Navigating college life is an exciting journey filled with new experiences, academic challenges, and burgeoning independence. Amidst the thrill of campus life and late-night study sessions, one crucial aspect often gets overlooked until it becomes a source of stress: managing your finances. For many students, this marks their first real foray into financial independence, and without a clear roadmap, it’s easy to feel overwhelmed by expenses ranging from tuition and textbooks to daily coffee runs and social outings.

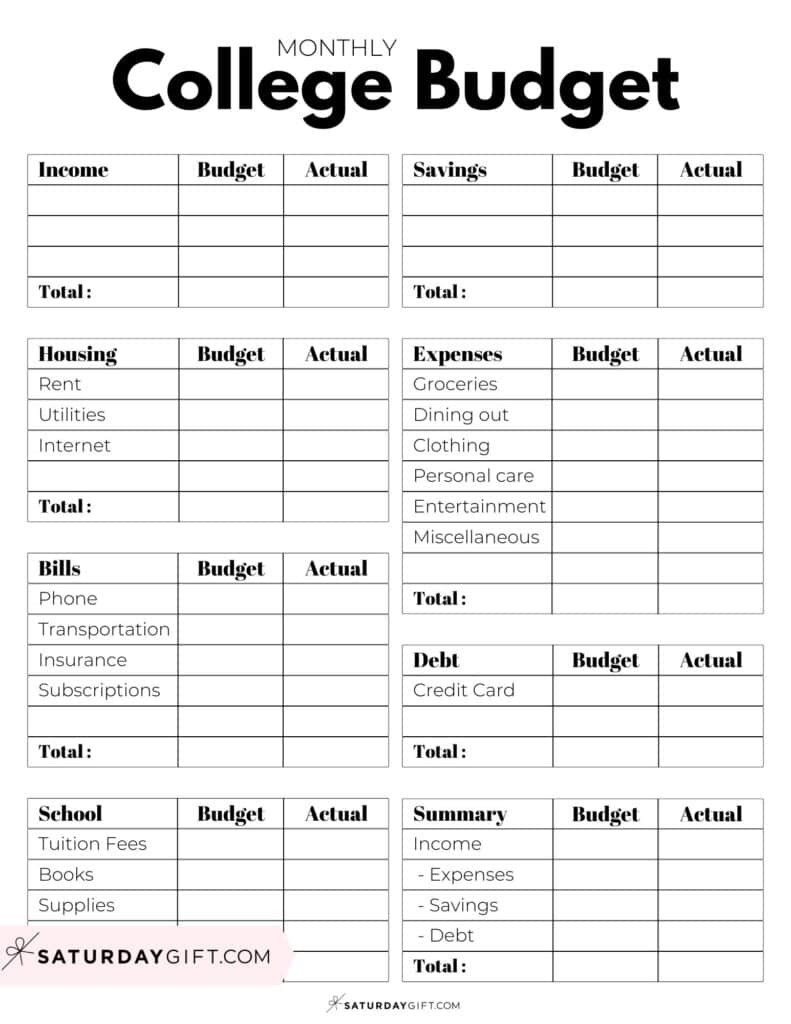

This is where a robust financial tool, such as a well-designed College Student Budget Template, becomes not just helpful, but essential. It serves as your personal financial compass, guiding you through the often-murky waters of income and expenditure. By providing a structured framework, it helps you visualize where your money comes from and, more importantly, where it goes, empowering you to make informed decisions that support both your academic success and your overall well-being without falling into unnecessary debt.

Why Every College Student Needs a Financial Game Plan

The transition to college often brings a significant shift in financial responsibility. Suddenly, you’re not just thinking about pocket money; you’re faced with substantial costs and the need to make your resources last. A financial game plan isn’t about restricting yourself; it’s about gaining control, reducing stress, and building a foundation for future financial health.

Having a clear student spending plan allows you to prioritize needs over wants, identify areas where you can save, and avoid the common pitfalls of overspending. It helps prevent those dreaded "I don’t know where my money went" moments, giving you peace of mind and the freedom to enjoy your college experience without constant money worries. Ultimately, it’s a proactive step towards greater financial literacy and independence.

