The confetti has barely settled, the last guest has departed, and a quiet sense of accomplishment should wash over you. Yet, for many hosts, this feeling is often overshadowed by a lingering anxiety about the final bill. The joy of a meticulously planned celebration can quickly fade when unexpected expenses or an overwhelming total land in your inbox. This common scenario highlights a fundamental truth: throwing a memorable party isn’t just about good company and delicious food; it’s also about smart financial management.

Imagine approaching your next event, whether it’s a milestone birthday, an intimate anniversary, a lively graduation bash, or a festive holiday gathering, with a clear financial roadmap. This isn’t just a pipe dream; it’s an achievable reality when you equip yourself with the right tools. A well-structured Party Planning Budget Template serves as your compass, guiding every financial decision and ensuring your celebration aligns perfectly with both your vision and your wallet. It transforms potential stress into a streamlined, enjoyable planning process, letting you focus on the fun, not the fiscal fear.

Why a Party Budget Is Your Best Friend

Embarking on any event, large or small, without a clear financial framework is akin to setting sail without a map – you might get there, but the journey will likely be turbulent and full of surprises. A detailed party budget plan isn’t about restricting your creativity or sacrificing fun; it’s about empowering you to make informed choices. It’s the foundation upon which every other planning decision rests, ensuring coherence between your grand ideas and your financial capabilities.

Firstly, a comprehensive event budget planner acts as a powerful preventative measure against overspending. It forces you to confront the numbers early on, allocating funds to various categories before commitments are made. This proactive approach helps avoid the common trap of accumulating small, seemingly insignificant costs that, when added up, lead to a budget blowout. You gain immediate clarity on what you can realistically afford, preventing that post-party financial hangover.

Secondly, developing an expense management system for your party significantly reduces stress. The uncertainty of costs is a major source of anxiety for many hosts. By laying out your expected expenditures, you eliminate guesswork and replace it with concrete figures. This clarity allows you to make calm, rational decisions, whether it’s choosing between catering options, selecting décor, or deciding on entertainment. It ensures that the planning process itself becomes an exciting endeavor rather than a daunting chore.

Finally, an effective financial blueprint for your bash helps prioritize. Not every element of a party carries the same weight. Perhaps a gourmet meal is paramount for your guests, or maybe it’s the live band that will truly make the night unforgettable. When you see your budget laid out, you can consciously decide where to allocate more funds and where to pull back, ensuring that the elements most important to you and your guests receive the attention—and funding—they deserve. It’s about strategic spending, not just saving.

The Anatomy of an Effective Party Budget

Understanding the core components of a successful celebration expense tracker is crucial for building one that genuinely serves your needs. It’s not just about listing costs; it’s about categorizing them logically to gain a holistic view of your spending. Think of it as breaking down your event into manageable financial segments, allowing you to track and adjust with precision.

The most effective party cost organizer will delineate several key categories, each with its own set of potential expenditures. Getting granular here will prevent those "I forgot about that!" moments.

- Venue: This can be one of the largest costs. Consider the rental fee, insurance, cleaning fees, and any necessary permits. For backyard parties, think about tent rentals, additional lighting, or portable restrooms.

- Catering & Beverages: Food and drinks are central to most celebrations. Factor in the cost per plate, service charges, staff gratuities, bar setup fees, alcohol, mixers, and ice. Don’t forget cakes, desserts, and coffee.

- Decorations & Rentals: Beyond basic décor, this includes tables, chairs, linens, dishware, centerpieces, lighting, floral arrangements, balloons, and any special props related to your theme.

- Entertainment: This category covers DJs, live bands, performers, photographers, videographers, photo booths, and any other activities designed to engage your guests. Don’t forget travel or setup fees.

- Invitations & Stationery: Costs associated with physical or digital invitations, thank-you notes, place cards, menus, and any custom signage. Consider printing costs, postage, and design fees.

- Favors & Gifts: Small tokens of appreciation for your guests, gifts for hosts, or prizes for games.

- Attire: While often personal, for events with specific dress codes or themes (e.g., costume parties), this might include outfits for hosts or specific accessories.

