Running a successful restaurant in today’s competitive landscape demands more than just culinary prowess and exceptional service; it requires astute financial management. The fast-paced environment, fluctuating ingredient costs, and the delicate balance of staffing needs can make profitability feel like a moving target. Without a clear financial roadmap, even the most beloved eateries can struggle to stay afloat, leaving owners and managers constantly guessing about their bottom line.

This is precisely where a dedicated financial planning tool becomes not just helpful, but absolutely essential. A robust system designed for the unique challenges of the food service industry offers clarity and control, transforming guesswork into strategic decision-making. By systematically tracking income and expenses, restaurant operators can identify trends, curb unnecessary spending, and allocate resources more effectively, ultimately paving the way for sustainable growth and a healthier financial future.

The Imperative of Financial Clarity in the Restaurant Industry

The restaurant business is notoriously challenging, marked by slim margins and high operational complexities. Unlike many other businesses, restaurants contend with perishable inventory, highly variable demand, and significant labor costs, often making up a large portion of overall expenses. These factors mean that a standard business budget often falls short of capturing the nuances crucial for effective restaurant financial planning.

A generic financial spreadsheet might track income and outgoing payments, but it won’t inherently categorize food costs by menu item, differentiate between front-of-house and back-of-house labor, or project revenue based on seasonality and special events. Without these specific insights, management may miss critical opportunities to optimize purchasing, streamline operations, or adjust pricing strategies. Therefore, a specialized approach to financial forecasting and expense tracking is paramount.

What Makes a Restaurant Budget Template Indispensable?

A well-structured budget provides more than just a snapshot of finances; it’s a dynamic tool that empowers restaurant owners to make informed decisions and steer their business toward greater profitability. By offering a detailed breakdown of all financial inflows and outflows, it highlights areas of strength and pinpoints potential weaknesses that need immediate attention. This proactive approach helps to avoid financial surprises and ensures resources are always aligned with strategic goals.

Such a comprehensive financial tool designed for eateries is crucial for tracking specific metrics that directly impact a restaurant’s viability. It helps in understanding the true cost of each dish, managing inventory waste, and optimizing staffing schedules. Essentially, it transforms raw financial data into actionable intelligence, enabling operators to make data-driven choices that enhance efficiency and increase overall financial health.

