Navigating the complexities of personal finance can often feel like trying to chart a course through a dense fog without a compass. For many, the idea of financial freedom, buying a home, or securing a comfortable retirement remains an elusive dream, not due to a lack of income, but often because of an absence of clear direction and consistent planning. This is where a well-structured financial framework becomes indispensable, offering the clarity needed to transform aspirations into tangible realities.

A robust personal budget framework is more than just a ledger of incomings and outgoings; it’s a living document that empowers you to understand your financial landscape, make informed decisions, and proactively work towards your goals. Whether you’re just starting your career, managing a growing family, or nearing retirement, an organized approach to your money eliminates guesswork, reduces stress, and lays the groundwork for a secure future. It’s the essential tool for anyone serious about taking control of their financial destiny.

Why a Financial Blueprint Matters

At its core, a detailed financial plan serves as your personal financial blueprint, guiding every monetary decision you make. It provides an honest snapshot of your current financial health, highlighting where your money comes from and, crucially, where it goes. Without this clarity, it’s all too easy for discretionary spending to erode savings potential, leaving individuals feeling stuck or unable to progress.

The benefits extend far beyond mere tracking. A solid budgeting tool fosters mindful spending, enabling you to differentiate between needs and wants and consciously allocate funds according to your values. It acts as an early warning system for potential financial shortfalls and a powerful accelerator for achieving larger financial milestones, from paying off debt to building an emergency fund or investing for the future. The peace of mind that comes from knowing exactly where you stand financially is immeasurable, freeing up mental space for other important aspects of your life.

Key Components of Your Financial Framework

To be truly effective, a comprehensive budgeting spreadsheet needs to capture specific categories of financial information. Understanding these core elements is crucial when developing a robust budgeting tool that genuinely reflects your unique situation and helps you steer your financial ship.

