Planning a wedding is an exhilarating journey, filled with dreams of perfect dresses, breathtaking venues, and unforgettable moments. While the romance is undeniably the heart of it all, the practicalities—especially financial ones—often loom large. Many couples start with a vision, only to find themselves overwhelmed by the sheer number of choices and the associated costs.

This is where a strategic approach to your finances becomes not just helpful, but essential. A well-constructed financial plan for your wedding isn’t about restricting your dreams; it’s about empowering them, ensuring that every decision aligns with your values and resources, leading to a celebration that is both magical and financially responsible.

Why a Wedding Budget is Your Best Ally

Embarking on wedding preparations without a clear financial roadmap is akin to setting sail without a compass. It can lead to unnecessary stress, difficult last-minute compromises, and even post-wedding financial strain. A comprehensive wedding budget planner provides clarity, allowing you to allocate funds intentionally and avoid the common pitfalls of overspending. It acts as a grounding force amidst the excitement, helping you make informed decisions from selecting vendors to choosing decor.

Moreover, a detailed financial framework for wedding expenses fosters open communication between partners. It encourages discussions about financial priorities, shared goals, and realistic expectations, laying a strong foundation not just for the wedding day, but for your future together. When both individuals are aligned on the financial aspects, the planning process becomes a collaborative and less stressful experience, allowing you to focus on the joy of getting married.

Key Components of a Comprehensive Wedding Budget

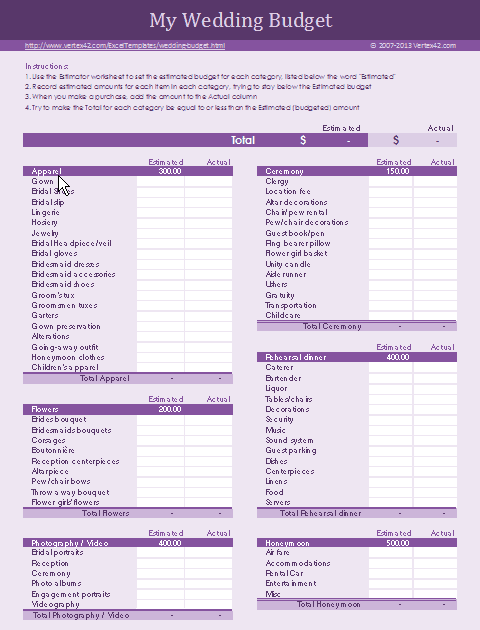

A robust wedding financial plan dissects your big day into manageable financial categories, ensuring no stone is left unturned. While every wedding is unique, certain core elements consistently feature in the overall expenditure breakdown. Understanding these components is the first step toward building an accurate and effective cost-tracking tool for weddings.

These typically include the venue (often the largest single expense), catering and bar services, photography and videography, attire for the couple, floral arrangements and decor, entertainment (DJ or live band), stationery, transportation, and officiant fees. Beyond these primary items, remember to factor in less obvious costs such as beauty services, wedding rings, gifts for the wedding party, and a contingency fund for unexpected expenses. Each category requires careful consideration and research to ensure your budget reflects realistic market rates.

Crafting Your Personalized Financial Blueprint

Once you understand the common expense categories, the next step is to tailor a financial blueprint that reflects your personal priorities and overall financial capacity. Begin by determining your absolute maximum spend—this is the non-negotiable ceiling for your wedding expenses. This initial figure will guide all subsequent decisions. Having a clear upper limit helps prevent scope creep and keeps your aspirations grounded in reality.

With your total budget established, it’s time to allocate funds strategically. Consider what aspects of your wedding are most important to you and your partner. Is a gourmet meal a top priority, or is having a destination wedding more important? Perhaps photography is paramount to capture every memory perfectly. This prioritization will help you decide where to allocate larger percentages of your wedding financial plan, ensuring that the elements you cherish most receive adequate funding, while areas of lesser importance can be trimmed. This process transforms a generic Wedding Planning Budget Template into a highly personalized document tailored specifically to your unique celebration.

Smart Strategies for Saving Without Sacrificing Style

Adhering to your budget doesn’t mean compromising on your dream wedding; it simply means making clever choices. There are numerous ways to reduce costs without sacrificing the style and elegance you envision. One effective strategy is to consider an off-peak wedding date or a less popular day of the week, as many venues and vendors offer reduced rates during these times. Simplifying your guest list is another significant cost-saver, as catering, favors, and even stationery costs are often per person.

Exploring DIY projects for certain decor elements or favors can add a personal touch while saving money, provided you’re realistic about your time and skills. Similarly, sourcing flowers locally and seasonally can dramatically cut floral expenses. Don’t be afraid to negotiate with vendors; many are open to custom packages or slight modifications to fit within your managing wedding costs. Remember, every dollar saved in one area can be reallocated to enhance another, ensuring your overall wedding expenditure breakdown remains balanced and beautiful.

