A Final Will and Testament is a legal document that outlines your wishes for the distribution of your assets and the care of any minor children after your death. It’s crucial to have a valid will in place to ensure your assets are distributed according to your wishes and to avoid potential family disputes.

Why is a Will Important?

Peace of Mind: Knowing your affairs are in order provides peace of mind for you and your loved ones.

Key Components of a Will:

Appointment of Executor: This person will be responsible for carrying out the terms of your will, such as paying debts, distributing assets, and filing necessary paperwork.

Image Source: eforms.com

Creating Your Will:

Consult with an Estate Attorney: An estate attorney can help you draft a legally sound will that meets your specific needs and complies with your state’s laws. They can also advise you on estate planning strategies to minimize taxes and ensure your wishes are carried out effectively.

Important Considerations:

Review and Update Regularly: Your circumstances may change over time (e.g., marriage, divorce, birth of children, acquisition of new assets). It’s essential to review and update your will regularly to reflect your current wishes.

Conclusion

Creating a Final Will and Testament is an essential part of responsible estate planning. By taking the time to draft a comprehensive will, you can ensure your assets are distributed according to your wishes, provide for your loved ones, and minimize potential family disputes. Remember to consult with an estate attorney to ensure your will is legally valid and meets your specific needs.

FAQs

Do I need a lawyer to create a will?

While you can create a simple will yourself using online resources or will-making software, it’s always advisable to consult with an estate attorney. An attorney can ensure your will is legally sound, complies with your state’s laws, and addresses all your specific needs and concerns.

What happens if I die without a will?

If you die without a valid will (intestate), your assets will be distributed according to your state’s intestacy laws. These laws may not reflect your true wishes, and it can lead to lengthy and costly legal battles among your family members.

Can I change my will after I’ve created it?

Yes, you can change your will at any time. This is known as “revoking” your will. You can create a new will that revokes the previous one, or you can add a codicil, which is a legal document that amends your existing will.

What is the difference between a will and a trust?

A will is a legal document that outlines how your assets will be distributed after your death. A trust is a legal arrangement where assets are transferred to a trustee for the benefit of beneficiaries. Trusts offer several advantages over wills, such as asset protection, tax minimization, and greater control over how and when assets are distributed.

How can I find an estate attorney?

You can find an estate attorney through referrals from friends, family, or other professionals (e.g., financial advisors, accountants). You can also search online directories or contact your local bar association for a referral.

This article provides general information and should not be considered legal advice. It’s essential to consult with an estate attorney for personalized guidance on your specific estate planning needs.

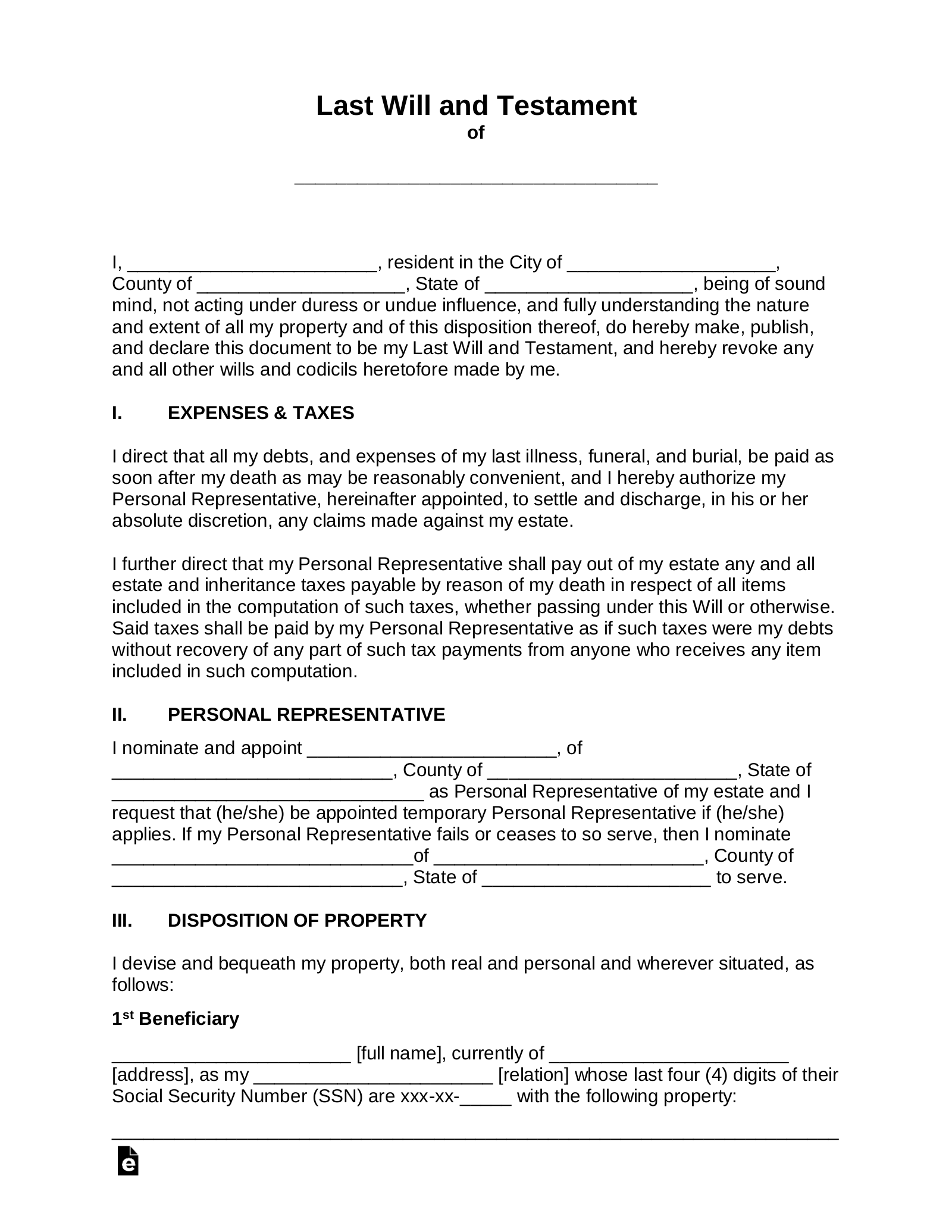

Final Will And Testament Form