In today’s fast-paced world, managing our finances can often feel like a juggling act. With bills, unexpected expenses, and lifestyle choices vying for our attention, it’s easy to lose track of where our money goes. Many of us have tried monthly budgeting, only to find it too broad or overwhelming, making it difficult to course-correct effectively throughout the month. This common challenge often leads to financial stress, missed savings goals, and a general lack of clarity about our monetary flow.

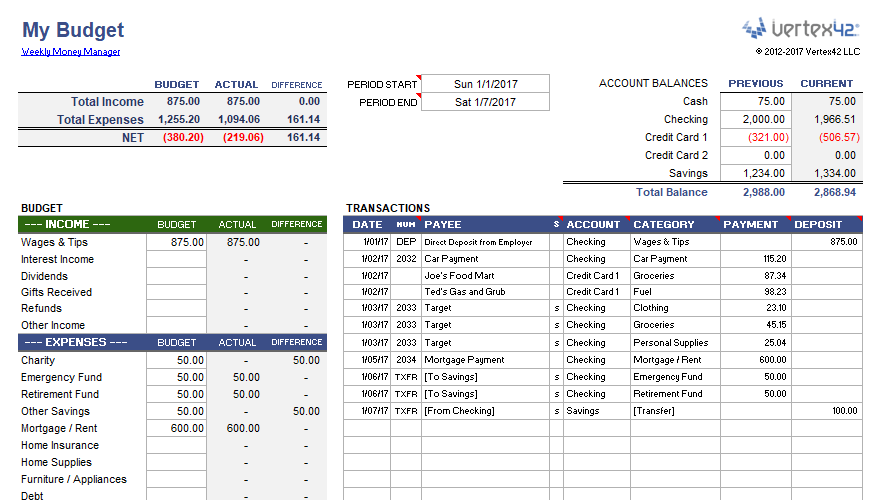

However, there’s a simpler, more immediate approach that empowers you to take control: weekly financial planning. By breaking down your financial goals into manageable, week-by-week segments, you gain a clearer picture of your spending habits and can make timely adjustments. A well-designed Personal Weekly Budget Planner Template serves as your compass, guiding your financial decisions and helping you build a robust foundation for fiscal well-being. It’s an indispensable tool for anyone seeking greater financial discipline, whether you’re saving for a major purchase, paying down debt, or simply aiming for more peace of mind regarding your money.

Why a Weekly Focus Matters

While monthly budgets have their place, the power of a weekly spending plan lies in its immediacy and granularity. Many of our daily spending decisions, from the morning coffee to impulse online purchases, occur on a shorter cycle than a month. Attempting to track these micro-transactions retrospectively at the end of four weeks can be daunting and often inaccurate. A weekly approach brings your financial reality into sharp focus, allowing you to identify overspending or opportunities for savings almost as they happen.

This shorter budgeting cycle offers several significant advantages. It makes it easier to anticipate and plan for fluctuations in income or expenses, especially for those with irregular paychecks. You can also make swift adjustments if an unexpected cost arises, preventing a small deviation from derailing an entire month’s plan. Embracing a weekly financial organizer fosters a habit of regular financial check-ins, transforming budgeting from a dreaded chore into a proactive and empowering routine. It’s about building momentum, one week at a time, towards your larger financial aspirations.

Key Elements of an Effective Weekly Budget

A robust weekly budgeting template isn’t just about listing income and expenses; it’s a dynamic tool that helps you understand and manage your cash flow. To be truly effective, any personal weekly budget tool should incorporate several critical components that reflect your unique financial landscape. These elements collectively provide a comprehensive snapshot of your financial health and guide your spending decisions.

Here are the essential components to include in your weekly spending plan:

- **Net Income:** Start by clearly stating all income you expect to receive for the week, after taxes and deductions. This could include your paycheck, freelance earnings, or any other regular income sources.

- **Fixed Weekly Expenses:** Account for the weekly portion of your regular, non-negotiable bills. This might include a calculated weekly amount for rent, utilities, loan payments, or subscription services. Breaking these down weekly makes them less intimidating.

- **Variable Weekly Expenses:** This is where many budgets falter. Categorize expenses that fluctuate, such as **groceries**, **transportation** (gas, public transit), **dining out**, and **entertainment**. Setting realistic weekly limits for these categories is crucial.

- **Savings Goals:** Dedicate a specific amount to transfer to your savings accounts each week. Whether it’s for an **emergency fund**, a down payment, or retirement, consistently setting aside money is key.

- **Debt Repayment:** Beyond minimum payments, allocate funds towards accelerating debt repayment. Even a small extra weekly contribution can make a big difference over time, reducing interest and paying off balances faster.

- **Miscellaneous/Buffer:** Always include a small buffer for unexpected minor expenses or impulse buys. This prevents feeling deprived and helps you stick to your plan even when minor surprises pop up.

Getting Started: Using Your Budget Planning Tool

Embarking on your weekly budgeting journey is simpler than you might think, especially with a structured framework like a **Personal Weekly Budget Planner Template**. The goal is not perfection from day one, but consistent effort and a willingness to learn and adapt. Think of it as mapping your financial journey, where clarity precedes control.