The Core Components of Your Student Spending Plan

Any effective financial plan for college revolves around two fundamental categories: income and expenses. Understanding what money you have coming in and what money you have going out is the first step toward creating a balanced budget. It’s a simple concept, but the details make all the difference.

Your income sources might be varied and potentially inconsistent, making careful tracking even more important. Conversely, expenses can range from fixed, predictable costs to highly variable, discretionary spending.

Typical income streams for college students often include:

- Scholarships and Grants: Funds that don’t need to be repaid.

- Student Loans: Money borrowed for educational expenses.

- Part-Time Job Earnings: Income from campus jobs or local employment.

- Parental Contributions: Regular allowances or ad-hoc financial support.

- Savings: Funds you’ve accumulated prior to college.

- Financial Aid Refunds: Leftover aid after tuition and fees are paid.

On the expense side, you’ll need to account for everything from your major educational costs to your daily living expenses. These can be broken down into fixed costs, which generally stay the same each month, and variable costs, which fluctuate based on your choices.

Building Your Personalized Spending Framework

Creating a student financial template involves more than just jotting down numbers; it’s about establishing a system that works for your unique situation. This personalized spending framework will adapt as your college journey progresses, helping you stay on track through different semesters and life changes. The key is to be honest with yourself about your habits and realistic about your capabilities.

Follow these steps to construct a robust financial guide for students:

- Gather Your Financial Data: Collect all statements, pay stubs, loan agreements, and financial aid award letters. Understand your total available funds and your regular income.

- Identify All Income Streams: List every source of money you expect to receive, whether it’s weekly, monthly, or per semester. Be as accurate as possible with the amounts.

- Categorize Your Expenses: Divide your spending into clear categories. Start with the major fixed expenses like tuition, housing, and insurance. Then move to variable costs such as groceries, transportation, and entertainment.

- Track Your Spending Diligently: For at least one month, meticulously record every dollar you spend. This step is crucial for understanding your actual habits versus your perceived ones. Use an app, a spreadsheet, or a notebook – whatever is easiest for you.

- Analyze and Adjust Regularly: At the end of each month (or another chosen period), compare your actual spending to your budgeted amounts. Identify where you overspent or underspent and make necessary adjustments to your future plan. This ongoing review is vital for success.

Essential Categories for Your College Spending Blueprint

To make your financial planning effective, it’s helpful to break down expenses into specific, actionable categories. This detailed approach allows for greater clarity and helps you pinpoint where your money is truly going. A comprehensive College Student Budget Template will have spaces for all these critical areas, ensuring nothing falls through the cracks.

Consider these key expense categories when developing your college spending blueprint:

- Tuition and Fees: This is often the largest expense. Include all university-mandated charges, not just the base tuition.

- Housing: Whether it’s dorm fees, off-campus rent, utilities (electricity, internet, water), or renter’s insurance.

- Food: Meal plans, groceries for cooking at home, dining out with friends, coffee, and snacks. This is often a highly variable category.

- Textbooks and Supplies: New or used textbooks, e-books, lab fees, notebooks, pens, and software. These costs can add up quickly each semester.

- Transportation: Gas, public transit passes, ride-sharing services, parking fees, and vehicle maintenance.

- Personal Care: Toiletries, haircuts, laundry supplies, and occasional personal shopping.

- Social & Entertainment: Movie tickets, concerts, campus events, nights out, streaming subscriptions, and hobbies. It’s important to budget for fun, but also to set limits.

- Health Insurance & Medical: Premiums if you’re not covered by a parent’s plan, co-pays, and prescription costs.

- Miscellaneous & Emergency Fund: A buffer for unexpected expenses like a lost item, a sudden trip home, or car repairs. Always aim to set aside a little extra.

Maximizing Your Financial Resources: Tips for Smarter Spending

Simply having a student budget isn’t enough; you also need strategies to make that budget work harder for you. Smart spending isn’t about deprivation, but about making conscious choices that align with your financial goals and values. These tips can help you stretch your dollars further and build healthier money habits.

Implement these practical approaches to enhance your college financial management:

- Track Every Dollar: Use budgeting apps like Mint or YNAB, a simple spreadsheet, or even a notebook. Knowing where your money goes is the first step to controlling it.

- Seek Student Discounts: Always ask if a student discount is available for services, stores, or entertainment. Your student ID is a powerful money-saving tool.

