating college life is an exciting, transformative journey, but it often comes with a significant financial learning curve. For many students, it’s their first real encounter with managing their own money, a skill as vital as any academic subject. The sheer cost of tuition, housing, books, and daily living expenses can quickly become overwhelming, turning what should be an enriching experience into a source of considerable stress. Without a clear understanding of where money comes from and where it goes, students can easily fall into debt or miss out on opportunities due to financial constraints.

This is where a structured financial tool, specifically a Budget For College Students Template, becomes an indispensable asset. It’s not just about cutting back; it’s about gaining control, making informed decisions, and building a foundation for lifelong financial literacy. By providing a clear framework, such a template helps transform abstract financial worries into concrete, manageable action steps, empowering students to take charge of their economic well-being and focus more effectively on their studies and personal growth.

Why Financial Clarity is Crucial for College Life

The collegiate years are often synonymous with freedom and exploration, but underlying these experiences is a web of financial responsibilities. Many students enter higher education with limited experience in personal finance, making them vulnerable to common pitfalls like overspending, accumulating credit card debt, or neglecting savings. This lack of financial clarity can lead to increased stress, impacting academic performance and overall well-being.

A well-organized approach to money management allows students to proactively address their financial situation rather than reacting to crises. It provides a roadmap for understanding income streams, tracking expenditures, and setting realistic financial goals. By developing these habits early, college students lay the groundwork for long-term financial independence, reducing the likelihood of graduating with overwhelming debt and enhancing their ability to navigate future financial challenges confidently.

Decoding Your College Finances: Income and Expenses

The first step in creating any effective college budget plan is to clearly identify all sources of income and categorize all expenditures. This comprehensive overview is the backbone of any sound financial strategy, enabling students to see their financial landscape in black and white. Understanding these components is essential for making realistic adjustments and achieving financial stability throughout the academic year.

Common Income Sources for Students

College students often have diverse ways of funding their education and living expenses. Accurately listing these helps in understanding the total amount available to them.

- Financial Aid: This can include federal and private student loans, grants (like Pell Grants), and scholarships which do not need to be repaid.

- Parental Contributions: Many students receive regular or occasional financial support from their families.

- Part-time Jobs: On-campus or off-campus employment can provide a steady income stream.

- Savings: Money saved before college or from summer jobs can be a crucial resource.

- Other: This might include gifts, trust funds, or earnings from freelance work.

Typical Student Expenses

Expenses can vary widely based on location, living situation, and lifestyle choices. Categorizing these allows for easier tracking and identification of areas where savings might be possible.

- Tuition & Fees: The most significant cost, often paid per semester or annually.

- Housing: Rent for off-campus apartments, dorm fees, or utilities (electricity, internet, water).

- Food: Groceries, dining out, meal plans. This is often a flexible category.

- Books & Supplies: Textbooks, notebooks, lab materials, software subscriptions.

- Transportation: Gas, public transit passes, ride-sharing, car maintenance.

- Personal Care: Toiletries, haircuts, laundry supplies, health expenses.

- Entertainment & Socializing: Movies, concerts, sports events, going out with friends.

- Miscellaneous: Clothing, unexpected repairs, technology replacements, club fees.

Benefits of Using a Structured College Budget Plan

Adopting a systematic approach to managing money, such as utilizing a student finance tracker, offers a multitude of advantages beyond simply knowing your bank balance. It cultivates discipline, reduces anxiety, and builds essential life skills that extend far beyond graduation. The proactive nature of budgeting empowers students rather than restricts them.

Firstly, a clear financial planning tool for students significantly reduces financial stress. When you know exactly where your money is going and how much you have, the uncertainty and fear associated with unexpected expenses diminish. This allows students to focus more effectively on their academic pursuits and enjoy their college experience without constant worry.

Secondly, it fosters financial independence. Learning to manage one’s own finances is a critical step towards adulthood. By regularly reviewing a personal finance template for university, students develop a sense of responsibility and accountability for their financial decisions, preparing them for life after college where they will be fully responsible for their own economic well-being.

Lastly, such a guide enables smarter spending habits and goal achievement. Whether it’s saving for a study abroad trip, paying off a portion of student loans early, or simply building an emergency fund, a budget provides the framework to set and reach these financial milestones. It helps differentiate between needs and wants, promoting conscious spending over impulse purchases.

