Financial harmony isn’t just a dream; it’s a practical outcome of shared understanding and mutual commitment. For many couples, money can be a source of stress, disagreement, or even unspoken resentment. One partner might be a natural saver, while the other enjoys spontaneous spending, leading to a constant tug-of-war over bank accounts and future plans. Without a clear roadmap, these differences can erode the foundation of a relationship, turning what should be exciting joint ventures into dreaded financial conversations.

Imagine a world where you and your partner are fully aligned on your financial goals, where every dollar has a purpose, and where planning for the future feels collaborative and empowering. This isn’t just about cutting expenses; it’s about building a shared vision, fostering transparent communication, and ensuring both individuals feel heard and valued in the financial journey. A well-structured Couple Monthly Budget Template can transform financial friction into a powerful force for unity, offering clarity, accountability, and a shared path towards your dreams.

Why a Shared Financial Plan is Your Relationship’s Secret Weapon

Embarking on a joint financial journey might seem daunting, but the benefits of establishing a monthly budget for couples extend far beyond simply tracking expenses. It’s a foundational element for a strong, resilient partnership, fostering an environment of trust and shared responsibility. By openly discussing income, outgoings, and aspirations, partners develop a deeper appreciation for each other’s financial perspectives.

This collaborative approach significantly reduces financial stress, which is a leading cause of relationship strain. When you both understand where your money is going, there are fewer surprises and less room for blame when unexpected costs arise. A collective financial framework also empowers you to set and achieve significant milestones together, whether it’s saving for a down payment, planning a dream vacation, or building a robust retirement fund. It transforms individual financial goals into shared aspirations, making the journey of wealth creation a unified effort.

The Anatomy of an Effective Couple’s Budget

Building a robust spending plan for two requires a clear understanding of its core components. Think of it as a comprehensive financial snapshot that outlines your collective income and strategically allocates every dollar. This blueprint isn’t about deprivation; it’s about intentional spending and saving, ensuring your financial resources align with your shared values and objectives.

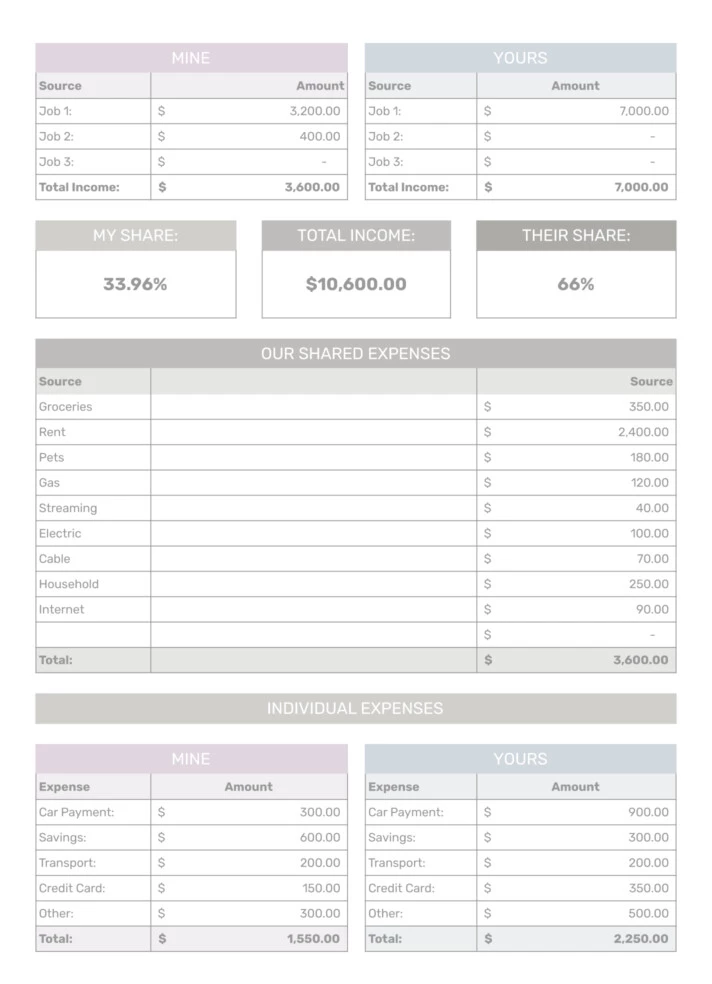

An effective household financial template typically breaks down into several key categories. First, income is the total money flowing into your household each month, from salaries, freelance work, or other sources. Next, you have fixed expenses, which are predictable monthly costs like rent/mortgage, loan payments, and insurance premiums. Then come variable expenses, the categories that fluctuate, such as groceries, dining out, entertainment, and transportation. Finally, crucial components include savings, for both short-term goals and long-term security, and debt repayment, if applicable, which systematically tackles outstanding balances.

Getting Started: Crafting Your Personalized Spending Plan

Creating a joint spending framework begins with an honest and open discussion between you and your partner. This isn’t a one-sided task; it requires both individuals to bring their financial information and their spending philosophies to the table. The goal is to build a collaborative money plan that genuinely reflects your unique lifestyle and future ambitions.

