In a world brimming with digital distractions and countless financial apps, there’s a certain timeless appeal and undeniable effectiveness to putting pen to paper. The journey to financial clarity and control often begins not with complex algorithms, but with a simple, tangible tool: a budget. Many Americans face the daunting task of managing their finances, navigating expenses, savings, and debt with varying degrees of success. This common struggle can often be traced back to a lack of a clear, actionable plan.

Imagine having a comprehensive, visual overview of your financial landscape each month, right at your fingertips. This isn’t just a dream; it’s a practical reality made possible by a well-designed monthly financial template. It serves as your personal financial compass, guiding you toward informed decisions and helping you achieve your monetary goals, whether that’s saving for a down payment, paying off debt, or simply understanding where your money goes.

Why a Monthly Budget Planner Template Matters for Your Financial Health

Financial peace of mind isn’t a luxury; it’s a fundamental component of overall well-being. Without a clear understanding of your income and expenses, it’s easy to feel overwhelmed, stressed, and constantly behind. A dedicated monthly budget planner offers more than just numbers on a page; it provides structure, accountability, and the power of informed decision-making.

Using a printable budget planner empowers you to see your financial situation with crystal clarity. It illuminates spending habits, highlights areas where you might be overspending, and reveals opportunities for savings. This tangible approach can feel more real and impactful than relying solely on digital tools, fostering a deeper connection to your financial journey. The act of physically writing down your numbers can solidify your commitment and make your financial goals feel more attainable.

Furthermore, a consistent budgeting practice, anchored by a reliable budget template printable, can be a powerful catalyst for achieving significant financial milestones. From building an emergency fund to planning a dream vacation or saving for retirement, every goal becomes more accessible when you have a detailed spending plan guiding your choices. It transforms vague aspirations into concrete, actionable steps, moving you steadily toward financial independence.

Key Elements of an Effective Printable Budget Template

Not all budget planners are created equal. An effective personal finance organizer is thoughtfully designed to capture all essential financial data while remaining intuitive and easy to use. It should provide a holistic view of your financial life, allowing you to track both the big picture and the minute details.

