A Power of Attorney (POA) is essentially a legal document that grants someone else the authority to act on your behalf. Imagine it as giving someone your legal permission to handle specific tasks or make decisions you’d normally do yourself. This could range from simple things like paying bills to more complex matters like managing your finances or making medical decisions.

Why would you need a Power of Attorney?

There are several situations where a POA can be incredibly helpful:

When you’re temporarily unavailable

Travel: If you’re going on a long trip or traveling abroad, a POA can allow someone to handle urgent matters like dealing with property issues, accessing your bank accounts, or making important business decisions.

When you’re unable to handle your own affairs

Long-term illness: If you have a chronic illness or disability, a POA can give someone the legal authority to manage your finances, make healthcare decisions, and handle other important aspects of your life.

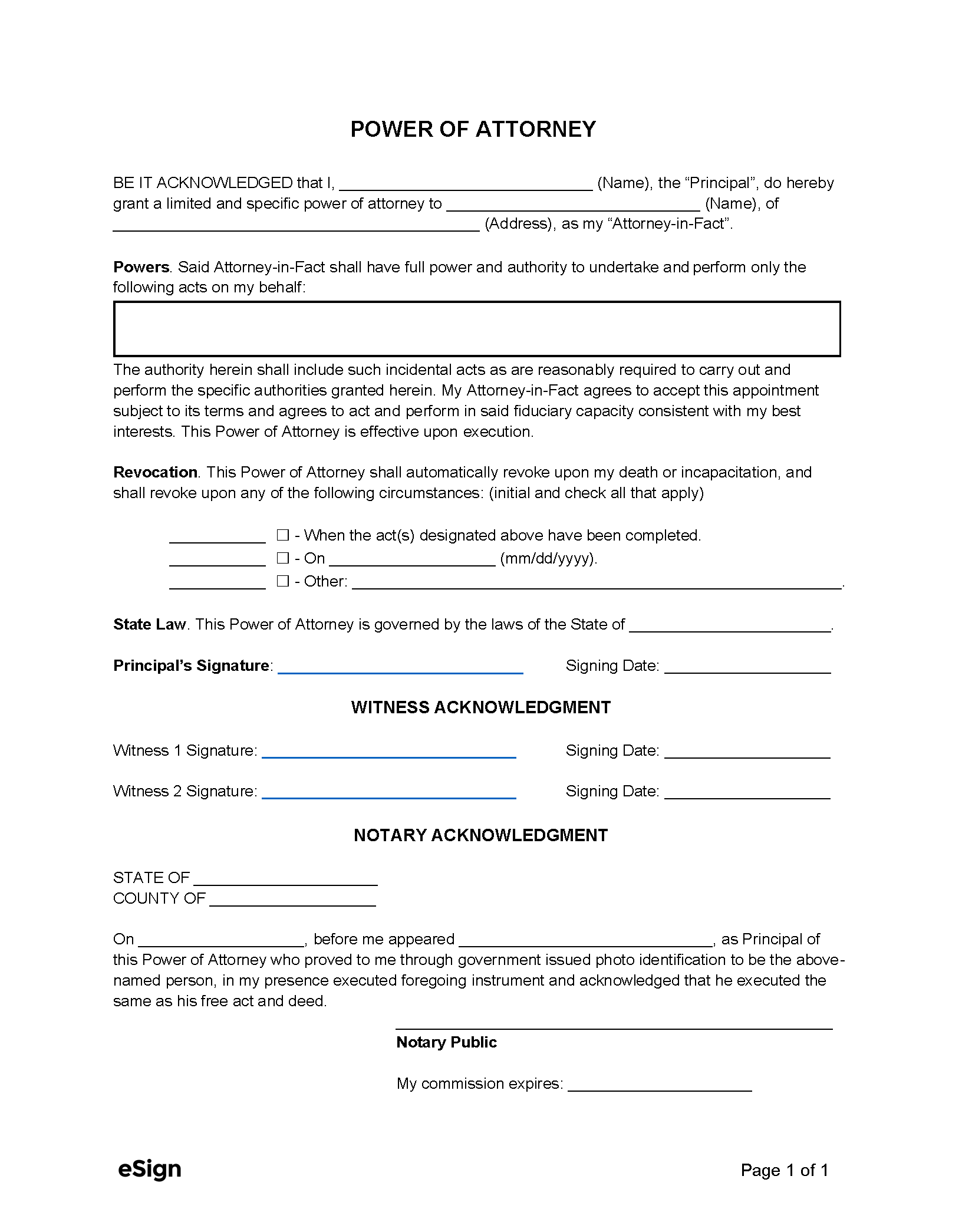

Image Source: esign.com

Types of Power of Attorney

There are different types of POAs, each with its own scope and limitations:

General Power of Attorney

This is the broadest type of POA, granting the designated person (called the “agent” or “attorney-in-fact”) extensive authority to act on your behalf. However, it’s usually only valid as long as you are mentally competent.

Special Power of Attorney

This type of POA is more limited in scope. It grants the agent authority to handle specific tasks or make specific decisions. For example, a Special POA could be used to:

Sell a property: Authorize someone to sell your house or other real estate.

Durable Power of Attorney

This type of POA remains valid even if you become mentally incapacitated. This is crucial for long-term care planning and ensuring that your wishes are respected if you are unable to communicate them yourself.

Medical Power of Attorney (Healthcare Proxy)

This specific type of POA focuses on healthcare decisions. It allows the designated person (often called a healthcare proxy) to make medical decisions on your behalf if you are unable to do so yourself.

Creating a Power of Attorney Letter

While the specific requirements for a POA can vary by state, here’s a general outline of what a typical POA letter might include:

1. Your Information: Your full legal name and address.

2. Agent’s Information: The full legal name and address of the person you are granting authority to.

3. Grant of Authority: A clear statement granting the agent the authority to act on your behalf. This section should specify the scope of the agent’s powers.

4. Effective Date and Duration: The date the POA becomes effective and the date (if any) on which it expires.

5. Your Signature: Your signature, along with the date you signed the document.

6. Witness Signatures: The signatures of two witnesses who were present when you signed the document.

7. Notarization: In some cases, the POA may need to be notarized by a notary public.

Important Considerations

Choose your agent wisely: Select someone you trust completely and who understands your wishes and values.

Conclusion

A Power of Attorney is a valuable legal tool that can provide peace of mind and ensure that your wishes are respected in a variety of situations. By understanding the different types of POAs and taking the time to create a well-drafted document, you can protect yourself and your loved ones.

FAQs

Can I revoke a Power of Attorney?

Yes, you can revoke a POA at any time as long as you are mentally competent. You can usually revoke a POA by creating a written statement revoking the document.

Do I need an attorney to create a Power of Attorney?

While you can sometimes create a simple POA yourself using a template, it’s always advisable to consult with an attorney to ensure that your POA is legally sound and meets your specific needs.

What happens if I become incapacitated and don’t have a Power of Attorney?

If you become incapacitated and don’t have a POA in place, a court may need to appoint a guardian or conservator to manage your affairs. This process can be time-consuming and costly.

Can a Power of Attorney be used for financial and medical decisions?

Yes, depending on the type of POA, it can grant authority to handle both financial and medical matters.

Can I limit the authority granted in a Power of Attorney?

Yes, you can certainly limit the scope of authority granted to your agent. A Special POA allows you to specifically define the tasks or decisions that your agent is authorized to handle.

Example Of Power Of Attorney Letter