In the complex landscape of corporate governance and risk management, internal audit serves as an indispensable sentinel, providing independent assurance that an organization’s operations are effective, compliant, and aligned with strategic objectives. However, the capacity of an internal audit function to fulfill its mandate effectively hinges significantly on one often-underestimated factor: a robust, well-planned budget. Far more than a mere financial exercise, crafting an internal audit budget is a strategic endeavor that dictates the scope of audits, the depth of analysis, and the very value an audit department can deliver to its stakeholders.

Without a clear financial roadmap, internal audit departments risk under-resourcing critical areas, over-investing in less material risks, or simply struggling to articulate their value proposition to senior leadership and the audit committee. An Internal Audit Budget Template, or a structured approach to budget development, provides the clarity and strategic foresight necessary to optimize resource allocation, ensure comprehensive coverage, and ultimately enhance the overall effectiveness of the audit function. This structured approach benefits not only the Chief Audit Executive (CAE) in managing their team but also helps the audit committee understand and support the necessary investments in assurance activities.

The Indispensable Role of Financial Planning in Internal Audit

The internal audit function is constantly navigating evolving risks, regulatory changes, and technological advancements. To remain agile and responsive, a proactive approach to resource planning is paramount. Simply reacting to budgetary constraints or making ad-hoc funding requests can lead to gaps in audit coverage, increased organizational risk, and a diminished perception of internal audit’s value. A well-defined audit department spending plan acts as a strategic blueprint, translating the internal audit plan into tangible financial requirements.

This financial framework helps justify staffing levels, technology investments, training needs, and external consultancy expenses, ensuring that the department is adequately equipped to address both current and emerging risks. It allows the CAE to articulate a compelling case for the resources needed to deliver high-quality assurance and advisory services, safeguarding organizational assets and enhancing operational efficiency. Without this clarity, internal audit might find itself perpetually playing catch-up, rather than leading the charge in proactive risk mitigation.

Beyond Numbers: The Strategic Benefits of a Structured Audit Budget

Developing a detailed internal audit financial plan extends far beyond simple numerical allocation; it offers a multitude of strategic advantages that elevate the entire function. It transforms budget discussions from cost-centric negotiations into value-driven conversations, demonstrating the return on investment of a strong internal audit presence.

Here are some key benefits:

- Enhanced Resource Allocation: Ensures funds are directed towards areas of highest risk and strategic importance, optimizing audit coverage.

- Improved Stakeholder Communication: Provides a clear, justifiable presentation of needs to the audit committee and senior management, fostering transparency and trust.

- Predictability and Stability: Minimizes financial surprises, allowing for better long-term planning and consistent delivery of audit services.

- Value Justification: Helps articulate the specific contributions of internal audit to risk mitigation, compliance, and operational efficiency, showcasing the department’s value.

- Proactive Risk Management: Allocates resources for emerging risks, such as cybersecurity or AI governance, before they materialize into major issues.

- Staff Development and Retention: Budgets for crucial training and certification programs, investing in the professional growth of the audit team.

- Technology Adoption: Supports the acquisition and implementation of audit software, data analytics tools, and other technologies that enhance efficiency and effectiveness.

- Benchmarking and Performance Measurement: Provides a baseline for comparing actual expenditures against planned spending, aiding in performance analysis and continuous improvement.

Key Components of an Effective Internal Audit Financial Plan

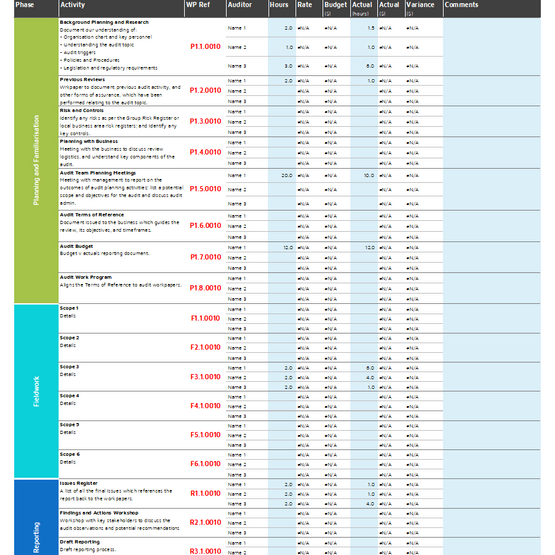

A comprehensive internal audit budget template or budgeting process should account for all facets of the audit function’s operations. It needs to reflect both fixed and variable costs, as well as one-time and recurring expenses, ensuring a holistic view of financial needs. Developing a robust audit program budget requires careful consideration of direct and indirect costs, personnel expenses, and strategic investments.

Typically, a robust framework for audit spending includes:

- Personnel Costs:

- Salaries and Wages: The largest component, covering auditors, managers, and administrative staff.

- Benefits: Health insurance, retirement contributions, social security, and other employee benefits.

- Recruitment and Onboarding: Costs associated with hiring new staff, including agency fees, background checks, and initial training.

- Professional Development and Training:

- Certifications: Fees for professional certifications (e.g., CIA, CISA, CPA).

- Conferences and Seminars: Costs for attending industry events to stay current on best practices and emerging risks.

- Online Courses and Workshops: Continuous learning initiatives.

- Technology and Software:

- Audit Management Software: Licensing fees and maintenance for platforms that streamline audit processes.

