Navigating the financial landscape of a nonprofit organization can often feel like steering a ship through a perpetual storm. Resources are frequently scarce, donor expectations are high, and the need to deliver on a crucial mission is paramount. Without a clear financial roadmap, even the most dedicated organizations can struggle to allocate funds effectively, demonstrate accountability, and plan for sustainable growth. This is where a robust financial planning tool becomes not just helpful, but absolutely indispensable for long-term success and mission fulfillment.

Imagine having a comprehensive, adaptable blueprint that details every income stream and every planned expenditure for an entire fiscal year. This isn’t merely about tracking money; it’s about strategic foresight, transparent governance, and empowered decision-making. A well-constructed financial framework provides clarity to your board, confidence to your donors, and stability to your operations. It transforms abstract financial data into actionable insights, ensuring every dollar supports your organization’s vital work.

The Unseen Power of a Well-Crafted Budget

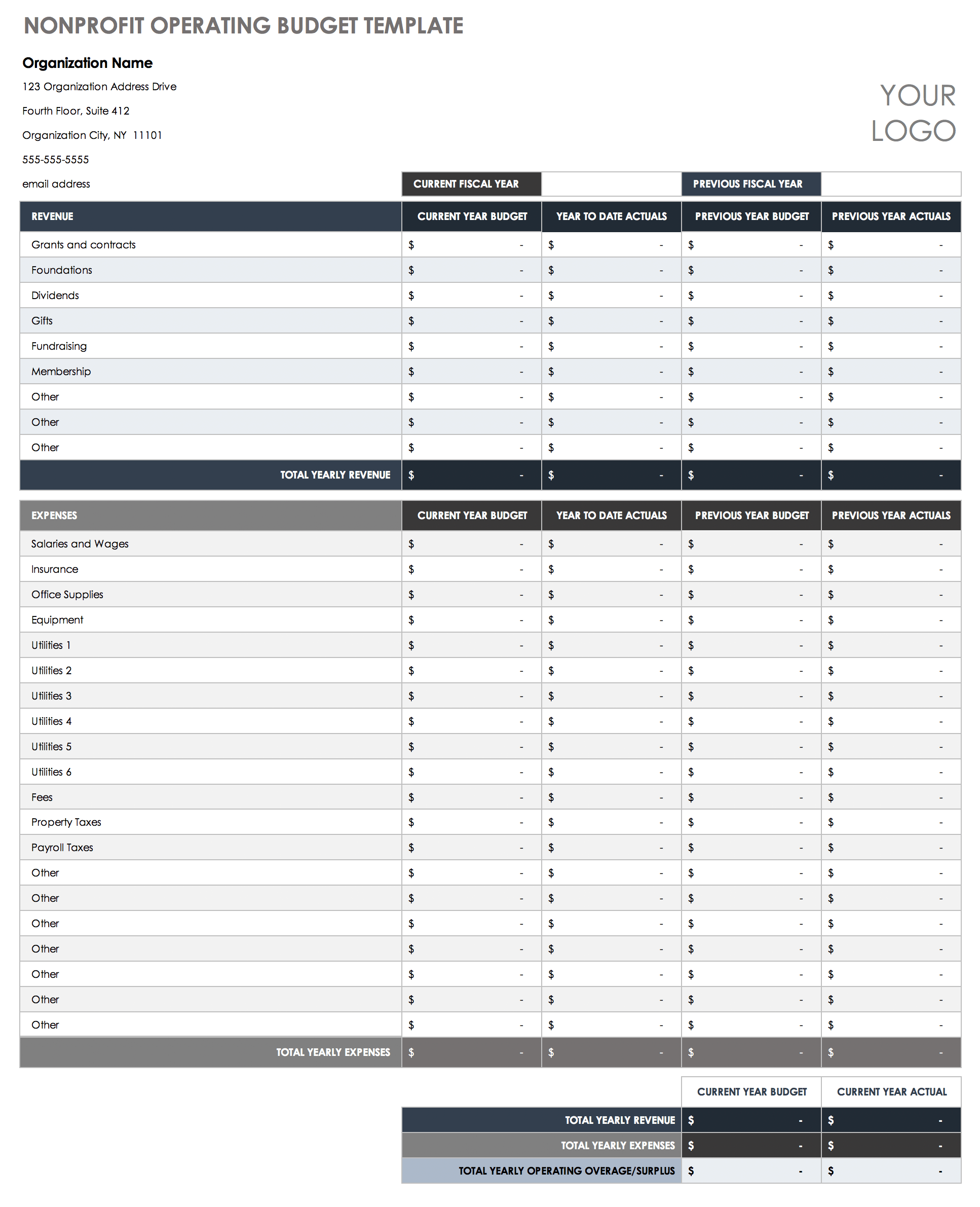

An effective annual operating budget for nonprofits is far more than a simple spreadsheet; it’s a living document that reflects an organization’s strategic priorities and operational realities. It serves as a vital communication tool, translating your mission into measurable financial terms. For board members, it offers clear oversight and enables informed governance decisions. For staff, it provides clear spending parameters and accountability. For potential funders, it demonstrates fiscal responsibility and a thoughtful approach to resource management, significantly increasing confidence in your organization’s ability to achieve its goals.

