Launching a non-profit organization is a journey fueled by passion, driven by a powerful mission, and dedicated to creating positive change in the world. Founders pour their hearts and souls into their cause, often focusing intensely on program development and community outreach. Yet, amidst this vital work, one critical element often doesn’t receive the comprehensive attention it deserves from day one: a meticulously crafted financial blueprint.

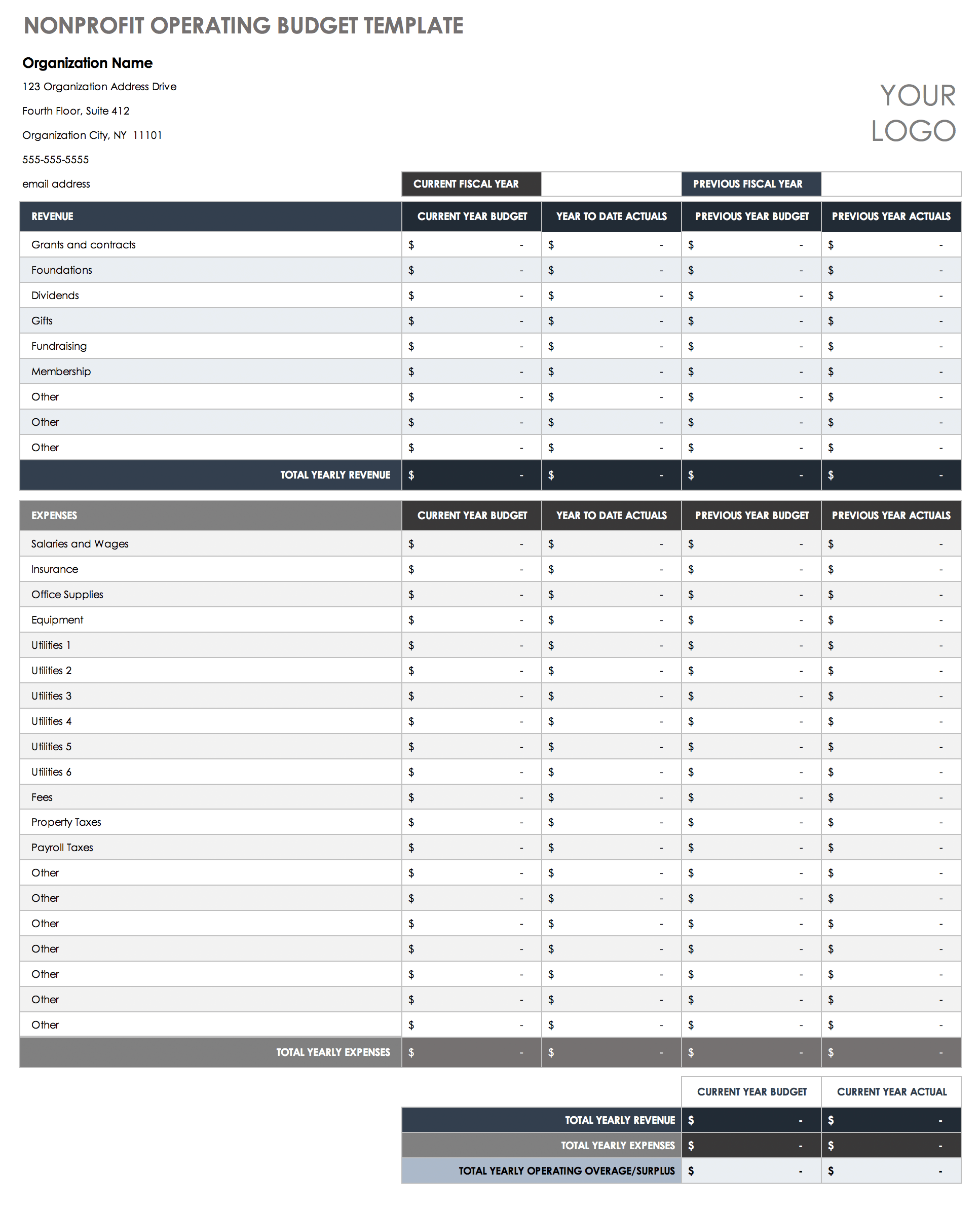

A solid financial foundation is not just about compliance; it’s the bedrock upon which all your aspirations and programs stand. Without a clear understanding of incoming resources and outgoing expenses, even the most impactful missions can falter. This is where a well-structured Non Profit Start Up Budget Template becomes an indispensable tool, guiding your organization from concept to sustainable impact and ensuring every dollar is aligned with your vision.

