Stepping into the world of financial independence can feel like gaining a superpower, offering the freedom to buy what you want, save for future dreams, and contribute to your own life. But with great power comes great responsibility, and managing your money effectively is one of the most crucial skills you can develop as a young adult. It’s not just about counting dollars; it’s about understanding where your money comes from, where it goes, and how to make it work for you, not against you.

Many teenagers earn money through part-time jobs, allowances, or gifts, yet often find their funds disappearing without a clear understanding of why. This isn’t a sign of poor spending habits necessarily, but rather a lack of a clear financial roadmap. That’s precisely where a structured approach to money management comes in, providing clarity and control. This article will guide you through the process, helping you lay a solid foundation for financial literacy with a practical, easy-to-use spending plan.

Why Every Teen Needs a Financial Game Plan

Imagine knowing exactly how much money you have, how much you can spend on fun activities, and how much you’re saving for that new phone, concert ticket, or even college. That’s the power of having a financial game plan. For teenagers, understanding and managing personal finances isn’t just a useful skill; it’s a foundational step towards adult independence and long-term security.

Developing good money management habits now can prevent significant stress and financial pitfalls later in life. It teaches valuable lessons in prioritization, delayed gratification, and the true cost of items. More importantly, it empowers you to make informed decisions about your money, fostering a sense of control and confidence as you navigate increasingly complex financial situations in the future. Starting with a basic budget template for teenager isn’t just about tracking money; it’s about building a mindset for prosperity.

Unpacking the Essentials of a Teen Budget

At its core, a budget is simply a plan for your money. It helps you see how much income you have coming in and how much you have going out. For young people, this usually involves a few key components that are easy to identify and track. The goal is to make this process feel empowering, not restrictive, by giving you a clear picture of your financial landscape.

Your financial planning for teenagers should start with identifying all sources of income. This might include your allowance, earnings from a part-time job, money from chores, or even cash gifts received for birthdays or holidays. Once you know your total income, the next step is to categorize your expenses. This is where most of the learning happens, as you begin to distinguish between necessities and wants, and understand where your money is actually going.

Crafting Your Own Spending Blueprint

Getting started with your own spending blueprint might seem daunting, but it’s simpler than you think. The key is to be realistic and honest about your income and spending habits. This isn’t about cutting out all fun, but rather about making intentional choices that align with your financial goals. A good budget framework provides a clear path to achieving what you want while still enjoying your life.

Think of your budget as a dynamic tool that adapts to your life. It’s not a one-time setup; it’s something you’ll revisit and adjust as your income changes, your goals evolve, or unexpected expenses arise. The beauty of using a simple spending plan for young adults is that it gives you a tangible way to see your progress and make adjustments along the way, turning abstract financial concepts into concrete actions.

