Creating a professional invoice might seem daunting, but it doesn’t have to be! A simple invoice format is key to getting paid on time and maintaining a good relationship with your clients. This guide will walk you through the essential elements of a clear and concise invoice that will impress your clients and streamline your invoicing process.

1. Invoice Number and Date

Every invoice needs a unique number for easy tracking and reference. You can use a simple numbering system (e.g., INV-001, INV-002) or a more complex system that includes the year (e.g., 2024-001).

2. Client Information

Client Name: Clearly state the full name or business name of your client.

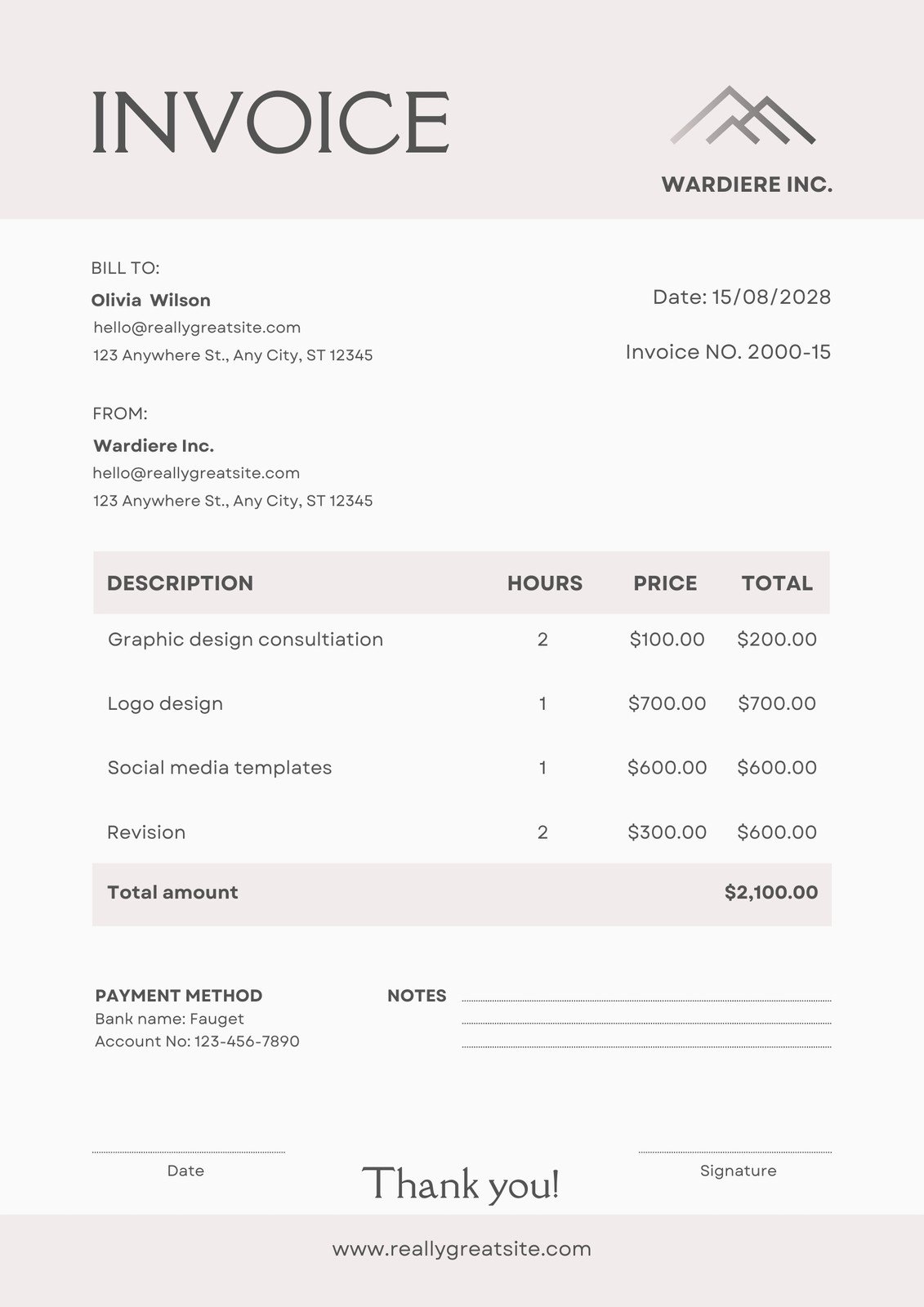

Image Source: canva.com

3. Invoice To (Your Information)

Your Business Name: Include the name of your business or your full legal name if you are a sole proprietor.

4. Invoice Date and Due Date

Invoice Date: The date the invoice was created.

5. Description of Services

This is the heart of your invoice.

6. Taxes and Fees

If applicable, include any applicable taxes (e.g., sales tax, VAT).

7. Total Amount Due

8. Payment Methods

Specify the accepted payment methods:

9. Invoice Notes (Optional)

This section is for any additional notes or instructions.

10. Professionalism and Clarity

Use a professional and easy-to-read font.

Conclusion

By following this simple invoice format, you can create professional and effective invoices that get paid quickly. Remember to keep your invoices organized and easily accessible for both you and your clients. Consider using invoicing software to streamline the process and save time.

FAQs

What is the best way to send invoices to clients?

You can send invoices electronically via email, through online invoicing platforms, or through client portals. For physical invoices, you can mail them or hand-deliver them.

Should I include a late fee on my invoices?

Including a late fee on your invoices can encourage timely payments. However, clearly state your late fee policy in advance to avoid any misunderstandings with your clients.

How can I track invoice payments?

Use a spreadsheet or invoicing software to track which invoices have been paid and which are still outstanding.

Can I use a template for my invoices?

Yes, using an invoice template can save you time and ensure consistency in your invoicing. Many word processing programs and online tools offer customizable invoice templates.

What are the benefits of using invoicing software?

Invoicing software can automate many aspects of the invoicing process, such as sending invoices, tracking payments, and generating reports. It can also help you save time and reduce errors.

Simple Invoice Format