A Financial Power of Attorney (FPOA) is a legal document that allows you to appoint someone you trust (called your “agent” or “attorney-in-fact”) to make financial decisions on your behalf. This can be incredibly important in case you become incapacitated due to an illness, injury, or mental decline.

Think of it this way: you’re giving your agent the legal authority to handle your money and other financial matters as if they were you. This could include things like:

Paying your bills

Managing your bank accounts

Investing your money

Filing your taxes

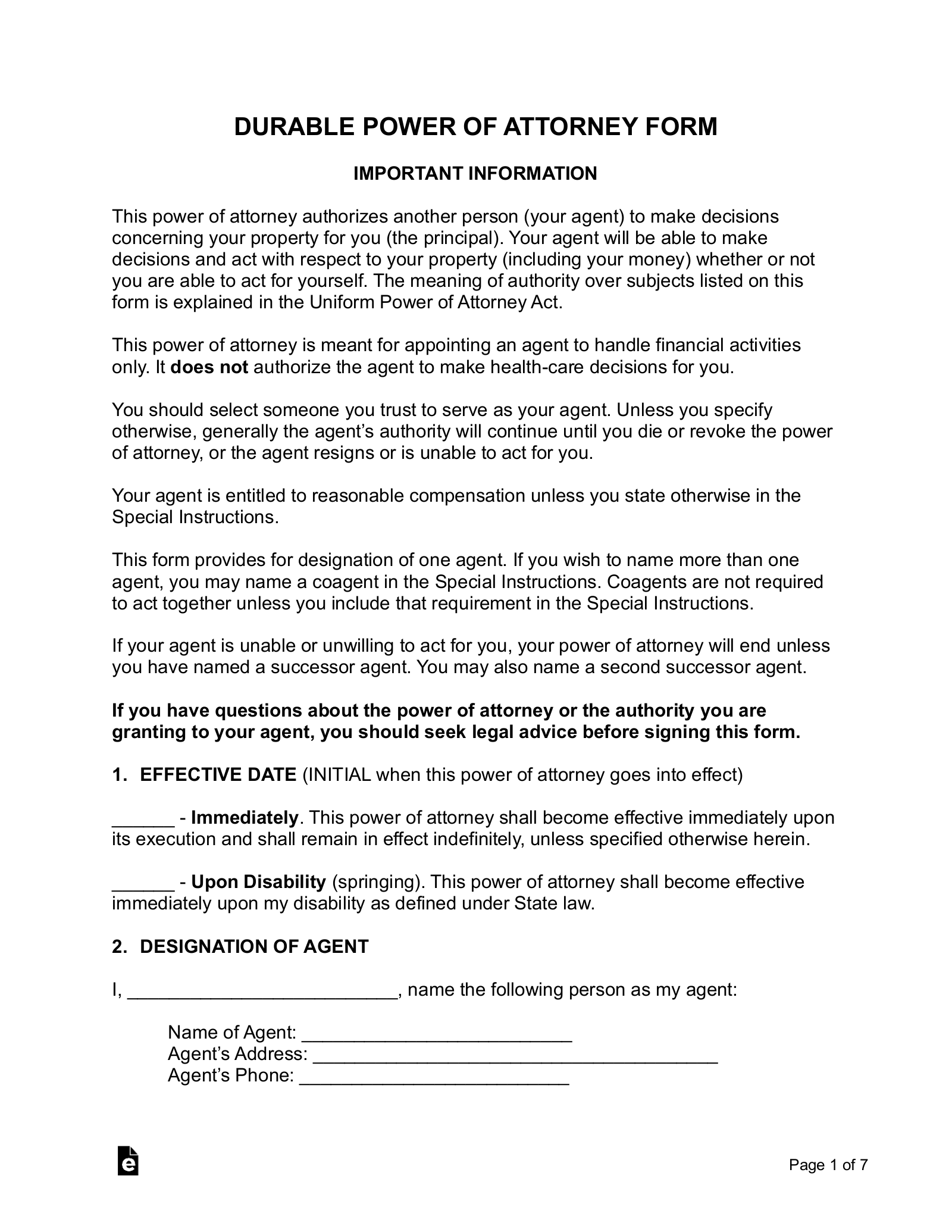

Image Source: eforms.com

Collecting Social Security or other benefits

Buying and selling property

Why is an FPOA so crucial?

Without an FPOA, if you become incapacitated, your family or loved ones may face significant challenges in managing your finances.

Potential Problems Without an FPOA:

Delayed or disrupted access to essential funds: Imagine you need urgent medical care, but your bank accounts are frozen because you can’t sign the necessary paperwork.

Types of Financial Power of Attorney:

General Power of Attorney: This is a broad document that grants your agent the power to handle virtually all of your financial affairs.

Creating Your Financial Power of Attorney:

You can create an FPOA yourself using an online template or by consulting a legal form library. However, it’s highly recommended that you consult with an estate planning attorney. They can help you:

Choose the right type of FPOA for your specific needs.

Choosing Your Agent:

Selecting the right person to be your agent is a critical decision. Consider the following factors:

Trustworthiness: Choose someone you absolutely trust and who has a good understanding of financial matters.

Important Considerations:

Review and update your FPOA regularly. Life circumstances change, and it’s important to ensure your FPOA reflects your current wishes and needs.

Conclusion

A Financial Power of Attorney is a vital legal document that can provide peace of mind and protect your financial well-being in case of incapacity. By taking the time to create and execute an FPOA, you can ensure that your financial affairs are handled responsibly and that your loved ones are not burdened with unnecessary stress during a difficult time.

FAQs

1. Do I need both a Medical Power of Attorney and a Financial Power of Attorney?

While related, these are distinct legal documents. A Medical Power of Attorney (also known as a healthcare proxy) allows you to appoint someone to make healthcare decisions on your behalf if you are unable to do so.

2. Can I change my agent at any time?

Yes, you can typically revoke or amend your FPOA at any time by creating a new document.

3. What if I don’t have any family or close friends to act as my agent?

You can appoint a trusted professional, such as a lawyer or financial advisor, to act as your agent.

4. Can I use a generic online template for my FPOA?

While online templates can be helpful, it’s always best to consult with an estate planning attorney to ensure your FPOA is legally sound and meets your specific needs.

5. What happens if I become incapacitated and don’t have an FPOA?

If you become incapacitated without an FPOA in place, your family may need to go through a court process to obtain guardianship or conservatorship over your finances. This can be a lengthy and costly process.

Financial Power Of Attorney Form