Begin by gathering all your financial information. This includes bank statements, pay stubs, credit card statements, and any records of recurring bills. Next, dedicate some time, perhaps an hour each week, to fill out your chosen budgeting framework. Input your expected income for the coming week, then meticulously list out all your anticipated expenses based on the categories outlined above. Be honest and realistic about your spending habits; underestimating can lead to frustration and abandonment of the plan. Once you’ve allocated funds to each category, you’ll have a clear picture of how much disposable income you have. Throughout the week, track every dollar you spend against your plan. Many find apps or simple spreadsheets helpful for this. At the end of the week, review your actual spending versus your planned budget. This review step is vital for understanding where you succeeded and where adjustments might be needed for the following week.

Customizing Your Financial Blueprint

No two financial situations are exactly alike, which is why the beauty of a budget worksheet lies in its adaptability. A standard weekly budget planner template provides an excellent starting point, but its true power is unlocked when you tailor it to your specific needs, income patterns, and financial objectives. This personalization ensures the tool remains relevant and sustainable for your unique lifestyle.

Consider adjusting the categories to reflect your actual spending. If you frequently incur costs for pet care, for instance, create a dedicated "Pet Expenses" category instead of lumping it into "Miscellaneous." Similarly, if you have multiple savings goals, such as "Vacation Fund" and "New Car Fund," separate them to track progress individually. If your income fluctuates, you might adopt a "zero-based budget" approach, allocating every dollar to a specific purpose. For those who prefer digital convenience, explore online budgeting apps or spreadsheets that allow for easy customization and automation. Conversely, a simple pen-and-paper notebook might be more appealing for those who prefer a tangible record. Regularly review and revise your financial planning template as your life circumstances or financial goals evolve, ensuring it remains a living, breathing document that truly serves your aspirations.

Tips for Budgeting Success

Sustaining a weekly spending plan requires more than just filling in numbers; it demands discipline, realistic expectations, and a proactive mindset. Many people start with great intentions but struggle to maintain consistency. Implementing a few strategic tips can significantly enhance your chances of long-term budgeting success and transform your personal finance tracker into an invaluable asset.

First, be realistic about your spending. Depriving yourself entirely of small luxuries can lead to burnout. Instead, budget for these items intentionally. Second, track every penny, especially in the initial weeks. This detailed tracking reveals surprising spending habits you might not have been aware of. Third, automate your savings. Set up automatic transfers to your savings accounts immediately after receiving your paycheck. This "pay yourself first" strategy ensures your financial goals are prioritized. Fourth, plan your meals and grocery shopping. This simple step can drastically reduce food waste and impulsive, expensive take-out meals. Fifth, review your budget regularly, not just at the end of the week. Daily or every-other-day check-ins help you stay on track and prevent overspending before it becomes a major issue. Lastly, don’t get discouraged by setbacks. Everyone has weeks where they overspend. The key is to learn from it, adjust your plan, and start fresh the next week without guilt.

Frequently Asked Questions

How often should I update my weekly spending plan?

Ideally, you should review and update your weekly spending plan at least once a week, typically at the beginning or end of your financial week. This allows you to plan for upcoming expenses, track your actual spending against your budget, and make any necessary adjustments for the following week. Daily check-ins can also be beneficial for staying on top of variable expenses.

What if my income isn’t consistent week-to-week?

If your income fluctuates, consider using an average income over a few weeks or a “low-income” week as your base budget to ensure you always have enough. You can also prioritize essential expenses first and then allocate any surplus income to savings or non-essential categories during weeks when you earn more. A zero-based budgeting approach, where every dollar is assigned a job, can be particularly effective for variable incomes.

Is a digital or paper budget worksheet better?

The “better” option depends entirely on your personal preference and habits. Digital budget worksheets (spreadsheets, apps) offer automation, easy calculations, and accessibility across devices. Paper templates provide a tactile experience, can feel less intimidating, and may help some individuals connect more deeply with their numbers. Experiment with both to see which method encourages greater consistency for you.

How do I handle unexpected expenses in my weekly budget?

The best way to handle unexpected expenses is to budget for them by creating a “buffer” or “miscellaneous” category in your weekly plan. For larger, truly unforeseen costs, draw from an emergency fund you’ve diligently built up. If you don’t have an emergency fund yet, you might need to temporarily reduce spending in flexible categories or find extra income to cover the expense, then prioritize building that fund.

What’s the biggest mistake people make with personal financial planning?

One of the biggest mistakes is being unrealistic or too restrictive with their budget, leading to burnout and abandonment. Another common error is failing to track spending consistently. Without accurate tracking, the budget becomes an educated guess rather than a precise financial management tool. Remember, a budget is meant to empower you, not to make you feel deprived.

Taking charge of your finances can feel like a monumental task, but it doesn’t have to be. By adopting a structured approach with a well-utilized personal weekly budget, you equip yourself with the tools to navigate your financial landscape with confidence and clarity. This isn’t just about saving money; it’s about gaining peace of mind, reducing stress, and building a secure foundation for your future aspirations.

Embrace the journey of weekly financial management, and watch as small, consistent actions compound into significant progress. Whether you’re aiming to pay off debt, save for a dream vacation, or simply understand where your money goes, a dedicated weekly financial planning template will illuminate your path. Start today, and unlock the power of intentional spending to transform your relationship with money and build the financial future you truly deserve.