In the intricate dance of modern life, managing personal finances can often feel like navigating a dense fog. We know we need to save, spend wisely, and plan for the future, yet the sheer volume of transactions and financial commitments can make gaining clarity seem like an insurmountable task. This is where a robust framework for understanding your financial world becomes not just helpful, but essential. Imagine a tool that provides a crystal-clear snapshot of your financial standing while simultaneously guiding your future spending and saving habits.

Such a tool exists, and it’s far more accessible than you might think. By combining the power of a personal financial statement with the practicality of a budget, you create a dynamic system for financial control. This comprehensive approach empowers individuals and families to move beyond guesswork, making informed decisions that pave the way for financial security and goal achievement. Whether you’re aiming to pay off debt, save for a down payment, or simply understand where your money goes, having a unified view of your assets, liabilities, income, and expenses is the first, most crucial step.

Beyond Guesswork: The Power of Financial Clarity

Many people operate under a vague notion of their financial situation, relying on their checking account balance or the amount on their last credit card statement. While these offer fleeting glimpses, they don’t provide the complete picture needed for strategic financial management. True financial clarity comes from consolidating all your financial data into one coherent document. This process illuminates spending patterns, highlights areas of potential savings, and reveals the true extent of your net worth, whether it’s growing or shrinking.

Understanding your financial position isn’t about judgment; it’s about empowerment. It’s about having the data to make conscious choices, rather than letting money happen to you. With a clear overview, you can identify financial strengths to leverage and weaknesses to address, transforming uncertainty into actionable insights. This foundation is indispensable for anyone serious about taking control of their money.

What Exactly Is a Personal Financial Statement?

At its core, a personal financial statement is a formal document that summarizes your financial health at a specific point in time. Think of it as your personal balance sheet and income statement rolled into one. It provides a snapshot of everything you own, everything you owe, and how much money flows in and out of your life over a period. This vital document is often requested for loan applications, investment reviews, or even estate planning, but its greatest value lies in its power for personal insight.

A complete personal financial statement typically comprises two main components: a statement of financial position (often called a personal balance sheet) and a statement of cash flow (or a personal income and expense statement). The balance sheet lists all your assets and liabilities, calculating your net worth. The cash flow statement tracks your income and expenses over a period, showing your net cash flow.

Integrating Budgeting for Future Control

While a personal financial statement provides a historical and current view, a budget is forward-looking. It’s your plan for how you will allocate your income to cover expenses, savings, and debt repayment over a future period, usually a month. The magic happens when you integrate these two powerful tools. The financial statement informs your budget by showing you what your actual income and expenses have been, and what your current financial obligations are.

By understanding your current assets and liabilities, you can set realistic budgeting goals for savings and debt reduction. For instance, seeing a high credit card balance on your financial statement might prompt you to allocate a larger portion of your income towards that specific liability in your budget. This integrated approach ensures your budget is grounded in your financial reality, making it more effective and sustainable.

Key Components of Your Financial Blueprint

A comprehensive financial blueprint, like the Personal Financial Statement Template Budget, requires a detailed look at several categories. Each element contributes to your overall financial picture and helps inform your budgeting decisions. Here’s what you’ll typically include:

- Assets: What You Own

- Liquid Assets: Easily convertible to cash. Examples include your checking and savings accounts, money market accounts, and certificates of deposit (CDs).

- Investments: Holdings designed to grow wealth. This includes stocks, bonds, mutual funds, exchange-traded funds (ETFs), and cryptocurrencies.

- Retirement Accounts: Funds specifically for retirement. Think 401(k)s, IRAs (Traditional, Roth, SEP), and other pension plans.

- Real Estate: Properties you own. This would be your primary residence, vacation homes, or rental properties.

- Vehicles: Cars, motorcycles, boats, or other significant modes of transport.

- Personal Property: High-value items like jewelry, art, collectibles, or expensive electronics.

- Liabilities: What You Owe

- Mortgages: Loans secured by real estate. This includes your primary home mortgage and any other property loans.

- Credit Card Debt: Balances owed on credit cards.

- Student Loans: Education-related debt.

- Auto Loans: Debts incurred for vehicle purchases.

- Personal Loans: Unsecured or secured loans for various purposes.

- Other Debts: Any other outstanding financial obligations, like medical bills or tax liabilities.

- Income: Money In

- Employment Income: Your regular salary or wages from a job.

- Investment Income: Dividends, interest, or capital gains from investments.

- Rental Income: Money earned from properties you lease out.

- Side Hustle Income: Earnings from freelance work, consulting, or other part-time ventures.

- Other Income: Alimony, child support, pensions, or social security benefits.

- Expenses: Money Out

- Fixed Expenses: Consistent costs that usually don’t change month-to-month. Examples are rent/mortgage payments, insurance premiums, loan payments, and subscriptions.

- Variable Expenses: Costs that fluctuate based on usage or choice. This includes groceries, utilities, transportation (gas, public transit), dining out, entertainment, and clothing.

- Discretionary Expenses: Non-essential spending. These are often the first to be cut when budgeting, such as vacations, luxury items, or expensive hobbies.