Key Elements of an Effective Student Finance Tracker

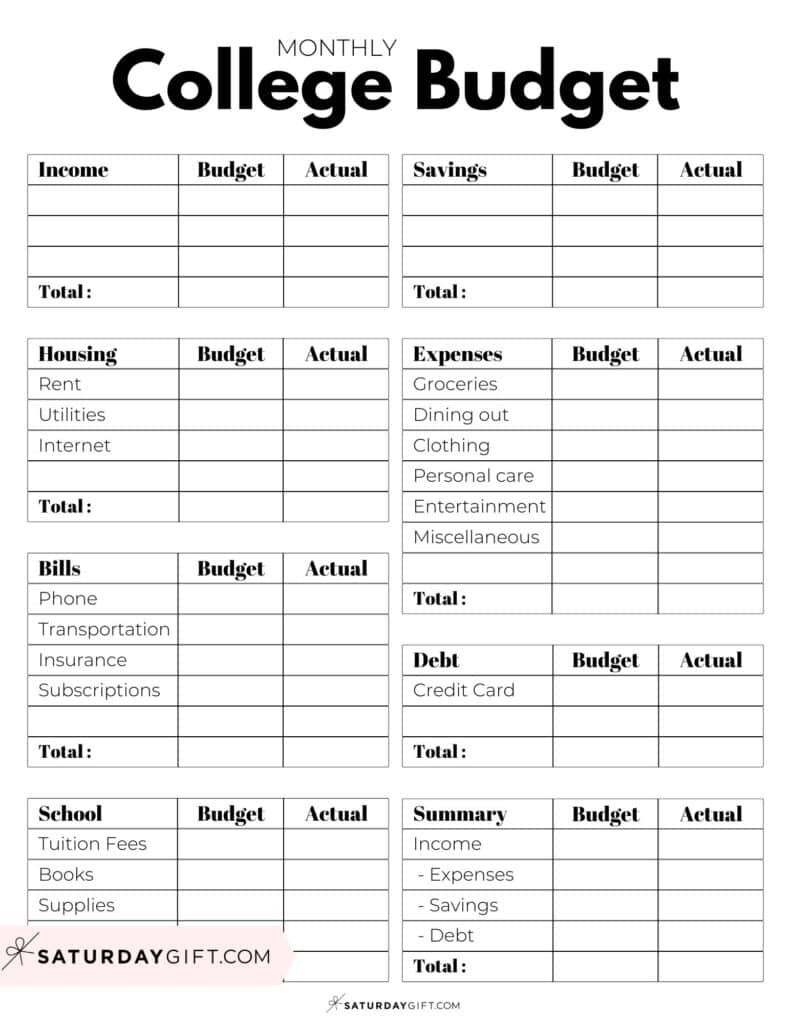

An effective student finance tracker isn’t just a spreadsheet; it’s a dynamic tool tailored to the unique financial landscape of a college student. To be truly useful, it must incorporate several core components that allow for both comprehensive oversight and detailed analysis. A robust Budget For College Students Template includes more than just income and expenses; it also anticipates future needs and allows for adjustments.

Here are the essential components:

- **Income Sources:** A detailed list of all money coming in, specifying whether it’s **fixed** (e.g., scholarships, parental allowance) or **variable** (e.g., part-time job hours).

- **Fixed Expenses:** Regular, predictable costs that typically don’t change month to month, such as **rent**, **tuition payments**, **loan payments**, or **insurance premiums**.

- **Variable Expenses:** Costs that fluctuate based on usage or choice, including **groceries**, **dining out**, **transportation**, **entertainment**, and **personal care items**.

- **Savings Goals:** Designated categories for money set aside for specific purposes, like an **emergency fund**, **future travel**, or **down payment** on a significant purchase.

- **Debt Tracking:** A section to monitor any debts, including **student loans** or **credit card balances**, with payment due dates and minimum amounts.

- **Budget vs. Actual:** This crucial feature allows students to compare their planned spending against their actual spending, highlighting areas where they might be **over or under budget**.

- **Buffer/Emergency Fund:** A small allocation for unexpected costs, providing a safety net to prevent financial disruptions.

Customizing Your Budget For College Students Template for Success

While a general college financial roadmap provides a solid foundation, its true power lies in its adaptability. Every student’s financial situation is unique, making customization a critical step for maximizing the effectiveness of any student money management tool. Tailoring your financial planning tool for students ensures it accurately reflects your personal income, expenses, and financial aspirations.

Begin by populating the template with your specific numbers for income and fixed expenses. Then, estimate your variable expenses based on past spending habits, if you have any, or by researching average costs in your area. Don’t be afraid to adjust these estimates as you go; the first month is often a learning period. The goal is to create a realistic spending plan, not an impossible one.

