Okay, let’s talk about LLC Operating Agreements. Sounds fancy, right? But it’s basically the rulebook for your Limited Liability Company (LLC). Think of it as the constitution for your business.

Now, you might be thinking, “Do I really need one?” And the answer is a resounding YES.

Why is an Operating Agreement Important?

Protects Your Personal Assets: Remember that “limited liability” thing? An Operating Agreement helps ensure it actually works. It clearly outlines how profits and losses are divided, how decisions are made, and how the LLC is managed. This helps shield your personal assets from business debts and lawsuits.

Key Components of an LLC Operating Agreement

Now, let’s dive into some of the essential elements that should be included in your Operating Agreement:

Name and Purpose: Start with the basics. What’s the official name of your LLC? What kind of business are you in?

Member-Managed: This is the most common structure. All members participate in the day-to-day management decisions.

Manager-Managed: You designate specific members or non-members as managers to run the company.

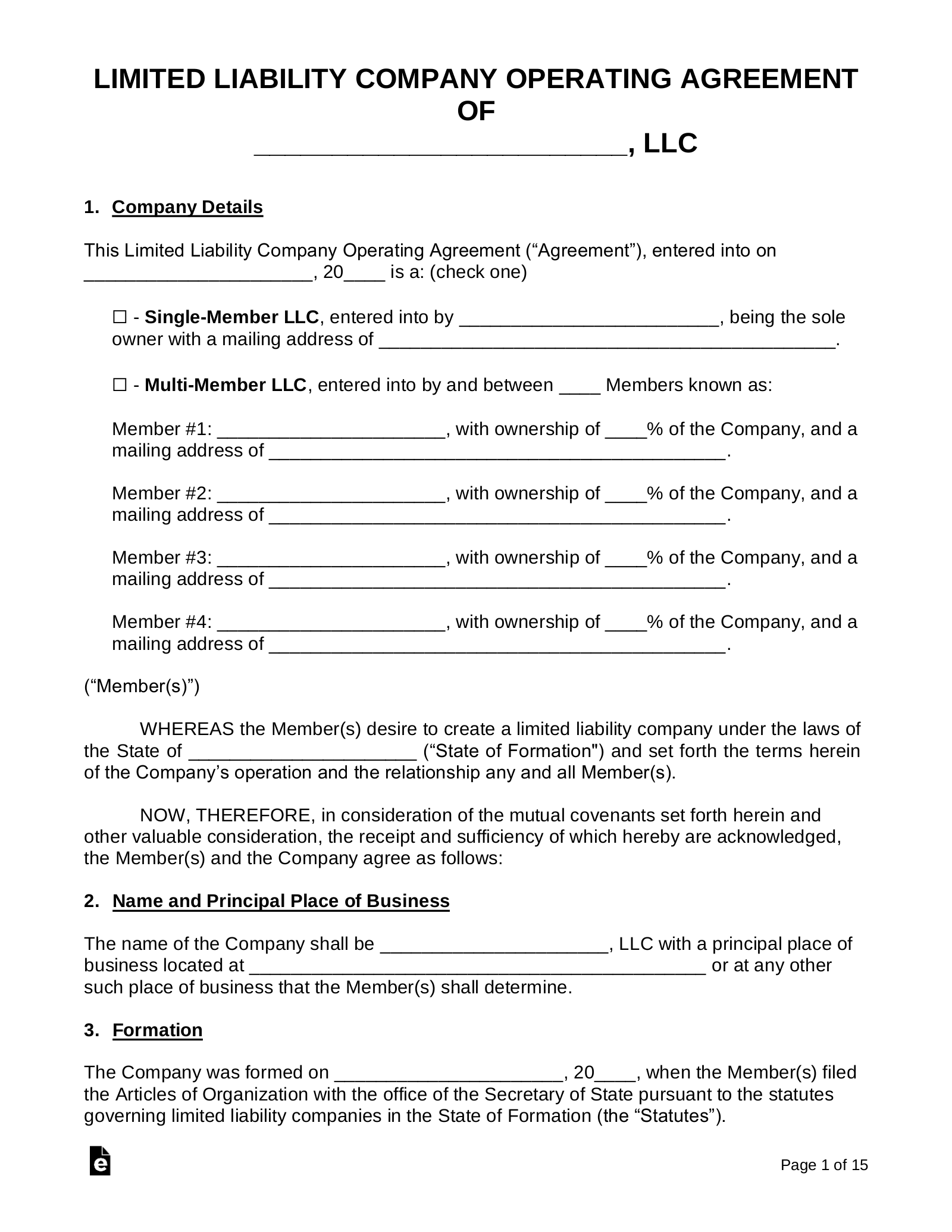

Finding an LLC Operating Agreement Template

Image Source: eforms.com

You don’t have to reinvent the wheel. There are plenty of resources available to help you draft your Operating Agreement:

Online Legal Services: Websites like LegalZoom and Rocket Lawyer offer customizable LLC Operating Agreement templates.

Tips for Writing Your Operating Agreement

Keep it Simple: Use clear and concise language. Avoid legal jargon whenever possible.

Conclusion

An LLC Operating Agreement is a vital document for any LLC. It provides a framework for how your business will operate, protects your personal assets, and helps you navigate potential challenges. By taking the time to create a well-drafted agreement, you’re setting a strong foundation for your LLC’s success.

FAQs

What happens if I don’t have an LLC Operating Agreement?

While technically not always required, operating without an agreement can expose you to significant risks. In the absence of a formal agreement, state laws will govern your LLC, which may not align with your business goals. This can lead to disputes, unexpected tax consequences, and difficulty attracting investors.

Can I use a generic LLC Operating Agreement template?

While generic templates can provide a starting point, it’s crucial to customize them to fit your specific business needs. Your attorney can help you tailor the agreement to address any unique circumstances or complexities.

Can I change my LLC Operating Agreement after it’s been signed?

Yes, you can amend your Operating Agreement at any time. However, all members must typically agree to the changes. It’s generally recommended to document any amendments in writing.

What if I have a single-member LLC?

Even if you’re the sole member of your LLC, it’s still a good idea to have an Operating Agreement. It can help protect your personal assets and provide a clear record of your business decisions.

Do I need to file my LLC Operating Agreement with the state?

In most states, you don’t need to file your Operating Agreement with the state. However, it’s always a good idea to keep a copy of the agreement with your LLC’s important business documents.

Llc Operating Agreement Example