Key Components of an Effective Restaurant Financial Planning Tool

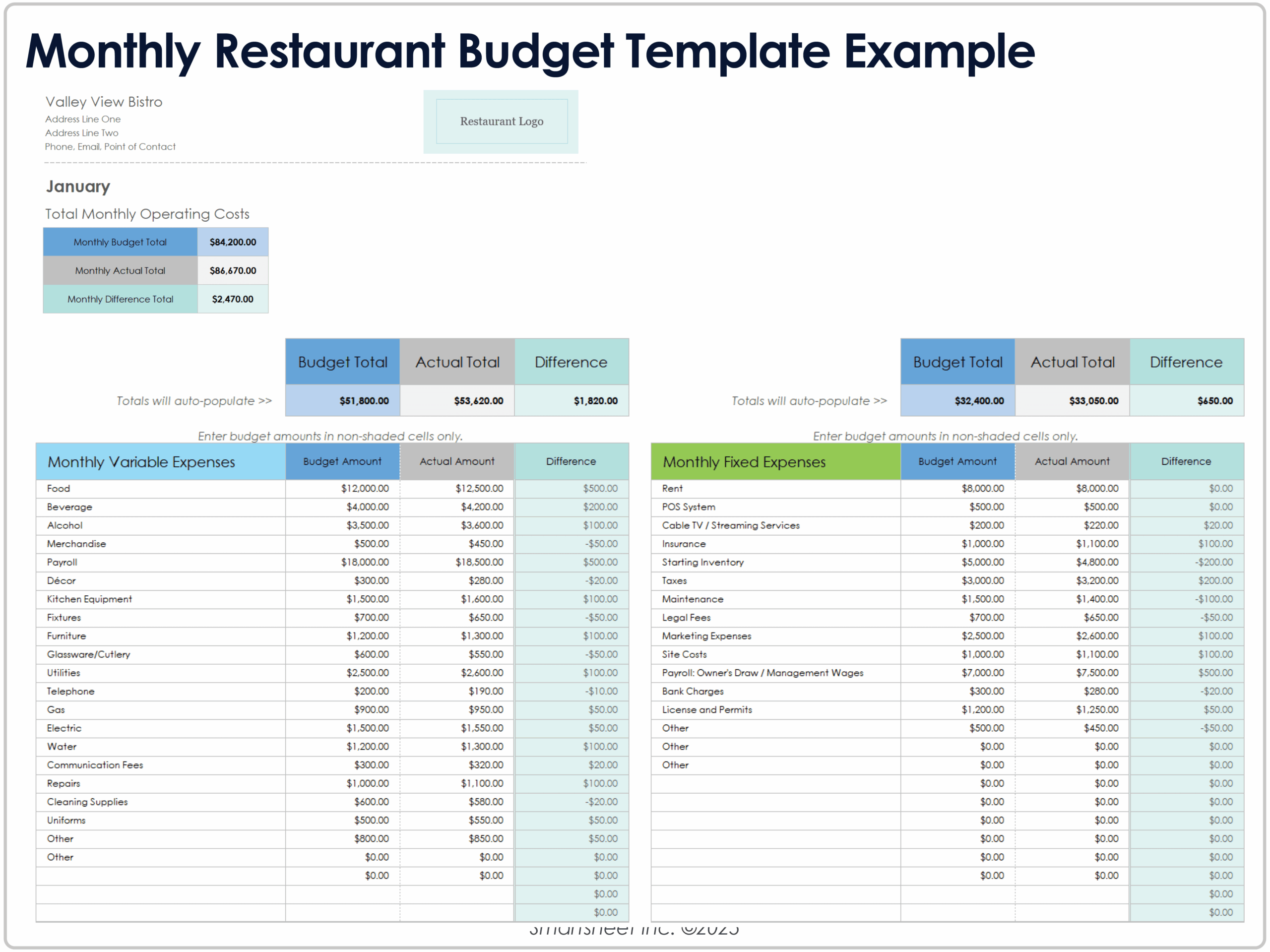

A truly effective financial planning instrument for the food service sector goes beyond simple income and expense tracking. It’s a comprehensive framework that captures all the unique financial elements of a dining establishment, enabling granular analysis and strategic adjustments. Here are some critical components you’ll find in a superior Monthly Budget Template Business Restaurant:

- **Revenue Streams**: Detailed breakdown of income sources, including dine-in sales, takeout/delivery, catering, bar sales, merchandise, and gift card redemptions. This helps in understanding which channels are most profitable.

- **Cost of Goods Sold (COGS)**: Specific tracking of food, beverage, and other direct product costs, allowing for calculation of food and liquor cost percentages. This is vital for menu engineering and supplier negotiations.

- **Labor Costs**: Comprehensive categorization of all staff expenses, including salaries, hourly wages, overtime, payroll taxes, benefits, and tips. Understanding these costs by department (kitchen, front-of-house) is crucial for staffing optimization.

- **Operating Expenses**: All other costs associated with running the business, such as rent, utilities, insurance, repairs and maintenance, licenses, and permits. This section ensures all fixed and variable overheads are accounted for.

- **Marketing and Advertising**: Allocation for promotional activities, digital advertising, social media campaigns, print ads, and public relations. Effective budgeting here helps maximize ROI on marketing efforts.

- **Administrative Costs**: Expenses related to office supplies, accounting software, legal fees, and other general administrative overheads. Though often overlooked, these small costs add up.

- **Depreciation**: Accounting for the wear and tear of assets like kitchen equipment, furniture, and fixtures. This is important for accurate profit calculation and tax planning.

- **Debt Service**: Payments for loans, lines of credit, and other financial obligations. Keeping track of principal and interest is essential for cash flow management.

Implementing Your Monthly Restaurant Budget

Once you have your comprehensive restaurant financial planning tool, the real work begins: implementation and consistent use. This isn’t a one-time setup; it’s an ongoing process that provides the most value when integrated into your monthly operational routine. The first step involves gathering all your financial data from the previous month, including sales reports, invoices from suppliers, payroll summaries, and bank statements.

