Embarking on a commercial construction project is an endeavor of monumental scale, often involving millions of dollars, intricate logistics, and a multitude of stakeholders. From groundbreaking to final inspections, every decision, every material purchase, and every labor hour contributes to the project’s overall financial health. Without a robust financial roadmap, even the most promising ventures can quickly veer off course, leading to costly delays, strained relationships, and ultimately, a compromised bottom line. The sheer complexity demands meticulous foresight and unwavering financial discipline.

This is where a well-structured and comprehensive financial planning tool becomes indispensable. It’s not merely about listing expenses; it’s about strategic allocation, proactive risk management, and maintaining crystal-clear visibility into every penny spent. For developers, general contractors, and project managers, having a clear, adaptable framework for managing project finances is not just a best practice—it’s the bedrock of successful project delivery.

The Imperative of Precise Financial Planning in Commercial Construction

Commercial construction projects are inherently complex. They involve a vast array of variables, from fluctuating material costs and labor rates to unforeseen site conditions and evolving regulatory requirements. A single commercial building, whether an office tower, a retail complex, or an industrial facility, represents a significant capital investment. Mismanagement of its financial aspects can have cascading negative effects, impacting not only the project owner but also contractors, subcontractors, and future occupants. Precise financial planning serves as the primary defense against common pitfalls like scope creep, unexpected cost increases, and schedule overruns, which can quickly erode profit margins and damage reputations.

Understanding the unique financial landscape of each commercial build is crucial. This landscape includes everything from preliminary due diligence and land acquisition to design, permitting, construction, and post-construction operational readiness. Each phase presents its own set of costs and financial challenges, necessitating a tool that can capture, categorize, and track these expenses in a coherent and actionable manner.

Understanding the Core Purpose of a Commercial Construction Project Budget Template

