What is an LLC Operating Agreement?

Think of an LLC Operating Agreement as your company’s rule book. It’s a legal document that outlines how your Limited Liability Company (LLC) will be run. It’s essential, even if your state doesn’t legally require it.

Why is it so important?

Protection from Liability: The primary purpose of an LLC is to shield you from personal liability for your business debts and obligations. An Operating Agreement strengthens this protection by clearly defining the company’s structure and how it will be managed.

Key Elements of an LLC Operating Agreement

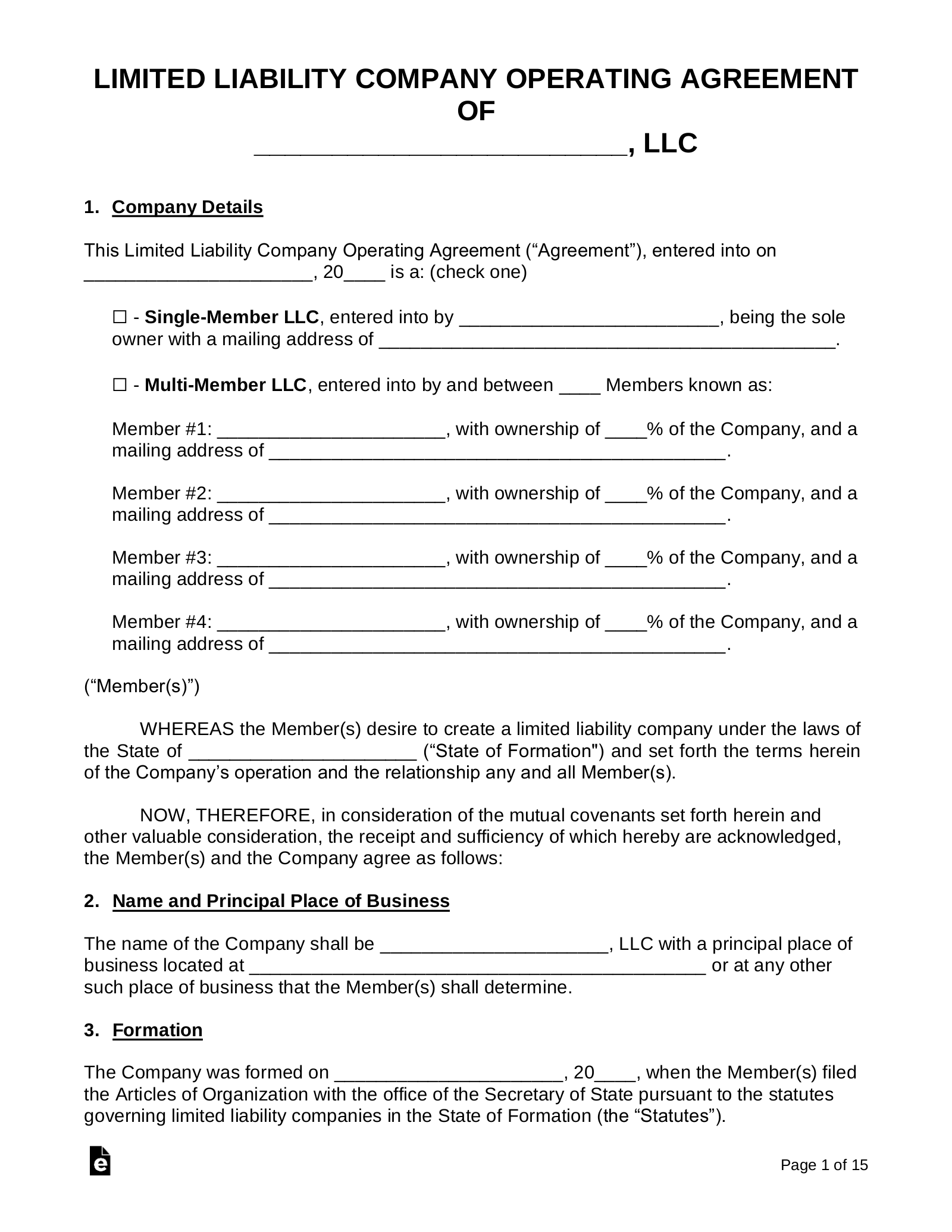

1. Company Information

Image Source: eforms.com

Name and Address: Clearly state the full legal name and registered address of your LLC.

2. Membership Interests

Membership Structure: Define the membership structure of your LLC (e.g., single-member, multi-member).

3. Management and Operations

Management Style: Determine how your LLC will be managed (e.g., member-managed, manager-managed).

4. Financial Matters

Capital Contributions: Outline the initial capital contributions of each member.

5. Meeting Procedures

Member Meetings: Outline the procedures for holding member meetings (e.g., notice requirements, quorum requirements).

6. Dissolution and Winding Up

Events of Dissolution: Define the events that will trigger the dissolution of the LLC (e.g., bankruptcy, withdrawal of a member).

7. Indemnification

8. Dispute Resolution

Creating Your LLC Operating Agreement

You can create your own Operating Agreement using templates and online resources. However, it’s highly recommended to consult with an attorney to ensure your agreement is legally sound and meets your specific business needs.

Conclusion

An LLC Operating Agreement is a crucial document for any LLC. It provides a framework for your business operations, protects your personal assets, and helps you avoid potential legal and financial pitfalls. By taking the time to create a well-drafted Operating Agreement, you can set your LLC up for success and ensure a smoother and more profitable business journey.

FAQs

1. Is an LLC Operating Agreement legally required? While not always legally required, an LLC Operating Agreement is highly recommended for all LLCs.

2. Can I use a template for my LLC Operating Agreement? Yes, you can use templates as a starting point. However, it’s crucial to review and modify the template to fit your specific business needs.

3. How often should I review my LLC Operating Agreement? It’s a good practice to review and update your Operating Agreement periodically (e.g., annually) or whenever there are significant changes to your business.

4. What happens if I don’t have an LLC Operating Agreement? Operating without an agreement can expose you to increased liability risks, potential disputes among members, and difficulties in resolving business issues.

5. Can I change my LLC Operating Agreement after it’s been created? Yes, you can amend your Operating Agreement at any time by following the procedures outlined in the agreement itself.

Disclaimer: This article is for informational purposes only and does not constitute legal advice. Please consult with an attorney for guidance on specific legal matters.

This article provides a basic overview of LLC Operating Agreements. Remember to consult with legal professionals to ensure you have a comprehensive and legally sound agreement for your specific business needs.

Llc Operating Agreement Form