So, you’ve successfully consulted a client, and now it’s time to get paid. But before you send that invoice, let’s talk about creating a professional and effective consultancy bill format. A well-structured bill not only ensures you get paid promptly but also reflects positively on your professionalism and builds trust with your clients.

The Essentials of a Consultancy Bill

A basic consultancy bill should include the following key elements:

1. Your Company Information

Your Company Name: Include your official business name.

2. Client Information

Client Name: Include the full legal name of your client (individual or company).

3. Invoice Number and Date

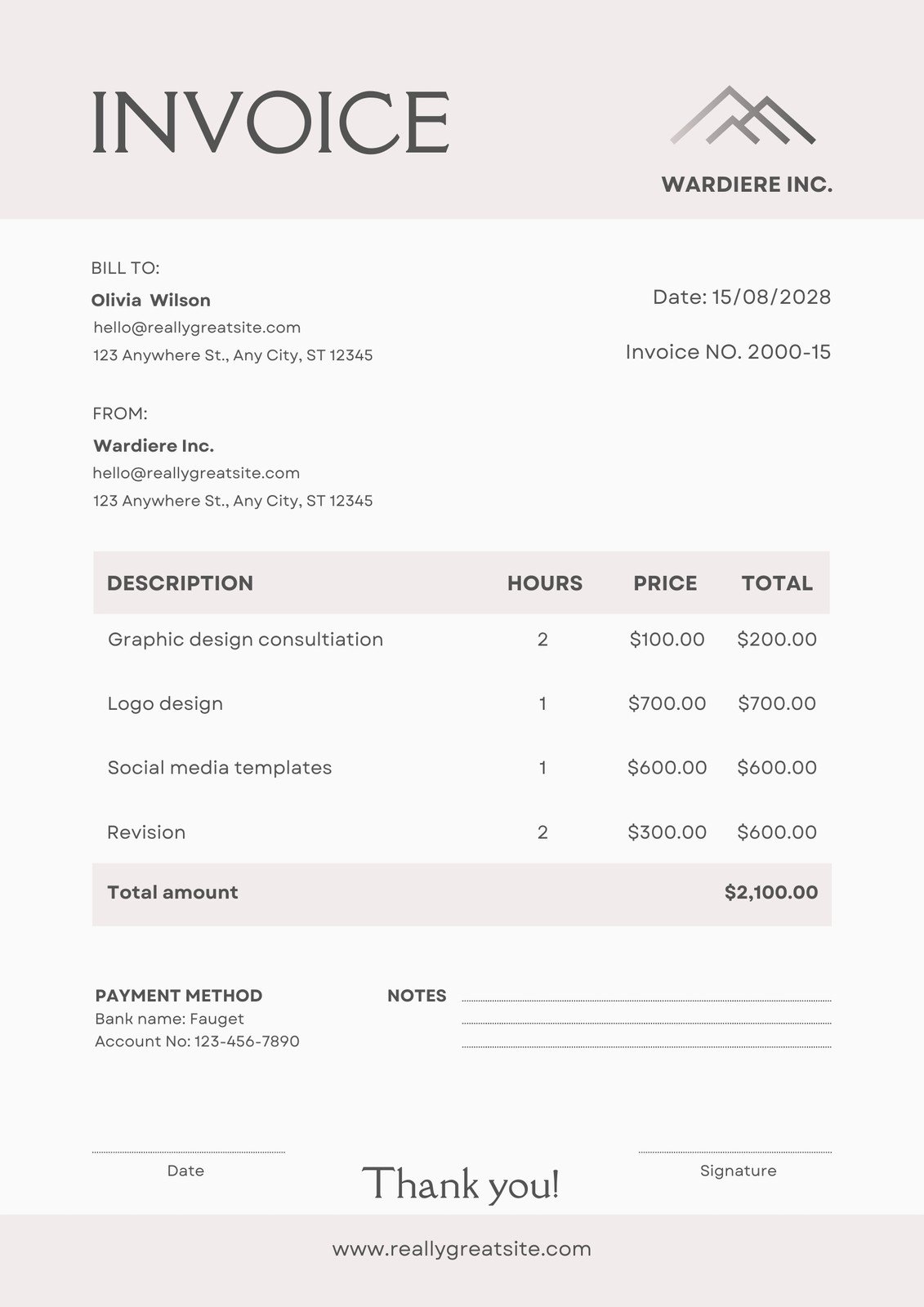

Image Source: canva.com

Invoice Number: Assign a unique invoice number for easy tracking and reference.

4. Description of Services

Clear and Concise Descriptions: Itemize each service provided with a brief but descriptive title.

5. Pricing and Fees

Hourly Rates: If you charge by the hour, clearly state your hourly rate.

6. Payment Terms

Payment Due Date: Specify the date by which payment is expected.

7. Contact Information for Inquiries

Tips for Creating a Professional Consultancy Bill

Use Professional Software: Consider using invoicing software like QuickBooks, Xero, or FreshBooks to streamline the process and generate professional-looking invoices.

Example of a Basic Consultancy Bill Format

[Your Company Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Your Website]

Invoice Number: [Invoice Number]

Invoice Date: [Date]

Bill To:

[Client Name]

[Client Address]

Description of Services

Hours: [Number of Hours]

Hourly Rate: $[Hourly Rate]

Subtotal: $[Subtotal]

Expenses (if applicable):

Tax (if applicable): [Tax Amount]

Total: $[Total Amount]

Payment Terms:

Thank You

[Your Company Name]

Conclusion

By following these guidelines and using a professional bill format, you can ensure that you get paid promptly and maintain a positive relationship with your clients. Remember that a well-presented invoice is a reflection of your professionalism and contributes to your overall business success.

FAQs

1. What are the benefits of using invoicing software?

Invoicing software can save you time and effort by automating many of the invoicing tasks, such as generating invoices, tracking payments, and sending reminders. It can also help you to organize your finances and improve your cash flow.

2. How can I ensure that my clients receive their invoices promptly?

Set up a system for generating and sending invoices promptly after completing each project. You can also consider setting up email reminders to send out invoices automatically.

3. What should I do if a client disputes an invoice?

If a client disputes an invoice, it’s important to communicate with them promptly and professionally to resolve the issue. Review the invoice carefully and be prepared to provide any necessary documentation to support your claims.

4. How can I prevent late payments?

Clearly state your payment terms on the invoice and send reminders to clients if payment is overdue. Consider offering early payment discounts to incentivize prompt payment.

5. What are some common invoicing mistakes to avoid?

Some common invoicing mistakes include errors in calculations, incorrect client information, and missing payment terms. Always proofread your invoices carefully before sending them out.

I hope this guide helps you create effective and professional consultancy bills!

Consultancy Bill Format