- Cook More at Home: Eating out frequently can quickly deplete your food budget. Meal prepping and cooking your own meals is significantly cheaper.

- Borrow or Buy Used Textbooks: Check the library, online marketplaces, or fellow students before buying new. Many textbooks are available for rent or as cheaper digital versions.

- Review and Limit Subscriptions: Take inventory of all your monthly subscriptions (streaming, music, apps). Cancel any that you don’t use regularly.

- Utilize Campus Resources: Take advantage of free campus events, the gym, student health services, and career counseling. These are often included in your tuition fees.

- Build an Emergency Fund (Even a Small One): Start by saving just a little bit each month. Having a buffer for unexpected costs can prevent you from going into debt.

- Use Public Transportation or Bike: If possible, reduce reliance on cars to save on gas, parking, and maintenance costs.

Beyond the Basics: Advanced Budgeting Strategies

Once you’ve mastered the fundamentals of tracking and categorizing expenses using a robust financial planning tool for students, you might be ready to explore more advanced strategies. These techniques can help you optimize your savings, manage debt effectively, and align your spending with broader financial goals. They represent the next step in becoming truly financially savvy.

Consider integrating these sophisticated approaches into your money management for college:

- The 50/30/20 Rule: Allocate 50% of your after-tax income to **needs** (housing, food, transport), 30% to **wants** (entertainment, dining out), and 20% to **savings and debt repayment**. This provides a balanced framework.

- Zero-Based Budgeting: Assign every dollar of your income a “job.” This means every dollar is allocated to an expense, savings, or debt. The goal is for income minus expenses to equal zero.

- Automate Savings: Set up automatic transfers from your checking account to a savings account each payday. This “pay yourself first” method ensures you save consistently before you have a chance to spend the money.

- Debt Management Strategies: If you have student loans or credit card debt, research strategies like the “debt snowball” or “debt avalanche” to pay off balances more efficiently. Prioritize high-interest debts.

- Invest in Yourself: Beyond academics, consider small investments in skills or resources that could enhance your future earning potential, such as certifications or online courses.

Frequently Asked Questions

How often should I update my student spending plan?

Ideally, you should review and update your student spending plan at least once a month. This allows you to compare actual spending against your budget, make necessary adjustments, and reflect any changes in income or expenses, such as new scholarships or a different part-time job.

What’s the best tool for managing a student budget?

The “best” tool depends on your personal preference. Many students find success with free options like Google Sheets or Microsoft Excel for a customizable spreadsheet-based approach. For automated tracking and categorization, popular budgeting apps like Mint, YNAB (You Need A Budget), or EveryDollar offer excellent features and can sync with your bank accounts.

What if I consistently overspend in one category?

If you find yourself consistently overspending in a particular category, take time to analyze why. Is your initial budget unrealistic for that area? Are there specific habits you need to change? You might need to adjust your budget by reallocating funds from other categories, finding ways to cut back in the problematic area, or increasing your income. It’s a learning process.

How can I build an emergency fund on a student income?

Building an emergency fund as a student can be challenging, but it’s crucial. Start small – even $5 or $10 a week adds up. Look for windfalls like birthday money or a bonus from your job and allocate a portion to savings. Cut back on discretionary spending like daily lattes or unnecessary subscriptions. Every little bit contributes to a vital financial safety net.

Is it okay to use a credit card as a student?

Using a credit card responsibly can be beneficial for building a credit history, which is essential for future loans (car, mortgage) and even some job applications. However, it requires extreme discipline. Only charge what you can afford to pay off in full each month to avoid interest charges and accumulating debt. If you’re prone to overspending, it might be best to stick with a debit card or cash.

Mastering your finances in college is one of the most valuable life skills you can acquire. It’s not about being rich, but about being responsible, informed, and empowered to make choices that serve your long-term goals. A well-utilized College Student Budget Template provides the structure and clarity needed to transform daunting financial tasks into manageable steps.

Embrace this opportunity to develop strong financial habits now, and you’ll reap the benefits for years to come. Don’t let financial stress overshadow your college experience. Take control, plan wisely, and lay the groundwork for a future of financial confidence and freedom. Your journey starts with a single step: taking charge of your money today.