A Power of Attorney (POA) is essentially a legal document that grants another person the authority to act on your behalf. Think of it as giving someone else the keys to your legal car – they can drive it (make decisions) according to your instructions. This can be incredibly useful in various situations, from handling financial matters to making healthcare decisions.

Types of Power of Attorney

There are several types of POAs, each with specific purposes:

General Power of Attorney

This is the broadest type, granting the designated person (called the “agent” or “attorney-in-fact”) extensive authority to act on your behalf. This can include managing finances, signing contracts, and even selling property. However, it’s crucial to note that a General POA often becomes invalid if you become incapacitated.

Special Power of Attorney

This type of POA is more limited in scope. It grants the agent authority to handle specific tasks or situations. For example, you might create a Special POA for your agent to sell your car, manage a specific real estate transaction, or handle the finances for a particular project.

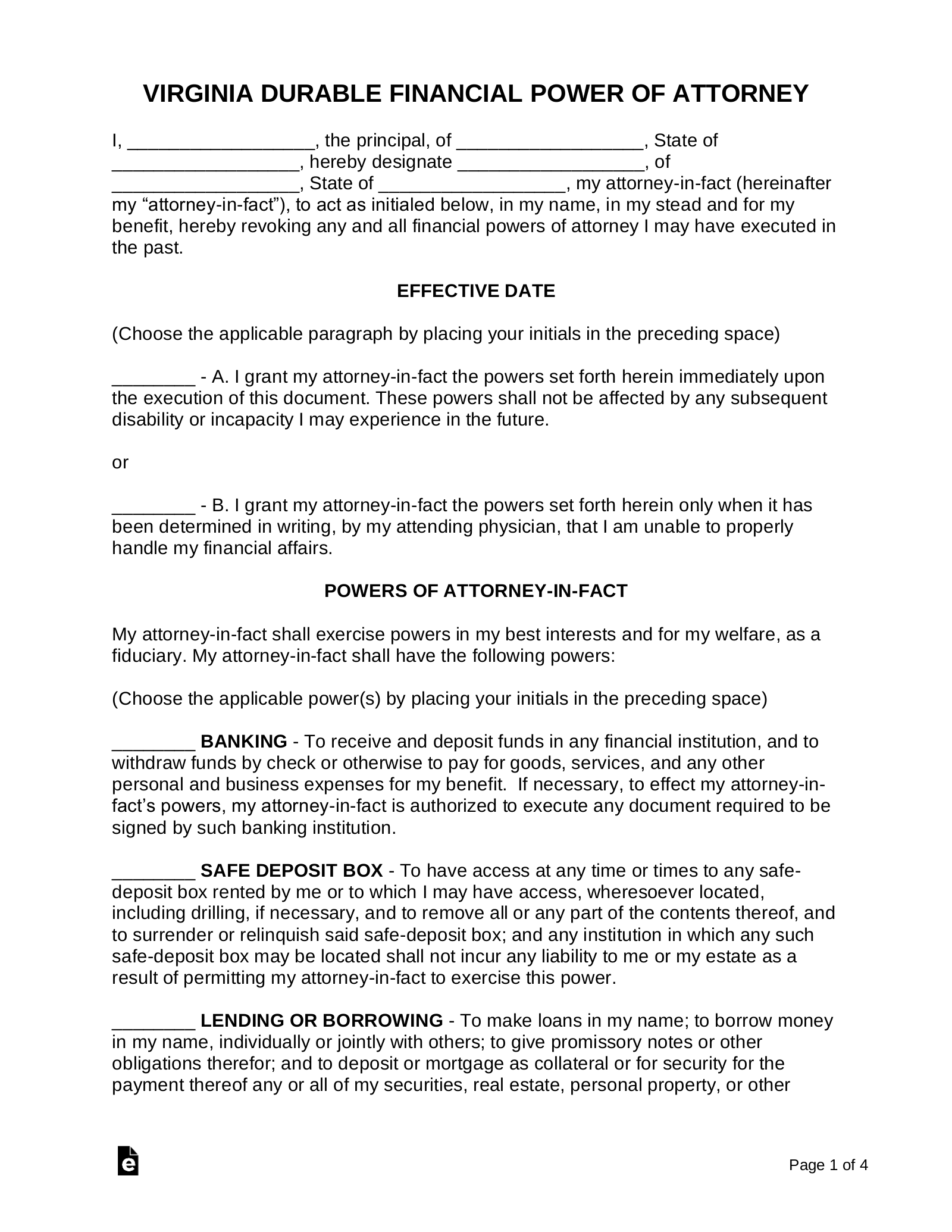

Durable Power of Attorney

Image Source: eforms.com

This POA is specifically designed to remain valid even if you become mentally incapacitated. This is crucial for long-term planning, as it ensures that someone you trust can make important decisions for you if you’re unable to do so yourself.

Healthcare Power of Attorney (also known as Medical Power of Attorney)

This type of POA allows you to designate someone to make healthcare decisions for you if you become unable to do so. This can include decisions about medical treatments, end-of-life care, and even organ donation.

Why You Need a Power of Attorney

Having a POA in place can provide significant peace of mind and offer numerous benefits:

Facilitates Financial Management

If you become incapacitated or unable to handle your own finances, your agent can pay bills, manage investments, and ensure your financial affairs are in order.

Enables Healthcare Decision-Making

In the event of a medical emergency, your agent can make crucial healthcare decisions that align with your wishes and values.

Simplifies Legal and Administrative Matters

Your agent can handle legal matters, such as signing contracts or dealing with property issues, on your behalf.

Provides Peace of Mind

Creating a Power of Attorney

The process of creating a POA typically involves the following steps:

1. Choose an Agent: Select someone you trust implicitly and who is capable of handling the responsibilities associated with the POA.

2. Consult with an Attorney: An attorney can help you determine the most appropriate type of POA for your specific needs and ensure that the document is legally sound.

3. Execute the Document: You will need to sign the POA in front of a notary public to make it legally binding.

4. Store the Document Safely: Keep the original POA in a secure location, and provide copies to your agent and any other relevant parties.

Important Considerations:

Review and Update Regularly: Life circumstances change, so it’s essential to review your POA periodically and update it as needed.

Conclusion

A Power of Attorney is a valuable legal tool that can provide significant peace of mind and ensure that your wishes are respected in various situations. By carefully considering your needs and selecting a trustworthy agent, you can create a POA that effectively protects your interests and provides for your well-being.

FAQs

1. Can I revoke a Power of Attorney?

Yes, you can revoke a Power of Attorney at any time by creating a new document stating your intention to revoke.

2. What happens if my agent becomes incapacitated?

You may want to designate a successor agent in your POA to handle your affairs if your primary agent becomes incapacitated.

3. Can a Power of Attorney be used for tax purposes?

Yes, a POA can grant your agent the authority to handle tax-related matters on your behalf.

4. Is a Power of Attorney the same as a will?

No, a Power of Attorney deals with decision-making while you are still living, while a will outlines how your assets should be distributed after your death.

5. Can I create a Power of Attorney myself?

While you can find templates online, it is highly recommended to consult with an attorney to ensure your POA is legally valid and meets your specific needs.

This information is for general knowledge and informational purposes only and does not constitute legal advice. You should always consult with a qualified attorney for legal guidance on any specific legal matter.

Va Power Of Attorney Form