This critical financial document helps identify potential funding gaps before they become crises, allowing leadership to proactively seek additional support or adjust programs as needed. It also supports sound internal controls by establishing clear guidelines for expenditures, minimizing the risk of mismanagement or fraud. Ultimately, a detailed organizational spending plan empowers your nonprofit to operate with greater efficiency, transparency, and a higher probability of sustaining its impact for years to come.

Key Components of an Effective Operating Budget

A comprehensive nonprofit budget template should meticulously detail both revenue and expenses, offering a granular view of your financial health. Understanding these core components is essential for any organization aiming for financial stability and strategic growth. Each element plays a crucial role in painting an accurate picture of your financial capacity and needs.

Revenue Streams

These are the lifeblood of your organization, encompassing all the ways funds are generated. A good annual budget framework will itemize each source, often forecasting amounts based on historical data and fundraising plans.

- **Grants:** Funding secured from foundations, corporations, or government agencies.

- **Individual Donations:** Contributions from private donors, including one-time gifts and recurring pledges.

- **Special Events:** Income generated from fundraising galas, races, silent auctions, etc., net of event costs.

- **Program Service Fees:** Revenue from services rendered, such as tuition, workshop fees, or consulting.

- **Membership Dues:** Regular payments from members in exchange for benefits or support.

- **Investment Income:** Earnings from endowments or other invested funds.

- **In-Kind Contributions:** Non-cash donations of goods or services, which may be reflected for financial planning and reporting purposes (though not always in the core operating budget for cash flow).

Expenditures

These are the costs associated with running your organization and delivering on your mission. Breaking down expenses helps in identifying areas for cost-saving and ensuring resources are aligned with strategic priorities.

- **Program Expenses:** Costs directly related to delivering your mission and services.

- **Staff Salaries & Benefits:** Compensation for program-specific personnel.

- **Supplies & Materials:** Resources used directly in programs.

- **Travel & Training:** Costs for program staff development or site visits.

- **Administrative Expenses:** Costs related to the overall management and general operations.

- **Executive Salaries & Benefits:** Compensation for leadership and administrative staff.

- **Office Rent & Utilities:** Facilities costs.

- **Insurance:** Coverage for property, liability, and other operational risks.

- **Professional Fees:** Legal, accounting, or consulting services.

- **Office Supplies & Equipment:** General operational needs.

- **Fundraising Expenses:** Costs incurred to generate financial support.

- **Fundraising Staff Salaries & Benefits:** Compensation for development personnel.

- **Marketing & Communications:** Costs for donor appeals, campaigns, and awareness.

- **Event Costs:** Expenses for special fundraising events (venue, catering, entertainment).

- **Depreciation:** Non-cash expense reflecting the decline in value of assets over time.

Building Your Annual Operating Plan: A Step-by-Step Approach

Creating a solid yearly financial blueprint requires a systematic approach, involving careful planning, collaboration, and review. It’s an iterative process that benefits from input across various departments, not just the finance team.

- Review Past Performance: Start by analyzing previous years’ budgets versus actual results. What were the variances? Why did they occur? This historical context is invaluable for making realistic projections.

- Define Strategic Goals: What are your organization’s key objectives for the upcoming year? The budget should directly support these goals, allocating resources where they will have the greatest impact.

- Estimate Revenue: Based on fundraising plans, grant pipelines, historical giving trends, and program projections, forecast your anticipated income streams with a healthy dose of realism.

- Project Expenses: Work with department heads to estimate their operational needs. Break down costs into fixed (e.g., rent) and variable (e.g., program supplies) categories. Don’t forget to account for inflation or anticipated changes in services.

- Balance the Budget: Ideally, projected revenues should meet or exceed projected expenses. If there’s a deficit, revisit expense categories for potential reductions or identify new revenue opportunities. If there’s a surplus, consider how to allocate it strategically (e.g., reserves, new initiatives).

- Seek Internal Review: Circulate the draft budget among key stakeholders, including program directors, the executive team, and the finance committee. Their input can identify overlooked items or suggest efficiencies.

- Board Approval: Present the finalized financial plan to your board of directors for formal approval. This step ensures alignment and accountability at the highest level.

- Monitor and Adjust: Once approved, the budget isn’t static. Regularly compare actual revenues and expenses against the budget. Be prepared to make adjustments throughout the year as circumstances change.

