In the complex and ever-evolving landscape of American healthcare, financial stability isn’t just a goal; it’s a prerequisite for providing quality patient care and ensuring the longevity of your practice or facility. From small private clinics to mid-sized specialty centers, managing the ebb and flow of revenue and expenses can feel like an intricate dance, often requiring specialized expertise that many healthcare professionals simply don’t have readily available. The challenge is clear: how do you maintain fiscal health without diverting precious resources from patient services?

The answer often lies in establishing a robust yet manageable financial framework. Imagine having a clear, concise roadmap for your organization’s financial journey, one that empowers you to make informed decisions, anticipate challenges, and allocate resources effectively. This is precisely the role a well-designed operating budget plays, and why a more accessible approach is gaining traction. It’s about demystifying the numbers and providing a practical tool to navigate the financial currents of the healthcare industry.

Why a Streamlined Healthcare Budget is Essential

Healthcare operations face unique financial pressures unlike almost any other sector. Reimbursement changes, rising supply costs, staffing shortages, and technological advancements all contribute to an environment where financial forecasting and control are paramount. Without a clear understanding of where money comes from and where it goes, even the most dedicated providers can find themselves in precarious positions, impacting everything from equipment upgrades to staff retention.

A well-structured financial model offers more than just accounting; it provides a strategic compass. It allows leadership to identify areas of overspending, pinpoint opportunities for efficiency gains, and ensure that adequate funds are available for critical investments in patient care, technology, and personnel development. Ultimately, effective budget management translates directly into a more stable, higher-quality healthcare environment for both providers and patients.

What Makes a Budget “Simple”

The term “simple” in the context of a healthcare operating budget template doesn’t imply a lack of detail or sophistication. Instead, it refers to clarity, intuitive design, and ease of use. A simple budget framework is one that can be readily understood and implemented by individuals who may not have an extensive background in finance, yet need to manage the financial health of their medical practice or department.

It strips away unnecessary complexity, focusing on the core financial elements that drive decision-making in a healthcare setting. This approach aims to minimize the time spent on administrative tasks, allowing more focus on patient care, while still providing the robust financial insights necessary for sustainable operation. The goal is to make budgeting an accessible, empowering process, rather than a daunting annual chore.

Key Components of an Operating Budget for Healthcare Providers

A comprehensive operating budget for a healthcare organization typically categorizes financial activities into revenue and expenditure. Understanding these core components is crucial for any medical practice or facility seeking to maintain financial stability and plan for future growth.

Here are the essential elements typically found in a practical operating budget for healthcare:

- **Revenue Streams:** This includes all income generated. For healthcare, this primarily consists of:

- **Patient Service Revenue:** Payments from insurance companies (commercial, Medicare, Medicaid), self-pay patients, and co-pays/deductibles.

- **Ancillary Service Revenue:** Income from lab tests, imaging services, physical therapy, or other non-direct patient care services.

