Navigating the complexities of personal finance can often feel like an uphill battle. Between managing income, tracking expenditures, and saving for future goals, many of us seek a straightforward, intuitive system to keep our financial lives in order. While countless apps and services promise financial nirvana, the solution for many Apple users lies closer to home, within their own powerful productivity suite.

For those entrenched in the Apple ecosystem, the Numbers application on your Mac offers a remarkably flexible and user-friendly platform for personal budgeting. Far from being just a basic spreadsheet program, Numbers provides a visually rich and interactive environment that can transform the daunting task of money management into an engaging and empowering experience.

The Power of Personal Budgeting on Your Mac

In today’s fast-paced world, understanding where your money goes is the first step towards achieving financial freedom. A robust personal budget isn’t just about restricting spending; it’s about allocating your resources purposefully, making informed decisions, and aligning your financial actions with your long-term aspirations, whether that’s saving for a down payment, retirement, or a dream vacation.

For Mac users, Apple Numbers stands out as an excellent, often overlooked, tool for this critical task. Its elegant design, intuitive interface, and powerful calculation capabilities make it a strong contender against more complex or subscription-based financial software. The seamless integration with iCloud also means your budget is always accessible and up-to-date across all your Apple devices.

Unpacking the Personal Budget Template Numbers Mac Experience

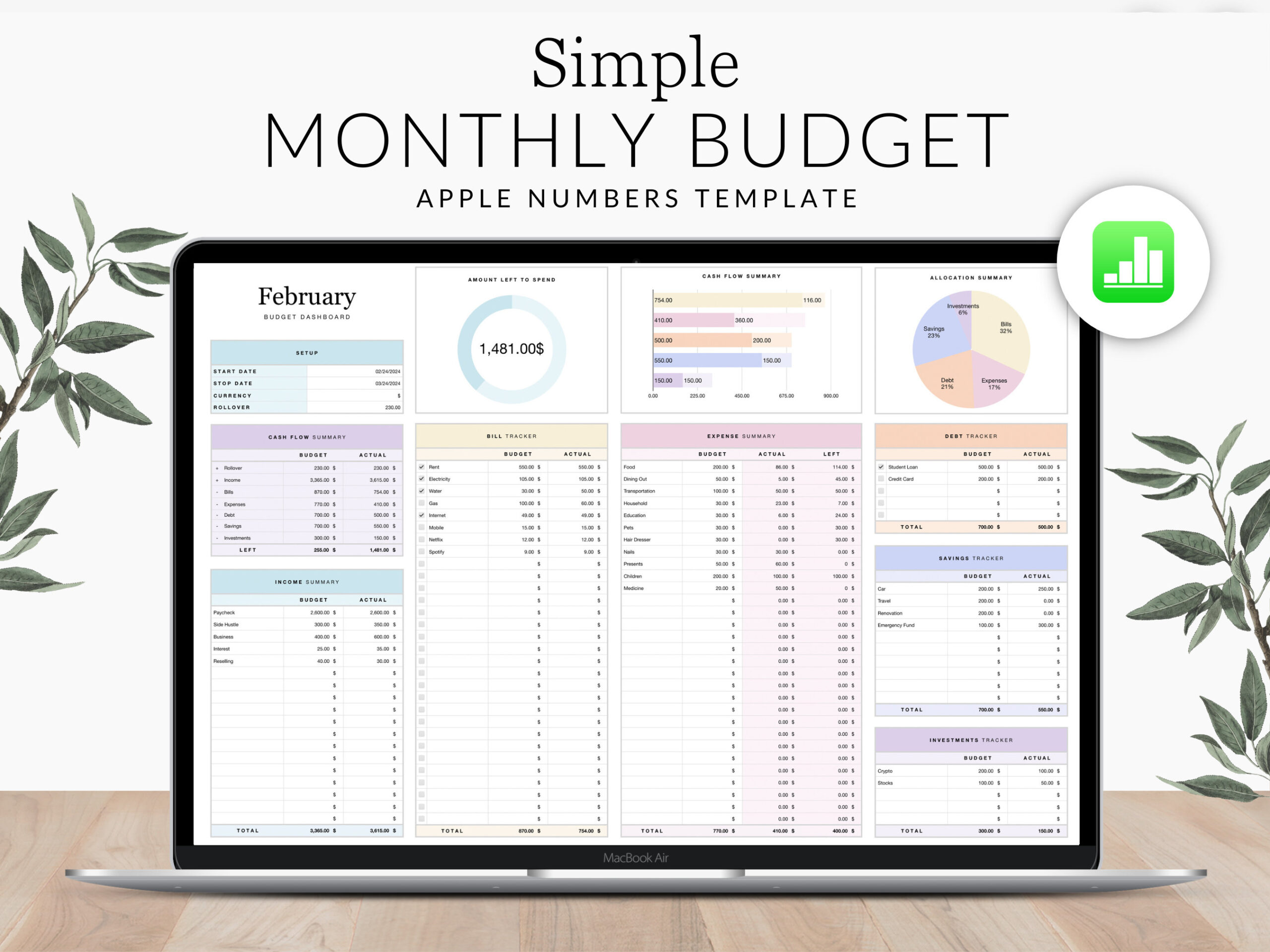

So, what exactly does a Personal Budget Template Numbers Mac offer? Imagine a pre-designed spreadsheet that organizes your income, fixed expenses, variable spending, and savings goals into clear, easy-to-understand categories. These templates remove the initial barrier of setting up a complex spreadsheet from scratch, allowing you to dive straight into tracking and managing your money.

