Securing grant funding is often the lifeblood of non-profits, research institutions, and community organizations. While the narrative of your proposal paints a picture of your vision and impact, the financial details provide the scaffolding, demonstrating feasibility and accountability. This is where a meticulously crafted budget becomes not just a requirement, but a strategic asset.

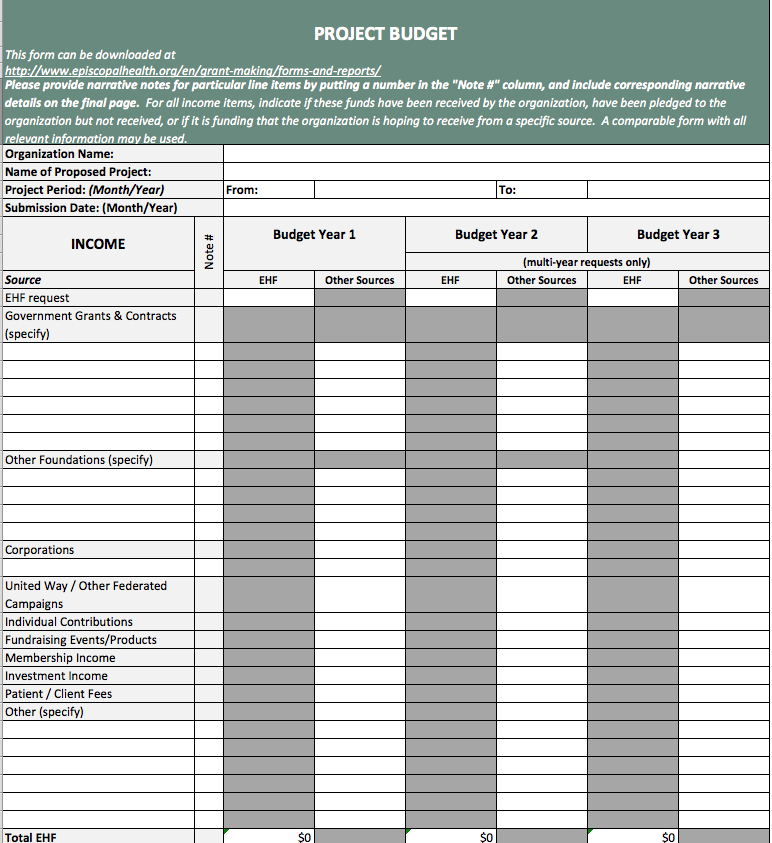

The Grant Project Budget Template is not just a form; it’s a strategic financial blueprint that translates your project’s ambitions into concrete, justifiable expenditures. It’s the critical link that assures funders your groundbreaking ideas are not only viable but also managed with fiscal responsibility. Understanding its intricacies and mastering its use is paramount for any organization serious about securing and sustaining its funding.

The Indispensable Role of a Solid Grant Budget

A grant budget is far more than a simple list of expenses. It’s a comprehensive financial plan that outlines every dollar requested and how it will be spent to achieve your project’s objectives. It communicates your organization’s financial acumen and commitment to transparency, providing funders with the confidence that their investment will be managed wisely and yield tangible results. Without a clear and defensible budget, even the most compelling project narrative can fall short.

Moreover, a well-defined financial plan for your grant application acts as an internal roadmap. It guides your project’s implementation, helps prevent scope creep, and ensures that resources are allocated efficiently. It’s a foundational document that, when properly developed, strengthens your entire grant proposal and sets the stage for successful project execution and reporting.

Key Benefits of Using a Structured Budget Tool

In the competitive world of grant funding, every advantage counts. Using a structured financial planning tool for grants significantly enhances your proposal’s credibility and your chances of success. It systematizes a complex process, ensuring nothing is overlooked and every cost is appropriately categorized and justified.

A robust budgeting framework for grant proposals offers multiple advantages. It clarifies financial needs, justifies the requested amount, and provides a clear audit trail. It also streamlines the reporting process once funding is secured, making it easier to track expenditures against approved line items. This level of organization speaks volumes about your institution’s professionalism.

- **Clarity and Justification:** A detailed project budget template forces you to articulate exactly what funds are needed for and why, providing strong justifications for each expense.

- **Increased Credibility:** Presenting a professional, well-organized financial plan demonstrates your organization’s capacity for sound financial management.

- **Risk Mitigation:** By meticulously planning out costs, you can identify potential shortfalls or overestimations before they become problems, allowing for adjustments.

- **Enhanced Accountability:** A clear project spending outline makes it easier to track expenditures, ensure compliance with funder guidelines, and report accurately.

- **Improved Chances of Funding:** Funders are more likely to invest in projects that present a transparent, realistic, and thoroughly justified financial plan.

- **Internal Efficiency:** A standardized grant expense tracking document simplifies the internal review process, ensuring all stakeholders are aligned on financial expectations.

