Managing personal finances can often feel like navigating a complex maze, especially when income and expenses don’t perfectly align with traditional monthly cycles. For millions of Americans paid every two weeks, the standard monthly budget can sometimes lead to confusion, “phantom money” syndrome, or simply a disconnect between when money comes in and when bills are due. This common pay schedule demands a more tailored approach to financial planning, one that mirrors the rhythm of your earnings.

Imagine a clear roadmap for your money, specifically designed for your bi-weekly income. This isn’t just about tracking what you spend; it’s about proactively allocating every dollar across your two-week pay cycle, ensuring you’re always ahead of your financial commitments. A dedicated two-week budget plan offers clarity, reduces stress, and empowers you to make informed decisions about your spending and saving, transforming financial anxiety into confidence and control.

Why a Bi-Weekly Budget Makes Sense for Many

The bi-weekly pay schedule is incredibly common in the United States, yet many individuals still attempt to force their finances into a monthly budgeting model. This misalignment can create significant challenges. When you receive your paycheck every two weeks, you often get two paychecks in most months, but then you’ll experience “three-paycheck months” twice a year. This variability can be a blessing or a curse, depending on how you plan.

A bi-weekly spending plan synchronizes your financial planning with your actual income flow. Instead of trying to stretch two bi-weekly paychecks across an entire month, or figuring out what to do with that “extra” third check, a two-week budget helps you allocate funds more precisely. This approach can dramatically reduce the feeling of running out of money before the end of a traditional month, as each budget cycle is shorter and more manageable.

Furthermore, it provides a more granular view of your spending habits. By reviewing your budget every two weeks, you can identify areas for adjustment much more quickly than with a monthly review. This agile approach allows for course correction, preventing small overspends from snowballing into larger financial headaches. It fosters a proactive stance on money management, turning financial planning into a consistent, actionable habit rather than a daunting monthly chore.

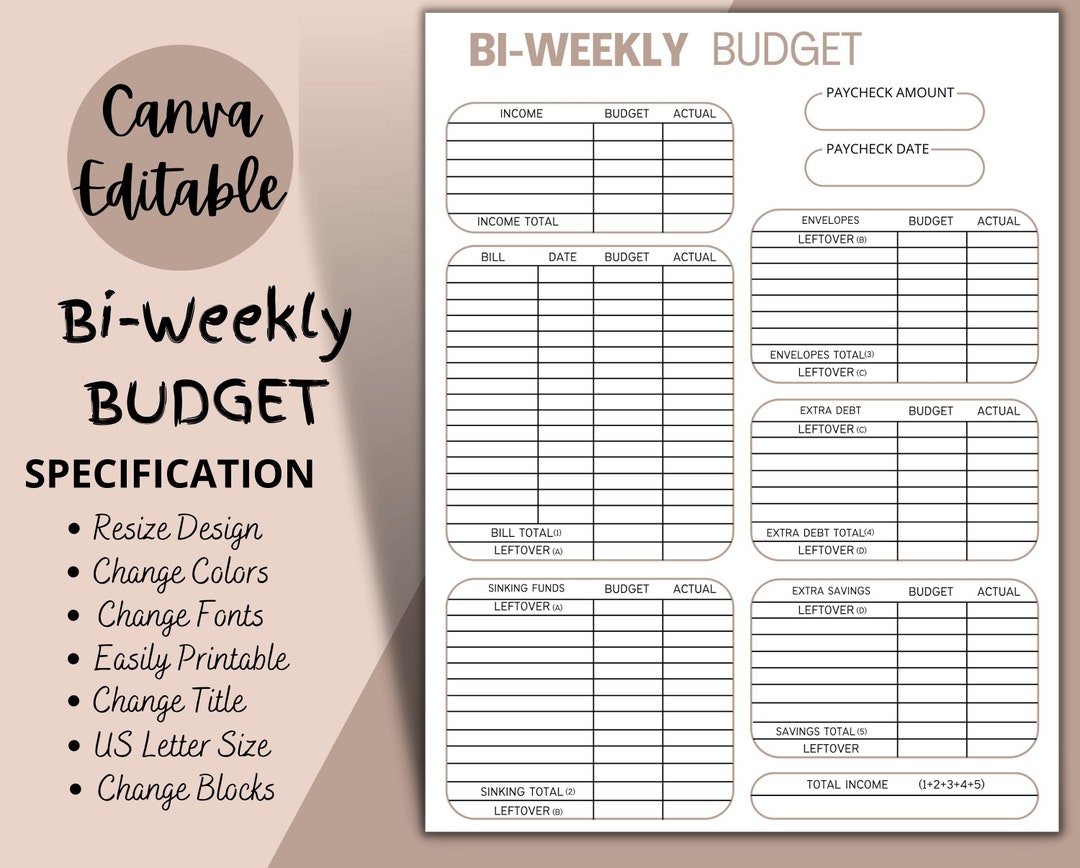

Key Elements of an Effective Bi-Weekly Budget

Building a robust two-week financial plan involves understanding and categorizing where your money comes from and where it goes. It’s more than just a ledger; it’s a strategic framework for your income. A comprehensive framework will consider both fixed and variable expenses, along with savings and debt repayment goals within each specific pay period.