Unlike a generic blank spreadsheet, these templates often come equipped with built-in formulas, visually appealing charts, and summary dashboards. This means you can quickly see your spending habits, assess your financial health, and identify areas where adjustments might be needed, all without wrestling with intricate functions or design elements. It’s about empowering you with immediate financial insight.

Getting Started: Finding and Utilizing Your Budget Template

Finding a suitable budgeting tool for Mac is simpler than you might think. Apple itself provides a selection of free templates within the Numbers application, covering various personal finance scenarios. Beyond Apple’s offerings, many financial bloggers and template designers offer specialized Mac budgeting templates that cater to diverse needs and preferences, often available for free or a small fee.

Once you’ve selected your preferred template, the process of setting it up is straightforward. Begin by opening the template in Numbers and immediately saving a copy under a new name to preserve the original. Then, input your monthly income from all sources. Next, list your fixed expenses, such as rent/mortgage, loan payments, and subscriptions. Finally, begin to track your variable expenses like groceries, dining out, and entertainment.

Here are some key elements you’ll typically find in a well-structured Mac budget template:

- Income Categories: Sections to input various sources of income, such as salary, freelance work, or investments.

- Fixed Expenses: Areas for recurring, predictable payments like rent, mortgage, car payments, insurance premiums, and utility bills.

- Variable Expenses: Categories for spending that fluctuates monthly, including groceries, dining, entertainment, shopping, and transportation.

- Savings Goals: Designated sections to track contributions towards specific savings targets, like an emergency fund or a down payment.

- Debt Tracking: Some templates include space to monitor outstanding debts, interest rates, and minimum payments.

- Summary Dashboard: A visual overview, often with charts and graphs, summarizing your income, expenses, and savings at a glance.

- Transaction Log: A detailed area where you record individual transactions as they occur, ensuring accuracy and complete tracking.

Customizing Your Financial Blueprint for Maximum Impact

While a pre-made Numbers budget spreadsheet offers an excellent starting point, its true power often lies in its adaptability. Your financial situation is unique, and your budget should reflect that. Numbers allows for extensive customization, enabling you to tailor the template to fit your specific lifestyle, financial goals, and tracking preferences.

Begin by adjusting the categories to better match your spending habits. If you rarely dine out but spend a lot on hobbies, rename “Dining Out” to “Hobby Supplies” or create a new category entirely. You can easily add or remove rows and columns, change cell formatting, or even introduce new sheets for specific projects, like tracking a vacation fund or a home renovation budget. Advanced users can leverage Numbers’ powerful functions to create custom calculations or use conditional formatting to highlight overspending categories in red.

Beyond the Basics: Maintaining Financial Clarity

Creating a budget template is only the first step; maintaining it consistently is where the real magic happens. Make it a habit to update your budget regularly – daily, weekly, or bi-weekly, depending on your spending patterns. This consistent engagement helps you stay aware of your financial position and prevents minor overspends from turning into major budget derailments.

Regularly review your financial management template on Mac to assess its effectiveness. Are you consistently exceeding your budget in certain categories? It might be time to adjust your allocation or find ways to cut back. Are you meeting your savings goals? Celebrate those wins! Your budget is a living document, and it should evolve with your life, reflecting changes in income, expenses, and aspirations.

Frequently Asked Questions

Is Apple Numbers really free to use?

Yes, Apple Numbers is free to download and use on all new Mac, iPhone, and iPad devices. If you purchased an Apple device recently, you likely already have it installed. Even older devices can often download it for free from the App Store.

Can I sync my budget across multiple Apple devices?

Absolutely. Numbers integrates seamlessly with iCloud. As long as you are signed in with your Apple ID and iCloud Drive is enabled for Numbers, your budget spreadsheet will automatically sync across your Mac, iPhone, iPad, and even the web version of Numbers, ensuring you always have access to the latest version.

How often should I update my personal spending plan?

The ideal frequency depends on your personal habits and needs. Some people prefer to log expenses daily, while others opt for a weekly review. A good starting point is to update it at least once a week to capture all transactions accurately and maintain a clear picture of your spending.

Are there any privacy concerns with financial data in Numbers?

Your data in Apple Numbers is stored locally on your device and, if enabled, synced securely via iCloud, which uses strong encryption. Apple has a robust privacy policy, and your financial data within Numbers is generally considered very private, especially compared to third-party financial apps that might connect to your bank accounts.

What if I’m new to spreadsheet software?

Numbers is designed to be user-friendly, even for spreadsheet beginners. Its intuitive interface, pre-built templates, and helpful guides make it easier to learn than more complex programs. Start with a basic template, focus on entering data, and gradually explore more features as you become comfortable.

Taking control of your finances doesn’t have to be an overwhelming ordeal. By leveraging the power and simplicity of a Personal Budget Template Numbers Mac, you gain a clear, actionable insight into your financial landscape. This elegant solution empowers you to track, analyze, and optimize your spending and saving habits with ease.

Embrace the journey towards financial clarity and peace of mind. With your customizable Numbers budget template, you have a powerful ally in achieving your financial aspirations, transforming abstract goals into concrete plans and measurable progress. Start today, and watch your financial future unfold with purpose and precision.