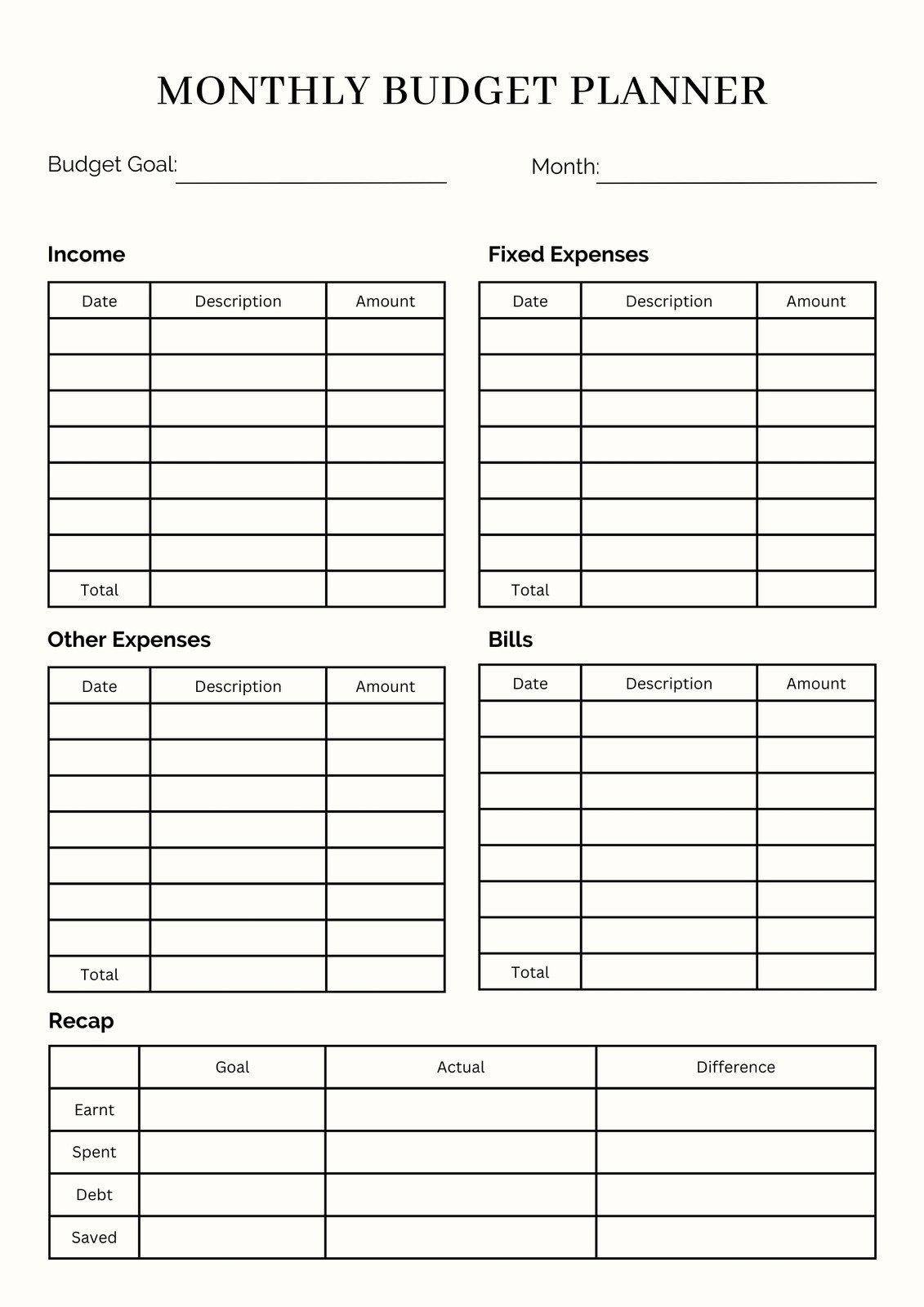

A robust monthly financial template typically breaks down your finances into several crucial categories, ensuring you account for every dollar. It moves beyond just income and expenses, incorporating sections for debt management and savings goals, offering a truly comprehensive framework. This structured approach helps prevent overlooked expenditures and ensures that your financial planning is thorough and realistic.

When selecting or creating your own printable budget worksheet, look for these fundamental components to ensure it serves as a powerful tool for your financial management:

- **Income Sources:** A clear section to list all forms of income, including salaries, freelance earnings, passive income, and any other incoming funds. This provides a precise total of your available funds each month.

- **Fixed Expenses:** These are costs that typically remain the same month after month, such as your mortgage or rent payment, car loan payments, insurance premiums, and subscription services. These are usually non-negotiable.

- **Variable Expenses:** This category includes costs that fluctuate, such as groceries, utilities (electricity, water, gas), transportation (gas, public transit), and dining out. These are often areas where you can find opportunities to reduce spending.

- **Debt Repayment:** Dedicated space for tracking payments towards credit cards, student loans, personal loans, and any other outstanding debts. Monitoring this is crucial for accelerating debt payoff.

- **Savings Goals:** Clearly defined sections for different savings objectives, like an emergency fund, a down payment for a house, retirement contributions, or vacation funds. This reinforces the importance of paying yourself first.

- **Discretionary Spending:** This covers non-essential expenditures like entertainment, hobbies, personal care, and shopping. It’s an important category for understanding where your “fun money” goes.

- **Actual vs. Planned Comparison:** A vital component that allows you to compare your estimated budget with your actual spending and income for the month. This comparison helps you identify discrepancies and adjust future spending plans.

How to Maximize Your Printable Budget Planner

Having a well-designed budget template printable is only the first step; consistent engagement and strategic usage are what truly unlock its power. To transform your monthly spending organizer into an engine for financial success, cultivate habits that integrate it seamlessly into your daily and weekly routine. It’s about more than just filling in numbers; it’s about thoughtful reflection and proactive adjustment.

Start by dedicating a specific time each month, perhaps at the beginning or end of your pay cycle, to sit down with your budget template. Be honest and realistic with your initial estimates for each category, drawing on past spending habits if necessary. This initial setup is critical for creating a workable spending plan that you can realistically stick to, rather than an aspirational one that sets you up for frustration.

Throughout the month, make it a habit to track every dollar spent. This doesn’t have to be cumbersome; a few minutes each day or a longer session once or twice a week is usually sufficient. Keep receipts, check bank statements, or use a simple note in your phone to record transactions as they happen. The more diligent you are with this tracking, the more accurate and insightful your monthly budget will become, giving you a true picture of where your money flows.

