Introduction

In today’s business world, invoices are the lifeblood of any successful transaction. They serve as crucial documents that outline the goods or services provided, the agreed-upon price, and the payment terms. A well-crafted invoice ensures smooth and efficient financial transactions while maintaining clear records for both the seller and the buyer.

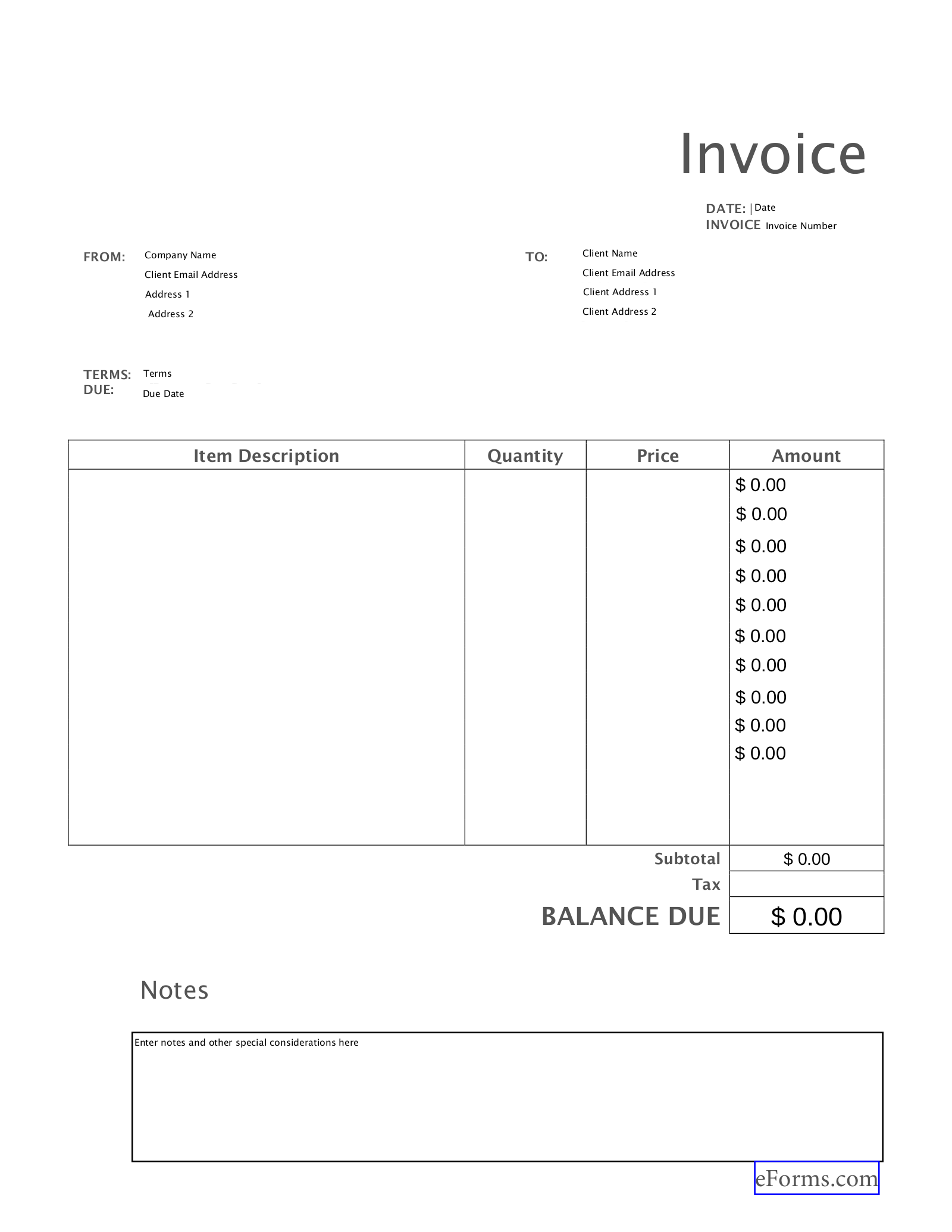

This guide will delve into the essential components of a sample blank invoice, providing you with a comprehensive understanding of its structure and significance. We’ll explore the key sections, formatting tips, and best practices to create professional and effective invoices that streamline your business operations.

Understanding the Importance of a Blank Invoice

Before we dive into the specifics, let’s understand why a blank invoice template is indispensable for businesses of all sizes.

Image Source: eforms.com

Efficiency and Time-Saving: A pre-designed blank invoice template eliminates the need to recreate the entire invoice from scratch for each transaction. This significantly saves time and effort, allowing you to focus on other critical aspects of your business.

Essential Components of a Sample Blank Invoice

A standard blank invoice typically includes the following key sections:

1. Invoice Header:

Invoice Number: A unique identifier for each invoice.

2. Invoice Body:

Item Description: A detailed description of the goods or services provided.

3. Invoice Footer:

Subtotal: The total cost of all items before any taxes or discounts.

4. Payment Terms:

Payment Methods: Acceptable payment methods (e.g., Check, Credit Card, Bank Transfer).

5. Notes Section:

Additional Notes: Any additional information or instructions for the customer.

Formatting Tips for a Professional Invoice

Use a Clear and Concise Font: Choose a professional and easy-to-read font such as Arial, Calibri, or Times New Roman.

Best Practices for Creating Effective Invoices

Issue Invoices Promptly: Issue invoices as soon as possible after completing the work or delivering the goods.

Conclusion

A well-designed and professional invoice is a critical tool for any business. By implementing the tips and best practices outlined in this guide, you can create effective invoices that streamline your billing process, improve cash flow, and maintain a positive relationship with your clients.

FAQs

What software can I use to create invoices?

There are many software options available, including:

Dedicated invoicing software: QuickBooks, Xero, Zoho Invoice

Spreadsheet software: Microsoft Excel, Google Sheets

Word processing software: Microsoft Word, Google Docs

Can I use a free invoice template?

Yes, there are many free invoice templates available online. You can find them on websites like:

Google Docs/Sheets Templates Gallery

Microsoft Office Templates

Invoice Generator websites

How often should I send invoices?

Generally, invoices should be sent as soon as possible after completing the work or delivering the goods.

For recurring services, invoices can be sent on a regular schedule (e.g., weekly, monthly).

What should I do if a customer disputes an invoice?

If a customer disputes an invoice, it’s important to:

Review the invoice carefully for any errors.

Communicate with the customer promptly and professionally to address their concerns.

Provide any necessary documentation to support your claims.

How can I ensure my invoices are legally compliant?

Ensure your invoices comply with all relevant tax laws and regulations in your jurisdiction.

Consult with a tax professional or accountant for guidance.

I hope this comprehensive guide provides you with valuable insights into creating effective invoices for your business.

Sample Blank Invoice