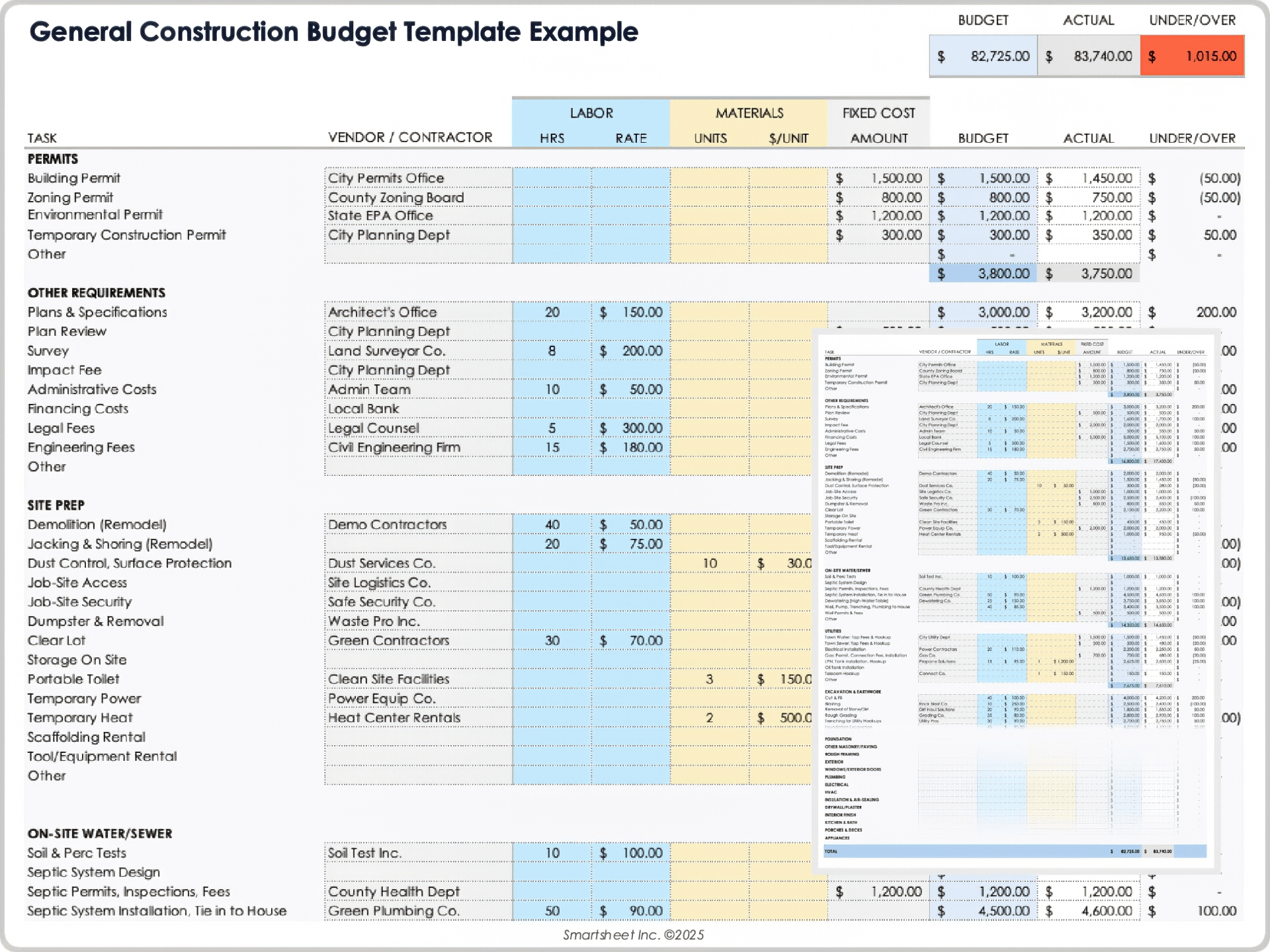

At its heart, a **Commercial Construction Project Budget Template** is more than just a spreadsheet; it’s a dynamic financial blueprint that guides the entire project from inception to completion. It serves as a centralized hub for all financial data, offering a structured way to estimate, allocate, and monitor funds across every phase and element of construction. Its primary purpose is to provide a comprehensive overview of anticipated costs, compare them against actual expenditures, and facilitate informed decision-making throughout the project lifecycle.

By utilizing a detailed budget framework, project teams can establish realistic financial goals, communicate effectively with stakeholders, and maintain control over spending. It acts as a critical communication tool, ensuring everyone from the project owner to the site superintendent is aligned on financial targets and understands the implications of every financial decision. Ultimately, it transforms financial uncertainty into a strategic advantage, enabling projects to stay on track and within financial parameters.

Key Benefits of Adopting a Robust Budget Framework

Implementing a comprehensive financial model for your commercial builds offers a multitude of benefits that extend beyond mere cost tracking. These advantages contribute significantly to overall project success and long-term financial health.

- Enhanced Cost Control: A detailed project budget template allows for granular tracking of all expenses, helping to identify and mitigate potential cost overruns before they escalate. It provides a baseline against which all expenditures are measured.

- Improved Risk Mitigation: By meticulously planning for various cost categories, including contingencies, project teams can anticipate and prepare for financial risks associated with material price fluctuations, labor shortages, or unforeseen site conditions.

- Informed Decision-Making: With real-time financial data at your fingertips, project managers can make data-driven decisions regarding resource allocation, material choices, and subcontractor selection, optimizing value without sacrificing quality.

- Increased Stakeholder Confidence: A transparent and well-managed financial plan instills confidence in investors, lenders, and clients, demonstrating professionalism and a clear path to project profitability and success.

- Greater Operational Efficiency: A standardized project budgeting tool streamlines financial processes, reduces administrative overhead, and allows teams to focus more on construction execution rather than scrambling to track costs.

- Clear Accountability: By assigning specific budget line items to various team members or departments, a budget framework fosters accountability, ensuring that spending remains within allocated limits.