Finally, regularly review and adjust your budget template. Life is dynamic, and your financial situation can change. A sudden unexpected expense, a new income stream, or a shift in your financial goals all warrant a re-evaluation of your spending plan. Think of your budget as a living document, not a rigid set of rules, that you can adapt to serve your evolving needs. This flexibility is key to long-term budgeting success and stress reduction.

Customizing Your Monthly Financial Template for Personal Success

While a standard budget template provides an excellent foundation, its true power lies in its adaptability. Every individual and household has unique financial circumstances, goals, and spending patterns. Therefore, customizing your monthly budget planner is not just an option, but often a necessity to ensure it truly resonates with your lifestyle and helps you achieve your specific financial aspirations.

Consider your personal financial landscape. Are you a single individual focused on paying off student loans, or a family of four saving for a child’s college education? Do you have a steady, predictable income, or does your income fluctuate from month to month due to freelancing or commissions? These factors should influence how you personalize your financial planning template. For instance, those with irregular income might benefit from a “zero-based budget” approach, allocating every dollar to a category once it’s received.

Customization can involve adding or subtracting categories, making them more granular or broader to suit your tracking preferences. You might want a specific line item for “Pet Care” or “Kids’ Activities,” or perhaps a consolidated “Household Supplies” category. Color-coding different sections can also enhance visual clarity and make the budgeting process more engaging. Don’t be afraid to experiment with layouts or add extra pages for goal tracking, debt repayment schedules, or future financial projections. The goal is to create a personal financial blueprint that feels intuitive and empowering, making the act of budgeting a positive and proactive experience rather than a chore.

Beyond the Numbers: The Psychological Benefits of Budgeting

While the immediate benefits of using a Monthly Budget Planner Template Printable are often seen in improved financial health and a healthier bank account, the impact extends far beyond mere monetary figures. Budgeting is a powerful practice that cultivates significant psychological advantages, fostering a profound sense of control and reducing the mental burden associated with financial uncertainty.

Many people experience anxiety or stress when thinking about their money, especially when they feel unsure of where it all goes. A clear, tangible spending plan demystifies your finances, replacing ambiguity with clarity. This newfound transparency can dramatically reduce financial stress, allowing you to sleep better and approach daily life with greater peace of mind. Knowing you have a plan, even if challenges arise, instills a comforting sense of security.

Furthermore, consistent use of a budget template can boost your self-confidence and self-efficacy. Successfully sticking to your budget, paying off a debt, or hitting a savings goal provides tangible evidence of your ability to manage your life effectively. This success breeds further success, creating a positive feedback loop that encourages continued responsible financial behavior. It transforms you from a passive observer of your money to an active, empowered manager, capable of steering your financial ship in the direction you choose.

Frequently Asked Questions

What’s the main benefit of a printable budget over a digital one?

The primary advantage of a printable budget planner is its tangibility. The physical act of writing can enhance retention and focus, reducing screen fatigue and digital distractions. It offers a unique visual and tactile experience that many find more engaging and effective for long-term financial tracking and planning.

How often should I update my monthly spending plan?

While the planning itself is typically done monthly, it’s highly recommended to track your expenses daily or weekly to ensure accuracy and prevent overspending. A quick daily check-in to log new transactions or a more thorough weekly review can keep you aligned with your budget and allow for timely adjustments.

Can I use this budget template even if my income is irregular?

Absolutely. For irregular incomes, a budget template printable is incredibly valuable. Focus on budgeting for your minimum expected income first, allocating funds to fixed and essential variable expenses. Any additional income can then be strategically applied to savings, debt reduction, or discretionary spending, using a “zero-based budgeting” approach.

What if I consistently go over budget in certain categories?

Don’t get discouraged; this is a common learning experience. Review the category to understand why you’re exceeding the limit. Is the original allocation too low? Are there underlying spending habits that need to be addressed? Adjust your budget for the following month, explore ways to reduce spending in that area, or reallocate funds from less critical categories. Consistency in tracking will help you identify patterns and make informed corrections.

Harnessing the power of a physical monthly budget planner template is a journey toward profound financial empowerment. It’s an investment not just in your money, but in your peace of mind, your future goals, and your overall well-being. By embracing this tangible tool, you gain unparalleled clarity, foster disciplined habits, and cultivate a proactive approach to your financial life.

The path to financial freedom is paved with intentional decisions, and a well-utilized budget template printable stands as a cornerstone of that path. It’s time to move beyond guesswork and take decisive control of your financial narrative. Start today, and watch as your relationship with money transforms, unlocking new possibilities and a greater sense of security for tomorrow.