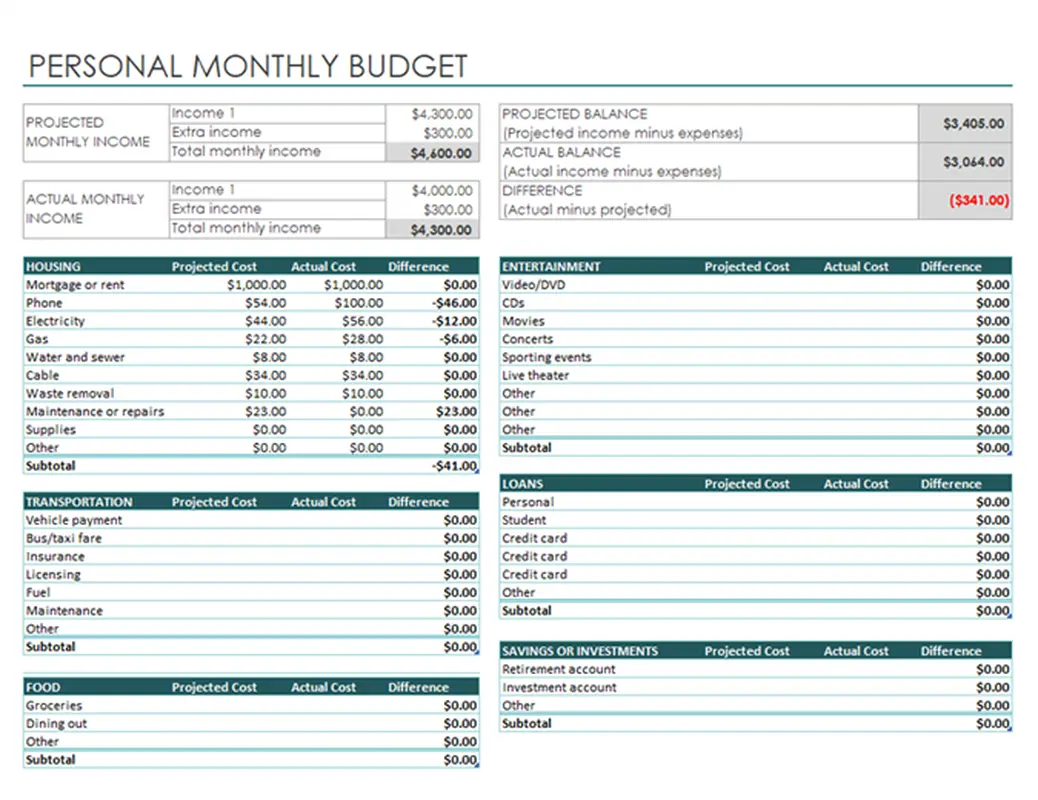

- Income Sources: This includes all money flowing into your household. Think salaries, freelance earnings, rental income, investment dividends, or any other regular influx of cash. Be sure to account for net income (after taxes and deductions) for the most accurate picture.

- Fixed Expenses: These are costs that typically remain the same each month and are generally non-negotiable. Examples include **rent or mortgage payments**, loan repayments (car, student), insurance premiums, and subscription services.

- Variable Expenses: These costs fluctuate from month to month and are often where you have the most control to adjust your spending. Categories here might include **groceries**, dining out, entertainment, utilities (which can vary seasonally), and transportation costs like gas.

- Savings & Debt Repayment: This section is critical for financial growth. It covers contributions to your emergency fund, retirement accounts (401k, IRA), investment portfolios, and any extra payments you’re making towards high-interest debts. Treat these as non-negotiable expenses within your budget.

- Net Cash Flow: This is the difference between your total income and your total expenses (including savings and debt payments). A positive net cash flow indicates you have money left over, which can be allocated to further savings or investments. A negative flow signals you’re spending more than you earn, requiring adjustments.

- Goal Tracking: Integrate specific sections to track progress towards your financial objectives, such as a down payment for a house, a child’s education fund, or a dream vacation. This keeps your goals front and center and motivates consistent adherence to your spending plan.

How to Build and Customize Your Budgeting Tool

Creating a truly functional Personal Financial Plan Budget Template involves more than just plugging numbers into a pre-made sheet. It requires active engagement and customization to fit your specific financial life. The beauty of a personal budget framework lies in its adaptability.

- Gather Your Financial Data: Start by collecting all relevant financial statements from the past few months. This includes bank statements, credit card statements, pay stubs, loan statements, and investment account summaries. This data will provide an accurate baseline for your income and spending patterns.

- Choose Your Format: Decide whether you prefer a digital spreadsheet (like Excel, Google Sheets), a dedicated budgeting app, or even a pen-and-paper ledger. Digital options offer greater flexibility for calculations and tracking over time.

- Input Your Income: List all sources of income, ensuring you use the net amount you actually receive in your bank account. If your income varies, use an average or a conservative estimate.

- Categorize Your Expenses: Go through your past statements and meticulously categorize every expense into fixed and variable categories. Be honest and thorough; neglecting even small recurring costs can throw off your entire budget.

- Set Realistic Spending Limits: Based on your past spending and your financial goals, set specific limits for each variable expense category. Don’t be too restrictive initially, as this can lead to frustration and abandonment. Aim for sustainable adjustments.

- Allocate Funds for Savings & Debt: Make saving and debt repayment a priority. Treat these allocations as fixed expenses that must be met each month. Automate transfers whenever possible to ensure consistency.

- Review and Adjust Regularly: Your life and financial situation will evolve, and your financial planning template should evolve with it. Schedule weekly or monthly reviews to compare your actual spending against your budget. Identify areas where you overspent or underspent and make necessary adjustments for the next period. This iterative process is key to long-term success.

Leveraging Your Budget for Long-Term Goals

A well-maintained financial management blueprint isn’t just about managing today’s cash flow; it’s a powerful instrument for shaping your financial future. By understanding where every dollar goes, you gain the ability to intentionally direct your resources towards significant life milestones. Whether it’s saving for a down payment on a house, funding a child’s college education, planning for a comfortable retirement, or even starting your own business, your budget acts as the strategic roadmap.

It allows you to calculate exactly how much you need to save each month to reach a specific goal by a certain date. This visualization of progress, clearly outlined in your income and expense planner, provides immense motivation. It transforms abstract dreams into concrete, actionable steps. Furthermore, a consistent spending plan helps you identify areas where you can optimize, potentially freeing up more capital to accelerate your progress towards these long-term aspirations, turning what once felt impossible into an achievable reality.