Here are the fundamental components you should include in your bi-weekly spending plan:

- Income Sources: List all income received within the two-week period. This typically includes your bi-weekly paycheck, but also consider any side hustle income, freelance payments, or other regular deposits.

- Fixed Expenses: These are bills that generally stay the same amount and often have specific due dates. Examples include rent/mortgage, loan payments (car, student), insurance premiums, and subscription services. You’ll need to allocate funds for these as they fall within or across your bi-weekly cycles.

- Variable Expenses: These fluctuate from pay period to pay period. Categories like groceries, dining out, entertainment, transportation (gas, public transit), and personal care fall here. This is where most overspending often occurs, so careful tracking is essential.

- Savings Goals: Dedicate a portion of each paycheck to your financial goals. This could be an emergency fund, a down payment for a house, retirement contributions, or a vacation fund. Making savings a line item ensures it’s a priority, not an afterthought.

- Debt Repayment: Beyond minimum payments on loans, consider allocating extra funds to accelerate debt reduction, especially for high-interest debts like credit cards. This can free up future cash flow significantly.

- Discretionary Spending: This covers non-essential spending that brings joy but isn’t strictly necessary. Think hobbies, shopping, or spontaneous outings. Allocating a specific amount here helps prevent guilt and ensures you enjoy your hard-earned money responsibly.

Getting Started with Your Bi-Weekly Budget Plan

Embarking on your journey to financial clarity with a Bi Weekly Budget Template doesn’t have to be complicated. The first step is often the most challenging, but with a structured approach, you can build a sustainable financial habit. The key is to gather all necessary information before you even start allocating funds, giving you a complete picture of your financial landscape.

Begin by collecting all your financial statements from the last 1-2 months. This includes bank statements, credit card statements, utility bills, loan statements, and pay stubs. This data will provide a realistic snapshot of your typical income and expenses. Don’t rely on memory; actual numbers are crucial for an accurate spending plan.

Next, determine your net income (take-home pay) for one bi-weekly period. This is the amount that actually lands in your bank account after taxes and deductions. This figure will be the foundation of your budget. Once you have this number, list all your expenses. Categorize them into fixed and variable, and note their due dates. This step is particularly important for a bi-weekly schedule, as you’ll need to decide which paycheck will cover which bills.

For bills that are due mid-month, you might need to allocate funds from your first bi-weekly check to cover a portion, or from your second if the due date aligns. The goal is to ensure that by the time a bill is due, the necessary funds have been set aside. This proactive allocation prevents scrambling and ensures all obligations are met on time. Consider setting up automatic transfers for savings immediately after each payday to ensure you pay yourself first.

Customizing Your Bi-Weekly Budget for Success

While the core principles of budgeting remain universal, the true power of any financial plan, including a two-week spending tracker, lies in its ability to adapt to your unique life. A one-size-fits-all approach rarely yields long-term success. Instead, think of your financial plan as a living document, evolving with your circumstances.

One of the most effective customization strategies for a bi-weekly budget is to create “buckets” for your expenses. For instance, with your first paycheck of the month, you might allocate funds for rent/mortgage, utilities, and a portion of your groceries. With the second paycheck, you might cover car payments, student loans, the remainder of groceries, and discretionary spending. This method ensures that critical fixed expenses are covered reliably, even if their due dates don’t perfectly align with your paydays.

Consider the “three-paycheck month” phenomenon. Instead of letting this extra income disappear into general spending, plan for it deliberately. Many people use this third paycheck to accelerate debt repayment, bolster their emergency fund, make extra savings contributions, or even fund a larger irregular expense like annual insurance premiums or car maintenance. Having a specific plan for these bonus paychecks is a powerful way to leverage them for significant financial progress.

Finally, don’t be afraid to adjust your budget as needed. Life changes – a new job, an unexpected expense, a shift in priorities – and your budget should reflect these changes. Review your bi-weekly spending plan regularly, perhaps at the end of each two-week cycle, to see what worked and what didn’t. This iterative process of review and refinement is crucial for long-term financial health and ensures your money management tool remains relevant and effective.

Tips for Mastering Your Bi-Weekly Spending Plan

Once you have your bi-weekly financial plan in place, the real work begins: sticking to it and making it a sustainable habit. Consistency and discipline are vital, but there are also practical strategies that can make the process smoother and more effective.

- Automate Everything Possible: Set up automatic payments for all your fixed bills. Also, automate transfers to your savings and investment accounts immediately after each payday. This ensures you’re paying yourself first and meeting obligations without manual effort.

