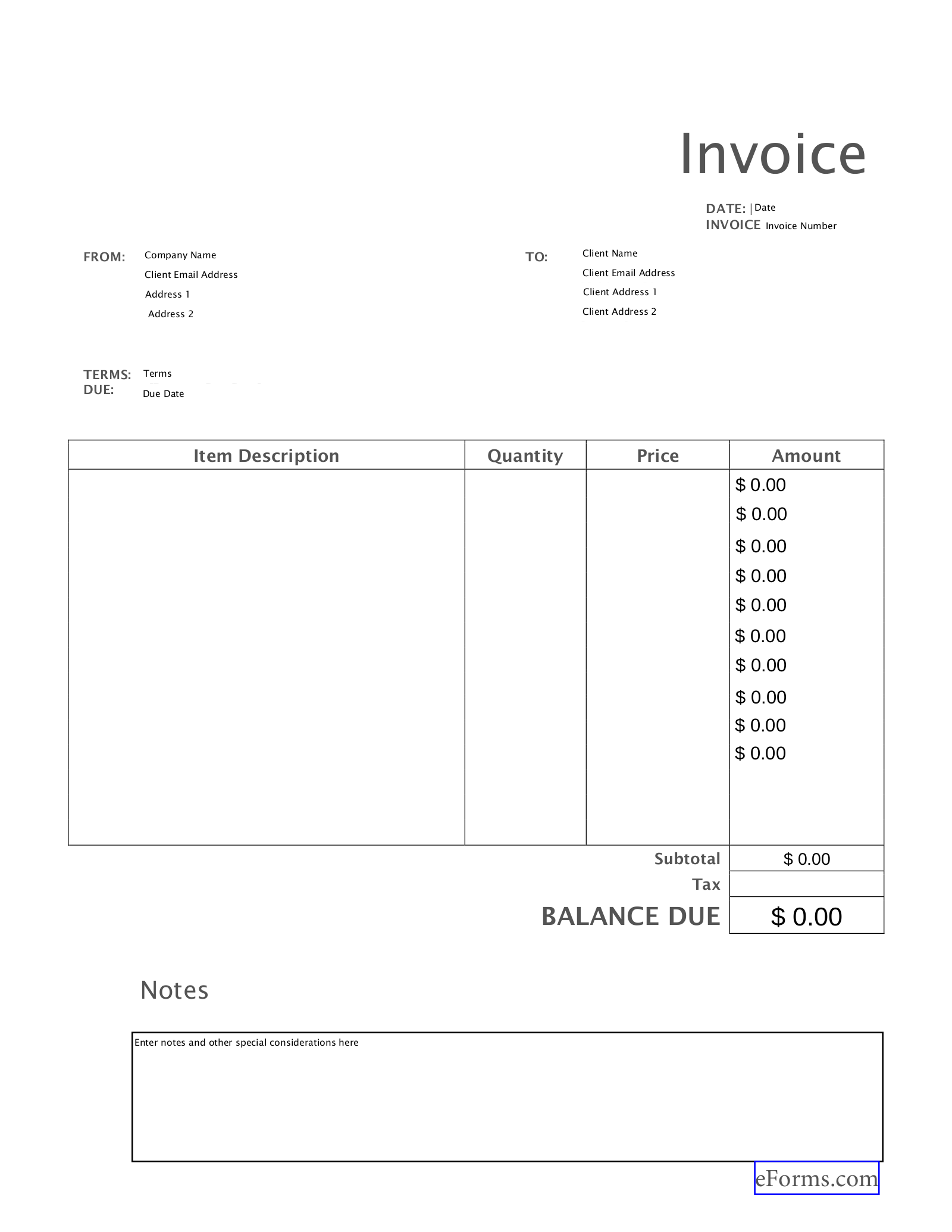

A blank invoice is essentially a template document used to record a commercial transaction between a seller and a buyer. It outlines the goods or services provided, their quantities, agreed-upon prices, and the total amount due. While seemingly simple, the blank invoice serves as a crucial legal and financial document for both parties involved.

What Information Should a Blank Invoice Include?

1. Invoice Number: A unique identifier for easy tracking and reference.

2. Invoice Date: The date the invoice is issued.

3. Invoice Due Date: The date by which payment is expected.

4. Seller Information:

5. Buyer Information:

6. Invoice Items:

7. Subtotal: Total amount before taxes.

8. Tax: Total amount of taxes applied.

9. Shipping/Handling: (If applicable)

10. Discount: (If applicable)

11. Invoice Total: Final amount due.

12. Payment Terms:

13. Payment Methods:

14. Notes/Special Instructions: (Optional) Any additional notes or specific instructions for the buyer.

Why are Blank Invoices Important?

Legal Documentation: Invoices serve as legal proof of a transaction. They can be crucial in resolving disputes or legal issues.

Image Source: eforms.com

How to Create a Blank Invoice

You can create blank invoices using various methods:

Spreadsheet Software: Utilize software like Microsoft Excel or Google Sheets to create a customizable invoice template.

Tips for Creating Effective Invoices

Keep it Simple and Clear: Avoid clutter and use a clean, professional layout.

Conclusion

Blank invoices are fundamental to any business transaction. By understanding their importance and following best practices for their creation and use, businesses can streamline their operations, improve cash flow, and maintain strong relationships with their customers.

FAQs

Can I use a handwritten invoice?

While not as common as electronic invoices, handwritten invoices can still be legally valid. However, they may be more prone to errors and harder to track.

What is the difference between an invoice and a receipt?

An invoice is issued before a payment is made, while a receipt is issued after a payment is received.

Do I need to include tax on every invoice?

Tax requirements vary depending on your location and the nature of the goods or services provided. Consult with a tax professional to determine the applicable taxes for your business.

Can I use a generic invoice template for all my clients?

While you can use a template, it’s best to customize it slightly for each client to maintain professionalism and avoid confusion.

What happens if a client disputes an invoice?

If a client disputes an invoice, it’s crucial to review the invoice carefully and address their concerns promptly. If necessary, you may need to provide additional documentation or even consider mediation.

This article provides a basic overview of blank invoices. Remember that specific requirements and best practices may vary depending on your industry and location.

Blank Invoice