A proforma invoice is essentially a preliminary bill. It provides an estimate of the costs associated with goods or services before a formal agreement is in place. Think of it as a “preview” of what the final invoice will look like.

Why Use a Proforma Invoice?

Get Client Approval: It allows clients to review and approve the costs before any work begins. This helps avoid any unexpected expenses down the line.

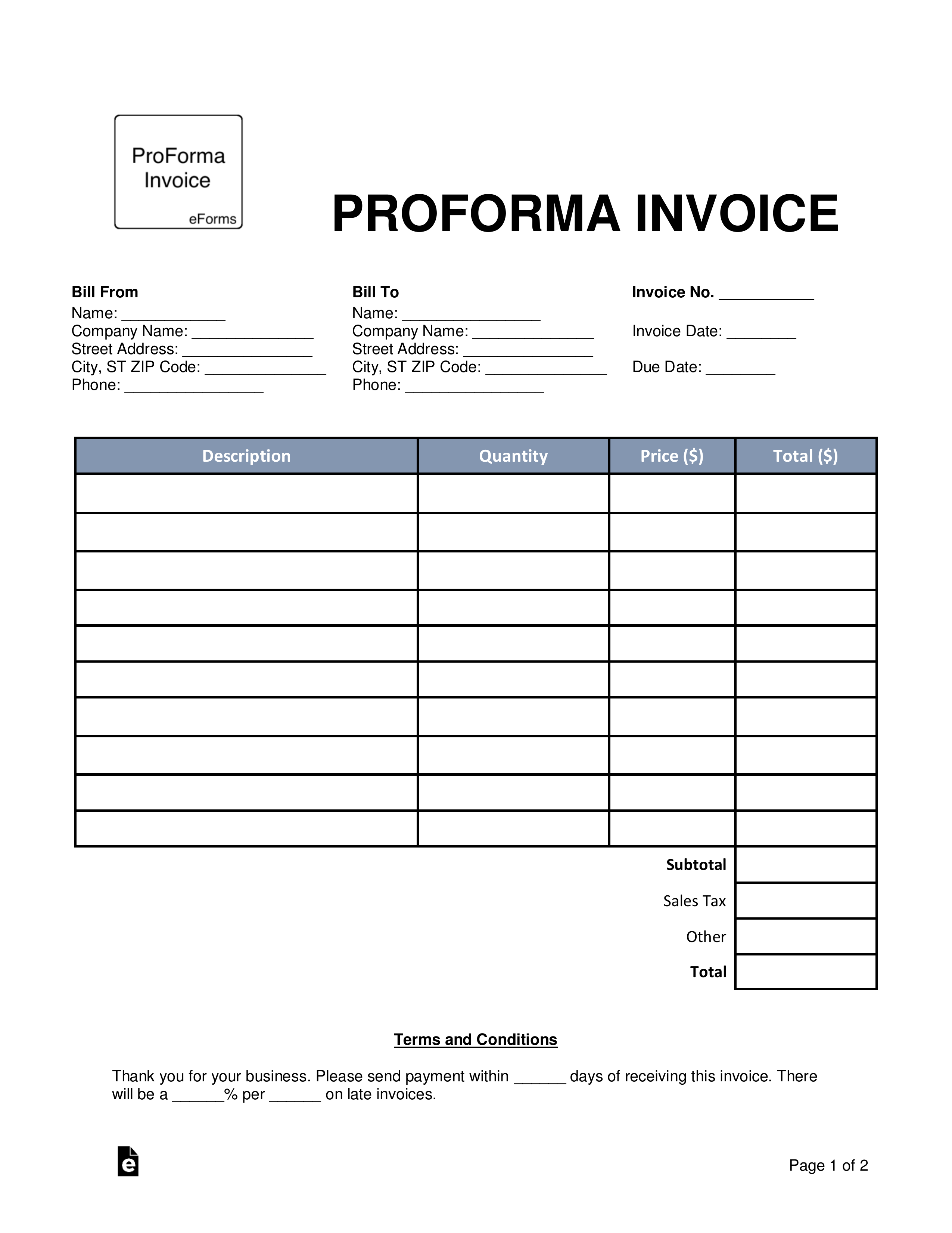

Key Elements of a Proforma Invoice

A typical proforma invoice should include the following:

Invoice Number

Image Source: eforms.com

A unique identifier for the invoice.

Invoice Date

The date the invoice is issued.

Customer Information

Company Name

Seller Information

Company Name

Shipping Information

Shipping Address

Payment Terms

Payment Due Date

Description of Goods or Services

Item Name

Taxes and Duties

Total Amount

The total amount due, including all taxes and shipping costs.

Validity Period

The period within which the proforma invoice is valid.

Example of a Simple Proforma Invoice

Proforma Invoice

Invoice No: PRO-001

Date: July 5, 2024

Customer: John Doe

Address: 123 Main St, Anytown, USA

Seller: ABC Company

Address: 456 Business Rd, Anytown, USA

Shipping Address: 123 Main St, Anytown, USA

Shipping Method: FedEx

Estimated Delivery: July 15, 2024

Payment Terms: Net 30 days

Description | Quantity | Unit Price | Total

—|—|—|—

Product A | 10 | $50.00 | $500.00

Product B | 5 | $20.00 | $100.00

Shipping | 1 | $50.00 | $50.00

Subtotal: | | | $650.00

Sales Tax (10%): | | | $65.00

Total: | | | $715.00

Validity Period: 30 days from the date of issue.

Creating a Proforma Invoice

You can create a proforma invoice using various methods:

Spreadsheet Software: Use software like Excel or Google Sheets to create a professional-looking invoice.

Tips for Creating Effective Proforma Invoices

Keep it Simple: Avoid overly complex language or formatting.

Conclusion

A proforma invoice is a valuable tool for businesses of all sizes. By using this preliminary bill, you can streamline the sales process, improve communication with clients, and minimize potential disputes. By following the guidelines outlined in this article, you can create professional and effective proforma invoices that will benefit your business.

FAQs

What is the difference between a proforma invoice and a commercial invoice?

A proforma invoice is a preliminary estimate of costs, while a commercial invoice is an official document used for customs clearance and shipping.

Can I charge for a proforma invoice?

Generally, you do not charge for a proforma invoice. It is typically provided as a courtesy to potential clients.

Do I need to include VAT on a proforma invoice?

VAT is typically not included on a proforma invoice. However, it’s essential to indicate if VAT will be applicable on the final invoice.

Can I use a proforma invoice for tax purposes?

No, a proforma invoice cannot be used for tax purposes. It is not considered a legally binding document for tax reporting.

What happens if the client doesn’t accept the proforma invoice?

If the client does not accept the proforma invoice, you may need to revise it or negotiate new terms.

I hope this comprehensive guide helps you understand proforma invoices and how to create them effectively.

Proforma Invoice Example