Essential Components of an Effective Grant Budget

Every grant funding financial plan, regardless of its specific format, will typically include several core categories of expenses. Understanding these components is crucial for accurately projecting costs and satisfying funder requirements. Each category must be detailed with specific items, unit costs, quantities, and a clear rationale.

These elements collectively form a comprehensive financial picture of your project, allowing funders to understand precisely how their contribution will be utilized. From human resources to administrative overhead, every line item tells a part of your project’s story in financial terms.

Common categories include:

**Personnel:** This covers salaries, wages, and associated benefits for project staff. Detail each position, the percentage of time dedicated to the project, and their corresponding salary.

**Fringe Benefits:** Costs associated with employee benefits such as health insurance, retirement contributions, FICA, and unemployment taxes. These are often calculated as a percentage of salaries.

**Travel:** Expenses for staff travel directly related to project activities, including transportation, lodging, per diem, and conference fees. Justify each trip’s relevance.

**Equipment:** Purchase or rental costs for necessary equipment with a useful life of more than one year and a specific minimum cost threshold (e.g., $5,000).

**Supplies:** Consumable items needed for the project, such as office supplies, educational materials, lab reagents, or software licenses. Itemize as much as possible.

**Contractual/Consultant Services:** Fees for external consultants or contractors hired to perform specific project tasks, including their rates and a description of services.

**Other Direct Costs:** Any other project-specific expenses that don’t fit neatly into the above categories, such as printing, postage, communication costs, or participant stipends.

**Indirect Costs (Facilities & Administrative Costs):** These are costs not directly attributable to a specific project but are necessary for the general operation of the organization, like utilities, rent, and administrative salaries. These are often calculated as a negotiated percentage of direct costs.

Crafting Your Budget: A Step-by-Step Guide

Developing a robust project budget template requires a methodical approach. It’s a process of breaking down your project into its constituent activities and then assigning accurate costs to each. This systematic methodology ensures completeness and provides a strong foundation for your financial request.

The goal is to create a financial blueprint that is both comprehensive and easy to understand, allowing funders to quickly grasp how their investment will translate into tangible project outcomes. Careful planning at this stage will save significant time and effort later on.

- **Thoroughly Review Funder Guidelines:** Every grant-making organization has specific requirements for budget presentation, allowable costs, and indirect cost rates. Start by understanding these rules inside out.

- **Break Down Project Activities:** List all activities required to achieve your project objectives. For each activity, identify the resources (personnel, supplies, equipment) needed.

- **Identify and Quantify Direct Costs:**

- **Personnel:** List each staff member involved, their role, the percentage of their time dedicated to the project, and their annual salary. Calculate the exact portion attributable to the grant.

- **Fringe Benefits:** Apply your organization’s standard fringe benefit rate to the total personnel salaries to determine these costs.

- **Travel:** Estimate costs for flights, accommodation, and per diem, specifying the purpose and number of trips.

- **Equipment & Supplies:** Research current market prices. For supplies, estimate quantities needed over the project period.

- **Contractual Services:** Obtain quotes from potential consultants or agencies, detailing their scope of work and hourly/daily rates.

- **Other Direct Costs:** Account for all remaining direct expenses, providing clear justifications.

- **Calculate Indirect Costs:** If permitted by the funder, apply your organization’s federally negotiated indirect cost rate (or a de minimis rate) to the appropriate direct cost base (e.g., modified total direct costs).

- **Write Clear Justifications:** For every significant line item, provide a brief, compelling narrative explaining why the expense is necessary and how it directly contributes to the project’s goals.

- **Review, Refine, and Reconcile:**

- Check for mathematical errors.

- Ensure the budget aligns perfectly with the project narrative and scope of work.

- Verify that all costs are allowable according to funder guidelines.

- Consider potential contingencies or unforeseen expenses and how they might be handled (without explicitly asking for contingency funds unless specifically permitted).

Beyond the Numbers: Strategic Considerations

While the accuracy of your numbers is paramount, an effective budgeting aid for grant seekers also involves strategic thinking. Your financial blueprint for grant applications should not only be mathematically sound but also strategically aligned with your overarching goals and the funder’s priorities. It tells a story of efficiency, impact, and sustainability.

Consider how the budget reflects the scale and ambition of your project. Does it seem realistic? Is it too lean, suggesting an inability to fully deliver, or too inflated, indicating a lack of fiscal discipline? A balanced approach, backed by thorough research, is key.

Alignment with Narrative: Your budget must be a direct reflection of your project description. Every expense should logically support an activity or outcome outlined in your narrative. Inconsistencies between the narrative and the budget are red flags for reviewers.

Realism and Reasonableness: Funders scrutinize budgets for realism. Are salaries competitive for your region and industry? Are travel costs within typical limits? Unrealistic projections, whether too high or too low, can undermine your proposal.

Sustainability: While not always a direct budget line item, your financial plan should subtly convey how the project’s activities might be sustained beyond the grant period, if applicable. This demonstrates long-term vision.