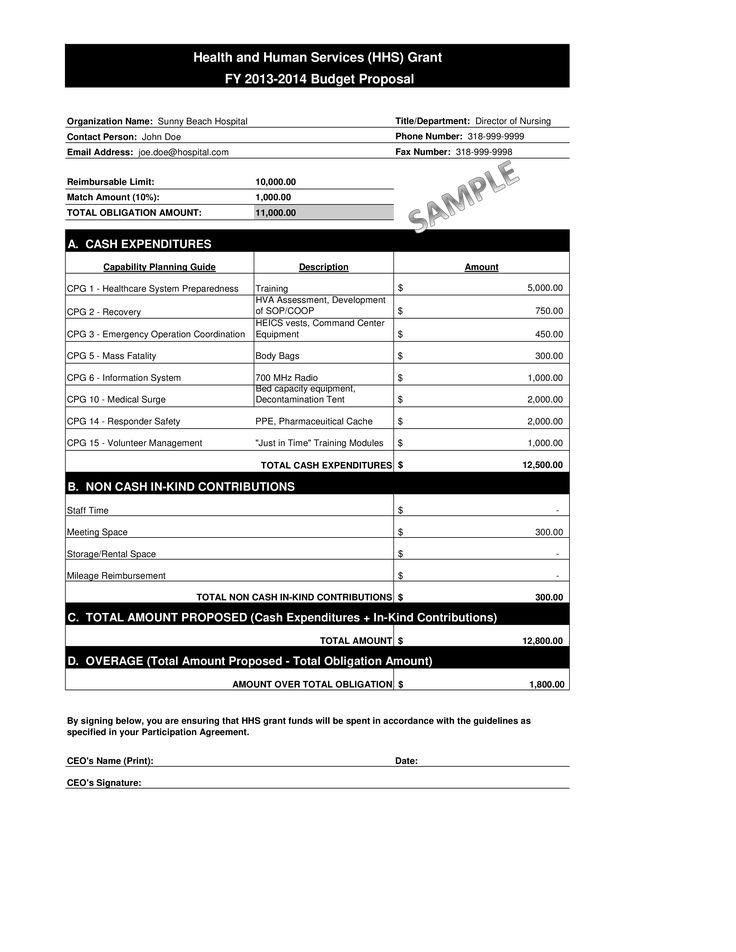

- **Other Operating Revenue:** Grants, research funding, rental income from unused space, or revenue from product sales (e.g., durable medical equipment).

- **Staffing Costs:** Often the largest expenditure for healthcare providers. This category includes:

- **Salaries & Wages:** For physicians, nurses, administrative staff, technicians, etc.

- **Benefits:** Health insurance, retirement contributions, PTO, worker’s compensation.

- **Payroll Taxes:** Employer’s portion of FICA, FUTA, SUTA.

- **Contract Labor:** Locum tenens, temporary staff, outsourced billing.

- **Operating Expenses:** The day-to-day costs of running the facility.

- **Medical Supplies & Pharmaceuticals:** Bandages, gloves, syringes, medications, durable medical equipment.

- **Facility Costs:** Rent or mortgage payments, utilities (electricity, water, gas), maintenance, repairs.

- **Administrative & Office Supplies:** Stationery, printing, office equipment.

- **Professional Fees:** Legal, accounting, consulting services.

- **Technology & Software:** Electronic Health Record (EHR) systems, practice management software, IT support, cybersecurity.

- **Marketing & Outreach:** Advertising, community events, website maintenance.

- **Insurance:** Malpractice, general liability, property insurance.

- **Travel & Education:** Conferences, continuing medical education (CME) for staff.

- **Depreciation & Amortization:** Non-cash expenses that account for the wear and tear of assets over time, such as medical equipment or building improvements.

- **Debt Service:** Principal and interest payments on loans for equipment, facility expansion, or other investments.

Benefits of Utilizing a Standardized Budget Framework

Adopting a standardized operating budget framework offers numerous advantages beyond mere financial tracking. For one, it fosters greater transparency across the organization. When financial data is presented in a consistent format, all stakeholders, from department heads to senior management, can more easily understand the financial health of the practice and their role within it.

Moreover, a consistent budget model simplifies the process of financial analysis and comparison. You can readily compare current performance against historical data, identify trends, and benchmark your organization against similar healthcare entities. This facilitates proactive decision-making, allowing leaders to adjust strategies quickly in response to market changes or internal performance indicators. It empowers managers to take ownership of their departmental spending and revenue generation, fostering a culture of fiscal responsibility.

Customizing Your Budget Tool for Unique Needs

While the core components of a healthcare operating budget template remain consistent, its true value comes from its adaptability. Every medical practice, clinic, or hospital department has unique operational nuances, patient demographics, and strategic goals. Therefore, the ability to customize your budgeting solution is paramount to its effectiveness.