- Miscellaneous & Contingency: This is perhaps the most critical, yet often overlooked, category. Always allocate 10-15% of your total budget for unexpected costs like last-minute purchases, gratuities for extra staff, emergencies, or minor price increases.

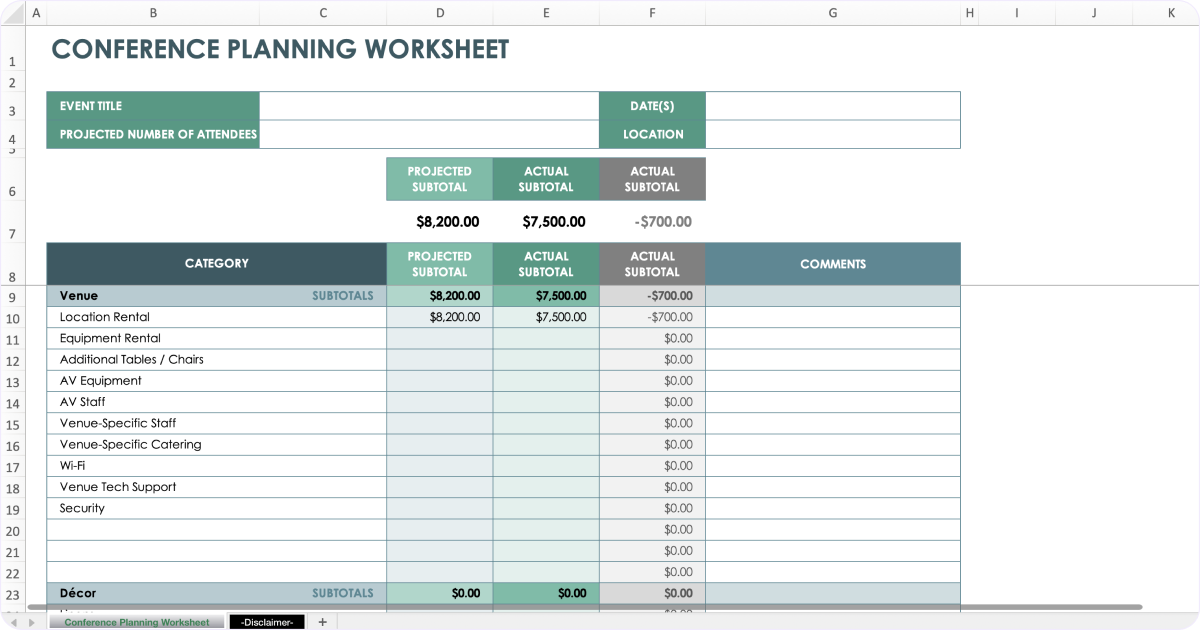

By breaking down your celebration into these actionable categories, you create a robust framework for tracking. Each category in your Party Planning Budget Template should have columns for the estimated cost, the actual cost, and the variance, allowing you to see at a glance where you are over or under budget. This level of detail ensures no expense is left unaccounted for, providing a clear and comprehensive view of your financial landscape throughout the planning journey.

Customizing Your Budget for Any Celebration

One of the greatest strengths of a robust cost estimation tool for parties is its adaptability. A universal template provides an excellent starting point, but truly effective budgeting involves tailoring that framework to the unique nature of each event. Whether you’re hosting an intimate dinner party for ten or a grand wedding reception for hundreds, your financial plan needs to flex and scale accordingly.

For smaller, more casual gatherings, your event expenditure guide might be simpler, perhaps consolidating categories like "Venue & Rentals" if you’re hosting at home, or merging "Decorations" with "Favors." The key is to eliminate unnecessary complexity while still capturing all relevant expenses. You might focus more heavily on food and beverage costs, which often dominate smaller event budgets, or on a unique entertainment element that will define the experience for a close-knit group.

Conversely, for larger or more formal events, the detail becomes paramount. You’ll likely expand sub-categories, adding lines for specific types of lighting, distinct floral arrangements for different areas, or multiple entertainment acts. Incorporating a section for vendor payments and due dates becomes critical here, transforming your party budget into a project management tool as much as a financial one. Consider separate line items for various permits, specialized insurance, or even travel and accommodation for out-of-town guests or key personnel.