To effectively utilize a Couple Monthly Budget Template, start by gathering all your financial statements from the past few months. This includes bank statements, credit card bills, and pay stubs. Once you have a clear picture of your income and spending patterns, work together to categorize every expense. Decide on your shared financial goals, whether it’s building an emergency fund, paying off student loans, or saving for a large purchase. Allocating funds to these goals within your budget transforms vague intentions into actionable steps, guiding your spending decisions throughout the month.

Tips for Budgeting Success as a Duo

Embarking on a journey with a shared financial plan is more than just tracking numbers; it’s about cultivating habits and communication strategies that strengthen your bond. Here are some invaluable tips to ensure your collaborative money plan not only survives but thrives:

- **Communicate Openly and Often:** Schedule regular money talks, perhaps once a week or bi-weekly. This isn’t about blaming; it’s about reviewing progress, discussing upcoming expenses, and adjusting your plan as needed.

- **Define “Fun Money”:** Agree on a specific amount each partner can spend without needing to consult the other. This prevents feelings of restriction and allows for individual freedom while maintaining overall budget integrity.

- **Be Flexible and Forgiving:** Life happens. There will be months with unexpected expenses or moments when one of you overspends. Instead of getting upset, discuss what happened, adjust the budget for the next period, and move forward.

- **Set Shared Goals:** Working towards common objectives, like a dream vacation or a down payment on a house, provides powerful motivation to stick to your two-person budget. Celebrate these milestones together.

- **Choose the Right Tools:** Whether you prefer spreadsheets, budgeting apps, or a physical notebook, ensure the tool you use for your monthly budget for couples is accessible and easy for both of you to understand and update.

- **Automate Savings:** Once you’ve set your savings goals, automate transfers from your checking account to your savings account immediately after paydays. “Set it and forget it” is a powerful strategy.

- **Review and Adjust Periodically:** Your financial situation and goals will evolve. Make it a habit to review your entire budgeting framework every few months, or annually, to ensure it still serves your needs.

Making Your Money Work for You, Together

A well-implemented couple’s spending plan isn’t merely about managing present funds; it’s a dynamic tool that empowers you to shape your financial future. By consistently applying the principles of intentional spending and saving, you can move beyond simply making ends meet to actively building wealth. This involves not only putting money aside but also making strategic decisions about where those savings go.

Consider expanding your financial discussions to include long-term investments, retirement planning, and building a robust emergency fund that can weather any storm. A solid financial guide for partners grows with your relationship, adapting to new jobs, children, home purchases, and other significant life events. It transforms from a simple expense tracker into a comprehensive wealth-building machine, fueled by mutual respect, shared ambition, and consistent effort.

Frequently Asked Questions

How often should we review our joint budget?

Ideally, you should review your household financial template at least once a month, typically before the new month begins or right after your paychecks come in. This allows you to track progress, make necessary adjustments for upcoming expenses, and ensure both partners remain engaged and informed.

What if one partner earns significantly more than the other?

Financial contributions don’t always have to be 50/50. Many couples find success by contributing proportionally to their income, or by deciding on a fixed amount each contributes to shared expenses while maintaining individual “fun money.” The key is open communication and mutual agreement on what feels fair and equitable for your specific situation.

Should we combine all our money or keep separate accounts?

There’s no single “right” answer, as it depends on your comfort level and financial habits. Many couples opt for a hybrid approach: a joint account for shared expenses and savings, and individual accounts for personal spending. This offers both collective responsibility and individual autonomy within your budgeting tool for two.

What’s the best tool for tracking our expenses?

The best tool is the one you both will actually use consistently. Options range from simple spreadsheets (like a customized Couple Monthly Budget Template) to dedicated budgeting apps (e.g., Mint, YNAB, Personal Capital) or even pen and paper. Experiment to find a system that fits your lifestyle and makes tracking easy and accessible for both of you.

How do we handle disagreements about spending priorities?

Disagreements are natural. The most effective approach is to discuss them calmly during your regular budget meetings, actively listening to each other’s perspectives. Try to find compromises, perhaps by allocating a portion of discretionary funds to each partner’s priority, or by postponing a desired purchase to save for it over time. Remember, the goal is alignment, not one person winning.

Embarking on the journey of shared financial management with a well-designed financial framework for couples isn’t just about controlling spending; it’s about building a stronger, more resilient partnership. It’s an ongoing conversation, a commitment to mutual goals, and a testament to your ability to face challenges and celebrate successes together. By embracing transparency and collaboration, you’re not just managing money; you’re cultivating a foundation of trust and understanding that will enrich every aspect of your life together.

Don’t let financial uncertainty cast a shadow over your relationship. Take the proactive step today to empower your partnership with clarity and direction. Begin by exploring how a tailored monthly budget for couples can transform your financial landscape, paving the way for a future where your dreams are not just aspirations, but achievable realities you build together.