The Foundation of Impact: Why Every Non-Profit Needs a Solid Financial Plan

For a burgeoning non-profit, a robust initial financial plan is more than just a list of numbers; it’s a strategic roadmap. It outlines how your organization will generate revenue, allocate resources, and achieve its mission responsibly. This foundational document establishes credibility with potential donors, grantmakers, and even your future board members, demonstrating foresight and a commitment to fiscal stewardship.

Unlike for-profit businesses, non-profits operate under a unique financial paradigm. Funds often come with specific restrictions, and accountability to a diverse group of stakeholders — from beneficiaries to the general public — is paramount. An effective organizational budget for non-profits allows you to clearly articulate needs, prioritize spending, and transparently communicate your financial health, fostering trust and long-term support. It also helps anticipate cash flow challenges before they become crises.

Key Components of a Robust Non-Profit Start-Up Budget

Developing a comprehensive initial financial plan for non-profits involves meticulous thought and realistic projections. This isn’t just about listing broad categories; it’s about breaking down every potential income source and expense into manageable, understandable line items. A good budget tool provides the structure to capture these details effectively.

Here are the essential components that every emerging non-profit should include in its financial blueprint:

- **Revenue Streams:** Identify all potential sources of income. This includes specific grant applications planned, individual donor solicitations, corporate sponsorships, fundraising events, membership fees, or even earned income through services or sales. Be realistic with projections, especially in the early stages.

- **Personnel Costs:** This is often the largest expense for many organizations. Detail salaries, wages, payroll taxes, and employee benefits (health insurance, retirement contributions). Don’t forget costs associated with consultants or independent contractors.

- **Programmatic Expenses:** These are the direct costs associated with delivering your mission-related services. For example, if you run an educational program, this would include curriculum materials, transportation, venue rental, and specific supplies for participants.

- **Administrative Expenses:** These are the costs to run the organization itself, distinct from program delivery or fundraising. Examples include office rent, utilities, insurance, legal fees, accounting services, professional development, and general office supplies.

- **Fundraising Expenses:** The costs directly related to soliciting contributions. This might encompass event planning, donor management software, marketing materials for campaigns, website development for donations, and staff time dedicated to fundraising.

- **Marketing & Communications:** Beyond fundraising-specific needs, consider costs for general awareness, branding, website maintenance, social media tools, and public relations efforts that promote your mission and impact.

- **Technology & Software:** Essential tools for modern non-profits include computers, specialized software (CRM, accounting, project management), internet services, and website hosting.

- **Travel & Training:** Expenses for staff or volunteers attending conferences, workshops, or site visits crucial for professional development or program delivery.

- **Contingency Fund (Reserve):** A crucial element often overlooked by start-ups. Allocate a percentage (e.g., 10-20%) of your total expenses as an emergency fund to cover unforeseen circumstances, sudden drops in funding, or unexpected costs. This builds financial resilience.

Navigating Common Budgetary Challenges

Even with a well-designed budget, new non-profits face unique financial hurdles. One common pitfall is **underestimating operational costs**. Founders often focus heavily on programmatic expenses, forgetting the significant overhead required to run a sustainable organization, from insurance to accounting software. Another challenge is **overestimating initial revenue**, particularly from grants or large individual donors, which can take time to secure.

Cash flow management is also critical. A budget might show positive net income over a year, but if expenses peak before major donations arrive, the organization can face a temporary liquidity crisis. Additionally, navigating donor restrictions requires careful attention; funds allocated for one purpose cannot be used for another, making flexible spending challenging. A detailed start-up financial blueprint for charities can help mitigate these risks by forcing founders to think through these scenarios in advance.

Crafting Your Own Non-Profit Financial Blueprint: A Step-by-Step Guide

Creating your organization’s inaugural budget doesn’t have to be an intimidating task. Approaching it systematically can make the process manageable and highly effective. Think of this as building your financial roadmap for social good ventures.

Step 1: Define Your Mission & Program Goals. Before you can budget, you must be crystal clear about what your non-profit aims to achieve and how it plans to do so. What specific programs will you run? Who will you serve? The clearer your mission and programs, the easier it will be to identify the costs associated with them.

Step 2: Research & Estimate Everything. This is where realism is key. For every income source, research realistic potential amounts and timelines. For every expense, get quotes, research market rates, and consult with others in the non-profit sector. Don’t guess; find data. This might involve calling vendors, looking at similar organizations’ public financial statements (if available), or using industry benchmarks.

