Embarking on the journey of financial independence is a significant step, and for many high school students, it begins with understanding where their money comes from and, more importantly, where it goes. It’s a common misconception that managing finances is a skill reserved for adults, but the truth is, the earlier you start, the more prepared you’ll be for the complexities of college life, first jobs, and beyond. This article isn’t just about cutting costs; it’s about cultivating a mindset that empowers you to make informed financial decisions.

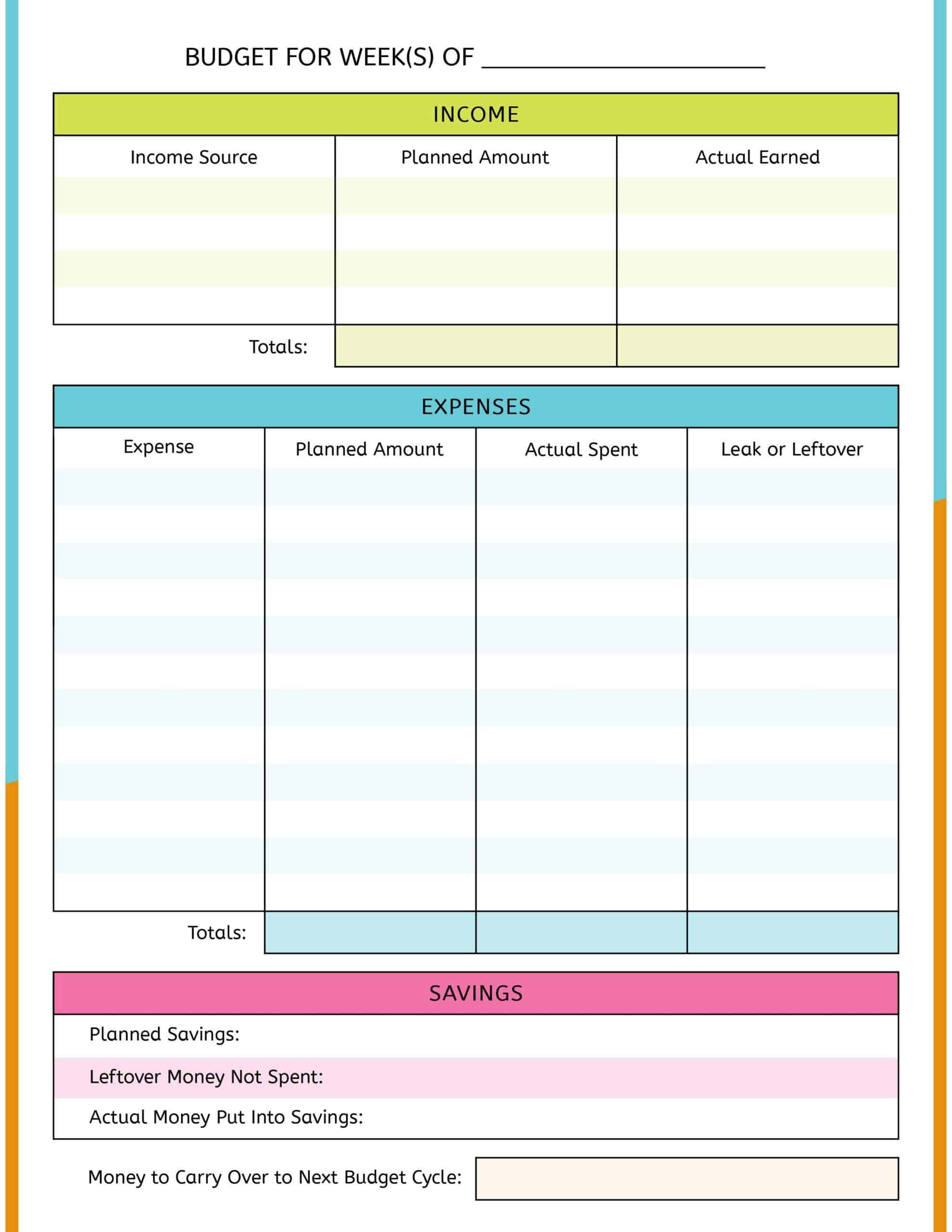

Imagine having a clear picture of your earnings and spending, enabling you to save for that concert ticket, a new video game, or even the down payment for your first car. That clarity is precisely what a well-structured High School Student Budget Template offers. It transforms abstract financial concepts into practical, manageable steps, giving you control and confidence over your cash flow. This isn’t about rigid restrictions; it’s about smart choices and understanding the value of your hard-earned dollars, setting the foundation for lifelong financial savvy.

