Organizing a successful fundraiser is an incredibly rewarding endeavor, but it’s also a complex undertaking that requires meticulous planning and a keen eye on financial details. The heart of any well-orchestrated charity event, whether it’s a gala, a walkathon, or a bake sale, lies in its budget. Without a clear financial roadmap, even the most passionate efforts can fall short, leaving your organization with less impact than desired. This is where a robust Fundraiser Event Budget Template becomes an indispensable tool, transforming abstract financial goals into concrete, actionable plans.

Imagine having a crystal-clear picture of every dollar coming in and going out, from the very first planning meeting to the final reconciliation. This level of financial foresight not only mitigates risks but also empowers your team to make informed decisions, optimize resource allocation, and ultimately maximize the funds raised for your cause. For non-profit organizations, school groups, community associations, and anyone tasked with charity event planning, understanding and utilizing an effective budgeting framework is not just good practice—it’s foundational to achieving your mission and demonstrating fiscal responsibility to your donors and stakeholders.

The Indispensable Role of a Budget in Fundraising Success

A well-structured budget serves as the financial backbone for your fundraising efforts. It moves you beyond guesswork, providing a precise framework to forecast revenues and meticulously track expenditures. This proactive approach allows event organizers to identify potential shortfalls early, giving ample time to adjust strategies, seek additional sponsorships, or find cost-saving alternatives without compromising the event’s quality or impact. Furthermore, a detailed budget enhances transparency, which is crucial for building trust with donors and demonstrating accountability for every dollar entrusted to your cause.

Beyond mere tracking, a comprehensive fundraising event financial plan is a powerful communication tool. It enables clear discussions with vendors, sponsors, and your internal team, ensuring everyone understands the financial parameters and expectations. When you can confidently present a realistic financial outlook, it strengthens your position in negotiations and fosters greater confidence among potential partners. Ultimately, this leads to a more efficient and profitable event, directly contributing to your organization’s ability to serve its community and achieve its objectives.

Key Elements of an Effective Event Budget

Creating a thorough financial outline for a charity event involves breaking down both anticipated income and projected costs into distinct, manageable categories. This structured approach ensures that no stone is left unturned and provides a clear overview of the financial landscape. A good template will guide you through these categories, prompting you to consider all potential financial implications.

Here are the critical components you should expect to find and populate within a comprehensive budget for a charity event:

- **Revenue Sources**: This section details all potential income streams.

- **Ticket Sales**: Clearly define ticket tiers, prices, and projected attendance.

- **Sponsorships**: List anticipated contributions from corporate or individual sponsors, often tiered by benefits offered.

- **Donations**: Include direct donations, pledges, and funds raised through specific activities like silent or live auctions, raffles, and direct appeals.

- **Merchandise Sales**: If selling branded items, estimate sales volume and profit margins.

- **Grants**: Note any specific grants received or applied for that are earmarked for the event.

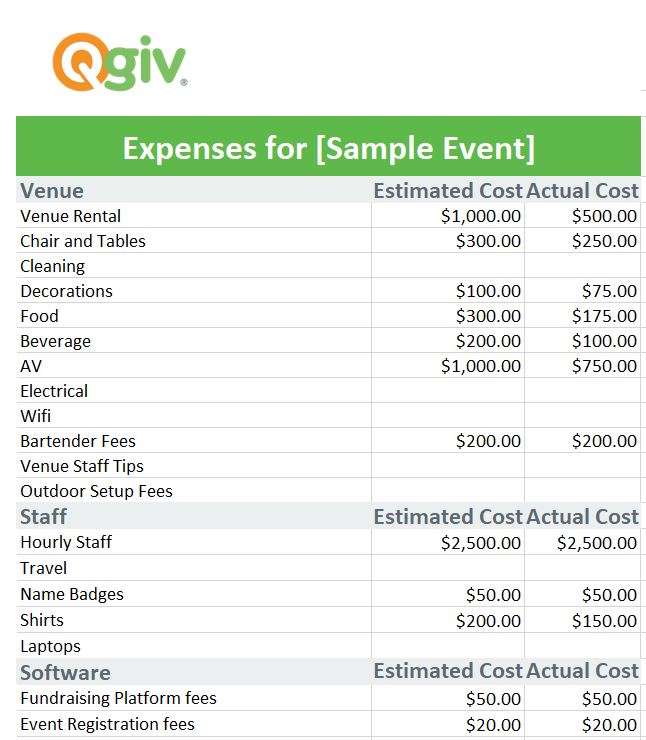

- **Expense Categories**: This is where you itemize every cost associated with the event.

- **Venue Costs**: Includes rental fees, security deposits, and any associated utility charges.

- **Catering & Beverages**: Detail food, drink, serving staff, and related equipment rentals.

- **Entertainment**: Costs for performers, speakers, DJs, or other talent.

- **Marketing & Promotion**: Expenses for advertising, graphic design, printing invitations, online ads, and social media campaigns.

- **Audio/Visual**: Equipment rental (microphones, screens, projectors, sound systems) and technical support.

- **Decorations & Supplies**: Event theme items, linens, centerpieces, signage, and essential supplies like nametags.

- **Staffing & Volunteers**: Costs for paid staff, security, event managers, and volunteer appreciation items.

- **Permits & Insurance**: Necessary legal documents and liability coverage.

- **Payment Processing Fees**: Charges from credit card processors or ticketing platforms.

- **Contingency Fund**: A crucial allocation, typically 10-15% of the total budget, for unforeseen expenses. This is vital for mitigating unexpected issues.