- Data Analytics Tools: Subscriptions or licenses for software used to analyze large datasets.

- Cybersecurity Tools: Any specialized software or services used by internal audit for security assessments.

- Hardware: Computers, specialized equipment, and network infrastructure if specific to the audit function.

- Travel and Expenses:

- Domestic and International Travel: For on-site audits, conferences, or training.

- Accommodation and Per Diem: Costs for lodging and daily expenses during travel.

- External Services:

- Co-sourcing/Outsourcing: Fees for engaging external audit firms or specialists for specific, complex, or resource-intensive audits (e.g., IT audit, forensic audit).

- Consulting Fees: For specialized advisory services.

- Legal and Compliance Advice: If specific to audit activities.

- Office Supplies and Administrative Overheads:

- General Office Supplies: Everyday consumables.

- Printing and Document Management: Costs related to audit report production.

- Subscriptions and Memberships: To professional organizations and industry publications.

- Contingency: A small percentage of the total budget allocated for unforeseen expenses or emergent audit needs.

Crafting Your Audit Department’s Spending Plan: Practical Considerations

Developing an effective internal audit financial plan requires more than just listing expenses; it demands strategic foresight and a deep understanding of organizational priorities. Start by aligning your proposed audit resource allocation with the annual audit plan, which in turn should be driven by the organization’s overall risk assessment and strategic objectives. This ensures that every dollar requested is directly tied to the achievement of specific audit goals and, ultimately, the organization’s success.

Consider historical spending patterns, but don’t be beholden to them. A zero-based budgeting approach, where every expenditure must be justified from scratch, can be particularly effective for internal audit, as it forces a critical evaluation of all activities. Factor in anticipated changes in regulatory requirements, emerging risks, and technological advancements that might necessitate new tools or specialized skills. Engage with key stakeholders early in the process to understand their expectations and potential needs, which can help in forecasting requirements more accurately and gaining early buy-in. Remember, your annual audit budget should be a living document, subject to periodic review and adjustment as circumstances evolve throughout the fiscal year.

Presenting and Defending Your Internal Audit Budget

Once the detailed internal audit cost estimation is complete, the next critical step is to present and defend it effectively to the audit committee and senior management. This is where the strategic value of your financial planning comes into play. Frame your budget request not as a list of costs, but as an investment in assurance, risk mitigation, and value creation for the organization. Link each major budget item directly back to the internal audit plan, specific risks being addressed, or strategic objectives being supported.

Use clear, concise language and supporting data to illustrate the return on investment. For example, demonstrate how investing in data analytics software can reduce manual effort, increase audit coverage, and identify risks more quickly. Highlight the implications of *not* funding certain areas—potential regulatory fines, reputational damage, or operational inefficiencies. Be prepared to answer questions about cost efficiencies, alternative solutions, and how your audit function financial blueprint compares to industry benchmarks. A well-prepared, value-driven presentation can transform a potentially adversarial budget discussion into a collaborative strategic alignment.

Frequently Asked Questions

What is the primary purpose of an internal audit budget?

The primary purpose of an internal audit budget is to strategically allocate financial resources to ensure the internal audit function can effectively execute its audit plan, manage risks, maintain compliance, and provide valuable insights to the organization. It translates the audit strategy into actionable financial terms.

How often should an internal audit budget be prepared?

An internal audit budget is typically prepared annually, aligning with the organization’s fiscal year. However, it should be reviewed and potentially adjusted quarterly or semi-annually to account for unforeseen changes, emerging risks, or shifts in organizational priorities that may impact audit resource needs.

What are the biggest challenges in creating an internal audit budget?

Common challenges include accurately forecasting future audit needs in a dynamic risk environment, justifying the value of assurance services to secure adequate funding, managing unexpected expenses, and balancing the desire for comprehensive coverage with financial constraints. Attracting and retaining skilled talent also presents a significant budgetary challenge due to competitive compensation landscapes.

Should contingency funds be included in the internal audit budget?

Yes, including a contingency fund is highly recommended. Internal audit operates in an unpredictable environment where new risks can emerge, or urgent, unplanned audits may be required. A contingency reserve, typically 5-10% of the total budget, provides necessary flexibility to address these unforeseen demands without disrupting planned activities or requiring emergency funding requests.

How can an internal audit department demonstrate the value of its budget requests?

To demonstrate value, internal audit departments should link budget requests directly to the organization’s strategic objectives, key risks, and prior audit findings. Highlighting potential cost savings, avoided losses, enhanced operational efficiency, and improved compliance resulting from audit activities can effectively illustrate the return on investment for the proposed audit function financial blueprint.

A well-constructed and thoughtfully managed internal audit budget is far more than an administrative necessity; it is a powerful strategic enabler. It provides the Chief Audit Executive with the tools to justify resource allocation, drive operational excellence, and consistently deliver impactful insights that protect and enhance organizational value. By viewing the budget process as an opportunity to articulate value and align with enterprise objectives, internal audit can strengthen its position as a trusted advisor and critical component of good governance.

Embrace the discipline of strategic financial planning for your internal audit department. Invest time in developing a comprehensive audit expense management framework that reflects your organization’s unique risk landscape and strategic priorities. The effort expended in crafting a detailed, defensible, and forward-looking budget will pay dividends, empowering your internal audit function to navigate complexities, anticipate challenges, and ultimately, elevate its contribution to the organization’s enduring success.