For many small business owners, the world of marketing can feel like a vast, unpredictable ocean. There are countless channels, strategies, and tools, each promising a path to growth. Without a clear compass, it’s easy to drift aimlessly, throwing money at various initiatives without a real understanding of their impact or, worse, running out of resources before significant results can be achieved. This financial uncertainty often leads to inconsistent marketing efforts, missed opportunities, and a general sense of being overwhelmed.

That’s where a structured approach becomes not just helpful, but essential. A well-designed financial blueprint for marketing provides the clarity and control needed to navigate this complex landscape effectively. It transforms guesswork into strategy, allowing entrepreneurs to make informed decisions about where and how to invest their hard-earned capital for maximum return. It’s more than just a spreadsheet; it’s a strategic planning tool that aligns your promotional activities with your overarching business objectives.

Why a Marketing Budget is Non-Negotiable for Small Businesses

Operating a small business requires constant vigilance over finances. Every dollar spent must be justified, especially when it comes to areas like marketing, which can sometimes feel abstract. A dedicated marketing spend plan for entrepreneurs isn’t just about limiting expenditure; it’s about optimizing it. It ensures that your promotional efforts are not just happening, but are happening strategically and sustainably.

Without a defined financial framework for marketing, small businesses risk several pitfalls: overspending on ineffective channels, underspending on crucial growth opportunities, or failing to track the performance of their campaigns. This leads to wasted resources, frustration, and a slower path to achieving business goals. Conversely, a clear expenditure guide empowers owners to allocate resources confidently, knowing they are investing in areas that support their growth ambitions. It provides a baseline for evaluating success and a roadmap for future adjustments.

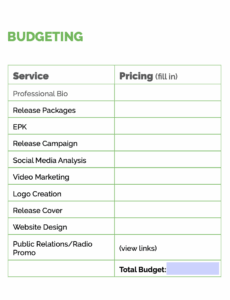

What to Include in Your Marketing Budget

Developing an effective marketing cost breakdown involves identifying all potential areas of expenditure. This isn’t just about what you might spend, but what you need to spend to execute your marketing strategy. Think broadly about both direct costs and the supporting infrastructure required for your campaigns.

Here are key elements every small business marketing budget should consider:

- **Digital Advertising:** This often includes expenses for platforms like Google Ads, social media ads (Facebook, Instagram, LinkedIn, TikTok), display ads, and retargeting campaigns. Be specific about platforms and projected spend.

- **Content Marketing:** Costs associated with creating valuable content such as blog posts, articles, videos, infographics, podcasts, and e-books. This might cover **writer fees**, video production, graphic design, or subscription to stock media libraries.

- **Social Media Marketing:** Beyond paid ads, this can include tools for scheduling, analytics, community management, or hiring a dedicated social media manager.

- **Email Marketing:** Subscription fees for email service providers (Mailchimp, ConvertKit, etc.), template design, and potentially costs for segmenting lists or developing specialized campaigns.

- **Website Development & SEO:** Maintenance, hosting fees, plugin subscriptions, website design updates, and services for search engine optimization (SEO) to improve organic search rankings.

- **Public Relations (PR):** Expenses for press releases, media outreach services, PR agencies, or crisis communication planning.

- **Event Marketing:** Costs related to attending trade shows, local fairs, webinars, or hosting your own events, including booth fees, travel, materials, and promotions.

- **Print & Offline Advertising:** Traditional media like flyers, brochures, direct mail, local newspaper ads, radio spots, or outdoor billboards.

- **Marketing Software & Tools:** Subscriptions for CRM systems, analytics platforms, project management tools, graphic design software, or reporting dashboards.

- **Personnel & Agencies:** Salaries for in-house marketing staff, fees for freelance contractors, or retainers for marketing agencies that handle specific aspects of your promotional efforts.

- **Market Research:** Expenses for surveys, focus groups, data analysis, or purchasing market reports to better understand your audience and competitive landscape.

This comprehensive list helps ensure no critical marketing expenditure is overlooked, giving you a holistic view of your resource allocation for marketing.

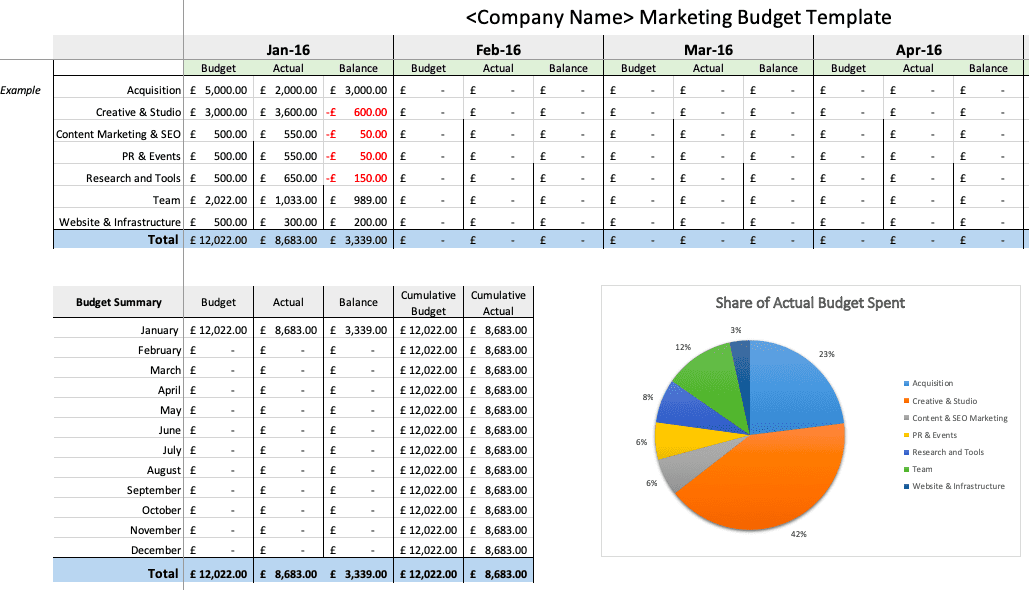

Crafting Your Own Marketing Budget Template

While many generic templates exist, the most effective marketing budget template for small business operations is one customized to your unique needs and goals. It’s about creating a tool that reflects your specific marketing strategy and allows for easy tracking and adjustment. Start by laying out the structure in a spreadsheet, dedicating columns for categories, projected costs, actual costs, and notes.