Step 3: Categorize & Allocate Funds. Using the components outlined earlier, list all your projected revenues and expenses. Group similar items together. For instance, combine all salary-related costs under "Personnel." Then, allocate your projected revenue across these expense categories, ensuring your planned spending doesn’t exceed your anticipated income.

Step 4: Project Cash Flow. This step is crucial for liquidity. Don’t just look at annual totals. Break your budget down by month or quarter. When do you expect significant donations or grant disbursements? When are your major expenses due (e.g., annual insurance premiums, large program event costs)? This allows you to identify potential cash shortfalls and plan for them, perhaps by staggering expenses or seeking bridge funding.

Step 5: Review & Refine. Once you have a draft, review it thoroughly. Get feedback from experienced financial professionals, mentors, or potential board members. Are your assumptions realistic? Have you missed anything? Is there an opportunity to reduce costs or diversify income? Iterate until you have a robust and defensible budget. This initial financial planning document should be a living tool, not a static report.

Step 6: Monitor & Adjust Regularly. A budget is a plan, not a prophecy. Throughout your first year, regularly compare your actual income and expenses against your budgeted figures. This monitoring allows you to identify deviations early, understand why they occurred, and make necessary adjustments to your spending or fundraising strategies. This ongoing process transforms your budget into a dynamic financial management guide for new organizations.

Beyond the Numbers: Strategic Budgeting for Sustainable Growth

While a Non Profit Start Up Budget Template is primarily a financial tool, its implications extend far beyond mere accounting. It serves as a powerful strategic document, shaping your organization’s trajectory and potential for sustained impact. A well-articulated initial financial plan can significantly influence your ability to attract funding. Donors and grantmakers look for organizations that demonstrate fiscal responsibility and a clear understanding of their financial needs. A professionally presented budget instills confidence and showcases your commitment to effective resource management.

Furthermore, a strategic budget helps you identify opportunities for growth and scale. By understanding your cost structure and revenue generation, you can make informed decisions about expanding programs, hiring additional staff, or investing in new technologies. It encourages foresight, enabling you to build reserves, plan for future challenges, and ultimately, ensure your non-profit can continue to pursue its mission for years to come. Embracing this foundational financial planning document empowers your non-profit to not just survive but thrive and make a lasting difference.

Frequently Asked Questions

How often should I update my start-up budget?

While your annual budget provides a year-long framework, you should review and adjust it monthly or quarterly, especially in the first year. This allows you to account for unexpected expenses, changes in funding, or shifts in program priorities, ensuring your financial plan remains relevant and accurate.

What’s the difference between restricted and unrestricted funds in a budget?

Unrestricted funds are donations that can be used for any purpose that supports your non-profit’s mission, offering maximum flexibility. Restricted funds, on the other hand, are donations given for a specific purpose (e.g., a grant for a particular program, a donation for a specific piece of equipment) and must be spent according to the donor’s wishes. Your budget should clearly delineate these two categories to ensure compliance and proper financial reporting.

Can a small non-profit really afford a contingency fund?

Yes, and it’s even more critical for small non-profits. While it might seem challenging to set aside funds when resources are tight, a contingency fund (even a small one, starting with 5-10% of your annual operating budget) provides a vital safety net against unforeseen circumstances. It’s better to plan for a buffer than to be caught unprepared, potentially jeopardizing your mission.

How do I budget for volunteer-led operations?

Even if your operations are largely volunteer-led, there are still associated costs to consider. Budget for volunteer recruitment, training materials, background checks, recognition events, and any supplies or technology they might need to perform their roles. While volunteers don’t receive salaries, their support isn’t free to the organization, and valuing their contribution through budgeted resources is important.

What accounting software is best for new non-profits?

For new non-profits, user-friendly and affordable options are key. Popular choices include QuickBooks for Nonprofits, Xero, or even free spreadsheet templates initially for very small organizations. Consider software that offers specific non-profit features like fund accounting, grant tracking, and donor management integrations as your organization grows. Always choose a solution that aligns with your team’s technical comfort level and your projected budget complexity.

Embarking on the non-profit journey is an exciting venture, full of purpose and potential. By meticulously planning your finances from the very beginning, you’re not just creating a document; you’re laying a robust foundation for enduring impact. A well-crafted budget serves as your compass, guiding every decision and ensuring that your dedication translates into tangible, sustainable change.

Embrace the process of developing a comprehensive financial strategy for start-up charities. It will empower you to communicate your needs clearly, attract the resources necessary for success, and ultimately, fulfill your mission with confidence and integrity. Your commitment to sound financial planning today will pave the way for a brighter, more impactful future for your organization and the communities you serve.