Okay, so you need a receipt. Maybe it’s for a friend who lent you money, or maybe you sold something on eBay. Whatever the reason, a simple receipt is a must-have. It’s basically a written record of a transaction, proving that something was bought or sold.

Why do you need a receipt?

Well, it’s a good idea to have proof of any financial transaction. Receipts can be helpful in a few ways:

Tax purposes: If you’re running a business, you’ll need receipts to track your income and expenses for tax purposes.

What should be included in a simple receipt?

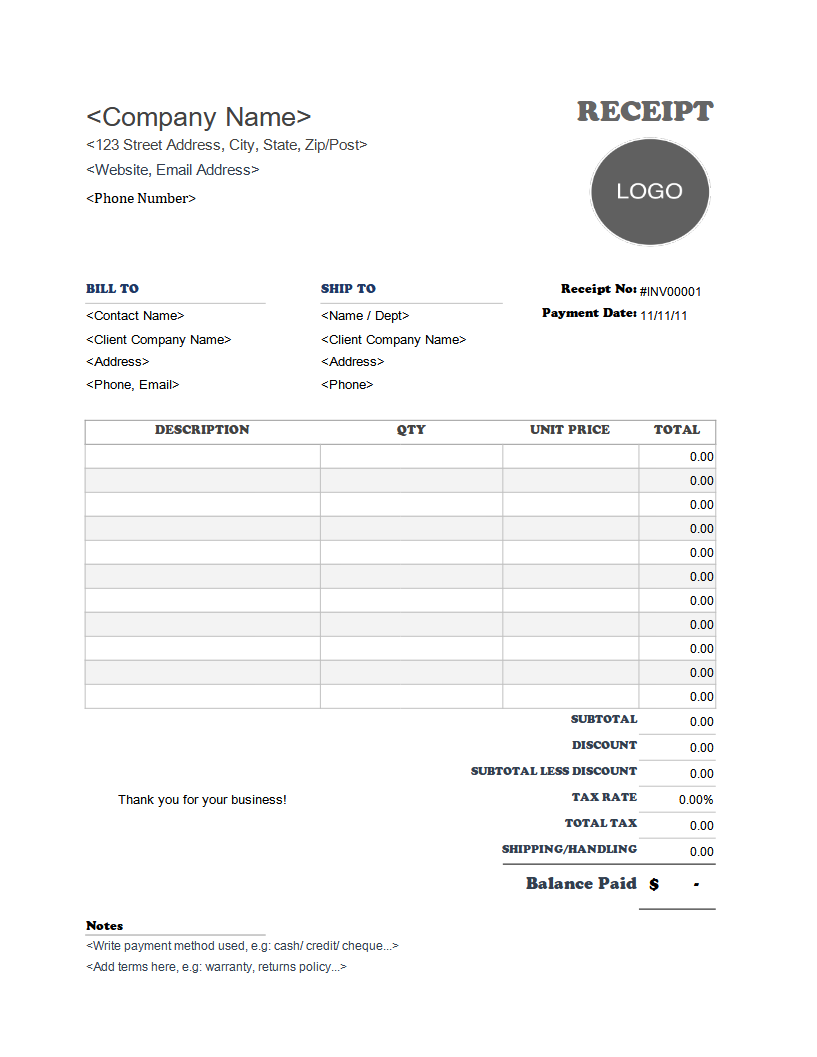

Image Source: invoicesimple.com

A basic receipt should include the following information:

1. Date: The date of the transaction.

2. Transaction ID: A unique identifier for the transaction.

3. Seller/Recipient: The name and contact information of the seller or recipient.

4. Buyer/Payer: The name and contact information of the buyer or payer.

5. Item(s) sold/service(s) provided: A description of the item(s) or service(s) involved in the transaction.

6. Quantity: The quantity of items sold or services provided.

7. Price: The price of each item or service.

8. Total amount: The total amount of the transaction.

9. Payment method: The method of payment used (e.g., cash, check, credit card).

10. Seller/Recipient signature: The signature of the seller or recipient.

How to create a simple receipt:

You can create a simple receipt using a variety of methods:

Use a receipt template: Many word processing programs, such as Microsoft Word or Google Docs, have receipt templates available.

Here’s a simple receipt sample:

[Your Name/Business Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

Receipt No.: [Unique Transaction ID]

Date: [Date of Transaction]

Sold To:

[Buyer Name]

[Buyer Address]

[Buyer Phone Number]

[Buyer Email Address]

Item | Quantity | Price | Total

—————— | ———– | ——– | ——–

[Item 1] | [Quantity] | [Price] | [Total]

[Item 2] | [Quantity] | [Price] | [Total]

[Item 3] | [Quantity] | [Price] | [Total]

Subtotal: [Subtotal]

Tax: [Tax Amount] (if applicable)

Total: [Total Amount]

Payment Method: [Payment Method]

Received By:

[Your Signature]

Tips for creating effective receipts:

Keep it simple: Don’t overcomplicate the receipt.

Conclusion

Creating a simple receipt is easy and can be very helpful. By following the tips and guidelines outlined in this article, you can create professional-looking receipts that meet your needs.

Frequently Asked Questions

What is the purpose of a receipt?

Receipts serve several purposes, including tax purposes, returns and exchanges, record-keeping, and dispute resolution.

What information should be included on a receipt?

A basic receipt should include the date, transaction ID, seller/recipient information, buyer/payer information, item(s) sold/service(s) provided, quantity, price, total amount, payment method, and seller/recipient signature.

How can I create a simple receipt?

You can create a simple receipt using a receipt template, creating your own template, or using a receipt app.

What are some tips for creating effective receipts?

Keep it simple, be clear and concise, use a professional format, and keep a copy for your records.

Can I use a receipt for tax purposes?

Yes, receipts are often required for tax purposes.

I hope this article helps you understand the importance of receipts and how to create them.

Simple Receipt Sample