Leveraging Your Budget for Strategic Growth and Accountability

A well-developed nonprofit annual operating budget template isn’t just a compliance document; it’s a powerful engine for strategic growth and enhanced accountability. By consistently measuring actual performance against your financial strategy, you gain insights that inform future decisions and strengthen stakeholder trust. This constant comparison allows your leadership to pinpoint areas of overspending or underspending, assess the effectiveness of programs, and make data-driven decisions about resource allocation.

For funders, a clear and well-managed organizational spending plan demonstrates your commitment to fiscal responsibility and efficient use of their contributions. It builds confidence that their investment is making a tangible difference. Internally, it fosters a culture of accountability, where every department and team member understands their financial parameters and their role in achieving the organization’s broader financial health. Beyond mere tracking, it becomes a dynamic tool for scenario planning, allowing you to model the financial implications of expanding a program, launching a new initiative, or responding to unforeseen challenges.

Common Pitfalls and How to Avoid Them

Even with the best intentions, creating and managing a yearly financial blueprint can present challenges. Recognizing common pitfalls allows organizations to proactively build more robust and realistic budgets. One frequent mistake is overly optimistic revenue projections, often driven by hope rather than historical data or confirmed pledges. This can lead to budget shortfalls and difficult decisions mid-year. Conversely, underestimating expenses, especially hidden costs like professional development or technology upgrades, can also destabilize your financial outlook.

Another pitfall is failing to involve key stakeholders in the budgeting process. When department heads and program managers aren’t consulted, the budget may not accurately reflect their operational needs, leading to friction and non-compliance. A static budget, one that isn’t regularly reviewed and adjusted, also loses its utility quickly in the face of changing realities. Finally, neglecting to build in a contingency fund for unexpected emergencies leaves an organization vulnerable to financial shocks. To avoid these issues, prioritize realism in projections, ensure broad participation, implement quarterly reviews, and always allocate a reserve fund.

Customizing Your Financial Blueprint

While a general nonprofit budget template provides an excellent starting point, true effectiveness comes from adapting it to your organization’s unique structure, mission, and funding model. Every charity financial plan should reflect the specific nuances of its operations, whether it’s a small, all-volunteer organization or a large entity with multiple programs and staff. Think about the level of detail required – a smaller nonprofit might need less granularity than one managing complex government grants.

Consider your primary revenue streams. If your organization relies heavily on individual donors, your template should have robust sections for tracking different types of gifts and fundraising campaign results. If you primarily receive grants, ensure ample space for specific grant deliverables and associated expenses. The organizational spending plan should also align with your accounting software capabilities, making data entry and reporting seamless. Don’t hesitate to add categories, remove irrelevant ones, or modify calculation methods to perfectly suit your needs. A flexible template is a powerful one, evolving alongside your organization.

Frequently Asked Questions

Why is an annual operating budget so crucial for nonprofits?

An annual operating budget is crucial because it provides a clear financial roadmap for the entire year, enabling strategic decision-making, ensuring fiscal accountability to donors and the board, identifying potential funding gaps, and helping to align spending with the organization’s mission and goals. It’s a foundational tool for financial health and sustainability.

How often should a nonprofit budget be reviewed and updated?

While an annual budget is set for the fiscal year, it should be reviewed at least monthly or quarterly by leadership and the board to compare actual performance against projections. Significant variances may necessitate minor adjustments, and a comprehensive review should occur annually to prepare for the next fiscal year.

What’s the difference between an operating budget and a capital budget?

An operating budget covers the day-to-day revenues and expenses required to run the organization’s programs and administration for a specific fiscal year (e.g., salaries, rent, program supplies). A capital budget, on the other hand, deals with large, long-term investments in assets like buildings, vehicles, or major equipment, which have a useful life of more than one year.

Should a contingency fund be included in the annual operating budget?

Absolutely. Including a contingency fund, typically 5-10% of total expenses, is a best practice. This reserve provides a buffer for unexpected costs, unforeseen challenges, or temporary dips in revenue, allowing the organization to maintain operations without immediately facing a crisis.

Who should be involved in the nonprofit budgeting process?

The budgeting process should involve key stakeholders from across the organization. This typically includes the executive director, finance director, program managers, development/fundraising staff, and members of the finance committee or board. Broad involvement ensures accuracy, buy-in, and a more comprehensive financial plan.

Developing and maintaining a robust nonprofit annual operating budget template is more than a financial exercise; it’s a profound commitment to your organization’s mission and the community you serve. It transforms uncertainty into clarity, allowing your team to focus their energy on delivering impactful programs rather than constantly worrying about financial stability. This essential tool provides the framework for responsible stewardship, transparent operations, and sustainable growth, ensuring that every resource is utilized to its fullest potential.

Embrace the power of a meticulously planned yearly financial blueprint. It will not only streamline your financial management but also empower your leadership with the insights needed to make informed decisions, secure vital funding, and ultimately, amplify your positive change in the world. By adopting a proactive and adaptable approach to your financial strategy, your nonprofit can build a stronger, more resilient future, ensuring your mission continues to thrive for years to come.