In the journey toward financial wellness, many of us find ourselves navigating a maze of expenses, income, and often, uncertainty. The dream of managing money with confidence, saving for future aspirations, and achieving long-term stability can feel elusive without a clear roadmap. This is precisely where the concept of a well-defined financial management tool transforms potential chaos into a structured path. It’s about moving beyond simply tracking what you spend and actively shaping where your money goes.

Imagine a world where your financial decisions are proactive, informed, and aligned with your deepest goals, rather than reactive responses to bills and unexpected costs. This isn’t just wishful thinking; it’s an attainable reality through thoughtful planning. Developing a robust, yet straightforward, framework for your finances can be the single most impactful step you take towards empowerment. It simplifies the complex, clarifies the obscure, and empowers individuals, families, and even small project teams to take command of their economic destiny.

Understanding the Core Need: Why a Simple Budget Template Matters

At its heart, a budget is more than just a list of numbers; it’s a living document that reflects your financial priorities and aspirations. Many people shy away from budgeting, perceiving it as restrictive or overly complicated. However, the true intent behind any effective financial planning tool is liberation – freeing you from financial stress and enabling you to make conscious choices about your resources. It serves as your personal financial compass, guiding you through spending, saving, and investing.

A well-crafted budgeting framework helps demystify where your money actually goes. It shines a light on spending habits that might otherwise remain hidden, revealing opportunities for optimization and smarter allocation. Without such a framework, financial decisions often become guesswork, leading to missed opportunities for saving, increased debt, and a general sense of unease about one’s economic standing. This foundational tool ensures that every dollar has a purpose.

Key Benefits of a Streamlined Financial Blueprint

Embracing a structured spending plan offers a multitude of advantages that extend far beyond simply keeping tabs on your money. It’s about building a foundation for sustainable financial health and growth. The insights gained from consistently utilizing a clear financial plan are invaluable, leading to more intentional living and a greater sense of security.

Here are some of the transformative benefits you can expect from adopting a personalized financial management template:

- **Enhanced Visibility:** Gain a crystal-clear picture of your income and expenditures, revealing exactly where every dollar is allocated. This clarity is the first step toward informed decision-making.

- **Informed Decision-Making:** With a transparent overview of your finances, you can make strategic choices about spending, saving, and investing. This empowers you to prioritize what truly matters.

- **Achieve Financial Goals:** Whether it’s saving for a down payment, paying off debt, building an emergency fund, or planning a vacation, a budget helps you allocate resources effectively towards your specific objectives.

- **Reduced Financial Stress:** Uncertainty about money is a major source of stress. A comprehensive spending plan provides peace of mind by giving you a sense of control and predictability over your financial future.

- **Identify Wasteful Spending:** Often, small, recurring expenses add up significantly over time. A budget template helps pinpoint these areas, allowing you to reallocate funds to more productive uses.

- **Improve Savings Habits:** By setting explicit savings goals within your budget, you cultivate discipline and consistency, making saving an automatic and integral part of your financial routine.

Designing Your Personal or Project Spending Plan

The beauty of a robust budget template lies in its adaptability. While the core principles remain universal, its application can be tailored to suit individual personal finances, household management, or even the fiscal oversight of a specific endeavor. A strong financial blueprint isn’t about deprivation; it’s about intentional allocation. It requires you to categorize your income and expenses systematically, allowing for clear analysis and adjustments.

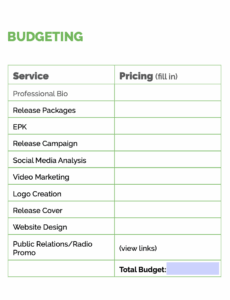

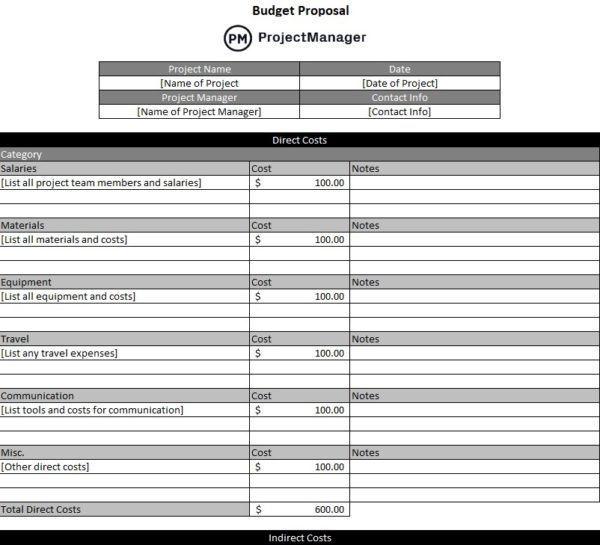

When developing your own budget template, consider these fundamental components that ensure comprehensiveness and usability. Start by gathering all necessary financial documentation, including bank statements, pay stubs, and recurring bill notifications. This initial data collection forms the bedrock of an accurate and actionable plan. A well-constructed Simple Budget Template Project Proposal should provide an intuitive framework for this crucial task, making the daunting seem manageable.