Common Pitfalls and How to Avoid Them

Even with the best intentions, individuals can stumble when implementing a personal finance organizer. Awareness of common pitfalls can help you navigate around them and maintain the integrity of your financial strategy document.

- Unrealistic Budgeting: Setting overly aggressive limits, especially for variable expenses like groceries or entertainment, can lead to quick burnout and abandonment. Solution: Start with realistic figures based on your actual spending, then gradually make small, sustainable cuts over time.

- Neglecting Small Expenses (Latte Factor): Many people overlook the cumulative impact of small, daily purchases. These "micro-spends" can quickly add up, sabotaging your budget without you realizing it. Solution: Track every dollar, even the smallest coffee or snack. Consider a "miscellaneous" category for these, but try to minimize it.

- Infrequent Review: A budget is not a set-it-and-forget-it tool. Life changes, and so do your spending habits and income. Solution: Commit to regular reviews – weekly or bi-weekly for active management, and monthly for broader adjustments. This keeps your money management tool relevant and effective.

- Guilt and Shame: Feeling guilty about overspending in a category can lead to giving up entirely. Solution: View budget deviations as learning opportunities, not failures. Adjust your plan for the next month and move forward. The goal is progress, not perfection.

- Lack of Flexibility: A rigid budget that doesn’t account for unexpected events or seasonal variations will eventually break. Solution: Build in some buffer room for emergencies or seasonal spikes (e.g., holiday spending, higher utility bills in winter). Your budget should serve you, not the other way around.

Frequently Asked Questions

What’s the best format for a personal budget framework?

There isn’t a single “best” format, as it largely depends on individual preference. Many find digital spreadsheets (like those in Google Sheets or Microsoft Excel) to be highly effective due to their automation capabilities, formulas, and ease of customization. Dedicated budgeting apps can also be great for on-the-go tracking. The key is to choose a format you’ll consistently use and that provides the level of detail you need.

How often should I update my spending plan?

Ideally, you should review your spending plan at least once a week to ensure you’re staying on track with your categories. A more comprehensive review and adjustment should be performed monthly, particularly after all bills and paychecks have cleared, to compare actual spending against budgeted amounts and make any necessary recalibrations for the upcoming month.

Can a budgeting spreadsheet really help me save more money?

Absolutely. A well-maintained budgeting spreadsheet provides unparalleled clarity into your spending habits. By visually seeing where your money goes, you can identify areas of wasteful spending, set realistic savings goals, and track your progress. This increased awareness and accountability are powerful motivators that directly contribute to increased savings and more effective debt repayment.

Is it okay to use a basic expense tracker, or do I need something more complex?

Starting with a basic expense tracker is perfectly fine and often recommended for beginners. The most important thing is to simply start tracking your money. As you become more comfortable and gain insights into your financial patterns, you can gradually introduce more complex elements like goal tracking, net worth calculations, or investment planning. Always choose the tool that best fits your current needs and comfort level.

What if my income fluctuates significantly each month?

For those with variable income, a “zero-based budget” or a “bucket budget” can be very effective. With a zero-based budget, you assign every dollar of your income a job (spending, saving, debt) each month, so your income minus expenses equals zero. For fluctuating income, consider budgeting based on your lowest expected income, and then allocate any surplus income towards savings or debt repayment as it comes in. This conservative approach prevents overspending and builds a buffer.

Taking the initiative to establish and diligently maintain your own financial roadmap is perhaps one of the most impactful steps you can take toward securing your financial future. It removes the guesswork from money management, replacing it with clarity, intentionality, and a tangible path toward your aspirations. This isn’t just about cutting costs; it’s about optimizing your resources to create the life you envision, free from the constant worry about your finances.

Embrace the power of knowing exactly where you stand and where you’re headed. By taking the initiative to create and diligently use a Personal Financial Plan Budget Template, you’re not just tracking money; you’re building a foundation for a prosperous future, empowering yourself to make smart choices that compound into lasting financial security and peace of mind. Start today, and watch your financial landscape transform.