Why Financial Literacy Starts Now: The Long-Term Benefits

Developing strong financial habits during your high school years isn’t just about immediate gratification; it’s an investment in your future. Learning to manage your money early equips you with critical skills that will serve you well in college, your career, and personal life. It teaches discipline, foresight, and the power of delayed gratification, all vital components of success. By understanding the basics of income and expenditure, you’re building a robust foundation for avoiding common financial pitfalls down the road, such as accumulating unnecessary debt.

Beyond simply tracking money, a solid financial plan for students helps cultivate a sense of responsibility and independence. It allows you to set and achieve financial goals, whether it’s saving for a study abroad trip, college application fees, or even contributing to household expenses. This practical experience far outweighs any textbook lesson, providing real-world insights into the value of work, the impact of spending choices, and the satisfaction of reaching financial milestones through careful planning.

Understanding Your Income Streams

Before you can plan how to spend or save, you need to know how much money you actually have coming in. For high school students, income can come from a variety of sources, and it’s important to account for all of them, whether they’re regular or sporadic. This clarity forms the bedrock of any effective spending plan.

Common income sources for students often include allowances from parents, earnings from a part-time job, money received as gifts for birthdays or holidays, or even income from odd jobs like babysitting, lawn mowing, or tutoring. It’s helpful to differentiate between consistent income (like a regular paycheck) and variable income (like occasional gifts), as this will influence how you allocate funds within your personal finance strategy. Listing out each source and its average monthly amount provides a realistic snapshot of your financial resources.

Tracking Your Expenses: Where Does Your Money Go?

Once you know your income, the next crucial step is to understand your spending habits. This can be the most eye-opening part of the budgeting process for many, revealing exactly where your money disappears to. Categorizing your expenses allows you to identify patterns, pinpoint areas where you might be overspending, and make conscious decisions about your financial priorities.

Expenses generally fall into two categories: fixed and variable. Fixed expenses are those that typically stay the same each month, such as a subscription service for streaming music or a monthly bus pass. Variable expenses fluctuate, like money spent on dining out, entertainment, shopping for clothes, or fuel for a car. It’s important to track both, even small purchases like snacks or coffee, as these "drip" expenses can add up significantly over time. Keeping a log, whether in a notebook, a spreadsheet, or a budgeting app, for a few weeks can give you invaluable insight into your actual spending behavior.

Crafting Your Personalized Spending Plan

With a clear understanding of your income and expenses, you’re ready to create your personalized financial blueprint. This isn’t about deprivation; it’s about intentional allocation of your funds to align with your goals and values. A robust student spending plan acts as a guide, helping you prioritize needs, allocate for wants, and consistently save for the future.

Start by listing your total monthly income. Then, subtract your fixed expenses. What remains is your discretionary income, which you’ll use to cover variable expenses and savings. The key here is to be realistic and honest with yourself. If you know you spend a certain amount on coffee with friends, factor that in. The goal is to create a plan that is sustainable and reflects your real-life habits, not an ideal that’s impossible to maintain. Allocate specific amounts to different spending categories, always remembering to designate a portion for savings, no matter how small it seems.

Key Elements of an Effective Student Budget

A useful financial framework for students doesn’t need to be overly complex, but it should include several essential components to be truly effective. These elements ensure you have a holistic view of your finances and can make informed decisions.

- Income Sources: List all money coming in, specifying whether it’s regular or occasional.

- Fixed Expenses: Categorize costs that are consistent monthly, like subscriptions, phone bills, or transport passes.

- Variable Expenses: Track spending that fluctuates, such as entertainment, dining out, and shopping.