Essential Components of an Effective Project Budget Template

To be truly effective, a commercial project budget must be comprehensive, breaking down costs into logical and manageable categories. While specific line items will vary by project type and scope, a robust template generally includes the following key components:

- Preliminary & Acquisition Costs:

- Land/Site Acquisition: Purchase price, broker fees, title insurance.

- Due Diligence: Environmental studies, geotechnical reports, surveys.

- Permits & Fees: Building permits, zoning fees, impact fees.

- Design & Engineering: Architectural, structural, mechanical, electrical, plumbing (MEP) fees.

- Direct Construction Costs:

- Materials: Lumber, concrete, steel, drywall, roofing, finishes, fixtures.

- Labor: Wages for on-site personnel, including general laborers, skilled trades, and superintendents.

- Equipment Rental/Purchase: Cranes, excavators, forklifts, specialized tools.

- Subcontractor Costs: Detailed bids for specialized trades like electrical, plumbing, HVAC, landscaping.

- Indirect Construction Costs (Soft Costs):

- Project Management: Salaries for project managers, administrative staff, office overhead.

- Insurance & Bonds: General liability, builder’s risk, performance bonds.

- Temporary Facilities: On-site offices, utilities, security.

- Site Logistics: Fencing, signage, waste removal, temporary access roads.

- Safety Measures: Personal protective equipment (PPE), safety training, first aid.

- Contingency Funds: An allocated percentage (typically 5-15%) of the total project cost to cover unforeseen expenses, change orders, and unexpected challenges. This is a critical buffer.

- Financing Costs: Loan interest, commitment fees, legal fees associated with financing.

- Marketing & Sales Costs: For speculative developments, this includes advertising, brokerage fees, and marketing materials.

- Owner’s Costs: Any expenses borne directly by the owner that are not covered by the general contractor, such as furniture, fixtures, and equipment (FF&E) or specialized IT infrastructure.

- Profit Margin: The expected return on investment for the project owner or contractor, built into the overall budget.

Practical Steps for Developing and Utilizing Your Project Budget

Creating a detailed and accurate construction spending plan requires a methodical approach. It’s an iterative process that begins early and continues throughout the project.

- Gather Comprehensive Data: Start by collecting all available information, including architectural plans, engineering specifications, site surveys, and preliminary bids from subcontractors and suppliers. Leverage historical data from similar past projects to inform your estimates.

- Break Down the Project: Divide the project into smaller, manageable work packages or phases. This allows for a more granular estimation of costs for each component.

- Obtain Multiple Bids: For significant cost categories, especially those involving subcontractors or major material purchases, solicit at least three competitive bids to ensure you are getting fair market value.

- Allocate Contingency: Always include a dedicated contingency fund. The exact percentage will depend on the project’s complexity, novelty, and inherent risks. For highly unique or complex projects, a higher contingency is prudent.

- Develop Cash Flow Projections: Beyond a static budget, create a cash flow forecast that outlines when money will be needed over the project timeline. This is crucial for managing working capital and financing.

- Implement Regular Monitoring and Reporting: Establish a routine for tracking actual expenditures against the budgeted amounts. Weekly or bi-weekly financial reviews are essential.

- Conduct Variance Analysis: Regularly compare actual costs to budgeted costs. Understand the reasons for any variances and take corrective action promptly. This might involve re-estimating future costs, negotiating better deals, or adjusting the project scope.

- Utilize a comprehensive construction budget template: Leverage the structure of your chosen financial model to organize all data, streamline input, and generate insightful reports. This ensures consistency and accuracy across all financial aspects.

Customization and Evolution: Adapting Your Financial Model

No two commercial construction projects are identical. A template, while providing a strong foundation, must be flexible enough to be tailored to the unique characteristics of each endeavor. Whether you’re building a multi-story office building, a sprawling retail center, or a specialized manufacturing plant, the details within your budget framework will need adjustment. This customization might involve adding specific line items for unique materials, specialized equipment, or particular regulatory compliance costs relevant to the project’s industry or location.