Navigating Unexpected Costs and Revisions

Even the most meticulously crafted financial framework for wedding expenses can encounter unforeseen circumstances. It’s a common reality in wedding planning that new ideas emerge, vendor quotes might fluctuate slightly, or an unexpected item might suddenly appear on your must-have list. This is precisely why including a contingency fund—typically 5-10% of your total budget—is crucial. This buffer acts as a safety net, absorbing minor overages or last-minute additions without derailing your entire financial plan.

Flexibility is key when managing wedding costs. Regularly review your budget with your partner, perhaps monthly or after major vendor bookings. This proactive approach allows you to identify potential overspends early and make necessary adjustments. Maybe you decide to cut back on elaborate centerpieces to accommodate a slightly higher photography package, or perhaps you find a more affordable stationery option. Open communication and a willingness to adapt your pre-wedding financial roadmap will help you navigate any financial surprises with grace and confidence.

Putting Your Budget into Action: A Step-by-Step Guide

Translating your financial intentions into concrete action is where a Wedding Planning Budget Template truly comes to life. It transforms from a static document into a dynamic, living tool that guides your every financial decision. Here’s how to ensure your cost-tracking tool for weddings is actively working for you:

- **Set Your Initial Budget:** Begin with your overall financial limit and a preliminary allocation for major categories. This initial budgeting for your big day provides a foundational structure.

- **Research and Collect Quotes:** As you contact vendors, meticulously record their quotes. Compare multiple options to find the best value that aligns with your financial plan for weddings.

- **Track Every Expense:** Every deposit, payment, and minor purchase should be logged. Use a spreadsheet, an app, or a dedicated budget notebook to keep a running tally of your actual spending against your planned amounts. **Don’t skip small purchases**; they add up.

- **Review Regularly:** Schedule dedicated times to sit down with your partner and review your budget. This could be weekly or bi-weekly. Discuss where you’re on track and where adjustments might be needed. **Open communication is vital**.

- **Communicate Changes:** If a vendor quote comes in higher or lower than expected, update your budget immediately. Communicate any significant changes or reallocations with your partner to ensure you both remain aligned on your financial framework for wedding expenses.

- **Adjust as Needed:** Be prepared to reallocate funds. If you find a fantastic deal on catering, you might decide to put those savings towards upgraded florals. Conversely, if one area goes over, identify another area where you can pull back. A good budgetary guide for nuptials is adaptable.

Frequently Asked Questions

How much should I budget for my wedding?

There’s no single answer, as wedding costs vary wildly based on location, guest count, and your preferences. The national average can be a starting point, but focus on what you can realistically afford without incurring significant debt. Begin by honestly assessing your savings and any contributions from family, then build your financial plan for weddings from there.

When should I start creating my wedding expenditure breakdown?

Ideally, you should start as soon as you get engaged and before you book any vendors. Having a clear budgetary guide for nuptials from the outset will prevent you from making commitments that fall outside your financial comfort zone. It’s much easier to plan with an overall budget in mind than to adjust one after major decisions have been made.

What’s the most common budget mistake?

The most common mistake is not tracking expenses diligently or not having a buffer for unexpected costs. Couples often underestimate the cumulative cost of small items, or they forget to include taxes, gratuities, and vendor tips in their initial estimates. This is where a detailed cost-tracking tool for weddings truly shines.

Can I really save money with a wedding cost-tracking tool?

Absolutely. A dedicated Wedding Planning Budget Template allows you to visualize your spending in real-time, identify areas where you might be overspending, and make proactive adjustments. It prevents emotional, impulsive decisions by providing a factual overview of your financial situation, leading to significant savings and better financial control.

What if my budget changes during planning?

It’s common for budgets to evolve. If your financial situation changes or your priorities shift, simply revisit your pre-wedding financial roadmap with your partner. Adjust your allocations, identify areas where you can cut back or spend more, and communicate these changes openly. The key is to be adaptable and to keep your financial framework for wedding expenses current and reflective of your reality.

Planning your wedding should be an exciting and joyful experience, not a source of financial stress. By embracing the power of a well-structured financial plan, you equip yourselves with the clarity and control needed to make informed decisions at every turn. It’s more than just a spreadsheet; it’s a tool for peace of mind, allowing you to focus on the true meaning of your special day.

Implementing a thoughtful and detailed financial blueprint will not only help you stay within your means but also empower you to create a celebration that perfectly reflects your unique love story and priorities. So, take the first step towards a stress-free wedding journey by meticulously planning your expenses, and watch your dream day unfold beautifully and responsibly.