Practical Steps to Utilizing Your Budget Template

Once you have your Fundraiser Event Budget Template in hand, the real work of populating and managing it begins. This isn’t a one-time task but an ongoing process that evolves with your event planning. Effective utilization ensures you stay on track and can pivot when necessary, maintaining financial control throughout.

First, begin with thorough research and estimation. Don’t just guess numbers; reach out to vendors for quotes, research past event costs, and consult with experienced planners. Gather multiple bids for significant expenses like venue rental or catering to ensure you’re getting competitive rates. Next, categorize and itemize every single cost and potential revenue source. Be as granular as possible, as broad categories can obscure important details. For instance, instead of just "marketing," break it down into "social media ads," "print invitations," and "poster design."

As your planning progresses, regularly update your event budget for fundraisers with actual costs and confirmed revenues. This allows for real-time comparison against your initial projections. If an expense comes in higher than expected, you’ll immediately see its impact and can seek adjustments elsewhere or explore new revenue opportunities. Finally, conduct a post-event analysis. Compare your final actuals against your budget to identify areas where you excelled and where there’s room for improvement. This valuable data will inform future event planning, making your next charity fundraiser even more financially successful.

Mastering Cost Control and Revenue Projection

Achieving financial success with your event budget for fundraisers requires a proactive approach to both spending and earning. Cost control isn’t about being cheap; it’s about being smart and strategic with every dollar spent. Begin by prioritizing needs over wants. While lavish decor might be appealing, assess whether it genuinely contributes to your fundraising goal or if simpler, more cost-effective alternatives could suffice. Leverage partnerships and in-kind donations whenever possible. Many local businesses are willing to donate goods or services in exchange for recognition, significantly reducing your out-of-pocket expenses. Always get multiple quotes for major items and don’t be afraid to negotiate.

On the revenue side, robust projection involves more than just hoping for the best. Analyze historical data from previous events, research similar fundraisers in your area, and understand your donor base’s capacity and interests. Tiered ticket pricing, diversified sponsorship packages, and engaging fundraising activities like silent auctions with desirable items can all boost your income. Crucially, continuously monitor your fundraising progress against your projections. If ticket sales are lagging, for example, a swift marketing push or a special offer might be needed. This dynamic management of your event’s finances is key to maximizing its philanthropic impact.

Customizing Your Template for Diverse Events

While a standard Fundraiser Event Budget Template provides a solid foundation, its true power lies in its adaptability. Not all fundraising events are created equal; a black-tie gala will have vastly different cost structures and revenue streams than a charity fun run or a community carnival. The beauty of a flexible financial framework is its ability to be tailored to the specific nature and scale of your unique event.

For a large-scale gala, you might expand sections on entertainment, high-end catering, and sophisticated marketing materials. Conversely, a grassroots community event might emphasize permits, volunteer coordination, and more modest promotional costs. When preparing a financial plan for a non-profit event, consider specific grant requirements or reporting needs that might necessitate additional categories. Think about the unique resources available to your organization—do you have access to a donated venue, or do you need to budget for rental? Does your team have in-house design capabilities, or will you need to contract a graphic designer? Customizing your event’s spending guide to reflect these specific circumstances ensures accuracy and relevance, making it a truly valuable tool for your organization’s specific needs.

Frequently Asked Questions

Why is a contingency fund so important in an event budget?

A contingency fund, typically 10-15% of your total budget, is crucial for covering unexpected expenses that inevitably arise during event planning. This could include last-minute equipment rentals, unforeseen permit fees, or changes in vendor costs. Without it, you risk going over budget or having to cut essential elements from your event.

How often should I review and update my event’s budget?

You should review and update your event budget regularly, ideally weekly or bi-weekly, especially as the event date approaches. This allows you to track actual expenses against projected costs in real-time, make necessary adjustments, and ensure you remain on track to meet your financial goals.

What’s the best way to estimate revenue for ticket sales and sponsorships?

To estimate revenue effectively, look at data from past events, research similar fundraisers in your area, and set realistic attendance goals. For sponsorships, create tiered packages with clear benefits and research potential sponsors’ giving histories. Always err on the side of caution with revenue projections to avoid overestimating income.

Can a budget template help me secure more sponsorships?

Absolutely. A detailed and professional event budget showcases your organization’s financial acumen and commitment to transparency. When you present a clear financial outline to potential sponsors, it demonstrates that their investment will be managed responsibly and directly contribute to the event’s success, making them more confident in supporting your cause.

What should I do if my actual expenses start exceeding my budget?

If expenses begin to exceed your budget, immediately identify the overspending areas. Look for opportunities to cut costs in non-essential areas, renegotiate with vendors, or seek additional in-kind donations. You might also consider new, creative fundraising activities or making a direct appeal to your donor base to bridge any unexpected financial gaps.

In conclusion, the journey of organizing a successful fundraiser is paved with passion, dedication, and, critically, sound financial management. A thoughtfully utilized Fundraiser Event Budget Template isn’t merely a spreadsheet; it’s a strategic asset that empowers your team, builds donor confidence, and safeguards your organization’s resources. It provides the clarity needed to navigate the complexities of event planning, ensuring that every decision is backed by financial foresight and fiscal responsibility.

Embracing this disciplined approach to financial planning means your organization can focus more on its mission and less on financial anxieties. By diligently tracking income and outgoings, you not only ensure the profitability of your current event but also gather invaluable data for future endeavors. Equip your team with this powerful tool, and watch as your fundraising events transform into seamless, impactful, and financially triumphant celebrations of your cause, making a real and lasting difference in the community you serve.