Furthermore, a project budget isn’t a static document; it’s a living financial model that evolves as the project progresses. Market conditions can change, design modifications may occur, and unforeseen challenges will inevitably arise. Regular reviews, updates, and re-forecasting are critical to maintaining its accuracy and relevance. Integrating the project budget with other project management software, accounting systems, and procurement platforms can enhance its dynamic capabilities, offering real-time insights and enabling agile financial adjustments throughout the construction lifecycle.

Avoiding Common Budgeting Pitfalls

Even with the best intentions, several common mistakes can derail a project budget. Awareness of these pitfalls is the first step in avoiding them:

- Insufficient Contingency: Underestimating the need for buffer funds is one of the most frequent errors, leaving no room for unexpected issues.

- Lack of Detailed Bids: Relying on general estimates rather than granular, firm bids from subcontractors can lead to significant discrepancies.

- Ignoring Scope Creep: Allowing the project’s scope to expand without adjusting the budget accordingly is a surefire way to exceed financial limits.

- Overlooking Soft Costs: Focusing solely on direct construction costs and forgetting about indirect expenses like legal fees, insurance, and administrative overhead.

- Poor Communication: Inadequate communication among the project team, stakeholders, and financial managers regarding budget changes or potential overruns.

- Failure to Track Regularly: Creating a budget but not consistently monitoring actual vs. planned expenditures renders the entire exercise useless.

- Not Accounting for Inflation/Market Fluctuations: For long-duration projects, ignoring potential changes in material costs or labor rates can severely impact the budget.

Frequently Asked Questions

How often should a construction project budget be reviewed?

A project budget should be reviewed at least monthly, but for large or complex projects, weekly reviews are often advisable. This allows for timely identification of variances and proactive adjustments to keep the project on track.

What’s the typical contingency percentage for commercial projects?

Contingency percentages typically range from 5% to 15% of the total project cost. The exact percentage depends on the project’s complexity, known risks, and the level of detail in the initial estimates. Highly innovative or risky projects may warrant a higher contingency.

Can a budget template help with securing financing?

Absolutely. Lenders and investors require a detailed and credible financial plan before committing funds. A well-prepared project financial model demonstrates foresight, risk management, and a clear understanding of the project’s financial viability, significantly increasing the chances of securing financing.

Is software necessary, or can I use a spreadsheet?

While a robust spreadsheet can serve as an effective project budget template for many projects, specialized construction project management software often offers enhanced features like integration with scheduling, accounting, and reporting tools. The choice depends on the project’s scale, complexity, and the team’s familiarity with the tools.

What is the difference between direct and indirect costs?

Direct costs are expenses directly attributable to the physical construction of the project, such as materials, on-site labor wages, and equipment rental. Indirect costs (or soft costs) are expenses necessary to support the project but not directly incorporated into the physical structure, including project management salaries, insurance, permits, and temporary facilities.

In the demanding world of commercial construction, successful project delivery hinges on more than just skilled labor and quality materials; it fundamentally relies on astute financial management. A meticulously crafted and diligently maintained budget is the compass that guides every financial decision, ensuring that resources are allocated effectively, risks are mitigated, and the project remains financially sound from conception to completion.

Embracing a structured approach to your project finances transforms potential chaos into a predictable and controlled process. It empowers project teams with the insights needed to navigate economic shifts, unforeseen challenges, and evolving stakeholder expectations with confidence and precision. Investing time and effort into developing a robust financial planning framework is not an expenditure; it’s an investment in the long-term success and profitability of your commercial construction ventures.

By leveraging a comprehensive financial outline, project owners and contractors can move forward with clarity, securing both the financial stability and the sterling reputation that are the hallmarks of excellence in the commercial construction industry. Make financial foresight your competitive advantage, and build not just structures, but legacies of success.