Bringing a Simple Budget Framework to Life

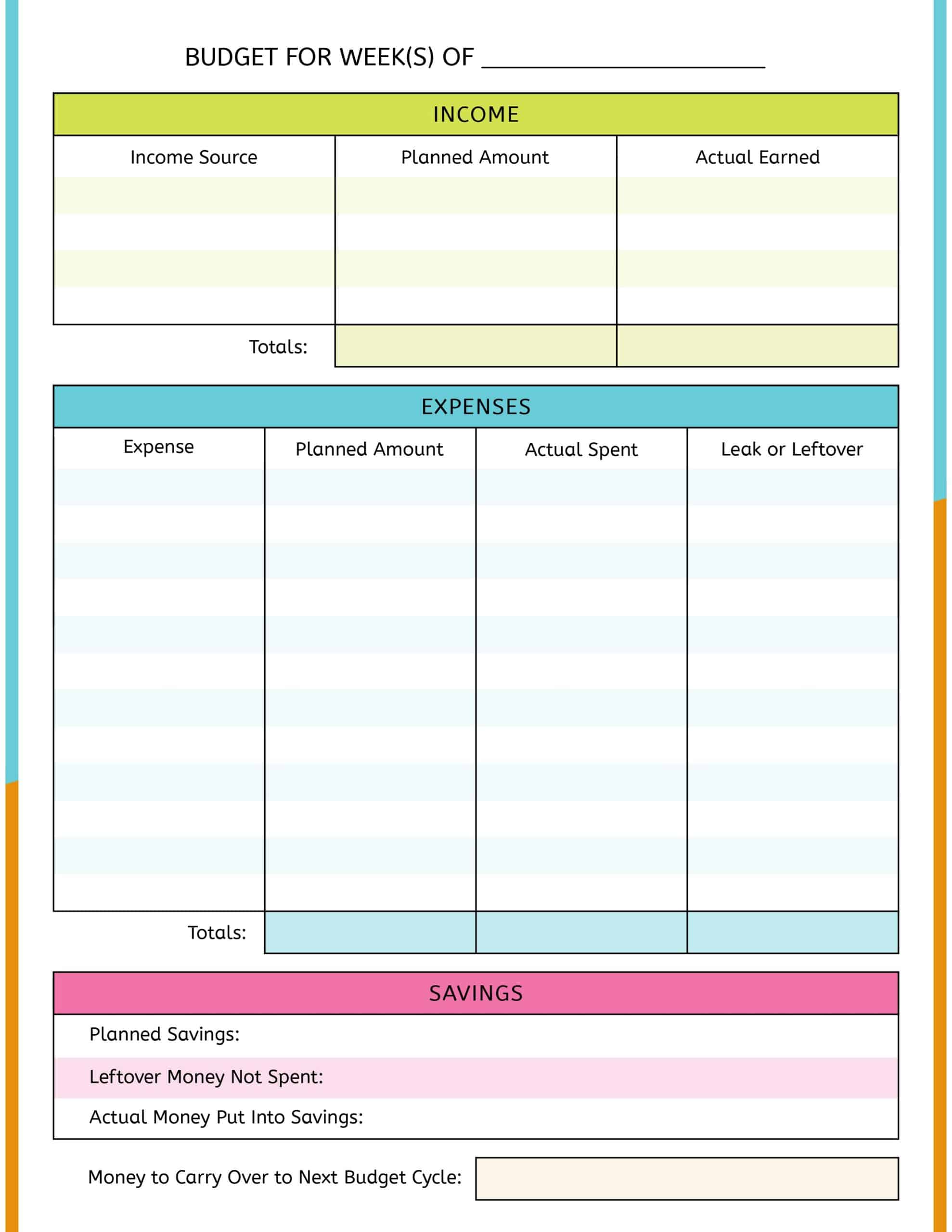

Now that you understand the "why," let’s dive into the "how." A Basic Budget Template For Teenager is essentially a structured way to record your income and expenses. It doesn’t have to be complicated; a simple spreadsheet or even a notebook can work wonders. The crucial part is consistency in tracking.

Here’s a breakdown of the key elements you’ll want to include in your financial tracking sheet for adolescents:

- Income Sources: List all the ways you receive money.

- Allowance: Regular money from parents/guardians.

- Job Earnings: Paychecks from part-time work.

- Odd Jobs: Money from babysitting, yard work, pet sitting.

- Gifts: Cash received for holidays or birthdays.

- Fixed Expenses: These are costs that typically stay the same each month.

- Subscriptions: Streaming services, gaming passes (if paid by you).

- Phone Bill: If you contribute to or pay your own.

- Club Dues: Regular payments for extracurricular activities.

- Variable Expenses: These costs fluctuate depending on your choices.

- Entertainment: Movies, concerts, social outings with friends.

- Food/Snacks: Eating out, coffee, vending machine purchases.

- Shopping: Clothes, accessories, impulse buys.

- Transportation: Gas money, bus fare (if not fixed).

- Savings Goals: Designate categories for money you want to save.

- Short-Term Goals: Items you want to buy soon (e.g., new video game, specific outfit).

- Mid-Term Goals: Bigger purchases (e.g., concert tickets, driving lessons, a new laptop).

- Long-Term Goals: Future plans (e.g., college fund, car down payment, travel).

- Emergency Fund: A small amount set aside for unexpected costs.

- This teaches the importance of a financial safety net.

Start by tracking your income for a month. Then, diligently record every penny you spend. This initial tracking period might be eye-opening! Once you have a clear picture of your spending habits, you can begin to allocate specific amounts to each category, ensuring you have enough for your needs, wants, and savings goals. This systematic approach is the foundation of effective youth budget guidance.

Smart Money Habits Beyond the Numbers

While a good financial organizer for young people is an excellent tool, it’s the habits you build around it that truly make a difference. Budgeting is more than just data entry; it’s a lifestyle choice that fosters financial responsibility for high schoolers and beyond. Here are some smart money habits to cultivate:

Firstly, pay yourself first. This means that as soon as you receive income, set aside a portion for your savings goals before you start spending. Even a small amount adds up over time and reinforces the priority of saving. This simple act builds discipline and ensures your long-term goals are always moving forward.

Secondly, distinguish between needs and wants. A "need" is something essential for survival or basic functioning (like a phone bill if it’s your only form of communication). A "want" is anything else that enhances your life but isn’t strictly necessary (like that new designer t-shirt). Learning this distinction is crucial for making smart spending decisions and avoiding impulse purchases that derail your financial plan.

Lastly, regularly review and adjust your budget. Life changes, and so should your financial strategy. If you get a raise, start a new expense, or achieve a savings goal, take the time to update your teen money tracker. This ensures your budget remains relevant and effective, reflecting your current financial situation and aspirations. Flexibility is a cornerstone of successful personal finance management for youth.

Frequently Asked Questions

Is a budget really necessary for a teenager?

Absolutely! A budget provides structure and control over your money, teaching valuable lessons in financial literacy, responsibility, and goal setting that will benefit you for life. It helps you understand where your money goes and allows you to make informed decisions about your spending and saving.

How often should I update my financial plan?

Ideally, you should review your spending plan at least once a month to ensure it accurately reflects your income and expenses. If your income or spending habits change significantly (e.g., you start a new job, have a major purchase, or face an unexpected expense), it’s a good idea to adjust it sooner.

What if I don’t have a regular income?

Even without a consistent income, a budget is still incredibly useful. You can track irregular income (like gifts or money from odd jobs) and plan how to allocate it. This teaches you to manage windfalls wisely, prioritize spending, and make lump sums last longer by allocating them to different categories or savings goals.

Can I still have fun while budgeting?

Yes, definitely! Budgeting isn’t about deprivation; it’s about intentional spending. By planning for fun activities and allocating money to your entertainment category, you can enjoy yourself without guilt or overspending. A well-managed budget helps ensure you have funds for both your responsibilities and your recreational desires.

Where can I find a good personal finance organizer for young people?

Many options are available! You can use a simple notebook, create a basic spreadsheet in Google Sheets or Excel, or explore free budgeting apps designed for general use, which can easily be adapted for a teenager’s needs. The best one is the one you’ll actually use consistently.

Embarking on your financial journey with a clear financial map is one of the smartest moves you can make as a teenager. The skills you develop now — the discipline of tracking income and expenses, the satisfaction of reaching a savings goal, and the confidence that comes with financial literacy — will serve you well for decades to come. Think of it as investing in your future self, building a strong foundation for financial well-being.

Don’t let the idea of money management intimidate you. Start small, be patient with yourself, and celebrate every victory, no matter how minor. Adopting a simple spending plan will empower you to make informed decisions, achieve your aspirations, and navigate the world with greater independence and security. Your financial future is in your hands – take control of it today!