- Savings Goals: Dedicate a specific amount towards future aspirations, whether short-term (e.g., a concert) or long-term (e.g., college).

- Emergency Fund: A small allocation for unexpected costs, like replacing a broken phone or urgent school supplies.

- "Fun Money": An allowance for guilt-free spending on wants, promoting balance and preventing burnout.

- Tracking Method: Choose a consistent way to monitor your finances, be it a spreadsheet, app, or notebook.

- Review Schedule: Plan to regularly check and adjust your budget to ensure it remains relevant.

Tips for Budgeting Success

Creating a personal spending plan is the first step; sticking to it is the real challenge. However, with a few practical strategies, you can make budgeting a sustainable and even enjoyable part of your financial routine. Consistency and adaptability are your best allies.

Firstly, make it a habit to review your finances regularly. This could be weekly or bi-weekly, just a quick check-in to see if you’re on track. Secondly, be flexible. Life happens, and your budget should be a living document that you adjust as your income or expenses change, not a rigid set of rules that leaves no room for error. If you overspend in one category, look for ways to cut back in another, or adjust your plan for the following month. Lastly, reward yourself for reaching financial milestones. This positive reinforcement can be incredibly motivating and make the process feel less restrictive and more rewarding.

Beyond the Numbers: Developing Smart Money Habits

While a structured spending plan provides the framework, the true power of financial management lies in developing lasting smart money habits. It’s not just about crunching numbers but understanding the psychological aspects of spending and saving. Learning to differentiate between needs and wants, for instance, is a critical skill that will serve you throughout your life.

Beyond simply saving, consider exploring basic concepts of investing, even with small amounts. Understanding how compound interest works, for example, can be a game-changer. Look for opportunities to earn extra income through side hustles, fostering an entrepreneurial spirit. Be mindful of consumer culture and the pressure to keep up with trends. Cultivating patience, avoiding impulse purchases, and prioritizing long-term goals over immediate gratification are all invaluable habits that transform you from a passive consumer into an active, empowered financial decision-maker.

Frequently Asked Questions

How often should I update my student budget?

Ideally, you should review your spending plan at least once a month to compare your actual spending with your planned allocations. However, a quick check-in weekly can help keep you on track and make monthly reviews less daunting. Adjustments should be made whenever there’s a significant change in your income or expenses.

What if I consistently go over budget in a specific category?

If you find yourself repeatedly overspending in a particular area, it’s a sign that your initial allocation might have been unrealistic. Instead of feeling guilty, adjust your budget to reflect your actual spending habits. You might need to reallocate funds from another category or look for ways to reduce spending in that problematic area.

Is it okay to use a budgeting app instead of a spreadsheet?

Absolutely! The best budgeting tool is the one you will actually use. Many high school students find budgeting apps more convenient and engaging, as they often offer automated tracking, visual charts, and reminders. Whether it’s an app, a spreadsheet, or a simple notebook, consistency is key.

Should I include money received as gifts in my budget?

Yes, it’s a good practice to include all money you receive, even gifts, in your overall financial overview. You can categorize it as a variable income. This helps you get a complete picture of your financial inflows and allows you to make conscious decisions about how to spend or save that money, rather than letting it disappear without a trace.

What’s the difference between saving and an emergency fund?

Savings are typically for planned future expenses or goals, like a new laptop, college tuition, or a specific trip. An emergency fund, on the other hand, is specifically for unexpected and necessary expenses, such as a medical bill, a repair, or replacing something essential that broke. It acts as a financial safety net to prevent you from going into debt when unforeseen costs arise.

Taking control of your finances as a high school student is one of the most empowering steps you can take towards a secure and independent future. It’s not just about managing money; it’s about learning self-discipline, goal setting, and the profound satisfaction that comes from achieving your financial aspirations. The skills you develop now, from tracking expenses to making informed spending choices, will serve as invaluable assets for the rest of your life.

Embrace the journey of financial literacy with curiosity and determination. Start small, be patient with yourself, and celebrate every victory, no matter how minor. By actively engaging with your personal finances today, you are laying the groundwork for a lifetime of smart financial decisions and unlocking a future where your money works for you, not against you.