Consider how your facility’s specific services might require additional categories. A surgical center, for instance, will have distinct surgical supply lines, while a primary care clinic might have more detailed preventive care program expenses. Incorporate lines for specific grants, research projects, or specialized equipment purchases that are unique to your organization. The goal is to make the template reflect your reality, providing line items that accurately capture your specific inflows and outflows without becoming overly cumbersome.

Tips for Effective Budget Management and Oversight

Implementing a budget framework is just the first step; ongoing management and oversight are critical for its success. Regular reviews are essential. This isn’t a “set it and forget it” tool; it’s a living document that needs to be revisited monthly or quarterly to compare actual performance against budgeted figures. This variance analysis allows you to identify discrepancies early and take corrective action.

Foster a culture of accountability by involving department heads in the budgeting process and empowering them to manage their respective budgets. Provide training and clear guidelines to ensure everyone understands their financial responsibilities. Furthermore, regularly communicate budget performance to your team, highlighting successes and addressing challenges transparently. This collective understanding and engagement can significantly improve financial outcomes and operational efficiency within your healthcare organization.

Leveraging Your Budget for Strategic Growth

Beyond merely tracking income and expenses, a well-managed operating budget can become a powerful instrument for strategic growth within your healthcare entity. It provides the financial blueprint for expansion, allowing you to model the impact of new service lines, equipment investments, or facility upgrades. By clearly projecting costs and potential revenue, you can make informed decisions about where to invest resources for maximum patient benefit and financial return.

This forward-looking approach transforms budgeting from a compliance task into a dynamic planning tool. It helps leadership envision future scenarios, assess financial risks associated with new initiatives, and strategically allocate capital. Ultimately, a robust financial plan underpins sustainable growth, ensuring that your healthcare organization can continue to meet the evolving needs of its community while remaining fiscally sound.

Frequently Asked Questions

What is the primary difference between an operating budget and a capital budget in healthcare?

An operating budget covers the day-to-day revenues and expenses involved in running a healthcare facility over a short period, typically a fiscal year. A capital budget, on the other hand, deals with long-term investments in assets like new buildings, major equipment purchases (e.g., MRI machines), or significant IT infrastructure, which have a useful life of more than one year.

How often should a healthcare operating budget be reviewed and updated?

While an annual budget is typically prepared, it’s crucial to review actual performance against the budget on a monthly or at least quarterly basis. This allows for timely identification of variances, course corrections, and reforecasting if significant operational changes or unexpected events occur.

Who should be involved in the budget development process for a medical practice?

Ideally, budget development should be a collaborative effort. Key personnel include practice owners or physicians, the practice manager, administrative staff responsible for billing and finance, and department heads. Involving those closest to the operations ensures accuracy and fosters greater ownership of financial goals.

Can a budget template help improve profitability?

Absolutely. By providing a clear overview of all revenues and expenses, a comprehensive financial model helps identify areas of inefficiency or excessive spending. It also allows you to track revenue generation more closely, pinpointing underperforming services or opportunities for growth, ultimately contributing to improved profitability.

Is specialized financial software necessary for effective budget management in healthcare?

While advanced financial software can offer robust features for larger organizations, a well-designed spreadsheet-based Simple Healthcare Operating Budget Template can be highly effective for many small to medium-sized practices. The key is consistent data entry, regular review, and a clear understanding of the financial categories.

Navigating the financial intricacies of healthcare no longer needs to be an intimidating endeavor reserved for finance experts. By adopting a clear, adaptable, and user-friendly budget framework, healthcare providers can empower themselves with the insights needed to ensure fiscal responsibility and sustained growth. This foundational financial tool shifts the focus from reactive problem-solving to proactive strategic planning, allowing your organization to thrive amidst industry changes.

Embrace the power of a well-structured financial plan to not only understand your current financial health but also to chart a confident course for the future. With the right tools and a commitment to regular oversight, you can transform your financial management from a complex challenge into a clear pathway to operational excellence and, most importantly, enhanced patient care. The journey to financial clarity and stability begins with a single, well-organized step.