Embarking on the journey of shared finances can feel like navigating uncharted waters, especially when individual spending habits and financial philosophies come into play. Many couples find themselves grappling with questions about who pays for what, how to save for joint goals, and perhaps most pressingly, how to avoid money-related arguments. A well-structured financial plan is not just about numbers; it’s about building a foundation of trust, transparency, and shared vision for your future together.

This is where a practical, adaptable financial roadmap becomes invaluable. Instead of a rigid, one-size-fits-all approach, envision a collaborative tool designed to empower both partners to take control of their financial destiny. By implementing a system that simplifies tracking income and expenses, couples can transform potential stress points into opportunities for growth and deeper connection.

Understanding the “Why”: The Power of Joint Financial Planning

For married couples, joint financial planning transcends mere arithmetic; it’s a cornerstone of a strong partnership. When both individuals are aware of the household’s financial standing, understand where money is coming from and going, and actively participate in decision-making, it fosters transparency and reduces the likelihood of misunderstandings. This shared oversight builds a sense of team ownership over your financial journey.

A unified financial strategy helps couples move from individual aspirations to collective goals, whether it’s saving for a down payment on a home, funding a dream vacation, or planning for retirement. It eliminates the guesswork and allows for intentional allocation of resources toward what truly matters to both of you. This collaborative approach ensures that financial decisions are made with mutual consent and support, rather than through individual silos.

Key Elements of an Effective Couple’s Spending Plan

Creating a robust financial framework requires understanding the core components that make up your economic landscape. This isn’t just about tallying receipts; it’s about gaining clarity on your income streams and categorizing your outflows to identify areas for optimization and growth. A truly effective joint household budget balances current needs with future aspirations.

Breaking down your financial picture into distinct categories makes the entire process less daunting and more actionable. It provides a clear snapshot of your financial health, highlighting where your money is currently being spent and where adjustments can be made to align with your shared objectives. Consider these essential components when crafting your plan:

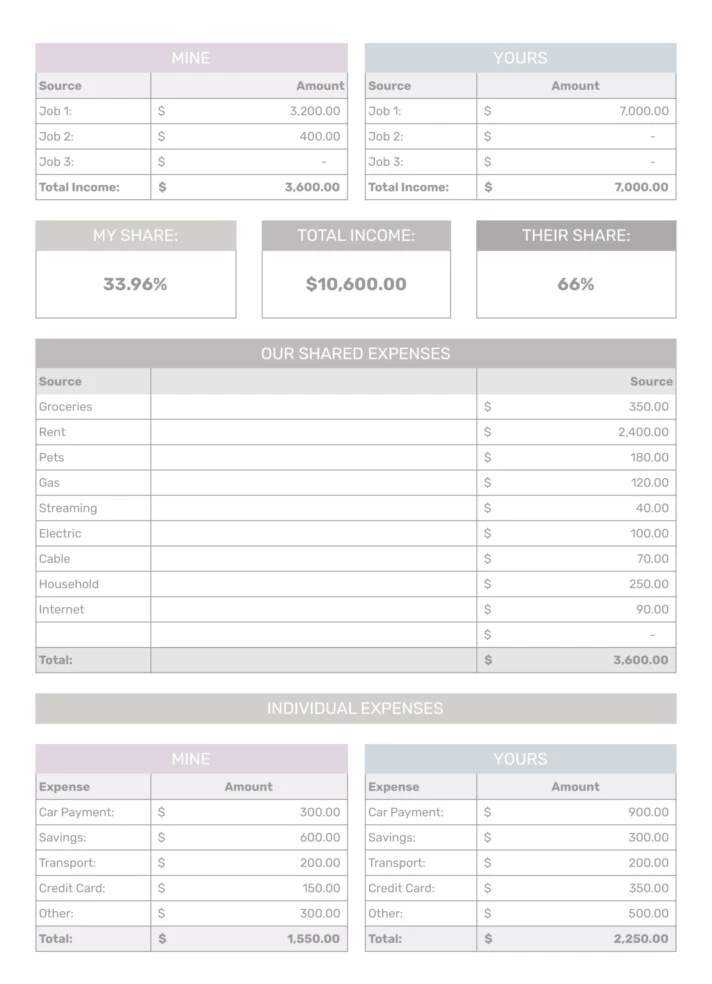

- Total Net Income: This is the combined take-home pay of both partners after taxes and deductions. Knowing your exact income is the first crucial step.

- Fixed Expenses: These are regular payments that typically don’t change month-to-month. Examples include your mortgage or rent, car payments, insurance premiums, and loan repayments.

- Variable Expenses: These costs fluctuate and can be controlled more easily. Think groceries, dining out, entertainment, utilities (which vary seasonally), and personal care. This category often offers the most flexibility for adjustments.

- Savings and Investments: Designate specific amounts for your emergency fund, retirement accounts, future home down payment, or any other short-term or long-term financial goals. Treating savings as a non-negotiable expense is key.

- Debt Repayment (beyond fixed): If you have credit card debt or other high-interest loans, setting aside extra funds for accelerated repayment can significantly improve your financial standing.

Building Your Own Weekly Budget Template For Married Couple: A Step-by-Step Guide

Implementing a functional financial tool requires a systematic approach, ensuring all aspects of your financial life are considered. This isn’t about restriction; it’s about smart resource allocation that empowers both partners. This Weekly Budget Template For Married Couple is designed to be adaptable, offering a clear path to financial clarity and control.

Step 1: Gather Your Financial Data

Before you can plan, you need a complete picture. Collect all recent bank statements, credit card statements, pay stubs, and any recurring bill statements. This initial data collection phase is crucial for establishing an accurate baseline of your income and expenditures. It helps in identifying all sources of income and every outflow of money.