Cost-Sharing/Matching Funds: If your grant requires or encourages matching funds, clearly delineate your organization’s contributions (cash or in-kind) within the budget, adhering strictly to funder guidelines.

Customizing Your Budget Model for Success

No two grants are exactly alike, and neither are their ideal budget structures. While the core components remain consistent, tailoring your Grant Project Budget Template to fit the unique demands of each opportunity is a sign of sophistication. This customization allows you to speak directly to the funder’s specific interests and requirements.

Whether it’s a capital project, a research initiative, or a community program, the underlying financial plan should reflect its particular nuances. Adaptability in your budgeting framework is a powerful asset in the grant application process, ensuring your financial presentation is as compelling as your program design.

Grant Type Specifics: A budget for a capital grant will heavily feature construction, renovation, and large equipment costs. A research grant budget will focus more on personnel, lab supplies, and data analysis software. Adjust your line items and justifications accordingly.

Funder’s Priorities: Some funders prioritize direct service delivery, meaning they may favor lower administrative costs. Others might emphasize evaluation, requiring a larger budget allocation for data collection and analysis. Understand these priorities and reflect them in your budget.

Leveraging Technology: Utilize spreadsheet software (like Excel or Google Sheets) or dedicated grant management platforms to create dynamic and flexible budget models. These tools allow for easy adjustments, calculations, and scenario planning.

Scalability: Design your budget template to be scalable. Can it be easily modified for projects of different sizes or durations? This saves time in future applications.

Common Pitfalls to Avoid

Even experienced grant writers can fall victim to common budgeting errors. Being aware of these pitfalls can help you steer clear of them and submit a stronger, more polished grant application. A proactive approach to identifying and mitigating these issues is crucial for success.

Underestimating Costs: This is a frequent error. Always research current prices and consider inflation, especially for multi-year projects. Under-budgeting can lead to project shortfalls or a perception of poor planning.

Lack of Justification: Presenting a number without explaining its necessity is a major red flag. Every significant expense needs a clear, concise rationale.

Mathematical Errors: Simple addition or multiplication mistakes can instantly discredit your entire budget. Double-check all calculations.

Misalignment with Narrative: If your budget requests funds for activities not mentioned in your project description, or vice-versa, reviewers will question the coherence of your proposal.

Ignoring Indirect Costs: If your organization has an indirect cost rate, failing to include it (or including it incorrectly) can leave significant funding on the table or violate funder rules.

Late Submission: Rushing the budget at the last minute increases the likelihood of errors and omissions. Allocate ample time for its development and review.

Frequently Asked Questions

What’s the difference between direct and indirect costs in a grant budget?

Direct costs are expenses directly attributable to your specific project, such as staff salaries working solely on the project, specific supplies, or travel for project activities. Indirect costs, also known as Facilities & Administrative (F&A) costs, are general organizational expenses necessary to run your operations but not easily tied to one specific project, like rent, utilities, general administrative salaries, or IT infrastructure. Funders often have specific rules on how indirect costs can be calculated and included.

How do I justify personnel costs effectively?

To justify personnel costs, clearly list each position, their role in the project, the percentage of their time dedicated to grant activities, and their annual salary. Explain how their expertise is vital to achieving specific project objectives. Providing a clear scope of work for each role strengthens the justification.

Can I include contingency funds in my project budget?

Generally, direct contingency funds (e.g., “10% for unforeseen expenses”) are discouraged by funders as they suggest a lack of precise planning. Instead, build in buffers by slightly overestimating specific line items where costs might fluctuate, or ensure your budget allows for flexibility through reallocations, if permitted by the funder, to cover minor unforeseen costs. Always check funder guidelines on this matter.

How often should I update my grant project budget after it’s approved?

While the initial grant budget is a projection, it’s a living document. You should regularly monitor actual expenditures against your approved budget, typically monthly or quarterly. Significant deviations may require formal budget revisions submitted to the funder, depending on their policies and the extent of the change. This ongoing tracking is essential for sound financial management and reporting.

Do I need separate project budgets for different grant applications?

Yes, absolutely. Each grant application should have a unique project budget template tailored specifically to that funder’s guidelines, project period, and the specific activities you propose to fund with their money. While you may have a master organizational budget, the project-specific budget for each grant must stand alone and accurately reflect the funding request for that particular opportunity.

Mastering the art of grant budget development is an empowering step for any organization seeking external funding. It transforms a perceived bureaucratic hurdle into a powerful tool for strategic planning, accountability, and persuasive communication. By meticulously detailing your financial needs, you not only meet funder requirements but also build a compelling case for your project’s inevitable success.

Embrace the process of developing a robust financial plan for your grant application as an investment in your organization’s future. A well-constructed budget is a testament to your professionalism, foresight, and dedication to making your project a reality. It’s the financial backbone that supports your vision, helping to ensure that your impactful work receives the funding it deserves.