Crafting Your Own Financial Management Tool

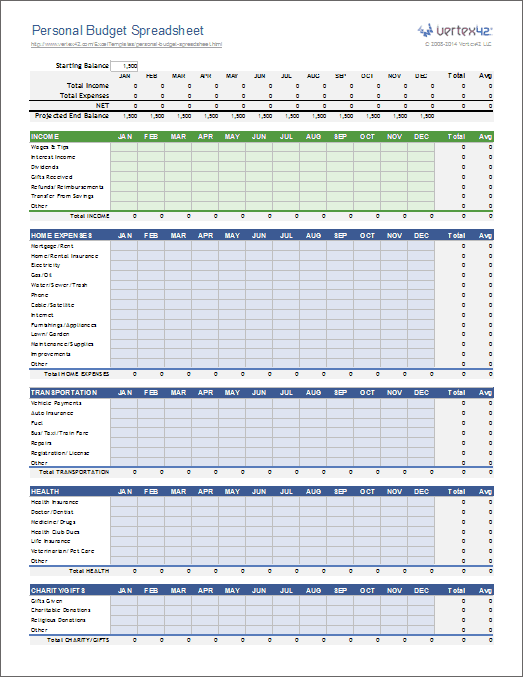

The beauty of a Personal Financial Statement Template Budget lies in its adaptability. You don’t need expensive software to get started. Many individuals find success with a simple spreadsheet, whether it’s Microsoft Excel, Google Sheets, or Apple Numbers. These platforms allow you to set up columns for assets, liabilities, income, and expenses, and use basic formulas to calculate net worth and net cash flow automatically. Several free templates are available online to kickstart your journey.

Alternatively, some personal finance software or apps offer integrated budgeting and net worth tracking features. Whichever method you choose, the key is consistency and personalization. Tailor the categories to reflect your unique financial life. If you have unique income streams or specific types of debt, make sure your template accommodates them. The goal is to create a system that works for you, not against you.

Benefits of a Structured Financial Approach

Adopting a disciplined financial approach using a combined personal financial statement and budget offers a wealth of benefits that extend far beyond simply knowing your numbers. It transforms your relationship with money, fostering confidence and clarity.

Firstly, it provides an unvarnished truth about your financial health, allowing you to identify areas of overspending or opportunities for increased savings. This factual basis is crucial for setting realistic and achievable financial goals. Secondly, it significantly improves decision-making. Should you take on that car loan? Can you afford to start investing more? Your integrated financial picture gives you the answers.

Moreover, a clear financial oversight tool helps you achieve financial goals faster. Whether it’s saving for retirement, a down payment on a house, or eliminating high-interest debt, seeing your progress and understanding the impact of your choices keeps you motivated. It also brings peace of mind, reducing financial stress by replacing uncertainty with a sense of control. For tax season or when working with a financial advisor, having all your information neatly organized is an invaluable time-saver.

Tips for Maximizing Your Financial Oversight Tool

To ensure your financial oversight tool serves you effectively, here are some practical tips:

- Be Honest and Thorough: The accuracy of your financial picture depends entirely on the honesty and completeness of the data you enter. Don’t omit anything, even small debts or assets.

- Update Regularly: While a personal financial statement is a snapshot, your financial life is dynamic. Aim to update your statement at least quarterly, and review your budget monthly. This helps you track progress and make timely adjustments.

- Track Every Penny (Initially): Especially when starting out, try to track all income and expenses. This can reveal surprising spending habits you weren’t aware of. You can ease up slightly once you have a good understanding of your patterns.

- Categorize Wisely: Use clear, consistent categories for income and expenses. This makes analysis easier and helps you identify trends. For example, differentiate between “Groceries” and “Dining Out.”

- Review and Adjust: Your budget is not set in stone. Life happens. Regularly compare your actual spending to your budgeted amounts and adjust your plan as needed. Flexibility is key to sustainability.

- Automate Where Possible: Set up automatic transfers to savings accounts or for bill payments. This reduces the mental load and ensures you prioritize your financial goals.

Frequently Asked Questions

Why can’t I just use my bank statements?

While bank statements show cash flow through one account, they don’t provide a consolidated view of all your assets (like investments, retirement accounts, or real estate) or all your liabilities (like mortgages, credit card debt across multiple cards, or student loans). A comprehensive personal financial statement brings all these elements together to show your true net worth and complete financial position at a single glance, which bank statements cannot.

How often should I update my personal financial statement?

For most individuals, updating your personal financial statement quarterly or semi-annually is sufficient to track significant changes in assets, liabilities, and net worth. Your budget, however, should be reviewed and updated monthly to ensure it aligns with your current income, expenses, and financial goals.

Is this tool only for people with a lot of money?

Absolutely not. A Personal Financial Statement Template Budget is perhaps even more critical for those who are just starting their financial journey or are working to manage debt. It provides the clarity needed to make strategic decisions, regardless of your current financial standing, and is a powerful tool for building wealth over time.

What’s the biggest mistake people make with their finances?

One of the biggest mistakes is failing to track where their money goes and not having a clear financial plan. This leads to impulsive spending, accumulating debt, and missing out on savings or investment opportunities. Without a clear financial picture and an active budget, it’s very difficult to achieve long-term financial stability and growth.

Can I use this for business purposes?

While the principles are similar, a personal financial statement is distinct from a business financial statement. Businesses have different accounting standards, tax implications, and financial reporting requirements. It’s best to use dedicated business financial statements (like a balance sheet, income statement, and cash flow statement for a business) when managing commercial enterprises, although your personal finances will naturally impact your business capacity.

Taking control of your finances might seem like a daunting endeavor, but with the right tools, it transforms into an empowering journey. The combination of a personal financial statement and a well-structured budget is more than just an accounting exercise; it’s a foundation for achieving your dreams, building security, and living a life free from financial anxiety. It provides the clarity to see where you are, the insight to understand how you got there, and the plan to get where you want to be.

Don’t let the complexity of financial jargon deter you. Start simple, be consistent, and watch as your understanding and confidence grow. The journey to financial mastery begins with a single, honest look at your numbers. Embrace this powerful approach, and unlock a future where you are in complete command of your financial destiny. Your financial well-being is too important to leave to chance; take that crucial first step today.