Implementing Your Financial Management Template: A Step-by-Step Guide

Putting your budgeting framework into practice is where the real magic happens. It’s an ongoing process that requires commitment and periodic review, but the steps to get started are straightforward. Think of it as cultivating a new, positive habit that will pay dividends for years to come.

Here’s a practical guide to implementing your financial management template:

- **Gather All Financial Data:** Collect all income sources (paychecks, freelance, investments) and expense details (bills, credit card statements, receipts) from the past month or two.

- **Categorize Income and Expenses:**

- **Income:** List all sources of money coming in.

- **Fixed Expenses:** These are costs that generally stay the same each month, like rent/mortgage, loan payments, insurance premiums, and subscriptions.

- **Variable Expenses:** These fluctuate monthly, such as groceries, dining out, entertainment, utilities (which can vary with usage), and transportation.

- **Set Realistic Targets:** Based on your average spending, allocate specific amounts for each category. Be honest with yourself to avoid frustration. If you spend $400 on groceries, don’t initially budget $200 unless you have a concrete plan to reduce it.

- **Track Your Spending Diligently:** This is perhaps the most critical step. For at least the first month, record every dollar you spend. Use a spreadsheet, an app, or even a notebook. This shows where your money is actually going versus where you planned for it to go.

- **Review and Adjust Regularly:** At the end of each month (or week, if you’re just starting), compare your actual spending to your budgeted amounts. Identify categories where you overspent or underspent. Make adjustments to your budget for the following month based on these insights.

- **Set Financial Goals:** Integrate your larger financial objectives—like saving for a down payment, paying off credit card debt, or building an emergency fund—directly into your budget. Allocate specific amounts towards these goals each month.

- **Stay Flexible:** Life is unpredictable. Your spending plan should be a living document that can adapt to changing circumstances, unexpected expenses, or shifts in income. Don’t be afraid to revise it as needed.

Beyond the Basics: Customizing Your Budgeting Framework for Success

While a standard simple budget template provides an excellent starting point, its true power unfolds when you tailor it to your specific financial landscape. Whether you’re managing personal finances, overseeing a household budget, or handling the fiscal aspects of a small business or a one-off project, customization is key. This could involve adding specific line items unique to your situation, creating separate tabs for different financial goals, or even incorporating visual elements to make tracking more engaging.

For instance, a freelancer with irregular income might benefit from a "buffer" category for lean months or a system that averages income over several months. A household budget might include specific categories for children’s activities, pet care, or home maintenance funds. A project-specific financial planning tool would necessitate detailed tracking of individual deliverables, resource costs, and milestone payments. The objective is to make the framework work for you, not the other way around, ensuring it remains a practical and sustainable tool for financial clarity and control. This ongoing process of refinement ensures that your financial blueprint remains relevant and highly effective.

Frequently Asked Questions

Is this financial planning tool only for individuals?

Absolutely not. While highly effective for personal finance, a well-structured budgeting framework is incredibly versatile. It can be adapted for households, small businesses, non-profit organizations, or specific project-based initiatives. The core principles of tracking income and expenses remain the same, regardless of the scale or nature of the entity.

How often should I review and adjust my spending plan?

Ideally, you should review your budget at least once a month. This allows you to compare actual spending against your planned amounts and make necessary adjustments for the upcoming month. Quarterly reviews are also beneficial for checking in on long-term goals and making larger strategic shifts.

What if my income is irregular? Can I still use a budget template?

Yes, certainly! For irregular income, strategies like the “buffer budget” (where you save up one month’s expenses in advance) or the “paycheck percentage” method (allocating a set percentage of each varying paycheck) can be very effective. The key is to build flexibility and a margin for error into your financial plan.

What are the most common pitfalls to avoid when budgeting?

Common pitfalls include setting unrealistic budgets that lead to frustration, forgetting to track all expenses (especially small cash transactions), giving up too soon when things don’t go perfectly, and not regularly reviewing or adjusting the budget. Treat your financial management template as a dynamic tool, not a static document.

Where can I find a good simple budget template?

Many excellent simple budget templates are available online, ranging from free spreadsheet templates (like those found in Google Sheets or Microsoft Excel galleries) to more sophisticated financial apps. Look for one that is easy to understand, customizable, and aligns with your preferred method of tracking (digital or manual).

Taking control of your finances doesn’t have to be an overwhelming ordeal. It begins with a single, deliberate step: adopting a clear, actionable financial plan. This commitment to understanding and managing your money effectively is an investment in your future, providing a solid foundation for achieving both immediate desires and long-term ambitions. It moves you from merely hoping for financial stability to actively building it, brick by careful brick.

Embrace the power of knowing exactly where you stand and where you’re headed financially. By implementing a thoughtful and customizable spending plan, you’re not just tracking money; you’re cultivating a mindset of empowerment, resilience, and intentional living. Start today, and unlock the profound sense of control and freedom that comes from mastering your financial world. Your future self will undoubtedly thank you for the clarity and discipline you establish now.