Buying or selling a business is a complex undertaking. It involves more than just transferring ownership – it’s about navigating legal hurdles, ensuring a smooth transition, and protecting the interests of both parties. This is where the Sale of Business Agreement comes in.

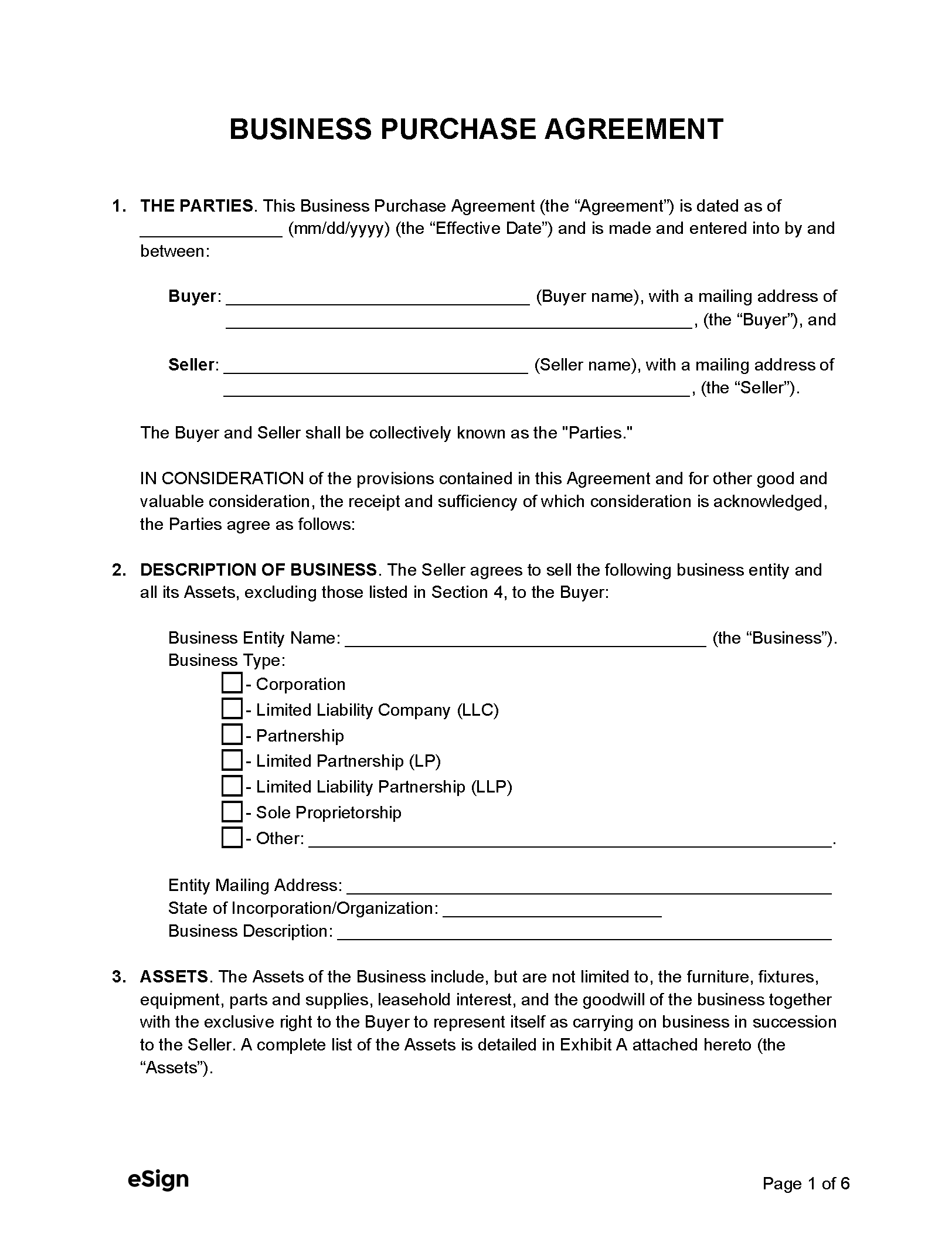

Essentially, this agreement is the legal contract that outlines the terms and conditions of the business sale. It’s the roadmap for the entire transaction, covering everything from the purchase price and payment schedule to warranties, indemnities, and post-sale obligations.

Key Components of a Sale of Business Agreement

Cash Payment:

A straightforward method involving a lump sum payment.

Installment Payments:

Image Source: esign.com

The buyer pays the purchase price in installments over a specified period.

Earn-out Arrangements:

A portion of the purchase price is contingent on the business’s future performance.

Financial Accuracy: The seller warrants the accuracy of financial statements.

Legal Compliance: The seller confirms the business is in compliance with all applicable laws.

Intellectual Property: The seller assures ownership of all intellectual property used by the business.

Litigation and Disputes: The seller discloses any ongoing or potential legal issues.

Intellectual Property: The seller assures ownership of all intellectual property used by the business.

Litigation and Disputes: The seller discloses any ongoing or potential legal issues.

Non-Compete Clauses: The seller agrees not to compete with the business for a certain period.

Non-Solicitation Clauses: The seller agrees not to solicit customers or employees of the sold business.

Regulatory Approvals: Obtaining necessary approvals from regulatory bodies.

Due Diligence Completion: Successful completion of the buyer’s due diligence investigation.

Financing Securing: The buyer securing the necessary financing for the purchase.

Financing Securing: The buyer securing the necessary financing for the purchase.

Negotiation:

The parties attempt to resolve the dispute through amicable discussions.

Mediation:

A neutral third party facilitates negotiations between the parties.

Arbitration:

The dispute is submitted to a neutral third party for a binding decision.

Litigation:

The parties resort to court proceedings to resolve the dispute.

The Importance of Professional Legal Advice

A Sale of Business Agreement is a legally binding document with significant financial and legal implications. It’s crucial to seek professional legal advice from experienced business attorneys throughout the entire transaction.

Conclusion

The Sale of Business Agreement is the cornerstone of any successful business sale. By carefully drafting and negotiating this agreement, both buyers and sellers can protect their interests, ensure a smooth transition, and minimize potential risks.

FAQs

1. What happens if the seller breaches the agreement?

The buyer may have various remedies available, depending on the specific breach. These may include:

2. How long does it typically take to negotiate a Sale of Business Agreement?

The negotiation process can vary significantly depending on the complexity of the transaction, the industry, and the parties involved. It can take anywhere from a few weeks to several months.

3. What is due diligence and why is it important?

Due diligence is the process by which the buyer investigates the target business to assess its financial health, legal compliance, and overall value. It’s crucial to identify any potential risks or liabilities before committing to the purchase.

4. What are the potential tax implications of a business sale?

The tax implications of a business sale can be complex and vary depending on the structure of the transaction, the type of business, and the buyer’s tax status. It’s essential to consult with a tax professional to understand the potential tax consequences.

5. Can the Sale of Business Agreement be amended or modified after signing?

Yes, the agreement can be amended or modified after signing, but it typically requires the written consent of both parties. Any modifications should be carefully documented and incorporated into the agreement.

Disclaimer: This article is for informational purposes only and does not constitute legal advice. You should consult with a qualified attorney for advice on specific legal issues.

Sale Of Business Agreement