The true art of customization lies in recognizing where your priorities lie for each specific event. Is it the ambiance? The cuisine? The guest experience? Once you identify these pillars, you can allocate a larger percentage of your funds to those areas, allowing other categories to be scaled back. This dynamic approach to your financial planning ensures that your celebration budget remains a living document, evolving with your vision and adapting to the practicalities of each unique occasion. Always remember that a flexible budget is a successful budget, capable of weathering changes and ensuring your party’s financial health.

Smart Saving Strategies and Unexpected Costs

Even with the most meticulously crafted financial framework, unexpected expenses can emerge. However, savvy planning and a few strategic choices can help you mitigate these surprises and even find ways to save without compromising the quality of your celebration. Thinking creatively about your spending is just as important as tracking it.

One of the most effective saving strategies is to embrace DIY (Do-It-Yourself) where appropriate. Crafting your own invitations, designing simple centerpieces, or even curating your own music playlist can significantly reduce costs associated with professional services. Be honest about your skills and time commitment, though; a poorly executed DIY project can end up costing more in the long run, both financially and in terms of stress.

Consider the timing of your event. Hosting during off-peak seasons or on weekdays can often lead to substantial savings on venue rentals, catering, and even entertainment. Vendors frequently offer lower rates when demand is not at its highest. Similarly, leveraging existing resources, such as borrowing décor from friends or utilizing a venue that already includes many necessary items, can drastically cut down on rental fees.

When negotiating with vendors, don’t be afraid to ask for package deals or inquire about what might be included in their standard pricing. Sometimes, minor adjustments to your requests can lead to cost reductions. Always get everything in writing to avoid misunderstandings later. Comparing quotes from multiple vendors is also a crucial step in ensuring you get the best value for your money.

Regarding unexpected costs, the "miscellaneous and contingency" category in your Party Planning Budget Template is your safeguard. Common culprits that often catch hosts off guard include:

- Service Charges & Gratuities: Often added to catering, bar services, or staff wages.

- Delivery & Setup Fees: For rentals, flowers, or specialized equipment.

- Corkage Fees: If you bring your own alcohol to a venue.

- Overtime Charges: For venue, staff, or entertainment if the party runs longer than planned.

- Last-Minute Purchases: Anything from extra batteries to a forgotten ingredient.

By anticipating these potential pitfalls and allocating a buffer within your budget, you ensure that these surprises don’t derail your financial plan, allowing you to handle them gracefully and keep the focus on enjoying your event.

Beyond the Numbers: The Psychology of Stress-Free Planning

While the practical benefits of a financial blueprint for your bash are undeniable, the advantages extend far beyond mere monetary savings. Implementing an effective budget for gatherings fundamentally shifts your mindset from reactive anxiety to proactive control. This psychological peace of mind is arguably one of the most valuable returns on your investment of time and effort in creating and maintaining your budget.

When you have a clear financial roadmap, you approach each planning decision with confidence. There’s no need to second-guess whether you can afford a particular vendor or decoration; the numbers are laid out, guiding your choices. This empowerment transforms the planning process from a series of stressful negotiations into a strategic exercise, where you’re making deliberate choices aligned with your overall vision and financial comfort. It allows you to say "yes" to what truly matters and "no" to what doesn’t, without guilt or regret.

Moreover, a well-managed party cost organizer frees up mental energy. Instead of constantly worrying about the bottom line, you can channel your creativity and focus on the elements that truly make a party special: the guest experience, the ambiance, the personal touches, and the joy of bringing people together. This allows you to fully immerse yourself in the fun aspects of planning, rather than being bogged down by financial constraints.

Ultimately, the goal of any celebration is to create lasting memories. By taking control of your financial planning with a comprehensive budget, you ensure that those memories are untainted by post-event financial stress. You get to enjoy the party you’ve worked so hard to create, fully present in the moment, knowing that every detail has been thoughtfully considered and responsibly managed. It fosters a sense of accomplishment and allows you to savor the success of your event, long after the last guest has gone home.