Step 2: Categorize Your Spending

Review your past spending for at least one month, ideally two or three, to get an average. Divide your expenses into categories like housing, transportation, food, utilities, entertainment, personal care, and miscellaneous. This categorization helps reveal where your money truly goes and highlights any “money leaks” you might not have noticed.

Step 3: Allocate Funds and Set Limits

Based on your income and categorized expenses, allocate specific amounts to each category for the upcoming week or month. This is where you decide how much you’re comfortable spending on groceries, entertainment, or going out. Be realistic and discuss these limits together, ensuring both partners feel heard and comfortable with the plan. Consider budgeting methods like the 50/30/20 rule (50% needs, 30% wants, 20% savings/debt) or a zero-based budget where every dollar has a job.

Step 4: Track and Adjust Regularly

The key to any successful financial plan is consistent tracking. Whether you use a spreadsheet, a budgeting app, or even a simple notebook, diligently record all your spending. At the end of each week or month, compare your actual spending against your allocated amounts. This review process allows you to identify areas where you overspent or underspent and make necessary adjustments for the next period. Flexibility is essential; life happens, and your budget should be able to adapt.

Step 5: Prioritize Shared Financial Goals

A joint budget is more effective when it’s tied to shared aspirations. Sit down together and define your short-term and long-term financial goals. Do you want to save for a vacation, a new car, or pay off student loans? By making these goals explicit, you can consciously allocate funds towards them within your weekly or monthly budget, turning abstract dreams into concrete financial targets.

Customizing Your Couple’s Financial Framework

Every couple’s financial situation and lifestyle are unique, meaning your joint financial planning tool should reflect that individuality. There’s no single right way to manage money for two; the best approach is one that both partners understand, agree upon, and can consistently maintain. Customization is about finding what truly works for your dynamic.

Perhaps a weekly check-in feels too frequent, and a bi-weekly or monthly review aligns better with your pay cycles. Or maybe one partner prefers a digital app for tracking, while the other finds satisfaction in a physical ledger. Embrace these differences and integrate them into a harmonious system that strengthens your financial bond.

Tips for Successful Joint Financial Management

Navigating marital money management can present its own set of challenges, but with the right strategies, it can become a source of strength and unity. It requires ongoing effort, open dialogue, and a willingness to adapt. These practical tips can help ensure your shared financial plan is a resounding success.

Schedule a regular financial meeting: Make it a standing appointment, perhaps over coffee, to discuss your financial progress, adjust categories, and address any concerns. This dedicated time fosters consistent communication and prevents issues from festering.

Communicate openly and honestly: Be transparent about your spending, income, and financial anxieties. Judgment-free conversations are crucial for building trust and finding solutions together. Remember, you’re a team working towards common objectives.

Compromise is key: You both likely have different spending habits and financial priorities. Be prepared to meet in the middle, understanding that compromise doesn’t mean sacrificing your needs but rather finding common ground that serves both partners.

Automate savings and bill payments: Set up automatic transfers to savings accounts and automate bill payments to ensure you consistently meet your financial goals and obligations. This reduces the mental load and minimizes the risk of missed payments.

Build an emergency fund: Prioritize saving for unexpected expenses. A robust emergency fund provides a financial safety net and prevents minor setbacks from becoming major crises, offering peace of mind to both partners.

Celebrate small victories: Acknowledge and celebrate every financial milestone, big or small. Paying off a credit card, hitting a savings goal, or sticking to your budget for a month are all worthy of recognition, reinforcing positive habits.

Frequently Asked Questions

How often should we review our weekly spending plan?

While the goal is a weekly budget, a formal review can be done weekly or bi-weekly, depending on your pay cycle and spending patterns. Many couples find a short, 15-minute check-in once a week helps keep them on track and aware of their current financial standing. A more in-depth review can then occur monthly.

What if one spouse is a spender and the other is a saver?

This is a common dynamic! The key is communication and compromise. Spenders can learn from savers about delayed gratification, while savers can learn from spenders about enjoying life. Consider allocating “fun money” for each spouse to spend freely, and clearly define shared financial goals that appeal to both, fostering a sense of joint purpose.

Should we have separate accounts or joint accounts?

There’s no single right answer, and many couples use a hybrid approach. A common strategy involves a joint account for shared expenses and bills, with individual accounts for personal spending. This offers transparency for household finances while maintaining individual financial autonomy. Discuss what feels most comfortable and practical for your partnership.

How do we account for irregular expenses in a weekly budget for couples?

Irregular expenses like car maintenance, annual insurance premiums, or holiday gifts can derail a weekly plan if not anticipated. Create a “sinking fund” category in your budget where you set aside a small amount each week or month for these larger, less frequent costs. This smooths out your spending and prevents sudden financial shocks.

What’s the best tool for managing a joint budget?

The “best” tool is the one you both will use consistently. Options range from simple spreadsheets (like Google Sheets or Excel), dedicated budgeting apps (e.g., YNAB, Mint, Personal Capital), to pen and paper. Experiment with a few to see which interface and features resonate with both partners. The goal is clarity and ease of use.

Taking control of your finances as a married couple is one of the most empowering steps you can take for your relationship and future. It moves you from simply reacting to financial events to proactively shaping your economic destiny, together. This collaborative effort not only leads to greater financial security but also strengthens the bond between partners through shared responsibility and mutual understanding.

By embracing the principles of clarity, consistency, and open communication inherent in a well-managed joint financial plan, you are not just budgeting; you are investing in a more harmonious and prosperous life together. Start small, be patient with each other, and celebrate every step of your journey towards financial freedom. Your future selves, and your relationship, will thank you for it.