Regular review is paramount. Schedule a weekly or bi-weekly check-in with your budget to log recent transactions and assess your progress. This allows you to identify potential overspending early and make necessary adjustments before minor issues become major problems. For example, if you find you’re consistently over budget on dining out, you might plan more home-cooked meals for the following week.

Furthermore, adapt your budget for various academic periods. A semester-long plan might differ significantly from a summer budget, especially if you’re taking fewer classes, working more, or traveling. Similarly, major life changes, such as getting a new part-time job, losing a scholarship, or moving to a different living situation, necessitate a thorough review and potential overhaul of your existing financial strategy. Embrace the flexibility of your college budget plan and let it evolve with your changing circumstances.

Practical Tips for Mastering Your College Spending Guide

Implementing a university financial planning tool is just the beginning; mastering its use requires discipline, consistency, and smart financial habits. These practical tips can help you get the most out of your student spending guide, empowering you to make informed decisions and maintain financial health throughout your academic career and beyond.

Firstly, track every single dollar. Whether it’s a coffee, a bus fare, or a textbook purchase, logging all your transactions is crucial. This gives you an accurate picture of your spending habits and prevents money from slipping through the cracks. Many digital apps can automate this, or a simple notebook works too.

Secondly, prioritize cooking at home. Eating out, while convenient, can quickly deplete your food budget. Learning to prepare simple, nutritious meals can save a significant amount of money and often leads to healthier eating habits. Explore campus dining options strategically, too, maximizing your meal plan if you have one.

Next, seek out student discounts wherever possible. Many local businesses, national retailers, and online services offer special pricing for students. Always ask if a student discount is available before making a purchase, as these small savings can add up over time.

Fourthly, utilize campus resources. Your university often provides free or low-cost services that can save you money, such as free fitness centers, mental health counseling, tutoring services, and career development workshops. Avoid paying for external services when a free campus alternative exists.

Finally, build an emergency fund, even if it’s small. Life in college is unpredictable. Having a small stash of cash for unexpected expenses – like a broken laptop, an urgent flight home, or an unforeseen medical bill – can prevent you from going into debt when emergencies arise. Even setting aside $10-$20 a month can make a difference.

Frequently Asked Questions

How often should I review my college budget plan?

Ideally, you should review your college budget plan at least once a week to track recent spending and make minor adjustments. A more comprehensive review should occur monthly to assess overall progress, reconcile accounts, and plan for upcoming larger expenses or income changes. A major review is recommended at the start of each semester or quarter.

What if my income fluctuates throughout the semester?

If your income is variable, it’s best to budget based on your lowest expected income for the month. This provides a conservative estimate and ensures you don’t overspend based on an inflated projection. Any additional income beyond this minimum can then be allocated towards savings, debt repayment, or discretionary spending as a bonus, rather than being relied upon for essential expenses.

Is it okay to spend money on entertainment?

Absolutely! A sustainable budget should include an allocation for entertainment and social activities. Depriving yourself entirely can lead to burnout or impulsive overspending later. The key is to set a realistic limit for this category and stick to it, ensuring it doesn’t compromise your ability to cover essential expenses or achieve your savings goals.

How can I save money on textbooks?

Saving on textbooks is highly achievable. Explore options like renting textbooks instead of buying, purchasing used copies, checking if your university library has them, or utilizing e-textbooks which are often cheaper. Also, consider buying from other students who have completed the course, or forming study groups to share the cost of one copy.

When should I start planning my finances for college?

The sooner, the better! Financial planning for college should ideally begin before you even step foot on campus. During your senior year of high school, start researching costs, understanding financial aid options, and developing initial savings goals. Once accepted, begin creating a detailed college budget plan based on actual tuition, housing, and other anticipated expenses for your specific institution. This early start provides a significant advantage.

Taking control of your finances in college is one of the most empowering decisions you can make. It’s a journey that builds resilience, teaches invaluable lessons in decision-making, and equips you with the confidence to manage money effectively for the rest of your life. The act of budgeting isn’t about scarcity; it’s about strategic allocation, ensuring your money works for you, supporting your academic goals, and enabling you to enjoy your college experience fully.

Embrace the process of managing student expenses, and view your financial planning tool not as a restrictive chore, but as a liberator. It’s the key to reducing stress, unlocking opportunities, and laying a robust foundation for your future financial success. Start today, and give yourself the gift of financial clarity and control as you navigate these pivotal years.