A Financial Power of Attorney (FPOA) is a legal document that grants someone you trust (your “agent” or “attorney-in-fact”) the authority to make financial decisions on your behalf. This can be incredibly important in situations where you are unable to handle your own finances, such as during a medical emergency, long-term illness, or mental incapacity.

Why is an FPOA Important?

Peace of Mind: Knowing your finances are taken care of can provide significant peace of mind to you and your loved ones.

What Can a Financial Power of Attorney Do?

An FPOA can grant your agent broad or limited powers, depending on your specific needs and wishes. These powers may include:

Managing Bank Accounts

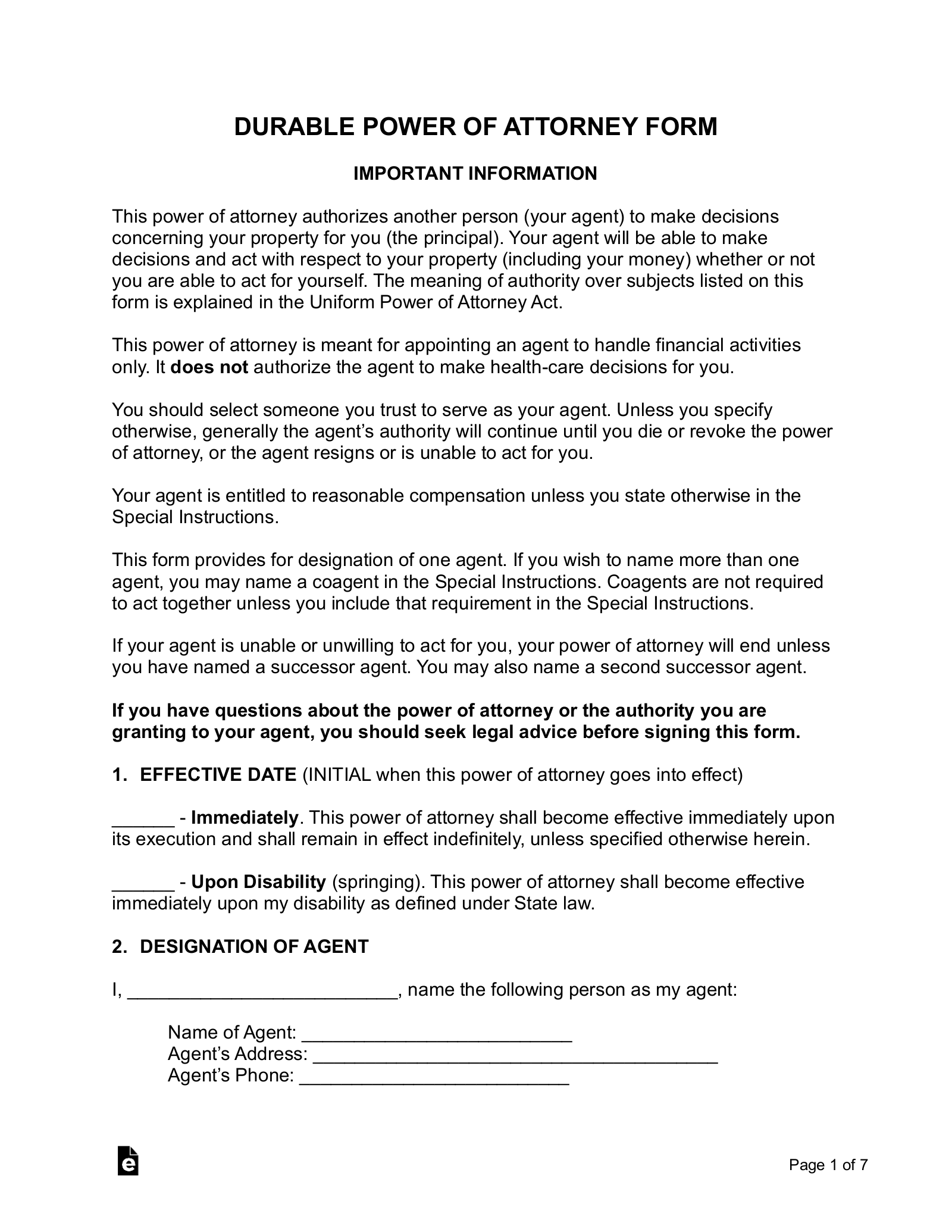

Image Source: eforms.com

Paying Bills and Debts

Collecting Income

Filing Taxes

Making Investments

Buying and Selling Property

Accessing Retirement Accounts

Types of Financial Power of Attorney:

General Power of Attorney: This grants your agent broad authority to handle most of your financial affairs.

Creating Your Financial Power of Attorney:

Consult with an Attorney: An experienced estate planning attorney can help you create an FPOA that meets your specific needs and complies with your state’s laws.

Finding a Financial Power of Attorney Template:

While you can find some basic FPOA templates online, it’s crucial to remember that these may not be legally valid or suitable for your specific situation.

Conclusion:

A Financial Power of Attorney is a valuable legal document that can provide peace of mind and protect your financial well-being. By carefully considering your needs and consulting with an attorney, you can create an FPOA that ensures your financial affairs are handled responsibly and effectively, even if you are unable to manage them yourself.

FAQs:

1. Do I need a lawyer to create a Financial Power of Attorney? While you can find some basic templates online, it’s highly recommended to consult with an attorney to ensure your FPOA is legally valid and meets your specific needs.

2. What happens if I become incapacitated and don’t have an FPOA? If you lack an FPOA, your family may need to go through a lengthy and potentially costly court process to gain the authority to manage your finances.

3. Can I revoke my Financial Power of Attorney? Yes, you can revoke your FPOA at any time by creating a written document revoking the authority granted to your agent.

4. Is a Financial Power of Attorney the same as a Will? No, they are different legal documents. A Will outlines how your assets will be distributed after your death, while an FPOA grants someone the authority to manage your finances while you are still living.

5. Can I choose multiple agents for my Financial Power of Attorney? Yes, you can typically designate multiple agents to act either jointly or successively.

Disclaimer: This information is for general knowledge and informational purposes only and does not constitute legal or financial advice. You should consult with a qualified professional for advice regarding your specific situation.

Financial Power Of Attorney Template