Inputting this data accurately into your template is crucial for reliable analysis. Many modern templates allow for integration with POS systems or accounting software, streamlining this process. After the data is entered, take the time to review the generated reports. Compare actual performance against your budgeted projections. Identify significant variances – areas where expenses were higher than expected or revenues fell short. Understanding these discrepancies is the key to making informed adjustments for the upcoming month. Make it a standing agenda item for your management meetings to discuss the budget performance and brainstorm solutions for any identified challenges.

Beyond the Basics: Advanced Tips for Restaurant Financial Management

While a basic Monthly Budget Template Business Restaurant provides a solid foundation, embracing advanced financial management techniques can elevate your restaurant’s profitability and resilience. Strategic financial planning extends beyond simply tracking past performance; it involves looking ahead and preparing for various scenarios. One powerful technique is **forecasting**, which involves predicting future revenue and expenses based on historical data, market trends, and upcoming events. This allows for proactive adjustments to purchasing, staffing, and marketing efforts.

Another crucial aspect is scenario planning. What if food costs suddenly spike? How would a 10% drop in foot traffic impact your bottom line? By modeling different hypothetical situations, you can develop contingency plans and understand the potential impact of external factors. Furthermore, benchmarking your restaurant’s financial performance against industry averages or direct competitors can provide valuable insights. Are your labor costs disproportionately high? Is your food cost percentage in line with similar establishments? These comparisons can highlight areas for improvement and competitive advantages. Leveraging technology, such as advanced analytics dashboards and integrated accounting software, can automate many of these processes, providing real-time data and deeper insights with less manual effort.

Frequently Asked Questions

Why can’t I just use a general business budget template for my restaurant?

General business budget templates often lack the specific categories and granular detail required for the unique financial complexities of a restaurant. They typically don’t distinguish between food and beverage COGS, differentiate various labor roles (kitchen vs. front-of-house), or account for menu-specific costing, which are all critical for effective restaurant financial planning and control.

How often should I review and update my restaurant’s budget?

While the template itself is for a monthly budget, you should ideally review your actual performance against your budget at least once a month. Quarterly or bi-annual deep dives are also recommended for strategic adjustments. However, certain key metrics like daily sales and weekly labor costs should be monitored much more frequently to allow for immediate operational corrections.

What are the biggest financial pitfalls restaurants face?

Common financial pitfalls include uncontrolled food costs due to poor inventory management or waste, excessive labor costs due to inefficient scheduling, high employee turnover, unexpected maintenance expenses, and insufficient marketing spend. Inaccurate pricing that doesn’t account for all operational costs is also a significant issue.

Can a budget really help with cash flow management?

Absolutely. A detailed operational budget helps you anticipate periods of high and low cash flow by projecting income and outgoing payments. This foresight allows you to plan for lean months, manage vendor payments strategically, and ensure you have sufficient funds to cover essential expenses, preventing a cash crunch.

Is this kind of template suitable for small cafes or food trucks too?

Yes, a specialized restaurant budget template is highly adaptable and beneficial for businesses of all sizes within the food service industry, including small cafes, food trucks, and catering operations. While the scale of operations may differ, the fundamental principles of tracking revenue, managing COGS, controlling labor, and overseeing operating expenses remain the same and are critical for their success.

Embracing a tailored financial planning approach is not merely about tracking numbers; it’s about gaining a profound understanding of your restaurant’s pulse. It transforms the daunting task of financial management into a strategic advantage, allowing you to make proactive decisions that drive growth, improve efficiency, and enhance profitability. The power of a detailed, industry-specific budgeting solution empowers you to not just survive but thrive in the dynamic world of hospitality.

By committing to consistent use and analysis of a robust restaurant specific budgeting tool, you are investing in the long-term health and success of your establishment. It’s the difference between navigating blind and charting a precise course to your financial goals. Take control of your restaurant’s financial destiny and unlock its full potential, one well-planned month at a time.