First, define your marketing goals for the upcoming period (quarterly or annually). Are you aiming for increased brand awareness, lead generation, customer acquisition, or retention? Your goals will dictate where your promotional spending plan should focus. Next, review your past marketing performance if you have any data. What worked? What didn’t? How much did it cost? This historical data provides a valuable baseline. Then, research industry benchmarks for your sector to get an idea of typical spending percentages, but remember these are just guides. Finally, start populating your template with estimated costs for each item identified above, aligning these estimates with your goals. Be realistic and factor in potential contingencies.

Allocating Your Marketing Dollars Wisely

Once you have a comprehensive financial planning for marketing, the real work begins: deciding how to distribute your funds strategically. This isn’t a one-size-fits-all solution; your allocation will depend heavily on your industry, target audience, business model, and specific marketing objectives. For instance, a B2B service provider might prioritize LinkedIn ads and content marketing, while a local retail store might focus more on community events and local SEO.

Consider the customer journey when allocating your budget. Where do your potential customers spend their time? What channels are most effective at different stages, from awareness to conversion? Don’t be afraid to start with an initial allocation, measure its effectiveness, and then pivot. A significant portion of your marketing financial blueprint should be dedicated to testing and experimentation. For example, allocate a small percentage to try out new platforms or ad formats. Track key performance indicators (KPIs) like cost per lead, conversion rates, and customer acquisition cost for each channel. This data will be crucial for making informed decisions and refining your expenditure tracking for small business promotion.

Measuring ROI and Adapting Your Strategy

A marketing budget is not a static document; it’s a living tool that requires regular review and adaptation. The ultimate goal of any strategic marketing investment is to generate a positive return on investment (ROI). This means that the revenue or value gained from your marketing efforts should outweigh the costs. Setting up clear metrics for success is paramount.

For every marketing activity, identify specific KPIs. For a social media campaign, it might be engagement rates and website clicks. For email marketing, open rates and conversion from emails. For digital ads, cost per click and cost per acquisition. Regularly review these metrics against your projected outcomes. If a channel isn’t performing as expected, ask why. Is it the content, the targeting, the budget, or the channel itself? This analysis allows you to make data-driven adjustments. Perhaps you need to shift funds from underperforming campaigns to those showing promising results, or reallocate resources to explore new opportunities. This continuous cycle of planning, executing, measuring, and adapting is what makes your promotional spending plan truly effective and helps drive sustainable growth for your small business.

Frequently Asked Questions

How often should I review my marketing budget?

Ideally, you should review your marketing budget monthly or quarterly. A monthly review allows you to catch underperforming campaigns or unexpected expenses quickly, making timely adjustments. A quarterly review provides a broader perspective on overall strategy and goal attainment, allowing for more significant shifts if needed. Annual planning sets the initial framework, but continuous monitoring is key for agility.

What percentage of revenue should a small business allocate to marketing?

The percentage varies widely based on industry, business maturity, and growth goals. Startups often spend a higher percentage (12-20%) to build brand awareness and acquire customers. Established businesses might allocate 5-12% of their revenue. Researching industry benchmarks for your specific sector can provide a good starting point, but always tailor it to your unique financial situation and strategic objectives.

Can I use a free online tool instead of building my own marketing budget template for small business?

Yes, many free online templates and spreadsheet tools are available from marketing blogs, software providers, or even within spreadsheet applications like Google Sheets or Microsoft Excel. These can be excellent starting points, offering pre-formatted categories and calculations. However, remember to customize any generic template to fit your specific business needs, marketing channels, and reporting preferences. The best template is one that you fully understand and can easily adapt.

How do I account for unexpected marketing opportunities or challenges?

It’s wise to include a contingency fund, or a “miscellaneous” category, within your strategic marketing investment. This buffer, typically 5-10% of your total budget, can cover unforeseen costs, unexpected opportunities (like a last-minute sponsorship), or allow for quick pivots in response to market changes. Flexibility is a crucial component of an effective marketing budget document.

What’s the biggest mistake small businesses make with their marketing budgets?

One of the biggest mistakes is treating the budget as a rigid, one-time document rather than a dynamic strategic tool. Businesses often fail to track actual spending against projections, neglect to measure ROI, or hesitate to adjust their plans based on performance data. Another common error is underinvesting in marketing altogether, stifling potential growth, or conversely, overspending without a clear strategy, leading to wasted funds. The key is consistent monitoring, analysis, and adaptation.

In the competitive landscape of small business, a well-defined and diligently managed marketing budget is not a luxury; it’s a necessity. It’s the compass that guides your marketing ship, preventing you from sailing into uncharted waters without a plan or running aground due to financial miscalculations. By proactively planning your marketing investments, tracking your spend, and meticulously measuring your results, you empower your business to make smarter, more impactful decisions.

Embrace the power of strategic financial planning for your marketing efforts. It’s an ongoing process of learning, adjusting, and optimizing, but the payoff—sustainable growth, increased brand visibility, and a stronger connection with your target audience—is immeasurable. Start today by outlining your strategic marketing investment, and watch as your business transforms from merely surviving to truly thriving.