- Track Every Dollar: For variable expenses, diligent tracking is key. Use a budgeting app, a spreadsheet, or even a simple notebook. Knowing exactly where your money goes allows you to identify areas for adjustment.

- Cash Envelope System for Variable Spending: If you struggle with overspending on categories like groceries or entertainment, try the cash envelope system. Allocate a set amount of cash for these categories at the start of each two-week cycle and only spend that cash.

- Plan for Irregular Expenses: Don’t let annual or semi-annual bills catch you off guard. Divide the total cost by 26 (for bi-weekly payments) and set aside that small amount from each paycheck into a dedicated sinking fund.

- Be Realistic and Patient: Don’t expect perfection from day one. There will be learning curves and occasional slip-ups. The goal is progress, not perfection. Adjust your budget as you learn more about your spending habits.

Maintaining Momentum: Beyond the First Few Paychecks

The initial enthusiasm for a new budgeting system, like a Bi Weekly Budget Template, can be high, but the challenge often lies in maintaining that momentum over months and years. Sustained financial discipline requires more than just a template; it demands consistent engagement and a positive mindset.

Regular reviews are your best friend. At the end of each two-week cycle, take 15-30 minutes to review your spending, compare it to your budget, and analyze any discrepancies. This isn’t about judgment; it’s about learning. What went well? Where did you overspend? What adjustments need to be made for the next cycle? These insights are invaluable for refining your financial strategy.

Celebrate small victories. Did you stick to your grocery budget for two weeks straight? Did you manage to put an extra $50 into savings? Acknowledge these achievements. Positive reinforcement helps build motivation and reinforces good financial habits. It transforms budgeting from a chore into a rewarding process.

Finally, stay connected to your “why.” Why are you budgeting? Is it to buy a house, pay off debt, save for retirement, or simply gain peace of mind? Keeping your larger financial goals front and center will provide the motivation needed during challenging times. Your bi-weekly money management tool is not just about numbers; it’s about building the life you envision.

Frequently Asked Questions

What is a bi-weekly budget, and how does it differ from a monthly budget?

A bi-weekly budget is a financial plan designed around a two-week pay cycle, where you allocate and track your income and expenses for each specific two-week period. This differs from a monthly budget, which plans for income and expenses over a 30-day period. The main advantage of a bi-weekly approach for those paid bi-weekly is that it aligns more closely with when money actually comes in, often resulting in greater clarity and control over cash flow, especially when dealing with those “three-paycheck months.”

Who benefits most from using a bi-weekly financial planning worksheet?

Anyone who receives income every two weeks will find immense value in a bi-weekly financial plan. It’s particularly beneficial for individuals who struggle with stretching paychecks across a full calendar month, experience cash flow issues mid-month, or want to take better advantage of the two extra paychecks that occur twice a year. It helps synchronize financial planning with actual income distribution, making money management feel more natural and less forced.

How do I handle monthly bills with a two-week budget?

Handling monthly bills with a two-week budget requires a bit of planning. You’ll need to decide which bi-weekly paycheck will cover which monthly bills. For example, if your rent is due on the 1st, you might allocate those funds from your last paycheck of the previous month or your first paycheck of the new month. For bills due mid-cycle, you might need to set aside a portion of your first paycheck to cover them, ensuring funds are available. The goal is to proactively assign each bill to a specific bi-weekly income period, perhaps creating a “bill fund” if needed.

What should I do with the “extra” third paycheck that comes twice a year?

The “extra” third paycheck from bi-weekly pay is a powerful financial tool. Instead of letting it disappear into general spending, plan for it strategically. Common uses include boosting your emergency fund, making extra payments on high-interest debt, increasing contributions to retirement or other savings goals, funding an annual expense (like insurance premiums or holiday spending), or making a significant purchase without going into debt. Having a specific plan for this bonus income prevents it from being unknowingly spent and maximizes its impact on your financial health.

Is it hard to switch from a monthly to a bi-weekly spending plan?

Switching from a monthly to a two-week spending plan can take some adjustment, but it’s generally not difficult once you understand the rhythm. The initial setup involves gathering financial data and re-categorizing expenses by a two-week cycle. The biggest change is often the mental shift in how you view and allocate your money. With a clear bi-weekly budget template and consistent effort, most people find the transition smooth and the benefits well worth the initial effort. It often leads to a more precise and less stressful approach to money management.

Embracing a bi-weekly approach to your finances can be a transformative step towards greater financial stability and peace of mind. By aligning your money management with your actual pay schedule, you gain a clearer picture of your cash flow, reduce financial stress, and unlock new opportunities for saving and debt reduction. It’s not just about crunching numbers; it’s about building a robust framework that supports your financial aspirations.

Don’t let the complexities of traditional budgeting hold you back. A well-designed two-week budget offers a practical, actionable path to taking control of your financial future, one paycheck at a time. Start today by mapping out your income and expenses for the next two weeks, and discover the clarity and confidence that comes with a personalized, proactive approach to your money.