Actionable Steps to Get Started

Ready to take control of your next celebration’s finances? Here’s a streamlined approach to building and utilizing your expense management tool for parties effectively, ensuring you move from good intentions to great execution.

First, define your vision and guest count. Before you even think about numbers, visualize your ideal party. What’s the occasion? What kind of atmosphere do you want to create? Who are you inviting? A clear vision and an estimated guest list are crucial, as they influence almost every budgetary decision, from venue size to catering portions. This initial clarity sets the stage for realistic financial planning.

Next, set your overall budget limit. This is the maximum amount you are comfortable spending. Be honest with yourself and make this number firm. Having a non-negotiable ceiling will guide all subsequent allocations and prevent scope creep. It provides the essential boundary within which all your planning will occur.

Then, break down your budget into categories and allocate percentages. Use the categories discussed earlier (venue, catering, décor, entertainment, etc.) and assign a percentage of your total budget to each. For example, catering might be 40%, venue 20%, décor 10%, and so on. These are initial estimates; you’ll adjust them, but they provide a starting point for resource distribution. Remember to include that vital 10-15% for contingency.

As you begin obtaining quotes and making bookings, track your actual expenditures diligently. This is where your Party Planning Budget Template truly comes to life. Input every quote and every actual expense into your tracker. Compare these figures to your estimates. This real-time tracking allows you to see exactly where you stand and whether you’re veering off course.

Finally, review and adjust regularly. Your budget isn’t static. As you progress, you might find certain categories are costing more than anticipated, or you might discover savings in others. Be prepared to shift funds between categories, always keeping your overall limit in mind. Flexibility and consistent monitoring are the hallmarks of a successful event budget.

Frequently Asked Questions

Is a budget template really necessary for a small party?

Absolutely. While the level of detail might vary, even a small gathering benefits immensely from a budget. It helps prevent overspending on seemingly minor items, ensures you don’t forget essential components, and provides peace of mind. For a small party, a simplified version of a celebration expense tracker can still highlight key areas like food, drinks, and a small décor budget, keeping your costs in check and your enjoyment high.

How do I account for last-minute changes?

The “miscellaneous and contingency” category is your answer. Always allocate 10-15% of your total budget to this buffer. This fund is specifically designed to absorb unexpected costs, last-minute guest additions, or sudden changes in vendor prices. By having this buffer, you can handle unforeseen circumstances without stressing or exceeding your overall financial limit.

What’s the biggest mistake people make with party budgets?

The most common mistake is failing to track actual expenses against estimates. Many people create an initial budget but then don’t update it as they spend. This oversight leads to a false sense of security, and by the time the party is over, they discover they’ve significantly overspent. Consistent, real-time tracking is crucial for maintaining control.

Can I use a single template for different types of events?

Yes, most Party Planning Budget Templates are designed to be highly adaptable. While the specific line items and their importance might shift between a child’s birthday and a corporate launch, the core categories remain relevant. You can easily customize a comprehensive event budget planner by adding or removing specific rows, adjusting percentages, and tailoring it to the unique demands of each celebration.

Should I include my own time in the budget?

While your personal time isn’t a direct monetary expense for the party itself, it’s wise to consider it, especially if you’re doing a lot of DIY. Factor in how much time you have available and if hiring a professional for certain tasks (like setup or cleanup) might be a better investment for your peace of mind and time management. It can be an indirect cost, affecting your overall well-being and enjoyment of the event.

Embarking on the journey of planning a celebration, no matter its scale, is an exciting endeavor. The joy of bringing people together, creating unforgettable moments, and marking significant milestones is truly special. However, this joy can be amplified when you approach the planning process with confidence and clarity, free from the shadow of financial uncertainty.

By embracing the power of a Party Planning Budget Template, you’re not just organizing numbers; you’re orchestrating success. You’re setting yourself up for an enjoyable planning experience, a memorable event for your guests, and a stress-free aftermath for yourself. Take the first step today to transform your next party from a potential financial headache into a flawlessly executed, budget-savvy triumph, allowing you to fully savor every moment of your hard-earned celebration.